Heineken N.V. reports 2022 full year results

Amsterdam, 15 February 2023 – Heineken N.V.

(EURONEXT: HEIA; OTCQX: HEINY) announces:

- Revenue growth

30.4%

- Net revenue (beia)

21.2% organic growth; per hectolitre 13.9%

- Beer volume 6.9%

organic growth; premium beer volume 11.4%; Heineken® volume

12.5%

- Gross savings at

€1.7 billion, on-track to deliver ahead of €2 billion by 2023

- Operating profit

€4,283 million; operating profit (beia) 24.0% organic growth

- Operating profit

(beia) margin 15.7%

- Net profit €2,682

million; net profit (beia) 30.7% organic growth

- Diluted EPS (beia)

€4.92 (2021: €3.54)

- Full year 2023

outlook unchanged, operating profit (beia) expected to grow

organically mid- to high-single-digit

Dolf van den Brink, Chairman of the Executive Board /

CEO, commented:

"I am pleased that we delivered a strong set of results in 2022

in a continuously challenging and volatile environment, growing

ahead of the beer category in the majority of our markets.

Our premium portfolio continued to outperform, led by the

excellent momentum of the Heineken® brand and further propelled by

the roll-out of Heineken® Silver. We are innovating to expand our

leadership positions in non-alcoholic and in beyond beer. We are

accelerating the deployment of our business-to-business digital

platforms and continued the decarbonisation of our breweries. The

progress on these and many other initiatives make us confident that

our EverGreen strategy is on course to deliver long-term,

sustainable value creation.

We delivered balanced growth as we priced responsibly, made a

further step in our productivity programme and continued to invest

in our brands and capabilities. Compared to 2019, volume has now

fully recovered, net revenue (beia) is ahead by close to 18% and

operating profit (beia) by over 11%, organically.

For the coming year, the global economic outlook will remain

challenging. We will continue to invest, whilst staying disciplined

on pricing and costs. Our outlook, as shared on 30 November 2022,

remains unchanged."

|

IFRS Measures |

€ million |

Total growth |

|

BEIA Measures |

€ million |

Organic growth2 |

| Revenue |

34,676 |

30.4 % |

|

Revenue

(beia) |

34,643 |

19.1 % |

| Net revenue |

28,719 |

30.9 % |

|

Net revenue

(beia) |

28,694 |

21.2 % |

| Operating

profit |

4,283 |

-4.5% |

|

Operating profit

(beia) |

4,502 |

24.0 % |

| |

|

|

|

Operating profit

(beia) margin (%) |

15.7 % |

|

| Net profit |

2,682 |

-19.3% |

|

Net profit

(beia) |

2,836 |

30.7 % |

| Diluted EPS (in

€) |

4.65 |

-19.4% |

|

Diluted EPS

(beia) (in €) |

4.92 |

38.9 % |

| |

|

|

|

Free operating

cash flow |

2,409 |

|

|

|

|

|

|

Net debt / EBITDA (beia)3 |

2.1x |

|

1 Consolidated figures are used throughout this report, unless

otherwise stated. Please refer to the Glossary for an explanation

of non-GAAP measures and other terms. Page 24 includes a

reconciliation versus IFRS metrics. These non-GAAP measures are

included in internal management reports that are reviewed by the

Executive Board of HEINEKEN, as management believes that this

measurement is the most relevant in evaluating the results.2

Organic growth shown, except for Diluted EPS (beia), which is total

growth. 3 Includes acquisitions and excludes disposals on a

12-month pro-forma basis.

During 2022, we accelerated the deployment of our EverGreen

strategy, designed to future-proof the company and deliver

superior, balanced growth in a fast-changing world. Our dream is to

shape the future of beer and beyond to win the hearts of consumers.

We are also shaping the future with our ambition to become the best

digitally connected brewer, raising the bar on sustainability and

responsibility and evolving our culture, operating model and

capabilities. At the same time, we are stepping up on productivity

to fund the investments required and improve profitability and

capital efficiency.

