First-Half 2022 Earnings

PRESS RELEASE

FIRST-HALF 2022 EARNINGS

Paris — July 26, 2022

Klépierre, the European leader in shopping

malls, today reported its earnings for the six-month period ended

June 30, 2022 (1). The main highlights include:

- First-half 2022 net current

cash flow at €1.32 per share(2), up 83.7% year-on-year

- Retailer sales(3)

near or above pre-pandemic level in the 5 undisturbed months of

2022, with a significant acceleration in the second quarter

- Like-for-like net rental income up

66.7% year on year

- Steady leasing activity with

a 2.7% positive reversion and occupancy rate improving

to 94.7% year on year

- Successful inauguration of the

extension of Gran Reno (Bologna, Italy) early July, 98%

occupied, with a yield on cost of 7.6% and better-than-expected

rents

- €431 million in disposals

closed since January 1, 2022

- Stronger financial metrics with a

Loan-to-Value ratio of 38.8%, a net debt to EBITDA ratio

of 8.6x(4) and an ICR of 10.0x

- EPRA Net Tangible Assets(5) per

share of €30.60, with a broadly stable portfolio value

- 2022 net current cash flow guidance

raised to at least €2.45(2) per share, a 5.4% increase

compared to the midpoint of the initial guidance

Jean-Marc Jestin, Chairman of the Klépierre

Executive Board, commented, “Klépierre delivered a steady

performance over the first six months, with a rise in net current

cash flow per share, supported by growth in rental income, an

increase in retailer sales and dynamic leasing activity. Regarding

development, I am particularly proud of the inauguration in early

July of our flagship mall Gran Reno in Bologna, with an occupancy

rate of 98%. This major achievement is a perfect illustration of

Klépierre’s ambitions for retail and its value creation abilities.

We have also actively pursued our asset rotation strategy with more

than €430 million in disposals closed to date, translating

into further improvement of our robust financial metrics with a net

debt to EBITDA ratio of 8.6x and an ICR of 10.0x. In May, S&P

confirmed our BBB+ rating with a stable outlook. Since the outbreak

of the pandemic, thanks to the resilience of our business model and

our financial discipline, Klépierre has paid €1.4 billion in

cash dividends to shareholders and reduced net debt by

c.€1 billion(4). On the back of our solid first-half results,

we are revising our full-year guidance upwards to at least

€2.45 per share, a 5.4% increase compared to the midpoint of

our initial guidance.”

KEY FINANCIALS

|

|

H1 2022 |

H1 2021 |

Reported Change |

Like-for-like change(a) |

|

In millions of euros, total share |

|

|

|

|

|

Total revenues |

613.8 |

475.4 |

+29.1% |

|

|

Net Rental Income (NRI), shopping centers |

490.3 |

315.9 |

+55.2% |

+66.4% |

|

Property portfolio valuation (inc. transfer taxes) |

20,577 |

21,471 |

-4.2% |

+0.8% |

|

Net debt |

7,867 (b) |

9,146 |

-14.0% |

|

|

Loan-to-Value (LTV) |

38.8% (b) |

42.6% |

-380 bps |

|

|

Net debt to EBITDA |

8.6x (b) |

12.6x |

-4.0x |

|

|

ICR |

10.0x |

6.5x |

+3.5x |

|

|

In euros, Group share |

|

|

|

|

|

EPRA Net Tangible Assets (NTA) per share |

30.6 |

29.7 |

+3.0% |

|

|

Net current cash flow per share |

1.30 |

0.72 |

+79.3% |

|

|

Net current cash flow per share (excluding IFRS 16) |

1.32 |

0.72 |

+83.7% |

|

(a) Like-for-like data exclude the

contribution of new spaces (acquisitions, greenfield projects and

extensions), spaces being restructured, disposals completed since

January 2022, and foreign exchange impacts.

(b) Taking into account disposals

closed after June 30, 2022.

