Klépierre: COMPONENTS OF JEAN-MARC JESTIN’S AND

STÉPHANE TORTAJADA’S COMPENSATION

REGULATORY RELEASE

COMPONENTS OFJEAN-MARC JESTIN’S AND

STÉPHANE TORTAJADA’S COMPENSATION

Paris, May 25, 2022

Based on a recommendation by the Nomination and

Compensation Committee, Klépierre SA’s Supervisory Board decided at

its May 24, 2022, meeting that the company’s Executive Board shall

be composed as follows for a three-year period starting on June 22,

2022:

- Jean-Marc Jestin, re-appointed as

member and Chairman of the Executive Board; and

- Stéphane Tortajada, appointed as

member of the Executive Board, in charge of the Finance

Department.

Pursuant to the AFEP-MEDEF Code, the components

of Jean-Marc Jestin’s and Stéphane Tortajada’s compensation, as

determined by the Supervisory Board of Klépierre SA on May 24, 2022

under the compensation policy set out in section 6.2.2 of Klépierre

SA’s 2021 Universal Registration Document, are described below.

COMPENSATION OF JEAN-MARC

JESTIN

Fixed compensation for 2022

Jean-Marc Jestin’s fixed compensation in respect

of fiscal year 2022 will be:

- €750,000 payable on a pro rata

basis for the period from January 1, 2022 to June 21, 2022;

and

- €825,000 payable on a pro rata

basis for the period from June 22, 2022 to December 31, 2022.

Short-term variable compensation for 2022

Jean-Marc Jestin’s short-term variable

compensation for 2022 will be decided based on his performance as

member and Chairman of the Executive Board, as part of the

compensation review process to be conducted in early 2023 for the

period from January 1, 2022 to December 31, 2022.His short-term

variable compensation will be based on a quantitative and a

qualitative component, as described on page 281 of Klépierre SA’s

2021 Universal Registration Document.

Long-term variable compensation for 2022

In accordance with the terms and conditions of

the authorization granted by the General Meeting of Shareholders

held on April 26, 2022, the rules of the plan to be implemented in

2022 for Chairman and other members of the Executive Board will

include a three-year vesting period, followed by an assessment of

whether the service condition and performance criteria have been

fulfilled. The conditions used to determine the vesting of

performance shares granted in 2022 are set out on pages 283 and 284

of Klépierre SA’s 2021 Universal Registration Document.

Other components of compensation

The other components of compensation to which

Jean-Marc Jestin is entitled for fiscal year 2022 are set out on

pages 285 and 286 of Klépierre SA’s 2021 Universal Registration

Document.

COMPENSATION OF

STÉPHANE TORTAJADA

Fixed compensation for 2022

Stéphane Tortajada’s fixed compensation for

fiscal year 2022 will be €450,000, with effect from the date of his

appointment, payable on a pro rata basis for the period from

June 22, 2022 to December 31, 2022.

Short-term variable compensation for 2022

Stéphane Tortajada’s short-term variable

compensation for fiscal year 2022 will be decided based on his

performance as Chief Financial Officer, as part of the compensation

review process to be conducted in early 2023 for the period from

June 22, 2022 to December 31, 2022.His short-term variable

compensation from this period onwards will be based on the same

structure as that applicable to the other members of the Executive

Board, i.e., including a quantitative and a qualitative component,

as follows:

|

QUANTITATIVE COMPONENT |

|

Weighting |

Description |

|

Capped at 100% of fixed annual compensation(i.e., 66.7% of the

maximum total short-term variable compensation) |

Net current cash flow guidance as disclosed to the markets at the

beginning of the year. Achieving the target net current cash flow

per share announced by Klépierre as guidance to the market grants

entitlement to 60% of the fixed annual compensation. In addition, a

performance floor has been set at 95% of the target. |

|

QUALITATIVE COMPONENT |

|

Weighting |

Description |

|

Capped at 50% of fixed annual compensation(i.e., 33.3% of the

maximum total short-term variable compensation) |

The qualitative portion of variable compensation is measured by

applying several criteria and for 2022 is based around the

following topics:

- Management of financial

transactions and improvement in the Group’s profitability;

- Management of tax risks;

- Management of the audit function;

and

- Investor relations.

|

The overall short-term variable compensation

paid to Stéphane Tortajada will be capped at 150% of his fixed

annual compensation.In accordance with Article L. 22-10-34 II,

paragraph 2 of the French Commercial Code (Code de commerce), the

annual variable compensation due for fiscal year 2022 may only be

paid after the Ordinary General Meeting of Klépierre SA’s

shareholders to be called in 2023 to approve the 2022 financial

statements, with payment contingent on its approval by that

Meeting.