SHAPE THE FUTURE OF BEER AND BEYOND

Superior and balanced growth

Our superior and balanced growth ambition is grounded in our

advantaged geographic footprint, our ability to scale strong

premium beer brands, including non-alcoholic variants, and in

developing winning beverage propositions in fast-growing

segments.

Revenue for the full year 2022 was €34,676

million (2021: 26,583 million). Net revenue (beia)

increased by 21.2% organically, with total consolidated volume

growing by 6.4% and net revenue (beia) per hectolitre up 13.9%. The

underlying price-mix on a constant geographic basis was up 14.3%,

driven by pricing for inflation and by premiumisation. All regions

contributed with double-digit organic growth. Currency translation

positively impacted net revenue (beia) by €1,582 million or 7.2%,

mainly driven by the Mexican Peso, Brazilian Real, Vietnamese Dong

and the US Dollar. Consolidation changes positively impacted net

revenue (beia) by €570 million or 2.6%, mainly from the

consolidation of United Breweries Limited (UBL) in India.

Beer volume grew 6.9% organically for the full

year and was ahead of 2019 by 2.7% on an organic basis. The growth

was led by the sharp recovery of Asia Pacific in the second half of

the year, the reopening of the on-trade in Europe in the first half

following the COVID-related restrictions of last year and continued

growth in the Americas and Africa, Middle East & Eastern Europe

regions.

| Beer

volume |

|

4Q22 |

|

|

|

Organic growth |

|

FY22 |

|

|

|

Organic growth |

|

(in mhl) |

|

|

4Q21 |

|

|

|

FY21 |

|

| Heineken

N.V. |

|

63.3 |

|

61.1 |

|

3.5 % |

|

256.9 |

|

231.2 |

|

6.9 % |

|

Africa, Middle East & Eastern Europe |

|

9.8 |

|

10.1 |

|

-3.3 % |

|

39.2 |

|

38.9 |

|

1.5 % |

|

Americas |

|

23.8 |

|

23.9 |

|

-0.5 % |

|

88.5 |

|

85.4 |

|

3.7 % |

|

Asia Pacific |

|

12.2 |

|

10.0 |

|

22.9 % |

|

48.0 |

|

29.4 |

|

29.3 % |

|

Europe |

|

17.5 |

|

17.1 |

|

1.9 % |

|

81.2 |

|

77.5 |

|

4.6 % |

In the fourth quarter, net revenue (beia) grew organically by

17.4%, with double-digit growth across all regions. Total

consolidated volume grew 3.0% and net revenue (beia) per hectolitre

was up 14.0%. Price-mix on a constant geographic basis was up

14.5%, again driven by pricing and premiumisation. Beer volume grew

3.5%, driven by Asia Pacific and continued growth in Europe, more

than offsetting lower volume in other regions.

Driving premiumisation at scale, led by

Heineken®

Premium beer volume grew 11.4% versus last year

and came 15.6% ahead of 2019, organically. Our premium brands

outperformed the total portfolio in the majority of our markets and

accounted for more than half of our total organic growth in beer

volume in 2022.

This growth is led by

Heineken®, up

12.5% versus last year (14.5% excluding Russia) and 31.5% relative

to 2019, significantly outperforming the total beer market. The

growth was broad-based with more than 50 markets growing

double-digits in 2022. The strong growth was led by

Heineken®

Original, bolstered by the remarkable performance

of its line extensions. Heineken®

Silver more than doubled its volume, driven by

excellent performances in Vietnam and China and its global rollout,

reaching 28 markets in total by the end of 2022.

