GROUPE PARTOUCHE: Income 1st Half-Year 2021/2022 - Solid 1st HY

Income and resumption of growth investments

Income 1st

Half-Year

2021/2022Solid

1st HY Incomeand

resumption of growth investments

- Turnover: €

187.2

M

(x4,0)

- EBITDA: €

34.2 M compared to

- €

42.0

M at 1st

HY 2021

- Net Income: €

24.6 M

compared to - €

88.0

M at 1st

HY 2021

- Healthy financial situation:

gearing of

0.2x

and leverage of

0.7x

Paris, 28th June 2022, 06:00 p.m. During its

meeting held on the 28th June 2022 and after having reviewed the

management report of Groupe Partouche Executive Board, the

Supervisory Board examined the 1st Half-Year of financial year

2021-2022 (November 2021 to April 2022).

Good operational performance driven by

the gradual normalization of activity

In a context of a gradual return to usual casino

operations, the operating performance for the

1st half of 2022

improves significantly compared

to the 1st half of the previous

financial year. However, the health constraints still in

place over the period continued to penalize the attendance1.

Otherwise, the data at 30th April 2022 take into

consideration the scope’s following effects:

- cessation of the

operations in Belgium (gaming & betting) and of the management

of the Ostend casino starting 29th July 2021 (Belgium turnover of €

21.6 M at 1st half-year 2020 and € 41.4 M at 1st half-year

2021);

- assignment of

the stake held in the Crans-Montana casino on 31st January 2022

(turnover of € 5.2 M at 1st HY 2019, the site being closed during

the 1st HY 2020 and most of 1st HY 2021);

- end of the

concession of the restaurant « Le Laurent » as from 7th

March 2022 (turnover of € 2.2 M during 1st HY 2019 and € 1.2 M

during 1st HY 2020, the restaurant being closed during the 1st HY

2021).

Gross Gaming Revenue

(GGR) over the period increases

very strongly at € 290.0

M (+ € 239.9 M compared to 1st half-year 2021) as

well as the turnover at € 187.2 M (+ €

140.0

M).

The Group’ EBITDA is positive again at €

34.2 M, compared to -€ 42.0 M at 1st half-year 2021, while

it is amputated from the Ostend Casino EBITDA (bricks and mortar

games, online gaming and sports betting) which amounted to € 2.3 M

at 1st half-year 2021.

The current operating income (COI)

totals € 9.7 M compared

to - € 73.2 M a year earlier,

driven by the casinos’ division

(COI of + € 16.0 M compared

to - € 68.2 M in 2021)

thanks to the reopening of all the casinos of the Group.

The COI of the hotels’ division increases

slightly to - € 1.8 M compared to - € 2.2 M in 20212.

Finally, the COI of the division Other totals -

€ 4.6 M at 1st half-year 2022, compared to - € 2.8 M at 1st

half-year 2021, impacted by the exit of the sports betting in

Belgium (+ € 1.8 M in 2021).

Purchases and

external expenses remain stable at - €

60.7 M:

- With

the reopening of the sites and the

increase in the turnover of other activities, the

purchases of materials, the expenses of

publicity/marketing and maintenance (- € 30.0 M in aggregated)

increase respectively by + € 13.3 M, + € 9.4 M and

+ € 2.2 M;

- In the same

time, the outsourcing expenses (- € 30.7 M) strongly

decrease following the cessation in Belgium of the online

casino and sports betting (a relief of € 35.1 M) and despite the

increase in the outsourcing expenses (guarding, cleaning) up to €

3.4 M linked with the reopening of the casinos.

It may be noted the increase of € 3.9 M in

expenses relating to the ramp-up of the online casino in

Switzerland.

The reopening of the casinos led to

employees’

expenses of € 81.9

M (compared to € 31.5 M at 1st HY 2021). As a reminder,

during the 1st HY 2021, the Group profited from partial

unemployment benefits and savings in employer contributions, as

well as exemptions/aids under the business aid measures put in

place by the government in the acute phase of the health crisis. In

addition, some casinos are once again paying a contribution to

their employees (+ €1.8 M).