Long-term variable compensation for 2022

In accordance with the terms and conditions of

the authorization granted by the General Meeting of Shareholders

held on April 26, 2022, the rules of the plan to be implemented in

2022 for members of the Executive Board will include a three-year

vesting period, followed by an assessment of whether the service

condition and performance criteria have been fulfilled. The

conditions used to determine the vesting of performance shares

granted in 2022 are set out on pages 283 and 284 of Klépierre SA’s

2021 Universal Registration Document.As for all members of the

Executive Board, the annual allotments made to Stéphane Tortajada

would not represent more than 100% of his short-term

compensation.Furthermore, in accordance with Article L. 225-197-1

of the French Commercial Code as set out in the AFEP-MEDEF Code,

Stéphane Tortajada would be required to hold in registered form a

number of shares equivalent to 50% of the gain on vested shares net

of tax and expenses as calculated on delivery of the shares until

the end of his term of office.In accordance with the AFEP-MEDEF

Code, Stéphane Tortajada will undertake not to enter into hedging

transactions until the end of the lock-up period imposed by the

performance share plans.

Other components of compensation

Employment contract and severance package

Stéphane Tortajada will not hold an employment

contract with Klépierre SA or any other entity belonging to the

Klépierre Group.In the event of forced departure from Klépierre,

Stéphane Tortajada may be entitled to receive a severance payment

in an initial amount of one year’s annual compensation, calculated

by reference to the fixed compensation (gross) as of the last day

of his term of office and the most recent (gross) short-term

variable compensation paid as at the date of termination, it being

specified that this initial amount will increase on a linear basis

according to Stéphane Tortajada’s length of service as a corporate

officer (on a basis of one month for each additional year of

service with effect from January 1, 2023) and up to a

maximum of two years’ compensation, in accordance with the

AFEP-MEDEF Code.Payment of this severance package is subject to

fulfillment of the performance conditions set out on page 285 of

Klépierre SA’s 2021 Universal Registration Document.

Extraordinary compensation

No extraordinary compensation will be paid to

Stéphane Tortajada in respect of fiscal year 2022.

Other benefits

Stéphane Tortajada is entitled to:

- The same benefits plan as other

employees in France;

- Unemployment insurance subscribed

with GSC;

- The material resources necessary

for the performance of his term of office;

- Upon presentation of supporting

documents, the reimbursement of business travel and expenses

incurred in the performance of his duties.

Compensation in respect of offices held within the Group

Stéphane Tortajada will not receive any

compensation for his offices in the various entities belonging to

the Group (other than Klépierre SA).

Deferred variable compensation or multi-annual variable

compensation

None.

Defined benefit or defined contribution pension plan

There are no defined benefit or defined

contribution pension plans. The members of the Executive Board

qualify for the same supplementary pension plan as other managers

in the Group of which Klépierre SA is a part.

| INVESTOR

RELATIONSCONTACTS |

MEDIA

CONTACTS |

|

Arnaud Courtial, Group Head of IR and FinancialCommunication+33

(0)6 74 57 35 12 — arnaud.courtial@klepierre.comPaul Logerot, IR

Manager +33 (0)7 50 66 05 63 — paul.logerot@klepierre.comJulia

Croissant, IR Officer+33 (0)7 88 77 40 37 —

julia.croissant@klepierre.com |

Hélène Salmon, Group Head of Corporate and Internal

Communications+33 (0)1 40 67 55 16 –

helene.salmon@klepierre.comWandrille Clermontel, Taddeo+33 (0)6 33

05 48 50 – teamklepierre@taddeo.fr |

ABOUT KLÉPIERRE

Klépierre is the European leader in shopping

malls, combining property development and asset management skills.

The Company’s portfolio is valued at €21.5 billion at June 30,

2021, and comprises large shopping centers in more than

10 countries in Continental Europe which together host

hundreds of millions of visitors per year. Klépierre holds a

controlling stake in Steen & Strøm (56.1%), Scandinavia’s

number one shopping center owner and manager. Klépierre is a French

REIT (SIIC) listed on Euronext Paris and is included in the CAC

Next 20 and EPRA Euro Zone Indexes. It is also included in ethical

indexes, such as Euronext CAC 40 ESG, MSCI Europe ESG Leaders,

FTSE4Good, Euronext Vigeo Europe 120, and features in CDP’s

“A-list”. These distinctions underscore the Group’s commitment to a

proactive sustainable development policy and its global leadership

in the fight against climate change. For more information, please

visit the newsroom on our website: www.klepierre.com

- PR - JMJ et ST - Eléments de rémunération

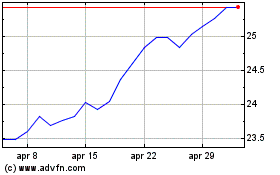

Grafico Azioni Klepierre (EU:LI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Klepierre (EU:LI)

Storico

Da Apr 2023 a Apr 2024