2024 first half results: Renault Group breaks new records and

continues to improve its performance

Press Release

July 24, 2024 |

| |

| |

20240724_Press release_Renault Group_2024 H1 Results

2024 first half

results

Renault Group breaks new records

and continues to improve its

performance

- New record profitability in

2024 H1:

- Group

revenue: €27.0bn, +0.4% and +3.7% vs. 2023 H1 at constant

exchange rates1

- Automotive

revenue: €24.4bn, -1.9% and +1.2% vs. 2023 H1 at constant

exchange rates1

- Record

profitability:

- Group operating margin: 8.1% of

revenue (+0.5 points vs. 2023 H1), up €0.1bn vs. 2023 H1

- Automotive operating margin: 6.6%

of revenue (+0.4 points vs. 2023 H1)

- Net

income: €1.4bn (including €440m of capital loss on

the disposal of Nissan shares)

- Solid free

cash flow: €1.3bn driven by a strong operational

performance. It included €600m of Mobilize Financial Services

dividend and a negative variation of working capital requirement of

€209m

- Record

automotive net cash financial position: €4.9bn at June 30,

2024 (+€1.1bn vs. December 31, 2023)

-

Complementary and growing automotive brands:

- Renault brand #3 in Europe, #1 in

France and leader in LCVs2

- Dacia in the top 10 best-selling

brands in Europe, with Sandero best-selling car across all

channels

- Alpine strong double-digit growth

before new launches

- Strong

orderbook in Europe at 2.6 months of forward sales,

reflecting the strong order intake

- Very

healthy level of total inventories at 500ku at June 30,

2024 (down 69ku yoy)

- Renault

Group confirms its 2024 financial outlook:

- A Group operating margin

≥7.5%

- A free cash flow

≥€2.5bn

“These record results are the fruit

of a considerable work made by the Renault Group teams over the

last years. Our efforts to reduce costs and focus our commercial

policy on value are reflected in a new line-up, the best one that

this company has had in 3 decades. We have implemented the

traditional levers of performance improvement, but we have also

reconnected the company with the innovative mindset that once made

its golden years.

For some months now, we have been

accelerating our transformation to become the most progressive

European automotive company. 5 focused businesses, a horizontal and

ecosystemic approach, the strengthening of our supply chain, key

processes optimization (“speed of lightness” program), AI

deployment at all levels and across all value chains: these are the

key ingredients of this Renault’s new secret sauce. Flexibility,

agility and innovation continue to drive performance improvement

and efficient capital allocation. And the most important: Renault

Group’s people are fully committed to achieve this transformation.

This is passion, fueling sustainable value creation for all our

stakeholders“ said Luca de Meo, CEO of Renault

Group

Boulogne-Billancourt, July 24,

2024

Financial results

Group revenue reached €26,958

million, up 0.4% compared to 2023 H1. At constant exchange

rates3, it increased by 3.7%.

Automotive revenue stood at

€24,372 million, down 1.9% compared to 2023 H1. It included 3.1

points of negative exchange rates effect (-€779 million) mainly

related to the devaluation of the Argentinean peso and to a lesser

extent of the Turkish lira. At constant exchange rates3,

it increased by +1.2%. This evolution was mainly explained by the

following:

- A price

effect of +1.8 points, mostly to offset currency devaluations

mainly in Argentina and Turkey. As already announced, Renault Group

has entered a phase of price stabilization combined with price

repositioning of targeted products enabled by cost reduction.

- A

positive product mix effect of +1.0 point, which reflected a

gradual improvement in line with the Group’s recent launches

(Scenic, Rafale and Espace). It has more than offset the negative

effect from the end of life of Zoe and the continuing success of

Sandero. This positive effect will continue to improve in the

coming quarters.

- A

positive geographic mix of +1.1 points, driven by the Group’s

activity in Europe.

- A

negative volume effect of -4.7 points. The 1.9% increase in

registrations was more than offset by a destocking within the

dealership network in 2024 H1 compared to an important restocking

in 2023 H1. As of June 30, 2024, total inventories of new

vehicles stood at a very healthy level and represented 500,000

vehicles (down 69k units yoy), of which 369,000 at independent

dealers and 131,000 at Group level.

- A stable

effect of sales to partners of +0.2 points, due to the decrease of

new vehicles sales to partners in a transition year before the

launch of new products as anticipated, offset by R&D billings

in line with the ramp-up of Group’s partnerships.