OPERATING PERFORMANCE

Retailer sales(3) and footfall

Retailer sales in January were negatively

impacted by the pandemic (store closures in the Netherlands, the

“2G” law in Germany and mandatory face coverings to visit stores in

other countries). From February to June, retailer sales continued

to improve strongly in line with the second half of 2021 with a

sequential monthly acceleration, supported by the end of health

restrictions and the economic rebound, reaching 92% of 2019 levels

in February and March and up to 101% in the second

quarter.Similarly, footfall continued to improve to reach the

highest level since 2021 at c.90% of 2019 levels in May and June

(10 percentage points better than in second-half 2021). High

transformation rates and average basket sizes once again drove the

increase in retailer sales.In all geographies, retailer sales and

footfall were on a steady upwards trend from February to June.By

segment, fashion confirmed its recovery over the first half and

posted one of the strongest rebounds in the second quarter.

Culture, gifts & leisure together with health & beauty

experienced a sustained increase over the second quarter, with

performances respectively above and on a par with 2019 levels.

Household equipment continued to outperform over the first half.

Lastly, food & beverage has posted solid rises since the

beginning of the year with also a sharp acceleration between the

first and second quarters.

Leasing update

Klépierre recorded a dynamic first half in terms

of leasing with 699 leases signed, including 516 renewals

and re-lettings at an average 2.7% positive rental reversion.

Strong retailer demand for Klépierre’s malls contributed to

maintaining a high occupancy rate at 94.7%, up 50 basis points

over one year with a sustained occupancy cost ratio of 12.4% (down

20 basis points over 6 months). Across its portfolio, Klépierre

continued to adapt its mix, prioritizing the expansion of

omnichannel retailers that are better suited to evolving consumer

expectations. This translated into a sustained deal flow with

banners such as Inditex (9 leases), H&M (6 leases), Calzedonia

(17 leases), Nike (3 leases), Mango (1 lease), Rituals (2 leases)

and Pandora (2 leases). Greater emphasis has also been placed on

dynamic segments like sports. Sneakers group Deichmann unveiled

seven stores in Italy, Sweden and Spain, while JD Sports

signed leases for the expansion of two stores in France and Italy.

In addition, the Group signed an important deal for the opening of

the first Nike stores in its Scandinavian malls at Emporia (Malmö,

Sweden) and Bruun’s Galleri (Aarhus, Denmark). Lastly, the

sportswear specialist, 4F, and the Danish retailer, Hummel, joined

malls in Poland and Denmark, respectively, while Adidas is set to

unveil a brand-new boutique in Arcades (Paris region, France) in

the second half of 2022. Convinced by the quality of the locations

offered by the Group, a host of newcomers and on-trend concepts

also chose Klépierre as part of their growth strategy. Jimmy

Fairly, the hip eyewear specialist, is set to unveil its new

flagship in France in the coming months, while the Chinese online

retail platform, AliExpress, launched an offline concept in Spain

in April. Likewise, household equipment specialist Tefal signed up

for its first stores in Klépierre’s portfolio in France and Sweden,

while several contracts were signed with Danish brand Flying Tiger

Copenhagen, lifestyle brand Miniso and Chinese retailer Xiaomi.

Leasing activity was also dense within the popular value retail

segment, with the opening of new stores for Normal, Pepco, Xenos or

HalfPrice. Lastly, with the normalization of the health situation,

the Group also resumed its specialty leasing activities

– especially pop-up stores – welcoming brands including

Izipizi, Devialet, Jean-Paul Gaultier, Havaianas, Bons Baisers de

Paname and Thermomix, all of which contributed to rejuvenating the

retail offering and boosting footfall and sales in numerous

shopping centers.

Rent collection

As of July 18, 2022, Klépierre had

collected 95% of invoiced rents and charges (96% collected for the

first quarter). The Group is on track to achieve a collection rate

of at least 96.7% for first-half 2022, only

1.7 percentage points below the 5-year average pre-pandemic

level.Collection rates for 2020 and 2021 continued to improve,

leading to additional income (reversal of provisions) in first-half

2022 for €38 million (one-off item).