|

Heineken® volume |

|

4Q22 |

|

Organic growth |

|

FY22 |

|

Organic growth |

|

(in mhl) |

|

|

|

|

|

Total |

|

14.8 |

|

11.2 % |

|

54.9 |

|

12.5 % |

|

Africa Middle East & Eastern Europe |

|

1.7 |

|

-9.5 % |

|

6.4 |

|

-2.7 % |

|

Americas |

|

6.4 |

|

6.9 % |

|

22.2 |

|

13.5 % |

|

Asia Pacific |

|

2.9 |

|

51.3 % |

|

9.5 |

|

33.4 % |

|

Europe |

|

3.7 |

|

7.8 % |

|

16.8 |

|

8.0 % |

Heineken® connects with millions of consumers every year with

world-class campaigns and sponsorships to share our brand DNA in a

meaningful way to spark growth, and to contribute to our

sustainability goals and responsibility initiatives. In 2022, we

launched the ‘Cheers to All Fans’ campaign, tackling gender bias

affecting football's players and fans. 2022 was Heineken®’s first

year as a leading sponsor of the UEFA Women’s EUROs, with the

objective to become the most inclusive sponsor of the

tournament.

We continued to successfully premiumise at scale via our

international brands portfolio, complementing

Heineken® by connecting with an even more diverse range of consumer

needs. Amstel grew volume in the mid-twenties,

with more than 15 markets growing double-digits, with a

particularly strong performance in Brazil and continued momentum

behind Amstel Ultra. Birra

Moretti grew in the mid-teens versus last year,

sharing the true taste of Italy across Europe, with outstanding

growth in the Netherlands, Serbia, Romania, Switzerland and

Ireland. In the UK, Birra Moretti more than doubled its volume

versus 2019 and became the market leader of the premium segment by

value. 2022 was the year of the Tiger; our brand

roared back to volume growth of more than 40%, driven by the

recovery in Southeast Asia, the success of Tiger Crystal and

continued growth in Nigeria and Brazil.

Pioneer choice in low & no-alcohol

We believe in empowering consumers seeking to enjoy a lower or

no-alcohol-content beverage by ensuring there is always a choice –

everywhere and on any occasion. Meeting this consumer need, our

Low & No-Alcohol (LONO) portfolio grew by

low-single-digit as continued momentum in the majority of our

markets was partially offset by declines in Egypt, Russia and

Poland. Our non-alcoholic beer and cider portfolio grew by

mid-single-digit, led by the growth of

Heineken® 0.0 in

the low-teens in Europe and the Americas regions.

We continued to introduce consumer-inspired innovations to

enhance our non-alcoholic beer and cider portfolio. For example, in

the United States, Lagunitas launched Hoppy Refresher, an adult

beverage proposition of hop-infused sparkling water that can

compete with carbonated soft drinks. In Nigeria, we launched ZAGG,

a malt-based energy drink, entering a new category in Nigeria with

potential to scale beyond within the Region. In Mexico, we are

currently introducing Tecate 0.0, a non-alcoholic variant to our

second largest brand globally by volume, aiming to counter the

stigma that beer cannot be enjoyed during mid-day meal

occasions.

Explore beyond beer

As we expand our view of consumer demand, we see opportunities

beyond beer for flavoured,

innovative, natural and moderate propositions leveraging our

industrial and route to market base. We are leveraging our scale as

the second largest player in this segment outside of the United

States to explore further this consumer space. Our overall volume

of flavoured beer and beyond beer alcoholic propositions grew by a

mid-single-digit to 12.9 million hectolitres (2021: 12.3 million

hectolitres).

Desperados is the leading "spirit beer" for

high energy occasions with a presence in more than 80 countries. It

continued its growth momentum in 2022, doubling its volume in

Nigeria, with continued growth in Europe (particularly in Germany,

the UK, Spain and France) and boosted by Desperados cocktail

inspired line extensions and Virgin 0.0.

We expanded our global leadership position in

Cider. Global volume grew by a low-single-digit to

5.0 million hectolitres (2021: 4.9 million), mainly driven by the

strong growth of Strongbow in South Africa. We launched Strongbow

Ultra, a low-calorie, low-carb and natural proposition to renovate

the brand and the overall cider category with strong early results.

In the UK, Strongbow Ultra Dark Fruit reached c.70% of the size of

the total hard seltzer category in its first year of launch.

In Mexico, we launched Sol Mangoyada, further strengthening our

leadership position in beyond beer. In the United States, building

on the success of Dos Equis Lime and Salt around rituals that

consumers follow, we launched Dos Equis Classic Lime Margarita.

