- Company reports revenues of EUR 13.4 million for the year

ended December 31, 2021

- As of December 31, 2021, cash and cash equivalents were EUR

32.3 million (USD 36.6 million)

- TWYMEEG® (Imeglimin hydrochloride) launched in Japan in Q3

2021 for the treatment of type 2 diabetes. Poxel entitled to

receive sales -based payments and escalating royalties of 8 - 18%

on net sales of TWYMEEG

- Results of PXL065 Phase 2 (DESTINY-1) trial in NASH expected

in Q3 2022

- Fast Track Designation (FTD) granted to PXL065 for

adrenoleukodystrophy (ALD); Phase 2a clinical Proof-of-Concept

(POC) biomarker program, subject to additional financing, planned

to start midyear with results to follow in early 2023

The management team will host webcast conference calls on

Tuesday, March 22 at:

- 6:00 pm CET, Paris time (1:00 pm ET) in French

and

- 2:00 pm ET, New York time (7:00 pm CET) in

English.

A presentation will be available on Poxel's website in the

Investor section.

To register for the webcast in French:

https://us02web.zoom.us/webinar/register/WN_4dWeP9qBSrObHPWD97xKQQ

To register for the webcast in English:

https://us02web.zoom.us/webinar/register/WN_4tH24fDcSxqoG5OoCu2vSA

POXEL SA (Euronext: POXEL - FR0012432516), a clinical stage

biopharmaceutical company developing innovative treatments for

serious chronic diseases with metabolic pathophysiology, including

non-alcoholic steatohepatitis (NASH) and rare metabolic disorders,

today announced its results for the year ended December 31, 2021

and provided a corporate update.

“The year 2021 was a pivotal year in Poxel’s evolution, first

noted by the marketing approval in June for Imeglimin in Japan,

followed by commercialization since September under the name

TWYMEEG®. This approval is strong validation of our R&D

capabilities and the result of many years of effort by our team in

close collaboration with our partner, Sumitomo Dainippon Pharma,”

stated Thomas Kuhn, CEO of Poxel. “Secondly, Poxel initiated its

strategic shift with a new emphasis on rare metabolic diseases,

starting with ALD. We have made significant progress preparing for

our Phase 2a Proof-of-Concept clinical studies for PXL065 and

PXL770 in ALD. These studies, subject to additional funding, are

planned to start in the middle of 2022, with results expected in

early 2023. We are also extremely pleased that the FDA recently

granted Fast Track status to PXL065 in ALD which confirms our

strategic direction and has the potential to substantially

accelerate the approval timeline for PXL065 in ALD.”

“In 2022, we look forward to sharing topline results of

DESTINY-1, our Phase 2 study in NASH for PXL065, expected in the

third quarter. We are actively pursuing a number of funding

initiatives in parallel to extend our cash runway, prioritizing

non-dilutive options. We are in advanced discussions with several

parties and are confident that we will close a transaction in a

reasonable timeframe to execute our strategic plan with the goal of

bringing innovative treatments to patients with chronic serious

metabolic diseases,” continued Thomas Kuhn.

Commercial Update

TWYMEEG® (Imeglimin)

- As of December 31, 2021, royalty revenue to Poxel based on

TWYMEEG net sales in Japan under the Sumitomo Dainippon Pharma

(“Sumitomo”) license agreement has been limited following TWYMEEG’s

recent commercial launch on September 16, 2021. TWYMEEG’s initial

commercial uptake has been impacted by prescribing restrictions for

new products during the first year of sales and COVID-19

conditions. This has also impacted the frequency of physician

visits and limited the significant market education efforts

required for an innovative new product with a new mechanism of

action.

- Sumitomo has made significant progress establishing high

awareness of TWYMEEG amongst prescribing physicians, thanks to its

comprehensive launch activities and ongoing promotional efforts.

TWYMEEG has the potential to be used both in combination with other

treatments, such as DPP4i’s, which are the most prescribed

treatments for Japanese Type-2-Diabetes patients, and as

monotherapy.Moreover, based on the Phase 3 TIMES program having

shown robust efficacy with a favorable safety and tolerability

profile, TWYMEEG offers potential for populations with limited

treatment options, including elderly and patients with renal

impairment. Sumitomo recently initiated a Phase 4 study targeting

Type-2-Diabetes patients with chronic kidney diseases (CKD) 3b/4 /

5.