Net rental income

Net rental income amounted to

€501.3 million, up 56.4% on a reported basis, with the

increase mainly attributable to lower rent abatements and

provisions for credit losses, and higher variable revenue and other

income for an aggregate amount of €197 million.On a

like-for-like basis, net rental income increased by 66.7%.

NET CURRENT CASH FLOW

Over the first half of 2022, net current cash

flow amounted to €428 million (total share), or €1.32 per

share, of which €0.12 relates to higher than anticipated rents

collection for 2020 and 2021.Compared to the same period last year,

the €0.60 per share improvement in net current cash flow(6) is

mainly attributable to net rental income (€0.64) and a lower cost

of debt (€0.02), partially offset by higher current tax expenses

(-€0.05).

PORTFOLIO VALUE AND EPRA NET TANGIBLE ASSETS

(NTA)

Klépierre’s total portfolio value stood at

€20,577 million(7) on a total share basis as of June 30,

2022, up 0.8% like-for-like over 12 months and up 0.3% over 6

months. Overall, as of June 30, 2022, the average EPRA

Net Initial Yield for the shopping center portfolio stood at 5.2%,

flat compared to December 31, 2021.EPRA NTA(5) per share

amounted to €30.60 compared to €31.20 as of December 2021.

This slight decrease mainly reflected the payment in a single

installment of the €1.70 per share distribution, partly offset by

the 6-month cash flow (€1.32 per share). The increase in the

like-for-like portfolio value had a positive impact of

€0.28 per share, while foreign exchange and other items had a

negative impact of €0.50 per share.

DEBT AND FINANCING

As of June 30, 2022, consolidated net

debt amounts to €8,124 million, versus €8,006 million six

months ago. Considering the disposals closed early July, notably

the €290 million assets in Norway (see the “Disposals” section

below), net debt stood at €7,867 million. The gross debt has

an average maturity of 6.5 years.As of

June 30, 2022, the Loan-to-Value (LTV) ratio stood at

39.5% (compared to 38.7% as of December 31, 2021) and

38.8% factoring in the recent disposals early July. Net debt to

EBITDA ratio stood at 8.6x while ICR was at 10.0x. The hedging

profile(8) remains solid with 88% of net debt hedged at fixed rates

in 2022, breaking down as 69% fixed-rate debt and payer swaps and

19% caps and with a weighted average maturity of

4.8 years.Klépierre’s liquidity position(9) stood at

€2.3 billion (including €1.8 billion of committed credit

facilities) and covers all the Group’s refinancing needs until the

end of 2024.

DEVELOPMENTS AND DISPOSALS

Investments

In the first half of 2022, the Group

focused on its main committed development projects: the extension

of Gran Reno in Bologna (Italy), the refurbishment and

extension of Grand Place in Grenoble (France) and the

development of five Primark megastores (31,000 sq.m.

total) in Italy and France with most set to open by the end of the

year.Total capital expenditure in the first half of 2022 amounted

to €90.9 million, of which €57.7 million in development projects

and €23.7 million in maintenance and refurbishment,

mainly.

Pipeline

Early July, Klépierre successfully inaugurated

the extension of Gran Reno (Bologna, Italy), on budget and

with better rents than expected. This operation finalized the full

makeover of this flagship shopping center and was 98% let at

opening. Perfectly illustrating the Group’s operational strategy,

the 16,700 sq.m. extension hosts an outstanding set of

retailers such as Sephora, New Balance, JD Sports, the Inditex

brands, H&M, Tommy Hilfiger and Primark, together with a

new food destination area. The full makeover of Gran Reno

delivered a 7.6% yield on cost.The refurbishment of

Grand Place, the leading retail destination in Grenoble

(France), was delivered in March 2022 with new store signings

including Vans and Lego. In addition, the first stone was laid on

the construction of the 16,200 sq.m. extension in

May 2022, with completion scheduled for the end of 2023.

