Just Eat Takeaway.com to Lose Place in FTSE 100 Index in Latest Reshuffle

25 Agosto 2021 - 11:37AM

Dow Jones News

By Ian Walker

Just Eat Takeaway.com NV will lose its place in the FTSE 100

index next month as part of the regular quarterly reshuffle after

FTSE Russell reassigned its nationality to the Netherlands, making

it ineligible for the FTSE UK Index Series.

FTSE Russell said late Tuesday that Just Eat's nationality has

been changed from the U.K. following a review in accordance with

FTSE Nationality Rules.

In addition, broadcaster ITV PLC and engineer Weir Group PLC are

expected to lose their places in the FTSE 100 index when the review

is announced next week, FTSE Russell said. Just Eat joined the

index in December 2019 before its merger with Takeaway.com, while

Weir has been a member since March this year, having joined after a

five-and-a-half year absence. ITV only rejoined the index in June

after a nine-month absence.

Defense company Meggitt PLC, Dechra Pharmaceuticals PLC and Wm.

Morrison Supermarkets PLC are expected to be promoted to the top

flight although both Meggitt and Morrisons are currently in

takeover situations so their moves are likely to be short lived. If

it joins, this will be Dechra's first entry into the FTSE 100

index.

The indicative changes are based on the companies' share prices

at close of business on Aug. 20.

The FTSE 100 is a share index of the 100 most highly-capitalized

companies listed on the London Stock Exchange. Any company that

falls to 111th and below is automatically ejected from the

top-flight index, while any firm that rises to 90 or above is

automatically promoted.

The changes will be announced after markets close on Sept. 1,

based on the companies' closing share prices on Aug. 31.

Earlier this month, Meggitt agreed to a 6.3 billion pounds

($8.65 billion) takeover by Parker Hannifin Corp. but has

subsequently received a further GBP7.03 billion takeover proposal

from TransDigm Group Inc., which the U.K. defense company's board

is considering. TransDigm has until Sept. 14 to either make an

offer or walk away under U.K. Takeover Panel rules.

On Friday, Morrisons agreed to a takeover from Clayton Dubilier

& Rice LLC that values it at GBP7 billion. It had previously

recommended a bid from a consortium led by SoftBank Group Corp.'s

Fortress Investment Group LLC, but withdrew that upon the Clayton

Dubilier deal. Fortress has said that it was considering its

options in respect of its own offer.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

August 25, 2021 05:27 ET (09:27 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

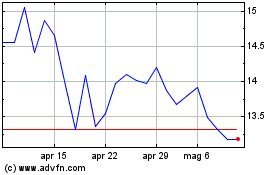

Grafico Azioni Just Eat Takeaway.com N.V (EU:TKWY)

Storico

Da Mar 2024 a Apr 2024

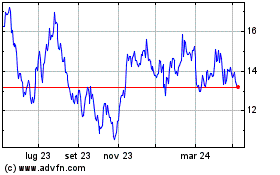

Grafico Azioni Just Eat Takeaway.com N.V (EU:TKWY)

Storico

Da Apr 2023 a Apr 2024