Our advantaged footprint

We continue to develop and expand our geographical and

portfolio footprint to enhance our long-term, sustained

growth advantage.

Between 18 and 24 January 2023 the Competition Tribunal of South

Africa held the hearings related to the transaction with Distell

Group Holdings Limited and Namibia Breweries Limited, and we are

awaiting their final decision. We remain very excited with the

opportunity to bring together strong businesses to create a

regional beverage champion, and we are committed to being a strong

partner for growth and to make a positive impact in the communities

in which we operate. We continue to expect the transaction to close

in the coming months.

We continue to make progress to transfer the ownership of our

business in Russia whilst dealing with frequently changing

regulations. We remain optimistic in our ability to reach an

agreement in the coming months. Based on our current assessment, an

impairment of €88 million is recorded for the period ended 31

December 2022. See page 14 for more details.

On 19 October 2022, we acquired 28.2% of the shares of Grupa

Zywiec (GZ) and, on 20 December 2022, concluded a mandatory tender

bid for the remaining 6.6% of the shares. On 19 January 2023, we

acquired the remaining shares of GZ through a squeeze-out process,

becoming the sole owner of the company. GZ has filed an application

to delist from the Warsaw Stock Exchange.

BECOME THE BEST-CONNECTED BREWER

HEINEKEN wants to become the best-connected, most relevant

brewer for customers living in the digital age. To achieve this, we

are digitally transforming our business and modernising our

technology landscape at the same time.

Digitise our route-to-consumer

We continue to deploy our business-to-business digital

(eB2B) platforms, supported by the eBusiness team, which

is driving this capability globally. By the end of 2022, the

platforms captured €9.2 billion in gross merchandise value, 2.5x

the value of last year. We now connect more than half a million

customers, over 50% more than last year. The growth was driven by

Vietnam, Nigeria, Mexico, Brazil, the UK, Ireland, France, Italy

and Cambodia.

The digitisation of customer relationships unlocks new growth

with more and better services and data insights, increasing sales

and productivity. For example, with AIDDA, an artificial

intelligence application, we support our sales representatives to

help our customers grow, making our sales organisation more

effective and efficient.

We will start migrating our eB2B platforms under a single brand

name and identity: eazle, business made easy. The

transition will enable better features at scale resulting in

improved customer experience with increased efficiency, helping

them to grow their business.

FUND THE GROWTH, FUEL THE PROFIT

Our growth algorithm aims to deliver superior, balanced growth

enabled by incremental investments behind the power of our brands,

digital transformation, capabilities and sustainability objectives.

We are bringing balance to our growth, investing behind the power

of our brands which enables us to price responsibly. To fund the

growth and offset inflationary pressures, we are structurally

addressing our cost base and building a cost-conscious culture. We

are embedding this into an ongoing continuum of productivity

improvements to fuel profit growth ahead of revenue growth over

time.

During 2022, we made significant progress in the delivery of our

productivity programme, targeting €2 billion of structural gross

savings by 2023, relative to our cost base of 2019. By the end of

2022, we captured €1.7 billion of these gross savings and are well

on track to deliver ahead of our target in 2023.

We are improving our performance on cost and embedding cost

management in the capabilities of the organisation. Our teams are

advancing thousands of initiatives across all our operating

companies and the head office. We are also accelerating large-scale

transformation programmes, such as the transition to a network

model for our supply chain in Europe. These achievements gave us

the confidence to declare our new ambition to deliver ongoing

productivity gains of €400 million year on year.

We continued to invest in our business and in addition, we

reversed the significant cost mitigation actions undertaken in 2021

to partially offset the financial impact of COVID-related

restrictions. Last year, these represented a reduction of expenses

(beia) of circa €0.5 billion for the full year relative to

2019.