- A

positive "Other" effect of +1.8 points, thanks to the robust

performance of parts and accessories as well as dynamic used cars

sales.

The Group posted a record

operating margin at 8.1% of revenue versus 7.6% in

2023 H1, up 0.5 points.

Automotive operating margin

stood at €1,600 million versus €1,541 million in 2023 H1. It

represented 6.6% of Automotive revenue, an improvement of +0.4

points versus 2023 H1. This evolution was mainly explained by the

following:

- A

positive impact of foreign exchange of €93 million, mostly

attributable to the impact of the Turkish lira devaluation on

production costs.

- A

negative volume effect of €329 million, mostly driven by the

destocking previously mentioned.

- In 2024

H1, price/mix/enrichment effect was a positive of €51 million and

costs decreased by €262 million thanks to a strong purchasing

performance and to a lesser extent to a raw materials tailwind.

Together, it represented a positive impact of €313

million. Renault Group continues to reduce its costs and to

pass part of those gains to its customers which allows the Group to

boost its competitiveness by offering attractive vehicles in terms

of price and content while offsetting regulatory requirements,

especially on new models and facelifts. Renault Group’s strategy is

to work on the combination of these two effects, with the sole

objective to improve margins.

- A

positive effect of R&D of €153 million: the increase in gross

R&D spendings and the lower capitalization rate (-6.2 pts

versus 2023 H1) were more than offset by R&D billings, in line

with the ramp-up of the Group’s partnerships, and lower

amortization of capitalized R&D expenses.

- A

negative impact of SG&A, which increased by €109 million,

mainly driven by an increase of marketing costs related to the

brands’ offensives and to the current performance of motorsport

activities.

- Prior to

deconsolidation, Horse was under the IFRS 5 assets held for sale

accounting treatment and therefore, amortization of its assets had

been suspended. Since Horse was deconsolidated on May

31st, 2024, invoices paid to Horse by Renault Group

include the cost of amortization again as well as Horse's mark up.

The cumulated effect of these 2 elements represented €55 million

for the month of June.

The contribution of Mobilize Financial

Services (Sales Financing) to the Group's operating margin

reached €593 million, up €75 million vs. 2023 H1, mainly thanks to

the continuous strong growth of the customer financing activity as

well as -€37 million of non-recurring negative impact of swaps

valuation in 2023 H1.

Other operating income and

expenses were negative at -€277 million (vs. +€56 million

in 2023 H1) and included notably +€286 million of capital gain on

Horse deconsolidation, -€440 million of capital loss on Nissan

shares disposal made in March 2024 and restructuring expenses for

-€123 million.

After considering other operating income and

expenses, the Group’s operating income stood at

€1,898 million compared to €2,096 million in 2023 H1.

Net financial income and

expenses amounted to -€385 million compared to -€260

million in 2023 H1. This variation is mostly explained by the

impact of hyperinflation in Argentina.

The contribution of associated

companies amounted to €195 million compared to €566

million in 2023 H1.

Current and deferred taxes

represented a charge of -€328 million compared to a charge

of -€278 million in 2023 H1. The effective tax rate amounted

to 17% at the end of June 2024, up +2 pts versus 2023 H1, due to

the first year of implementation of Pillar 2 directive and other

deferred tax impacts.

Thus, net income stood at

€1,380 million, including the capital loss on Nissan shares

disposal. Net income, Group share, was €1,293

million (or €4.74 per share).

The cash flow of the

Automotive business reached €2,972 million in 2024 H1 and

included €600 million of Mobilize Financial Services

dividend.

Excluding the impact of asset disposals, the

Group’s net CAPEX and R&D stood at €2,143 million i.e.

7.9% of revenue compared to 6.9% of revenue in 2023 H1. Assets

disposals amounted to €28 million, compared to €197 million in

2023 H1. Group's net CAPEX and R&D amounted to 7.8% of revenue

including asset disposals.

Free cash

flow4 stood at €1,257 million

and included a negative change in working capital requirement of

-€209 million.

The Automotive net cash financial

position stood at the record level of €4,860 million on

June 30, 2024, compared to €3,724 million on December 31, 2023, an

improvement of €1,136 million. This increase was driven by the

strong free cash flow, a positive impact of Horse deconsolidation

(+€420 million), cash received from the disposal of Nissan shares

(+€358 million), dividends received from Nissan (+€142 million). It

was partly offset by dividends paid to shareholders for -€628

million and financial investments for -€355 million, of which -€215

million in Flexis SAS.