- In accordance with the Sumitomo license agreement, Poxel is

entitled to receive escalating royalties of 8 - 18% on net sales of

TWYMEEG and sales-based payments of up to JPY 26.5 billion

(approximately EUR 200 million)1. In parallel, as part of the Merck

Serono licensing agreement2, Poxel will pay Merck Serono a fixed 8%

royalty based on the net sales of Imeglimin, independent of the

level of sales. As a result, based on the current forecast, Poxel

expects net royalties to be cash neutral through Sumitomo FY2022

(through March 2023). Once TWYMEEG achieves the next commercial

threshold, the royalty rate will increase to double-digits and

Poxel will retain all net royalties above 8%.

- Throughout 2021, Poxel and Sumitomo have continued to pursue

strong patent protection for Imeglimin. The patent estate for

TWYMEEG would extend to 2036 (including potential 5-year patent

term extension), with other patent applications ongoing.

- In 2021, the Company conducted and completed a comprehensive

evaluation of partnering options for the U.S. and Europe and does

not expect to enter into a broad strategic partnership for these

geographies in the near term. The Company is now considering

opportunities to leverage the Imeglimin data package in specific

territories, including those resulting from inbound interest.

- Results from all three Phase 3 clinical trials of Imeglimin

were published in the medical journals Diabetes Care and Diabetes

Obesity and Metabolism:

- The TIMES 1 publication entitled: "Efficacy and safety of Imeglimin monotherapy vs. placebo

in Japanese patients with Type 2 diabetes (TIMES 1)

: A Double-Blind, Randomized,

Placebo-Controlled, Parallel-Group, Multicenter Phase 3

Trial” was published in April 2021.

- The TIMES 2 publication entitled: “Long-term safety and

efficacy of Imeglimin as monotherapy or in combination with

existing antidiabetic agents in Japanese patients with type 2

diabetes (TIMES 2): A 52-week, open-label, multicentre phase 3

trial” was published in December 2021.

- The TIMES 3 publication entitled: “Efficacy and safety of

Imeglimin add-on to insulin monotherapy in Japanese patients with

type 2 diabetes (TIMES 3): A randomized, double-blind,

placebo-controlled phase 3 trial with a 36-week open-label

extension period” was published in January 2022.

Clinical Development Updates

NASH (PXL065 and PXL770)

- In September 2021, the PXL065 Phase 2 trial (DESTINY-1) in NASH

completed enrollment with 123 noncirrhotic biopsy-proven NASH

patients across multiple clinical sites in the US. Results from

this 36-week, randomized, double-blind, placebo-controlled,

parallel group, dose-ranging study designed to assess efficacy and

safety are anticipated in Q3 2022. The goal of DESTINY-1 is to

identify the optimal dose or doses of PXL065 to advance into a

Phase 3 registration trial for the treatment of noncirrhotic

biopsy-proven NASH patients.

- In November 2021, Poxel presented new clinical analysis on

PXL065 DESTINY-1 screening data at the AASLD The Liver Meeting®

2021.

- PXL770, a first-in-class, oral direct adenosine

monophosphate-activated protein kinase (AMPK) activator, has

successfully completed a Phase 2a Proof-of-Concept trial for the

treatment of NASH, which met its objectives. Future development of

PXL770 in NASH will be assessed pending results from the PXL065

Phase 2 trial in NASH and the Phase 2a POC studies in ALD.

Rare metabolic diseases (PXL065 and PXL770)

- The Phase 2a clinical Proof-of-Concept (POC) biomarker program

in X-linked adrenoleukodystrophy (ALD), subject to additional

funding, is anticipated to begin midyear, followed by results in

early 2023.

- In December 2021, Poxel announced the formation of its

Scientific Advisory Board (SAB) for rare metabolic diseases as part

of its strategy to increase its focus on rare diseases. The first

meeting of this SAB included productive discussions that informed

the design of the upcoming ALD POC Phase 2a studies and provided

insights into pivotal trial concepts.

- Poxel participated in several scientific and patient advocacy

conferences related to ALD and presented its programs, including

the comprehensive preclinical pharmacological package, targeting

this severe orphan neurometabolic disease with no approved

therapies. This included presentations at three major advocacy

organizations, Alex The Leukodystrophy Charity in the United

Kingdom, United Leukodystrophy Foundation and ALD Connect in the

U.S.

Early Stage Development

- During the year, Poxel pursued its evaluation of internal

opportunities from its adenosine monophosphate-activated protein

kinase (AMPK) activator platform and deuterated TZD platform and

completed a series of studies, including a preclinical assessment

of PXL770 and AMPK activation for an orphan kidney disease,

autosomal dominant polycystic kidney disease (ADPKD), which

demonstrated a robust effect to attenuate disease in established

model systems. Additionally, the Company is conducting studies in

other rare diseases including mitochondrial disorders.