Operating profit

(beia) grew 24.0% organically driven by the volume

recovery in Asia Pacific and Europe, pricing for inflation,

premiumisation and the delivery of our productivity programme,

partially offset by inflationary pressures in our cost base and

incremental investments behind our growth agenda. Currency

translation positively impacted operating profit (beia) by €258

million, or 7.6%, mainly driven by the Mexican Peso, Vietnamese

Dong and Brazilian Real. Operating profit declined by 4.5% as the

strong profit recovery this year was offset by lower exceptional

gains, which in the previous year included the €1.3 billion

remeasurement to fair value of the previously held equity interest

in United Breweries (UBL) in India.

Net profit (beia) grew 30.7% organically to

€2,836 million (2021: €2,041 million), ahead of the growth in

operating profit (beia) due to a lower effective tax rate. Currency

translation positively impacted net profit (beia) by €198 million

or 9.7%, driven mainly by the Mexican Peso, Vietnamese Dong and

Brazilian Real. Net profit after exceptional items

and amortisation of acquisition-related intangibles was

€2,682 million (2021: €3,324 million), lower than last

year due to the exceptional gains in 2021 as explained above.

For more details, please refer to the Financial Review.

RAISE THE BAR ON SUSTAINABILITY AND

RESPONSIBILITY

Brew a Better World is our 2030 strategy to drive progress

towards a net zero, fairer and more balanced world. We are making

good progress across all three pillars and are building executional

momentum to deliver our ambitions.

Environmental: Path to net zero impact

Our ambition is to reach net zero carbon emissions across our

value chain by 2040, with an intermediate 2030 goal to reach net

zero in scope 1 and 2, reduce our emissions in scope 3 by 21%, and

across our value chain (scope 1, 2 and 3) by 30%. Since 2018, we

have reduced our absolute carbon emissions in scope 1 and 2 by 18%

(2021: 16%). We also increased the percentage of combined renewable

energy to 37% (2021: 27%). We are driving progress in scope 3 by

engaging our top packaging, cooling and raw material partners

globally to set science-based targets and unlock low-carbon

solutions. We also achieved an “A” score for Climate from the

Carbon Disclosure Project (CDP) in 2022.

We continue to focus on healthy watersheds via water efficiency,

water circularity and water balancing. Our 2030 ambition is to

reduce water usage to 2.6 hectolitre per hectolitre (hl/hl) in

water-stressed areas and 2.9 hl/hl worldwide. In 2022, we reached

3.0 hl/hl and 3.3 hl/hl (2021: 3.1 and 3.4), respectively. 26 of

our 31 sites in water-stressed areas have begun watershed

protection programmes and 29% of these sites are fully balanced.

97% of our total wastewater volume is now treated before

discharge.

When it comes to circularity, more than 75% of our production

sites are now landfill-free, meaning 99% of our total waste volume

globally was reused or recycled in 2022.

Social: Path to an inclusive, fair and equitable

world

We are making progress when it comes to gender diversity. Over

the last 5 years, we increased the percentage of senior management

positions held by women from 19% to 27% (2021: 25%). Our ambition

is to achieve 30% by 2025 and 40% by 2030 on the path to gender

balance.

We also aim for equal pay for equal work between female and male

colleagues and want to ensure that all employees worldwide earn at

least a fair wage by 2023. By the end of 2022, 100% of operating

companies have been assessed on equal pay and have detailed action

plans to drive year-on-year progress. Regarding fair wage, 100% of

operating companies have been assessed and over 99% of direct

employees earn at least a fair wage, as defined by the Fair Wage

Network.1

As part of our ambition to create a positive impact in our

communities, we reached our annual target of having a social impact

initiative in place in 100% of our in-scope markets. We also

increased the volume of locally sourced agricultural raw materials

in Africa by 26% compared to a 2020 baseline, meaning we are

halfway to our goal of 50% by 2025.

1 A fair wage is often higher than the minimum wage and should

be sufficient for a decent standard of living, covering the basic

needs for the employee and their family: from food, housing and

education to healthcare, transportation and some discretionary

income and savings. Data on fair wages is obtained from the Fair

Wage Network.