Liquidity reserve at the end of

June 2024 stood at a high level at €17.6 billion.

2024 FY financial outlook

Renault Group confirms its 2024 FY financial

outlook:

- Group operating margin

superior or equal to 7.5%

- Free cash flow superior or

equal to €2.5bn

Renault Group's consolidated results

|

In € million |

2023 H1 |

2024 H1 |

Change |

|

Group revenue |

26,849 |

26,958 |

+0.4% |

|

Operating margin |

2,040 |

2,175 |

+135 |

|

% of revenue |

7.6% |

8.1% |

+0.5 pts |

|

Other operating income and expenses |

56 |

-277 |

-333 |

|

Operating income |

2,096 |

1,898 |

-198 |

|

Net financial income and expenses |

-260 |

-385 |

-125 |

|

Contribution from associated

companies1 |

566 |

195 |

-371 |

|

Current and deferred taxes |

-278 |

-328 |

-50 |

|

Net income |

2,124 |

1,380 |

-744 |

|

Net income, Group share |

2,093 |

1,293 |

-800 |

|

Free cash flow |

1,775 |

1,257 |

-518 |

|

Automotive net financial position |

3,724

at 2023-12-31 |

4,860

at 2024-06-30 |

+1,136 |

|

1 Subject to the approval by the governing bodies of the

associated companies. |

Additional information

The condensed half-year consolidated financial

statements of Renault Group at June 30, 2024 were reviewed by the

Board of Directors on July 24, 2024.

The Group’s statutory auditors have conducted a

limited review of these financial statements and their half-year

report will be issued shortly.

The financial report, with a complete analysis

of the financial results in the first half of 2024, is available at

www.renaultgroup.com in the "Finance" section.

2024 H1 Financial Results Conference

Link to follow the conference on July 25, 2024, from 8am CEST

and available in replay:

2024 H1 conference streaming

About Renault Group

Renault Group is at the forefront of a mobility

that is reinventing itself. Strengthened by its alliance with

Nissan and Mitsubishi Motors, and its unique expertise in

electrification, Renault Group comprises 4 complementary brands -

Renault, Dacia, Alpine and Mobilize - offering sustainable and

innovative mobility solutions to its customers. Established in more

than 130 countries, the Group has sold 2.235 million vehicles in

2023. It employs more than 105,000 people who embody its Purpose

every day, so that mobility brings people closer.

Ready to pursue challenges both on the road and in competition,

Renault Group is committed to an ambitious transformation that will

generate value. This is centred on the development of new

technologies and services, and a new range of even more

competitive, balanced, and electrified vehicles. In line with

environmental challenges, the Group’s ambition is to achieve carbon

neutrality in Europe by 2040.

www.renaultgroup.com

RENAULT

GROUP INVESTOR

RELATIONS |

|

Philippine de

Schonen

+33 6 13 45 68 39

philippine.de-schonen@renault.com

|

|

|

RENAULT

GROUP

PRESS

RELATIONS

|

|

Rie Yamane

+33 6 03 16 35 20

rie.yamane@renault.com |

François

Rouget

+33 6 23 68 07 88

francois.rouget@renault.com |

|

1 In order to analyze the variation in consolidated

revenue at constant exchange rates, Renault Group recalculates the

revenue for the current period by applying average exchange rates

of the previous period.

2 Excluding pick-up trucks.

3 In order to analyze the variation in consolidated

revenue at constant exchange rates, Renault Group recalculates the

revenue for the current period by applying average exchange rates

of the previous period.

4 Free cash flow: cash flow after

interest and taxes (excluding dividends received from listed

companies) less tangible and intangible investments net of

disposals +/- change in working capital requirement.

- 20240724_Press release_Renault Group_2024 H1 Results

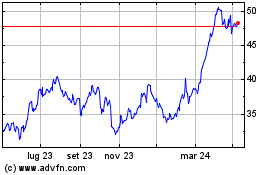

Grafico Azioni Renault (EU:RNO)

Storico

Da Nov 2024 a Dic 2024

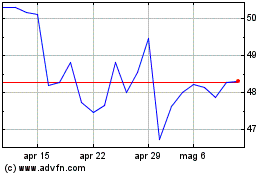

Grafico Azioni Renault (EU:RNO)

Storico

Da Dic 2023 a Dic 2024