Regulatory News:

Latécoère (Paris:LAT) (the “Company” or the

“Group”), a "Tier 1" international partner of the world's

major aircraft manufacturers, announces today it has entered into a

definitive Arrangement Agreement to acquire all of the issued and

outstanding common shares in the capital of Avcorp Industries Inc.

(“Avcorp”), a Canadian domiciled company that builds major

airframe structures for some of the world’s leading aircraft

companies.

Avcorp is an aerostructures supplier of wing sub-assemblies,

large scale composite parts and after-market services, with

exposure to key platforms including F-35, B737 Max, B767 and B787.

Avcorp generated CAD$99 million in revenue in 2021 with over 450

skilled employees. The company has three major manufacturing sites

in Delta, British Columbia (metallic and composite aerostructures

assembly and integration), Gardena, California (advanced composite

aerostructures fabrication capabilities) and Burlington, Ontario

(structural component repair services for commercial

aircrafts).

Strategic Fit

The acquisition of Avcorp is part of Latécoère’s 2025 roadmap to

achieve profitable growth as an active consolidator of the

aeronautics industry. In this context, the Company has already

completed a number of acquisitions in 2021 (Bombardier EWIS, TAC

and SDM) as well as announced the acquisition of MADES, which is

subject to the approval by the Spanish Council of Ministers

pursuant to defence foreign direct investment regulations and is

expected to close during Q2 2022. The acquisition of Avcorp

continues this consolidation, strengthening the Group’s

Aerostructures business by way of:

- Growing North American defence exposure

- Diversifying Latécoère’s platform exposure, with the addition

of the B737 Max and F-35

- Strengthening North American manufacturing presence and

improving geographic proximity to North American

customers

- Broadening its aerostructures capabilities, with the

addition of wing sub-assemblies and large scale composite

capabilities

- Expanding its Boeing Company and Bombardier

relationships, as well as gaining new commercial relationships with

BAE Systems, Lockheed Martin and Subaru

The Avcorp management team is led by Amandeep Kaler, CEO, who

has a solid track record in the industry and has been working

within the company for over 20 years. This team will continue to

manage the company and support business activity.

Thierry Mootz, Group Chief Executive Officer, stated: “In

2021 Latécoère has actively participated in aerospace market

consolidation, which continues into 2022 with the acquisition of

Avcorp. Avcorp is an excellent business with a track record of

delivering first class performance. Its successful management team

share our approach and vision for the enlarged business. The two

businesses have complementary client bases, geographical strengths

and service offerings. There are exciting opportunities to combine

Avcorp's expertise in defence and strong presence in North America

with Latécoère’s end-to-end technical capabilities and global

footprint. Thanks to this new acquisition the Group is well

positioned to serve the aerospace industry with innovative

solutions for a sustainable world and on track to deliver its

Ambition 2025 growth plan. On the top of rescaling the Group, it

will reposition the company on profitable growing segments.”

Commenting on the transaction Amandeep Kaler, CEO of Avcorp,

said: “This transaction represents the culmination of an

extended strategic review through a very challenging business

environment to find a partner with the financial strength and

expanded customer base to build upon Avcorp’s developed expertise

in composite aerostructure assembly and integration. Along with an

attractive premium to the weighted average share price, the

transaction provides a liquidity event for all of our shareholders.

In addition, Avcorp’s stakeholders will benefit from the enhanced

financial position, broader customer base and improved competitive

position resulting from the integration with a Tier 1 international

partner.”

Transaction Key Terms and Time

Line

Under the terms of the Arrangement Agreement, Latécoère has

agreed to acquire all of the issued and outstanding common shares

of Avcorp (each, an “Avcorp Share”) for consideration of

CAD$0.11 in cash per Avcorp Share. The consideration reflects a 16%

premium to the closing price of the Avcorp Shares on the Toronto

Stock Exchange (the “TSX”) of CAD$0.095 on 4 May, 2022, the

last trading day of Avcorp Shares prior to the announcement of the

Arrangement (defined below), and a 38% premium to the weighted

average trading price of the Avcorp Shares on the TSX of CAD$0.080

for the 90 trading days ended on 4 May, 2022. Pursuant to the

proposed transaction, the purchaser will pay a total of

approximately CAD$41 million for the Avcorp Shares. This

acquisition is fully financed with Group cash on hand.