Responsible: Path to moderate and no harmful

use

Our ambition is to make 0.0 alcohol options available for

consumers everywhere so that there is always a choice. Heineken®

0.0 is now available in close to 110 markets and, by 2023, we aim

for a zero-alcohol option to be available for at least two

strategic brands in the majority of our operating companies,

accounting for 90% of our business by volume. By the end of 2022,

we were at 46% (2021: 43%).

We continue to use the power of our flagship brand to advance

responsible consumption and make moderation cool. In 2022, our

operating companies invested over 10% of Heineken® media spend

reaching at least 1.2 billion unique consumers worldwide.

In addition to this, 100% of our in-scope markets had a

partnership with governments and society to address alcohol-related

harm.

Governance

In 2022, we continued to raise the bar on our ways of working,

governance and transparent reporting. Given the importance of

sustainability and responsibility for long-term value creation:

- We introduced three

ESG metrics in our long-term incentive plan for senior managers,

representing 25% of total remuneration. This proposal was approved

for the Executive Board at the 2022 AGM in April;

- We further

integrated sustainability & responsibility into our existing

planning processes, including ring-fencing the required

investments;

- We are enhancing our reporting

capabilities to meet emerging requirements such as the Corporate

Sustainability Reporting Directive (CSRD). We also completed our

first TCFD analysis and the outcomes are included in the Annual

Report.

UNLOCKING THE FULL POTENTIAL OF OUR PEOPLE AND

ORGANISATION

Critical to the success of our multi-year EverGreen strategy is

the evolution of our culture. Since the launch of EverGreen, we

have been focused on this shift towards disciplined

entrepreneurship with more agility, external focus, and clear

accountability. Throughout the organisation, we have redesigned

processes to facilitate horizontal learning and codified new

behaviours that support EverGreen in our ambition to shape the

future of beer and beyond.

Our Employee Engagement scores rank in the top quartile of the

benchmark of high performing companies and we aspire to maintain

this. In 2022, we scored even higher whilst our teams were dealing

with uncertainty and change, a clear sign of the strength and

commitment of our people.

On 30 November 2022, ahead of our Capital Markets Event, we

reconfirmed our guidance to our outlook statements. These

expectations remain unchanged and are included here as a reminder

with further details.

For 2023, we expect operating profit (beia) to grow organically

mid- to high-single-digit, subject to any significant unforeseen

macroeconomic and geopolitical developments. This outlook is based

on continued progress on EverGreen, a challenging global economic

environment and lower consumer confidence in certain markets.

We expect further progress towards building great brands, our

digital route to consumer, strategic capabilities and our Brew a

Better World activities with commensurate investments. We also

expect stable to modestly growing volume, increasing in developing

markets and declining in Europe. We will continue the discipline to

price responsibly as per local market conditions, aiming to cover

most of the absolute impact of inflation in our cost base. We

anticipate an increase in our input costs in the high teens per

hectolitre and significantly higher energy costs, particularly in

Europe. We will deliver on our gross savings ahead of the €2

billion target relative to the cost base of 2019, including an

increased ambition of savings in Europe. Overall as a result, net

revenue (beia) will grow organically ahead of operating profit

(beia). Due to the phasing of marketing and selling expenses and

input cost pressures, the operating profit (beia) organic growth

will be skewed towards the second half.

We also expect in 2023 an average effective interest rate (beia)

of around 3.1% (2022: 2.8%); an effective tax rate (beia) of around

27% (2022: 27.7%) and a significant increase in other net finance

expenses, driven by the expected impact from foreign currencies in

some emerging markets. As a result, net profit (beia) is expected

to grow organically in line or below the operating profit

(beia).