Pre-leasing is well on track, with 82% of projected net rental

income signed (68%) or under advanced negotiations (14%).

Disposals

Since January 1, 2022, the Group has

closed or signed disposals for a total consideration of

€470 million(10) at an average yield of 6.0%(11) and prices in

line with appraised values (-0.4%). €431 million were closed

to date mainly including the disposal, on July 1, 2022,

of three Norwegian properties (€290 million) as well as a few

portfolios of retail properties in France.

ACT FOR GOOD ®

Since the beginning of the year, Klépierre has

pressed ahead with its Act for Good® policy based on three pillars:

Act for the Planet, Act for Territories and Act for People. This

strategy demonstrates Klépierre’s intention to reconcile the

requirements of operational excellence with environmental, societal

and social performance and has already been largely recognized by

several non-financial rating agencies. Thanks to the outstanding

work put in day-in, day-out by Klépierre teams’ in making shopping

centers more efficient and ever more environmentally ambitious,

GRESB, MSCI, SBTi and CDP, ranked the Group as the leader in its

sector. Amid tight energy supply and higher associated costs,

Klépierre is also actively engaged in reducing its power

consumption while supporting retailers in the same aim.The Group

and its employees have also been highly committed to providing

support to the people in Ukraine since the outbreak of war on

February 24, 2022. Klépierre’s teams promptly organized

donations for refugees, and in our shopping centers in Europe, we

also arranged for the collection of clothes, food and healthcare

products from our retailers and visitors as well as from

non-profits organizations. These were then shipped to

Sadyba Best Mall in Warsaw (Poland) which became a

logistics hub for the distribution of the donations to Ukraine.

OUTLOOK

For 2022, the Group expects net current cash

flow to reach at least €2.45 per share(2), a 5.4% increase compared

to the midpoint of the initial guidance.This updated guidance

assumes that business operations are not impacted in H2 2022 by new

Covid-related disruptions on our clients’ operations or by any

major deterioration in the geopolitical situation. It does include

disposals closed to date and a €0.12 profit per share booked

in H1 2022 relating to higher rent collection for 2020 and

2021.

RETAILER SALES AND FOOTFALL

VERSUS

2019(A)

|

|

Retailer sales |

Footfall |

| January

2022 |

83% |

78% |

| February

2022 |

94% |

83% |

| March

2022 |

91% |

82% |

| April

2022 |

101% |

85% |

| May 2022 |

105% |

90% |

|

June 2022 |

99% |

89% |

(a) Change on a same store basis, excluding the

impact of asset sales and acquisitions.

TOTAL

REVENUES

|

In millions of euros |

Total share |

|

Group share |

|

H1 2022 |

H1 2021 |

|

H1 2022 |

H1 2021 |

|

France |

226.8 |

144.1 |

|

185.4 |

117.4 |

| Italy |

107.2 |

76.4 |

|

106.0 |

75.6 |

| Scandinavia |

75.9 |

85.2 |

|

42.6 |

47.8 |

| Iberia |

63.0 |

53.9 |

|

63.0 |

53.9 |

| Netherlands &

Germany |

53.8 |

43.6 |

|

53.2 |

42.8 |

| Central

Europe |

32.2 |

29.9 |

|

32.2 |

29.9 |

|

Other countries |

7.5 |

6.2 |

|

6.8 |

5.7 |

|

SHOPPING CENTER GROSS RENTAL INCOME |

566.4 |

439.3 |

|

489.2 |

373.1 |

|

Other retail properties |

10.9 |

5.1 |

|

10.9 |

5.1 |

|

TOTAL GROSS RENTAL INCOME |

577.3 |

444.3 |

|

500.1 |

378.2 |

|

Management and development fees |

36.5 |

31.1 |

|

35.1 |

29.3 |

|

TOTAL REVENUES |

613.8 |

475.4 |

|

535.2 |

407.5 |

|

Equity-accounted companies* |

41.2 |

30.9 |

|

39.7 |

29.1 |

* Contributions from equity-accounted investees include

investments in jointly controlled companies and investments in

companies under significant influence.

