Genomic Vision: 2021 Annual Results

21 Aprile 2022 - 6:00PM

Business Wire

- Revenue from activity up 9% in 2021, to €1.4

million

- Good control over current operating expenses

(-5.5%)

- Financial resources offering visibility

through to end-May 2022

- Implementation of a new financing line with

Winance, subject to shareholder approval

Regulatory News:

Genomic Vision (FR0011799907 – GV – the “Company”)

(Paris:GV), a biotechnology company that develops tools and

services dedicated to the analysis and control of changes in the

genome, today reported its annual financial results for the year to

December 31, 20211.

2021 annual results

(in € thousands – IFRS)

2021

2020

Sales

994

1,084

Other revenue

419

220

Total revenue from activity

1,413

1,304

Current operating expenses

(6,273)

(6,638)

Current operating loss

(4,860)

(5,334)

Other operating expenses/income

(34)

180

Operating loss

(4,895)

(5,153)

Cost of financial debt and other financial

expenses/income

(67)

(24)

Net loss

(4,998)

(5,177)

Total revenue from activity over the year to December 31,

2021 was €1,413 thousand, up 9% compared with the year to December

31, 2020, and broke down as follows:

- sales of €994 thousand in 2021, down 8% compared with

2020, each of these two financial years including the sale of a

platform. It should be noted that in 2021 commercial activity was

slowed by the Covid-19 crisis and the world’s focus on virology

research and stoppages in activity associated with successive

lockdowns in some countries. In particular, orders of consumables

such as Coverslips were affected. Platform sales also saw a

significant slowdown, travel restrictions having made commercial

prospecting difficult.

- other revenue of €419 thousand over the year to December

31, 2021, corresponding to Research Tax Credit whose increase was a

direct result of the Company’s refocus on its Research &

Development activities in 2021.

Current operating expenses decreased by 5.5% to €6.3

million and primarily broke down as follows, on top of the cost of

sales:

- €2.7 million in R&D spending, up 35%, reflecting the

Company’s refocus on projects with greater added value. 2021

allowed it to continue the development of priority and

high-value-added projects, such as the launch of TeloSizer® for the

precise detection and quantitative measurement of telomere

length;

- €1 million in Sales & Marketing expenditure, down 39%

compared with December 31, 2020;

- €2 million in General & Administrative expenses, down 12%

compared with December 31, 2020, demonstrating good control over

these costs.

The operating loss and net loss at December 31, 2021 were

-€4.9 million and -€5 million respectively, an improvement of 5%

and 3.5% compared with the previous year, despite a 32% increase in

the workforce, reflecting good control over other expenses.

The Company’s total headcount was 33 people at December 31,

2021, compared with 25 a year earlier.

Financial structure

The Company does not have sufficient net working capital to

cover its obligations and operating cash requirements for the next

twelve months.

The financial statements at December 31, 2021 were nonetheless

drawn up in accordance with the operational continuity principle by

notably taking into account the following elements:

- at December 31, 2021, “Cash and cash equivalents” totaled €2.3

million.

- on the basis of its proposed development plan, the Company

estimates that its available cash will enable it to finance its

activities until the end of May 2022 (excluding the exercise of the

Winance warrants and Bracknor/Negma warrants already in

circulation) and that its additional cash requirements enabling it

to continue its activities in 2022 are estimated at €4

million.

- in order to cover its working capital requirements, the Company

decided to put in place a financing line with Winance via the

signing, on June 11, 2020, of an OCABSA (convertible notes with

warrants) issuance contract, of which it has used €6 million gross

(€5.7 million net of costs) out of a possible €12 million. The

Company can no longer use this financing line given the expiry of

the Prospectus relating to this operation that was in any case due

to expire in June 2022.