Finally, we expect investments in capital expenditure related to

property, plant and equipment and intangible assets to amount to

c.9% of net revenue (beia) (2022: c.7%)

The Heineken N.V. dividend policy is to pay a ratio of 30% to

40% of full year net profit (beia). For 2022, a total cash dividend

of €1.73 per share, representing an increase of 40% (2021: €1.24),

and a payout ratio of 35.1%, in the middle of the range of our

policy, will be proposed to the Annual General Meeting on 20 April

2023 ("2023 AGM"). If approved, a final dividend of €1.23 per share

will be paid on 2 May 2023, as an interim dividend of €0.50 per

share was paid on 11 August 2022. The payment will be subject to a

15% Dutch withholding tax. The ex-dividend date for Heineken N.V.

shares will be 24 April 2023.

|

|

Translational Calculated Currency Impact |

The translational currency impact for 2022 was positive,

amounting to €1,582 million on net revenue (beia), €258

million at operating profit (beia) and €198 million at net profit

(beia).

Applying spot rates as of 13 February 2023 to the 2022 financial

results as a base, the calculated currency translational impact

would be negative, approximately €560 million in net revenue

(beia), €80 million at operating profit (beia), and €40 million at

net profit (beia).

|

|

Supervisory Board Composition |

On 20 December 2022, HEINEKEN announced the nomination of Mrs.

Beatriz Pardo and Mr. Lodewijk Hijmans van den Bergh for

appointment as members of the Supervisory Board at the Annual

General Meeting of Shareholders (AGM) on 20 April 2023 for a

four-year term.

Mrs. Beatriz Pardo, a Spanish national, is Vice President

General Manager of Starbucks Reserve in the United States at the

Starbucks Coffee Company. She joined Starbucks in 2018 from Grupo

Vips where she was Division CEO. Prior to this, Mrs. Pardo held

executive positions in Carrefour, Canelafoods and Monitor Deloitte.

During her international career, she built up extensive experience

in brand strategy, retail concept innovation and operations. She

graduated in Economics and Business Administration from the

Universidad Pontificia de Comillas of Madrid.

Mr. Lodewijk Hijmans van den Bergh, a Dutch national, currently

serves as chairman of the Supervisory Board of BE Semiconductor

Industries (until its AGM in April 2023). He is also a member of

the Supervisory Board of ING and vice-chairman of the Supervisory

Board of HAL Holding. He is a lawyer and was partner at the law

firm De Brauw Blackstone Westbroek. He was also Chief Corporate

Governance Counsel and member of the Executive Board of Royal

Ahold. He has vast expertise in corporate governance, corporate law

and sustainability. He holds a master’s degree in law from Utrecht

University.

Furthermore, non-binding nominations for the reappointment of

Mr. Michel de Carvalho and Mrs. Rosemary Ripley for a period of

four years shall be submitted to the AGM on 20 April 2023 for

approval. Mrs. Ingrid–Helen Arnold’s term at the Supervisory Board

will end at the AGM. The Supervisory Board is grateful for Mrs.

Arnold’s commitment and contributions to the Supervisory Board and

its Audit Committee over the past years.

|

Media |

|

Investors |

| Sarah

Backhouse |

|

José

Federico Castillo Martinez |

| Director of Global

Communication |

|

Investor Relations

Director |

| Michael

Fuchs |

|

Mark

Matthews / Chris Steyn |

| Corporate &

Financial Communications Manager |

|

Investor Relations

Manager / Senior Analyst |

| E-mail:

pressoffice@heineken.com |

|

E-mail:

investors@heineken.com |

| Tel:

+31-20-5239355 |

|

Tel:

+31-20-5239590 |

|

|

Investor Calendar Heineken N.V. |

| Combined

financial and sustainability annual report publication |

23 February 2023 |

| Trading Update

for Q1 2023 |

19 April 2023 |

| Annual General

Meeting of Shareholders |

20 April 2023 |

| Quotation

ex-final dividend 2022 |

24 April 2023 |

| Final dividend

2022 payable |

2 May 2023 |

| Half Year 2023

Results |

31 July 2023 |

| Quotation

ex-interim dividend 2023 |

2 August 2023 |

| Interim dividend

payable |

10 August 2023 |

| Trading Update

for Q3 2023 |

25 October 2023 |

HEINEKEN will host an analyst and investor video webcast about

its 2022 FY results at 14:00 CET/ 13:00 GMT/ 08.00 EST. The live

video webcast will be accessible via the company’s website:

https://www.theheinekencompany.com/investors/results-reports-webcasts-and-presentations.