The non-current operating income is a

net profit of € 17.5 M, compared to a loss of - € 8.6 M at

1st HY 2021, due to the following:

- the assignment,

at the end of January 2022, of the 57% stake held by Groupe

Partouche in the casino of Crans-Montana in Switzerland, that

generated an income of + € 14.1 M;

- no goodwill

impairment test was performed this HY (in 1st HY 2021, impairments

amounted to - € 15.0 M);

- conversely, in

Belgium, the final resolution of old disputes against the Belgian

State generated a non-recurring profit of € 3.4 M over this

half-year, in addition to the € 5.8 M of the same nature recorded

in the first half of 2021.

Finally, the net income is a profit of €

24.6 M compared to a loss of - € 88.0 M at 30th April

2021, after taking into consideration the following:

- a financial

income of - € 1.3 M (compared to - € 2,3 M at 1st HY 2021), which

benefits from a foreign exchange gain due to the reopening of

casinos on both sides of the Franco-Swiss border and a favourable

exchange rate;

- a tax expense

(including CVAE) standing at - € 1.2 M (compared to - € 4.0 M in

1st HY 2021).

With a cashflow net of

levies amounting

to € 120.5

M, an

equity of € 338.8 and

a net debt of € 55.7

M (constructed in accordance with the terms of the

syndicated loan contract, according to IAS 17, excluding IFRS 16),

the Group's financial structure is sound and solid; net

debt is down € 31.3 M

compared to the end of October 2021.

RECENT EVENTS & OUTLOOK

Since the lifting of the vaccination pass,

gaming activities have regained momentum with a very satisfactory

trend. At the same time, Groupe Partouche is intensifying its

investment plan aimed at renovating and increasing the gaming offer

of several of its casinos and will benefit from the entry into

force of the concession for the Middelkerke casino in Belgium from

1st July.

End of Palavas

renovation works

The casino restructuring project, a commitment

of the new concession obtained for 20 years, began on 1st November

2021 and aims at increasing the gaming surface while enhancing the

spaces, the building itself and the site. The project is located in

three places in the casino: the entrance, the upstairs room and the

restaurant, add to this, the façade and the parking.

The ground floor will be dedicated to slot

machines, in a calm and cosy atmosphere, while the 1st floor will

host the table games in their electronic and non-electronic form,

in a younger and more festive atmosphere. These works are currently

being completed.

Restructuring

the casino Le

Lyon Vert at la

Tour-de-Salvagny

The Casino Le Lyon Vert is undertaking a major

restructuring of the existing spaces and the creation of a major

extension on two levels (ground floor and 1st floor). The project

seeks to restore the initial qualities of the building. The

interior spaces will be adapted to the operations and enhanced. The

project develops new gaming spaces that are too cramped today and

respond to the current operation of modern casinos, ensures a

complete update of staff premises, brings clearances and emergency

exits up to standard, makes the building accessible to all and

increases the non-gaming offer (event rooms). The surroundings are

upgraded with the creation of two car parks for the public and a

car park to the North for staff. The works should be completed in

the spring of 2023.

Launching of the

extension works at Annemasse

casino

Extensive work is underway at the Annemasse

casino and will allow the opening of the left wing, the

construction of an extension at the front, the creation of two

outdoor rooms (smoking), the construction of a veranda for a

restaurant room and the creation of a large hall starting from the

entrance. These works are due to end in June 2023.

Upcoming

events:

- 3rd quarter financial information: Tuesday

13th September 2022, after stock market closure

- 4th quarter turnover: Tuesday 13th December

2022, after stock market closure

Groupe Partouche was established in 1973 and has

grown to become one of the market leaders in Europe in its business

sector. Listed on the stock exchange, it operates casinos, a gaming

club, hotels, restaurants, spas and golf courses. The Group

operates 41 casinos and employs nearly 3,900 people. It is well

known for innovating and testing the games of tomorrow, which

allows it to be confident about its future, while aiming to

strengthen its leading position and continue to enhance its

profitability.

Groupe Partouche was floated on the stock

exchange in 1995, and is listed on Euronext Paris, Compartment .