- within this context, the Company decided to implement a new

financing line with Winance via the signing of a new contract on

April 11, 2022 providing for the provision of a maximum of 15

tranches of €2 million each, i.e. up to €30 million, subject to the

following conditions precedent:

- the granting of an AMF visa for the new Prospectus,

- prior approval for the operation by the Company’s shareholders

at an Extraordinary General Meeting scheduled for May 23,

2022,

- the conditions for the drawdown of each tranche being met,

notably with the share price not being below the share’s par

value.

In the event that one or more of these conditions precedent –

which are not all in the Company’s hands – were not fulfilled

within the given timeframe, the Company could then not be in a

position to realize its assets and liabilities and settle its debts

within the framework of its normal course of business, and the

application of IFRS accounting rules and principles within a normal

context of the continuation of its activities, notably concerning

the evaluation of assets and liabilities, could prove to be

inappropriate. Consequently, this situation is generating

significant going concern uncertainty.

Governance

Jérôme Vailland, Chief Financial Officer of Genomic Vision, has

decided to leave the Company to pursue other projects.

Upcoming financial publication

- Revenue for the first quarter of 2022, on Thursday May 5,

2022

***

ABOUT GENOMIC VISION

GENOMIC VISION is a biotechnology company developing products

and services dedicated to the analysis (structural and functional)

of genome modifications as well as to the quality and safety

control of these modifications, in particular in genome editing

technologies and biomanufacturing processes. Genomic Vision

proprietary tools, based on DNA combing technology and artificial

intelligence, provide robust quantitative measurements needed to

high confidence characterization of DNA alteration in the genome.

These tools are mainly used for monitoring DNA replication in

cancerous cell, for early cancer detection and the diagnosis of

genetic diseases. Genomic Vision, based near Paris in Bagneux, is a

public listed company listed in compartment C of Euronext’s

regulated market in Paris (Euronext: GV – ISIN: FR0011799907).

For further information, please visit www.genomicvision.com

Member of the CAC® Mid & Small and CAC®

All-Tradable indexes

FORWARD LOOKING STATEMENT

This press release contains implicitly or explicitly certain

forward-looking statements concerning Genomic Vision and its

business. Such forward-looking statements are based on assumptions

that Genomic Vision considers to be reasonable. However, there can

be no assurance that such forward-looking statements will be

verified, which statements are subject to numerous risks, including

the risks set forth in the “Risk Factors” section of the universal

registration document filed with the AMF on February 9, 2021 under

reference number R.21-002, available on the web site of Genomic

Vision (www.genomicvision.com) and to the development of economic

conditions, financial markets and the markets in which Genomic

Vision operates. The forward-looking statements contained in this

press release are also subject to risks not yet known to Genomic

Vision or not currently considered material by Genomic Vision. The

occurrence of all or part of such risks could cause actual results,

financial conditions, performance or achievements of Genomic Vision

to be materially different from such forward-looking statements.

This press release and the information contained herein do not

constitute and should not be construed as an offer or an invitation

to sell or subscribe, or the solicitation of any order or

invitation to purchase or subscribe for Genomic Vision shares in

any country. The distribution of this press release in certain

countries may be a breach of applicable laws. The persons in

possession of this press release must inquire about any local

restrictions and comply with these restrictions.

1 Financial statements were approved by the Supervisory Board on

April 19, 2022. The statutory auditor’s certification report will

be issued upon completion of the ongoing audit procedures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220421005763/en/

Genomic Vision Dominique Remy-Renou CEO Tel.: +33 1 49 08

07 51 investisseurs@genomicvision.com

Ulysse Communication Press Relations Bruno Arabian

Tel.: +33 1 42 68 29 70 barabian@ulysse-communication.com

NewCap Investor Relations & Strategic

Communications Tel.: +33 1 44 71 94 94 gv@newcap.eu

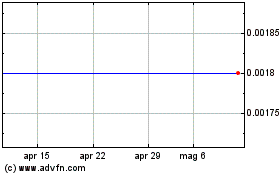

Grafico Azioni Genomic Vision (EU:GV)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Genomic Vision (EU:GV)

Storico

Da Apr 2023 a Apr 2024