QUARTERLY NET RENTAL

INCOME ON A TOTAL SHARE BASIS

| |

H1 2022 |

2021 |

|

In millions of euros |

Q2 |

Q1 |

Q4 |

Q3 |

Q2 |

Q1 |

|

France |

119.0 |

79.2 |

109.5 |

100.1 |

43.6 |

45.6 |

|

Italy |

53.1 |

45.5 |

70.5 |

48.2 |

36.1 |

22.9 |

|

Scandinavia |

32.3 |

32.8 |

31.6 |

33.9 |

50.5 |

23.4 |

|

Iberia |

29.8 |

27.4 |

29.9 |

33.5 |

22.9 |

19.8 |

|

Netherlands & Germany |

22.9 |

14.1 |

23.8 |

28.8 |

23.1 |

3.8 |

|

Central Europe |

12.7 |

17.4 |

12.5 |

18.7 |

10.4 |

9.6 |

|

Other countries |

2.9 |

1.4 |

3.7 |

2.9 |

1.9 |

2.3 |

|

SHOPPING CENTERSNET RENTAL INCOME |

272.5 |

217.8 |

281.5 |

266.0 |

188.5 |

127.3 |

|

Other retail properties |

7.2 |

3.8 |

5.3 |

6.1 |

2.5 |

2.2 |

|

TOTAL NET RENTAL INCOME |

279.8 |

221.5 |

286.8 |

272.1 |

191.0 |

129.6 |

NET CURRENT CASH FLOW

|

|

H1 2022 |

H1 2021 |

Change |

|

(Total share, in millions of euros) |

|

|

|

| Gross rental

income |

577.3 |

444.3 |

+29.9% |

| Rental and

building expenses |

(76.0) |

(123.8) |

-38.6% |

|

Net rental income |

501.3 |

320.6 |

+56.4% |

|

Management and other income |

42.0 |

35.7 |

+17.6% |

| General and

administrative expenses |

(76.7) |

(71.4) |

+7.5% |

|

EBITDA |

466.6 |

284.9 |

+63.8% |

|

Adjustments to calculate operating cash flow: |

|

|

|

|

Depreciation charge for right-of use assets(a) |

(4.0) |

(4.2) |

|

|

Employee benefits, stock option expense and non-current operating

expenses/income |

(1.9) |

0.0 |

|

|

IFRIC 21 impact |

7.7 |

8.2 |

|

|

Operating cash flow |

468.4 |

288.9 |

+62.1% |

|

Cost of net debt |

(58.1) |

(58.2) |

-0.2% |

|

Adjustments to calculate net current cash flow before taxes: |

|

|

|

| Amortization

of Corio debt mark-to-market |

(0.4) |

(1.9) |

|

| Financial

instrument close-out costs |

6.8 |

1.7 |

|

|

Current cash flow before taxes |

416.7 |

230.5 |

+80.8% |

|

Share in earnings of equity-accounted companies |

28.5 |

17.6 |

+62.6% |

| Current tax

expense |

(17.6) |

0.1 |

n.m. |

|

Net current cash flow |

427.7 |

248.1 |

+72.4% |

|

(Group share, in millions of euros) |

|

|

|

|

NET CURRENT CASH FLOW |

371.7 |

206.9 |

+79.6% |

| Average number

of shares(b) |

286,037,065 |

285,539,909 |

|

| (Per share, in

euros) |

|

|

|

|

NET CURRENT CASH FLOW – IFRS |

1.30 |

0.72 |

+79.3% |

|

IFRS 16 straight-line amortization |

0.02 |

(0.01) |

|

|

NET CURRENT CASH FLOW – ADJUSTED |

1.32 |

0.72 |

+83.7% |

(a) Right-of-use assets and lease liabilities

related to head office and vehicle leases as per IFRS 16.(b)

Excluding treasury shares.