ISIN : FR0012612646 - Reuters PARP.PA - Bloomberg : PARP:FP Reuters

: PARP.PA - Bloomberg : PARP:FP

FINANCIAL INFORMATIONGroupe

Partouche Phone :

01.47.64.33.45 – Fax : 01.47.64.19.20Valérie Fort, Chief

Financial

Officer info-finance@partouche.com

Annex

Consolidated Income

statement

|

In €M - At

30th April (6

months) |

2022 |

2021 |

GAP |

Var. |

|

Turnover |

187.2 |

47.2 |

140.0 |

296.9% |

|

Purchases & external expenses |

(60.7) |

(60.6) |

(0.0) |

0.1% |

|

Taxes & duties |

(10.2) |

(5.6) |

(4.6) |

80.8% |

|

Employees expenses |

(81.9) |

(31.5) |

(50.4) |

160.0% |

|

Depreciation, amortisation & impairment of fixed assets |

(26.2) |

(28.5) |

2.3 |

-8.1% |

|

Other current income & current operating expenses |

1.4 |

5.9 |

(4.5) |

-76.2% |

|

Current Operating Income |

9.7 |

(73.2) |

82.8 |

n/a |

|

Other non-current income & operating expenses |

3.4 |

6.4 |

(3.0) |

- |

|

Gain (loss) on the sale of consolidated investments |

14.1 |

- |

14.1 |

- |

|

Impairment of non-current assets |

- |

(15.0) |

15.0 |

- |

|

Non-current Operating Income |

17.5 |

(8.6) |

26.1 |

- |

|

Operating Income |

27.2 |

(81.8) |

108.9 |

n/a |

|

Financial Income |

(1.3) |

(2.3) |

0.9 |

- |

|

Income before tax |

25.8 |

(84.0) |

109.8 |

- |

|

Corporate Income Tax |

(0.4) |

(3.6) |

3.2 |

- |

|

CVAE Tax |

(0.7) |

(0.4) |

(0.3) |

- |

|

Income after Tax |

24.7 |

(88.0) |

112.7 |

- |

|

Share in earnings of equity-accounted associates |

(0.1) |

(0.0) |

(0.1) |

- |

|

Total Net Income |

24.6 |

(88.0) |

112.6 |

n/a |

|

o/w Group Share |

24.2 |

(81.6) |

105.8 |

- |

|

EBITDA (*) |

34.2 |

(42.0) |

76.3 |

n/a |

|

Margin EBITDA /

Turnover |

18.3% |

n/a |

|

n/a |

(*) Taking into consideration the application of IFRS 16 that

has the mechanical effect of improving the EBITDA by € 7.0 M at 1st

HY 2022 and € 7.3 M at 1st HY 2021.

Taxes & duties represent an expense of €

10.2 M compared to € 5.6 M at 1st half-year 2021.

The change in amortization and depreciation of

fixed assets, down -8.1% to € 26.2 M, reflects the change in the

scope of consolidation as well as the limitation of renewal

investments during the health crisis.

The other current income and current operating

expenses amount to a net income of € 1.4 M compared to € 5.9 M at

1st half-year 2021, mainly due to:

- the amount in half-year 2021 of

operating subsidies received or to be received as aid obtained

under the business aid measures put in place by the government

during the health crisis, in particular aids at fixed costs at €

10.0 M;

- the amount in half-year 2022 of €

4.9 M in additional aids of the same nature (favourable effect

linked to the increase in the aids’ ceiling and the implementation

by the government of additional mechanisms due to the continuing

health crisis).

Current operating income amounts to € 27.2 M

compared to - € 81.8 M at 1st Half-Year 2021.

Income before tax totals a profit of € 25.8 M

compared to a loss of € 84.0 M€ at 1st Half-Year 2021.

Tax expense (including CVAE) amounts to € 1.2 M

compared to € 4.0 M at 1st half-year 2021 due to elements of

various kinds related to the resumption of activity and the tax

consequences of certain non-recurring items.

Share in earnings of equity-accounted associates

is stable and not significant.

The consolidated net income of the half-year is

a gain of € 24.6 M compared to a loss of € 88.0 M at 30th April

2021. In this net income, the Group’s share is a profit of € 24.2 M

compared to a loss of € 81.6 M at 30th April 2021.

Balance sheet

Total net assets as of 30th April 2022 represent

€ 736.0 M compared to € 796.4 M as of 31st October 2021. The

noteworthy changes over the period are as follows:

- a decrease in non-current assets of

€ 0.7 M mainly due to the reduction of tax receivables (the

residual receivable from CICE 2018, i.e. € 3.2 M as of 31st October

2021, is now presented in current tax receivables for € 2.3 M,

repayment expected in February 2023) and the net increase in

property, plant and equipment of € 1.9 M, mainly made up of the

volume of investments and depreciation charges;

- a decrease in current assets of €

45.2 M, mainly due to a drop in the "customers and other debtors"

item of € 21.2M due in particular to the cessation of Belgian

online activity (same finding hereafter on the liabilities side, at

the level of “debts to suppliers and other creditors”) and a

consumption of cash of € 28.5 M.