An audio replay service will also be made available after the

webcast at the above web address. Analysts and investors can

dial-in using the following telephone numbers:

| United Kingdom

(Local): 020 3936 2999 |

| Netherlands: 085

888 7233 |

| USA: 1 646 664

1960 |

| All other

locations: +44 20 3936 2999 |

| Participation

password for all countries: 589454 |

Editorial information:HEINEKEN is the world's most international

brewer. It is the leading developer and marketer of premium and

non-alcoholic beer and cider brands. Led by the Heineken® brand,

the Group has a portfolio of more than 300 international, regional,

local and specialty beers and ciders. With HEINEKEN’s over 85,000

employees, we brew the joy of true togetherness to inspire a better

world. Our dream is to shape the future of beer and beyond to win

the hearts of consumers. We are committed to innovation, long-term

brand investment, disciplined sales execution and focused cost

management. Through "Brew a Better World", sustainability is

embedded in the business. HEINEKEN has a well-balanced geographic

footprint with leadership positions in both developed and

developing markets. We operate breweries, malteries, cider plants

and other production facilities in more than 70 countries. Most

recent information is available on our Company's website and follow

us on LinkedIn, Twitter and Instagram.

Market Abuse RegulationThis press release may contain

price-sensitive information within the meaning of Article 7(1) of

the EU Market Abuse Regulation.

Disclaimer: This press release contains forward-looking

statements based on current expectations and assumptions with

regard to the financial position and results of HEINEKEN’s

activities, anticipated developments and other factors. All

statements other than statements of historical facts are, or may be

deemed to be, forward-looking statements. Forward-looking

statements also include, but are not limited to, statements and

information in HEINEKEN’s non-financial reporting, such as

HEINEKEN’s emissions reduction and other climate change related

matters (including actions, potential impacts and risks associated

therewith). These forward-looking statements are identified by

their use of terms and phrases such as “aim”, “ambition”,

“anticipate”, “believe”, “could”, “estimate”, “expect”, “goals”,

“intend”, “may”, “milestones”, “objectives”, “outlook”, “plan”,

“probably”, “project”, “risks”, “schedule”, “seek”, “should”,

“target”, “will” and similar terms and phrases. These

forward-looking statements, while based on management's current

expectations and assumptions, are not guarantees of future

performance since they are subject to numerous assumptions, known

and unknown risks and uncertainties, which may change over time,

that could cause actual results to differ materially from those

expressed or implied in the forward-looking statements. Many of

these risks and uncertainties relate to factors that are beyond

HEINEKEN’s ability to control or estimate precisely, such as but

not limited to future market and economic conditions, the behaviour

of other market participants, changes in consumer preferences, the

ability to successfully integrate acquired businesses and achieve

anticipated synergies, costs of raw materials and other goods and

services, interest-rate and exchange-rate fluctuations, changes in

tax rates, changes in law, environmental and physical risks, change

in pension costs, the actions of government regulators and weather

conditions. These and other risk factors are detailed in HEINEKEN’s

publicly filed annual reports. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only of

the date of this press release. HEINEKEN assumes no duty to and

does not undertake any obligation to update these forward-looking

statements contained in this press release. Market share estimates

contained in this press release are based on outside sources, such

as specialised research institutes, in combination with management

estimates.

- Please click here to download the PDF and view the full press

release

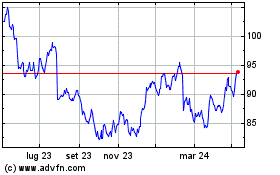

Grafico Azioni Heineken (EU:HEIA)

Storico

Da Mar 2024 a Apr 2024

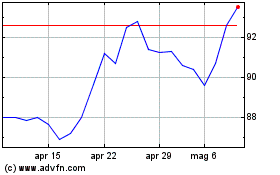

Grafico Azioni Heineken (EU:HEIA)

Storico

Da Apr 2023 a Apr 2024