2022 HALF-YEAR EARNINGS

WEBCASTPRESENTATION AND CONFERENCE

CALL

|

Klépierre Executive Board will present the 2022 half-year earnings

on Wednesday, July 27, 2022 at 9:00 am Paris

time (8:00 am London time). Please visit Klépierre’s website

at www.klepierre.com to listen to the webcast, or click here.A

replay will also be available after the event. |

|

|

AGENDA |

|

|

October 19,

2022 |

Business review for the first nine months of 2022 (after market

close) |

|

INVESTOR RELATIONS CONTACTS |

MEDIA CONTACTS |

|

Arnaud Courtial, Group Head of IR and Financial Communication+33

(0)6 74 57 35 12 — arnaud.courtial@klepierre.comPaul Logerot, IR

Manager +33 (0)7 50 66 05 63 — paul.logerot@klepierre.comJulia

Croissant, IR Officer+33 (0)7 88 77 40 37

—julia.croissant@klepierre.com |

Hélène Salmon, Group Head of Corporate and Internal

Communications+33 (0)1 40 67 55 16 –

helene.salmon@klepierre.comDelphine Granier, Taddeo+33 (0)6 33 05

48 50 – teamklepierre@taddeo.fr |

ABOUT KLÉPIERRE

Klépierre is the European leader in shopping

malls, combining property development and asset management skills.

The Company’s portfolio is valued at €20.6 billion at

June 30, 2022, and comprises large shopping centers in

more than 10 countries in Continental Europe which together

host hundreds of millions of visitors per year. Klépierre holds a

controlling stake in Steen & Strøm (56.1%), Scandinavia’s

number one shopping center owner and manager. Klépierre is a French

REIT (SIIC) listed on Euronext Paris and is included in the CAC

Next 20 and EPRA Euro Zone Indexes. It is also included in ethical

indexes, such as Euronext CAC 40 ESG, MSCI Europe ESG Leaders,

FTSE4Good, Euronext Vigeo Europe 120, and features in CDP’s

“A-list”. These distinctions underscore the Group’s commitment to a

proactive sustainable development policy and its global leadership

in the fight against climate change. For more information, please

visit the newsroom on our website: www.klepierre.com

This press release is available on the Klépierre

website:www.klepierre.com

(1) The Supervisory Board met at

Klépierre’s headquarters on July 25, 2022, to examine the interim

financial statements, as approved by the Executive Board on

July 21, 2022. The consolidated financial statements have been

subject to review procedures by the Company’s Statutory Auditors.

The review report on the interim financial information is to be

issued shortly.(2) Excluding the impact of amortizing

Covid-19 rent concessions.(3) Change on a same store

basis, excluding the impact of asset sales and acquisitions.

(4) Net debt restated for disposals

closed after June 30, 2022.(5) EPRA NTA per share

figures are rounded to the nearest

10 cents.(6) Figures are rounded to the nearest

10 cents.(7) Including transfer taxes, total

share.(8) Calculated as the ratio of fixed-rate debt

(after hedging) to gross borrowings expressed as a

percentage.(9) Liquidity position is the total financial

resources available to a company. This indicator is therefore equal

to the sum of the cash at hand at the end of the year, confirmed

and unused revolving credit facilities (net of commercial paper)

and uncommitted credit facilities.(10) Excluding

transfer taxes, total share.(11) Calculated based on

2022 estimated net rental income.

- PR_KLEPIERRE_2022_HY_REVENUES

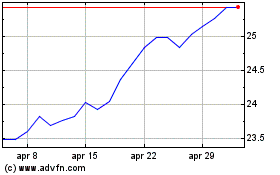

Grafico Azioni Klepierre (EU:LI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Klepierre (EU:LI)

Storico

Da Apr 2023 a Apr 2024