On the liabilities’ side, equity, including

minority interests, go from € 315.4 M at 31st October 2021 to €

338.8 M at 30th April 2022, including profit for the period of €

24.2 M. Financial debt decreases by € 59.3 M (current and

non-current portions). The following should be taken into

consideration:

- the full repayment, mid-April 2022,

of the second state guaranteed loan in the amount of - € 59.5

M;

- the two quarterly instalments of

the syndicated loan settled on 31st January 2022 and 30th April

2022 for - € 5.4 M;

- the repayment of other bank loans

in the amount of - € 6.3 M;

- the set-up of new bank loans for +

€ 8.9 M;

- as well as flows related to leases

treated according to IFRS 16.

Financial structure

– Summary of net debt

The Group's financial structure can be assessed

using the following table (constructed in accordance with the terms

of the syndicated loan agreement, according to the old IAS 17

standard, excluding IFRS 16).

|

In €M |

30/04/22 |

31/10/21 |

30/04/21 |

|

Equity |

338.8 |

315.4 |

283.2 |

|

Gross debt * |

176.3 |

239.1 |

253.7 |

|

Cash less gaming levies |

120.5 |

152.1 |

104.1 |

|

Net debt |

55.7 |

87.0 |

149.7 |

|

Ratio Net debt / Equity (« gearing ») |

0.2x |

0.3x |

0.5x |

|

Ratio Net debt / EBITDA (« leverage »)** |

0.7x |

N/A *** |

N/A *** |

(*) The gross deb includes bank borrowings, bond

loans and restated leases (with the exception of other contracts

restated according to IFRS 16, accrued interest, miscellaneous

loans and financial debts, bank loans and financial

instruments.

(**) The consolidated EBITDA used to determine

the “leverage” is calculated over a rolling 12-months period,

according to the old IAS 17 standard (that is to say before

application of IFRS 16), at namely € 76.8 M at 30/04/2022.

(***) The bond and banking partners have waived

the calculation of the "leverage ratio" expected at the closing

dates of 30th April 2021 and 31st October due to a negative EBITDA

over each period.

Glossary

The "Gross Gaming Revenue" corresponds to the

sum of the various operated games, after deduction of the payment

of the winnings to the players. This amount is debited of the

"levies" (i.e. tax to the State, the city halls, CSG, CRDS).

The «Gross Gaming Revenue» after deduction of

the levies, becomes the "Net Gaming Revenue ", a component of the

turnover.

“Current Operating Income” COI includes all the

expenses and income directly related to the Group's activities to

the extent that these elements are recurrent, usual in the

operating cycle or that they result from specific events or

decisions pertaining to the Group's activities.

"Consolidated Ebitda" (EBITDA) is made up of the

balance of income and expenses making up current operating income,

excluding depreciation and provisions related to the operating

cycle and one-off items related to the Group's activities included

in the current operating income but excluded from EBITDA due to

their non-recurring nature.

1 In France, paid antigenic and PCR tests together with the

“vaccination pass” until 13th March 2022. In Switzerland,

introduction of the “vaccination pass” from 20th December 2021 to

17th February 2022.2 This development takes into account the

improvement of € 1.1 M of the Aquabella hotel ROI, but also the - €

0.6 M cumulated impact of the reclassification of the Forges, Saint

Amand and Divonne hotel activities previously registered in the

casinos’ activity and other activity for the later.

- Half-year results H1 2022

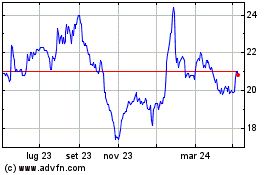

Grafico Azioni Groupe Partouche (EU:PARP)

Storico

Da Mar 2024 a Apr 2024

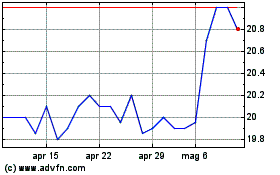

Grafico Azioni Groupe Partouche (EU:PARP)

Storico

Da Apr 2023 a Apr 2024