The transaction will be implemented by way of a court-approved

plan of arrangement under the Canada Business Corporations Act (the

“Arrangement”). The Avcorp Board has unanimously approved

the transaction and has recommended that Avcorp shareholders vote

their Avcorp Shares in favour of the Arrangement.

The transaction is expected to close in Q3 2022 and is subject

to customary closing conditions for a transaction of this nature,

including court approval of the Arrangement, applicable regulatory

and stock exchange approvals (including Committee on Foreign

Investment in the US (CFIUS) and Investment Canada Act clearance),

customer consents and Avcorp shareholder approval.

RBC Capital Markets acted as financial advisor to Latécoère.

Goodmans LLP and Kirkland & Ellis LLP acted as legal counsels

to Latécoère. Fort Capital Partners acted as financial advisor to

the Special Committee of Avcorp. McMillan LLP acted as legal

counsel to Avcorp.

_____________________________________________________

About Avcorp

The Avcorp Group designs and builds major airframe structures

for some of the world’s leading aircraft companies, including BAE

Systems, Boeing, Bombardier, Lockheed Martin and Subaru

Corporation. The Avcorp Group has more than 65 years of experience,

over 450 skilled employees and 560,000 square feet of facilities.

Avcorp Structures & Integration located in Delta British

Columbia, Canada is dedicated to metallic and composite

aerostructures assembly and integration; Avcorp Engineered

Composites located in Burlington Ontario, Canada is dedicated to

design and manufacture of composite aerostructures, and Avcorp

Composite Fabrication located in Gardena California, USA has

advanced composite aerostructures fabrication capabilities for

composite aerostructures. The Avcorp Group offers integrated

composite and metallic aircraft structures to aircraft

manufacturers, a distinct advantage in the pursuit of contracts for

new aircraft designs, which require lower-cost, light-weight,

strong, reliable structures. Comtek Advanced Structures Ltd., at

our Burlington, Ontario, Canada location also provides aircraft

operators with aircraft structural component repair services for

commercial aircraft.

Avcorp Composite Fabrication Inc. is wholly owned by Avcorp US

Holdings Inc. Both companies are incorporated in the State of

Delaware, USA, and are wholly owned subsidiaries of Avcorp

Industries Inc.

Comtek Advanced Structures Ltd., incorporated in the Province of

Ontario, Canada, is a wholly owned subsidiary of Avcorp Industries

Inc.

Avcorp Industries Inc. is a federally incorporated reporting

company in Canada and traded on the Toronto Stock Exchange

(TSX:AVP).

About Latécoère

As a "Tier 1" international partner of the world's major

aircraft manufacturers (Airbus, Boeing, Bombardier, Dassault,

Embraer and Mitsubishi Aircraft), Latécoère serves aerospace with

innovative solutions for a sustainable world. The Group is active

in all segments of the aeronautics industry (commercial, regional,

business and military aircraft), in two areas of activity:

- Aerostructures (46% of turnover): fuselage sections and

doors,

- Interconnection Systems (54% of turnover): wiring, electrical

furniture and on-board equipment.

As of December 31, 2021, the Group employed 4,764 people in 14

different countries. Latécoère, a French limited company

capitalised at €133,912,589.25 divided into 535,650,357 shares with

a par value of €0.25, is listed on Euronext Paris - Compartment B,

ISIN Codes: FR0000032278 - Reuters: LAEP.PA - Bloomberg:

LAT.FP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220504006362/en/

Taddeo Antoine Denry / Investor Relations +33 (0)6 18 07

83 27

Marie Gesquière / Media Relations +33 (0)6 26 48 97 98

teamlatecoere@taddeo.fr

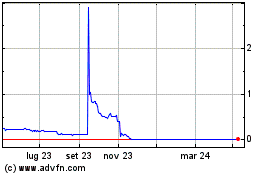

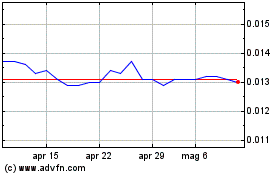

Grafico Azioni Latecoere (EU:LAT)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Latecoere (EU:LAT)

Storico

Da Apr 2023 a Apr 2024