Corporate Update

- In July 2021, Poxel announced a new strategic direction to

focus its pipeline on high value, rare metabolic indications and

NASH, with the goal of creating pipeline synergies, maximizing

resources, and driving shareholder value. Rare metabolic

indications represent the intersection of high unmet medical need,

promising pre-clinical and clinical data, opinion leader

enthusiasm, significant commercial opportunity, and attractive time

horizons.

- In 2021, Poxel finalized a one year review and comprehensive

evaluation of its existing Corporate Social Responsibility (CSR)

actions. As a result, the Company has defined a solid CSR strategy

supported by three pillars (social, governance and environmental)

and will commit to measure, assess and communicate its progress

over time, starting with the publication of its new CSR report

which will be included in the 2021 Universal Registration Document.

In order to enhance CSR as a corporate priority, Quentin Durand,

Executive Vice President, Chief Legal Officer, has been appointed

Head of CSR.

Significant Events after the Period

- In February 2022, the U.S. Food and Drug Administration (FDA)

granted Fast Track status to PXL065 for ALD in patients with

adrenomyeloneuropathy (AMN). Fast Track Designation (FTD) is

awarded by FDA to investigational drugs which treat a serious or

life-threatening condition, and which fill an unmet medical need.

FDA notes that 'the purpose [of the Fast Track program] is to get

important new drugs to the patient earlier’3.

Financial Statements for Full Year 2021 (IFRS

Standards)

Income statement

EUR (in thousands)

FY

FY

2021

12 months

2020

12 months

adjusted**

Revenue

13,397

6,806

Cost of sales

(59)

Gross margin

13,339

6,806

Net research and development expenses*

(25,174)

(26,702)

General and administrative expenses

(10,627)

(9,923)

Operating income (loss)

(22,463)

(29,819)

Financial income (expenses)

(1,297)

(1,975)

Income tax

(2)

(36)

Net income (loss)

(23,763)

(31,831)

*Net of R&D tax credit and other subsidies. **Change in

accounting policies related to the application of IAS19. The audit

procedures are ongoing.

Poxel reported revenues of EUR 13.4 million for the year ended

December 31, 2021, as compared to EUR 6.8 million during the

corresponding period in 2020.

The revenues for 2021 include the following payments from

Sumitomo Dainippon Pharma (“Sumitomo”) under the Sumitomo license

agreement:

- JPY 1.75 billion (EUR 13.2 million) milestone payment for the

approval of TWYMEEG in Japan on June 23, 2021, and

- JPY 7.5 million (EUR 58 thousand) of royalty revenue which

represents 8% of TWYMEEG net sales in Japan.

Cost of sales amounted to EUR 58 thousand, corresponding to the

8% royalties on net sales of Imeglimin in Japan due to Merck

Serono, as part of the Merck Serono license agreement.

R&D expenses totaled EUR 25.2 million in 2021, as compared

to EUR 26.7 million in 2020. R&D expenses in 2021 primarily

reflected the clinical costs incurred for the ongoing PXL065 Phase

2 DESTINY-1 trial.

R&D costs are net of the R&D Tax Credit (CIR) and other

subsidies that resulted in income of EUR 2.3 million in 2021, as

compared to EUR 2.5 million in 2020.

General and administrative expenses totaled EUR 10.6 million in

2021, as compared to EUR 9.9 million in 2020.

The financial loss amounted to EUR 1.3 million in 2021, as

compared to a loss of EUR 2.0 million in 2020.

The net result for the financial period ending December 31, 2021

was a net loss of EUR 23.8 million, as compared to a net loss of

EUR 31.8 million in 2020.

Cash

As of December 31, 2021, total cash and cash equivalents

amounted to EUR 32.3 million (USD 36.6 million), as compared to EUR

40.2 million (USD 49.4 million) as of December 31, 2020. Net

financial debt (excluding IFRS16 impacts and derivative

instruments) amounted to EUR 2.6 million at December 31, 2021,

compared to EUR (17.2) million at December 31, 2020.

Based on:

- the cash position at December 31, 2021,

- the current development plan of the Company including 1) the

completion of its ongoing Phase 2 NASH trial for PXL065 (DESTINY-1)

) but 2) excluding the two identical Phase 2a clinical

proof-of-concept (POC) biomarker studies for PXL065 and PXL770 in

adrenomyeloneuropathy (AMN),

- the cash forecast for the year 2022 approved by the Board of

Directors of the Company, that 1) does not include, as a

conservative approach, any net sales from Imeglimin in Japan and 2)

includes an amount of EUR 4,813 thousands for the repayments of the

loan with IPF partners until December 2022, and

- a strict control of its operating expenses,

the Company expects that its resources will be sufficient to

fund its operations and capital expenditure requirements through at

least December 31, 2022, representing 12 months from the reporting

date. However, the Company is subject to certain financial

covenants4 related to its debt with IPF Partners which could be

potentially breached in Q3 2022. This situation could lead the

Company’s auditors to issue an audit opinion which would include a

paragraph related to the going concern.

The Company is actively pursuing various financing options which

would extend its cash runway and avoid any breach of financial

covenants through at least 12 months from the reporting date. These

financing options include dilutive and non-dilutive sources, as

well as discussions with IPF partners, and the Company reasonably

expects that at least one of the pursued options would be completed

before Q3 2022. As a consequence, the Company’s 2021 financials are

presented on a going concern basis.

Planned Presentations and Participation at the Following

Upcoming Events

- Annual Meeting of the Japanese Diabetes Society, Kobe, Japan,

May 12-14

- European Renal Association Congress, Paris, France, May

19-22

- Global NASH Congress, London, UK, May 26-27

- Jefferies Global Healthcare Conference, New York, NY, June

8-10

- JMP Securities 2022 Life Sciences Conference, New York, NY,

June 15-16

Next Financial Press Release: First Quarter 2022

Financial Update, May 17, 2022

About Poxel SA

Poxel is a clinical stage biopharmaceutical company developing

innovative treatments for chronic serious diseases with metabolic

pathophysiology, including non-alcoholic steatohepatitis (NASH) and

rare disorders. Poxel has clinical and earlier-stage programs from

its adenosine monophosphate-activated protein kinase (AMPK)

activator and deuterated TZD platforms targeting chronic and rare

metabolic diseases. For the treatment of NASH, PXL065

(deuterium-stabilized R-pioglitazone) is in a streamlined Phase 2

trial (DESTINY-1). PXL770, a first-in-class direct AMPK activator,

has successfully completed a Phase 2a proof-of-concept trial for

the treatment of NASH, which met its objectives. For the rare

inherited metabolic disorder, adrenoleukodystrophy (ALD), the

company intends to initiate Phase 2a proof of concept studies with

PXL065 and PXL770 in patients with adrenomyeloneuropathy (AMN).

TWYMEEG® (Imeglimin), Poxel’s first-in-class lead product that

targets mitochondrial dysfunction, has been approved and launched

for the treatment of type 2 diabetes in Japan. Poxel expects to

receive royalties and sales-based payments from Sumitomo Dainippon

Pharma. Poxel has a strategic partnership with Sumitomo Dainippon

Pharma for Imeglimin in Japan, China, South Korea, Taiwan and nine

other Southeast Asian countries. The Company intends to generate

further growth through strategic partnerships and pipeline

development. Listed on Euronext Paris, Poxel is headquartered in

Lyon, France, and has subsidiaries in Boston, MA, and Tokyo,

Japan.

For more information, please visit: www.poxelpharma.com

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control. These

statements may include, without limitation, any statements preceded

by, followed by or including words such as “target,” “believe,”

“expect,” “aim,” “intend,” “may,” “anticipate,” “estimate,” “plan,”

“project,” “will,” “can have,” “likely,” “should,” “would,” “could”

and other words and terms of similar meaning or the negative

thereof. Forward-looking statements are subject to inherent risks

and uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements. The Company does not endorse or is

not otherwise responsible for the content of external hyperlinks

referred to in this press release.

1 Converted at the exchange rate at the date of the agreement

(30 Oct 2017). 2 As described in the “2.3.1. Merck Serono

Agreement” section of the Poxel 2020 Document d’Enregistrement

Universel. 3

https://www.fda.gov/patients/fast-track-breakthrough-therapy-accelerated-approval-priority-review/fast-track.

4 Under these financial covenants the Company should maintain

minimum cash position of the higher of i) ten million euros and ii)

the sum of the consolidated debt service of the Company plus the

amount of cash required to be spent by the Company as part of its

operations, in each case for the following 6-month period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220322005980/en/

Investor relations / Media

Aurélie Bozza Investor Relations & Communication Senior

Director aurelie.bozza@poxelpharma.com +33 6 99 81 08 36

Elizabeth Woo Senior Vice President, Investor Relations &

Communication elizabeth.woo@poxelpharma.com

NewCap Emmanuel Huynh or Arthur Rouillé poxel@newcap.eu +33 1 44

71 94 94

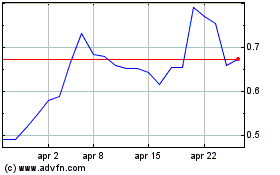

Grafico Azioni Poxel (EU:POXEL)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Poxel (EU:POXEL)

Storico

Da Apr 2023 a Apr 2024