MARKET WRAPS

Watch For:

Eurozone retail trade, meeting of eurozone finance ministers;

services PMI data for eurozone, Germany, UK, France, Italy; UK

monthly car registration figures, official reserves; trading update

from Ryanair

Opening Call:

Shares appear poised for slight gains at the start of the week

after China took steps to ease its Covid restrictions. Stock

benchmarks and commodities rose in Asia, while the dollar softened

and Treasury yields gained.

Equities:

Stock futures point to a slightly higher open on Monday amid

improved sentiment, after local authorities across China pared back

some of their strictest Covid-19 control measures.

European shares closed mixed last Friday following an

unexpectedly strong U.S. jobs report for November.

The resilience of the jobs data prompted investors to price out

the prospect of an imminent sharp slowdown in the Federal Reserve's

interest-rate rise cycle, CMC Markets said.

"Friday's stronger-than-expected jobs report gives the Federal

Reserve more reasons to continue raising interest rates and

maintain tighter monetary policy for longer, at least until the

labor market begins to weaken, which is a signal that the market

does not want to hear right now," said Robert Schein, chief

investment officer at Blanke Schein Wealth Management.

But some market strategists see a silver lining.

"The report is a positive development for the economy and helps

support the case that the Fed may be able to achieve a soft landing

in the economy, an outcome that's contrary to predictions made by

some of the nation's largest banks in recent months," said Peter

Essele, head of portfolio management at Commonwealth Financial

Network.

"The labor market remaining hot continues to justify what the

Fed is doing," said Nicole Webb, financial advisor at Wealth

Enhancement Group. "I don't think it changes course from the 50

basis-point expectation in December," she said, "but we've really

started to question how high the terminal rate has to get to, to

have the demand destruction that brings inflation down to 2%."

Forex:

The dollar weakened on a return of risk appetite amid the easing

of Covid restrictions in China.

However, ANZ has one eye on next week's FOMC meeting, noting the

Fed may lift its terminal rate projection above 5% even if it opts

for a smaller 50bp rise in the fed-funds rate.

"If that occurs, the question we're pondering is: how will the

USD fare?" said ANZ.

"We may be shaping up for an epic battle between the

'recessionists' and the 'rate-watchers', all of which portends USD

volatility."

Bonds:

Treasury yields rose in Asia, after the policy-sensitive 2-year

Treasury yield advanced Friday but finished the week lower. A

hotter-than-expected U.S. jobs report for November prompted traders

to push up the likelihood of a 5% or higher fed-funds rate by

March.

"While the Fed may slow down its rate increases from the 0.75%

per meeting pace to 0.50% per meeting pace, it may also place

pressure on them to extend those rate increases further into 2023,"

said Jason Pride, chief investment officer of private wealth at

Glenmede.

"Such a path to higher rates for longer should put a damper on

both fixed income and equity markets."

Read: Robust U.S. jobs market adds to worry over how much higher

interest rates need to go

Energy:

Crude oil futures rose early Monday after China loosened some of

its Covid curbs.

However, traders could remain on edge after the European Union

and Group of Seven nations imposed a price cap of $60/bbl on

Russian oil, which is set to take effect this week, ANZ said.

European sanctions on Russian oil also kick in this week, while

OPEC+ has made the decision to keep its output steady, which raises

uncertainty on oil supply and demand in coming months, ANZ

added.

Metals:

Gold prices rose in Asia, reversing a previous pullback after a

"shockingly hot" nonfarm payroll report, said Oanda.

The unexpectedly strong jobs report spurred the dollar to rise,

and traders began to raise expectations of future hikes from the

Fed, added Oanda. The pullback in gold prices was unwarranted, as

inflation is steadily declining, which should mean the Fed will

slow the pace of its rate hikes.

-

Copper prices advanced, extending a recent rally amid rising

hopes for the easing of pandemic curbs in China.

ANZ said many investors are betting on expectations of sharply

higher copper demand from the world's second-largest economy.

But ANZ warned of "signs of weakness in the physical market,"

and "ample supply" that has pushed down prices for some copper

contracts and port inventories.

-

Iron-ore prices should be buoyed by seasonal supply challenges

over the next few months, Jefferies said following recent gains in

the steelmaking commodity.

The benchmark price of iron ore is up by 35% since the start of

November, underpinned by Beijing's plans to stabilize China's

property market and ease some Covid restrictions.

"Seasonal supply constraints should also help over the next 2-3

months," Jefferies said, referring to the severe storms that can

occur in Australia and Brazil around the turn of the year.

Meanwhile, Yongan Futures thinks the upbeat sentiment will

remain strong for some time, as traders seek to position for an

expected demand rebound into the spring of 2023.

But Yongan cautioned that investors should monitor the momentum

for steel production, which has been under pressure due to weak

profitability.

TODAY'S TOP HEADLINES

OPEC+ Keeps Oil Curbs Despite Russia Price Cap

OPEC+ said Sunday it would lock in current production levels, a

pause that suggests the word's leading oil producers are uncertain

about the direction of crude prices with a price cap on Russia's

petroleum exports set to take effect.

The decision on Sunday allows the Organization of the Petroleum

Exporting Countries and a group of producers led by

Russia-collectively known as OPEC+-to take more time to assess the

market impact of an EU and Group of Seven price cap, which is

intended to crimp Russia's revenue for the Ukraine war. It locks in

a 2 million-barrels-a-day production cut decided in October.

Dow Shines as Higher Rates Squeeze Nasdaq's Tech Stocks

The Dow is beating the broader market to a degree not seen in

nearly a century.

The Dow Jones Industrial Average is down 5.3% this year, which

isn't normally a cause for celebration. But that performance looks

downright golden compared with the broad S&P 500, which is off

15%, and the tech-heavy Nasdaq Composite, which has dropped

27%.

China Loosens Covid Restrictions as Public Anger Simmers

HONG KONG-Local authorities across China are paring back some of

their strictest Covid-19 control measures, just days after public

anger spilled over into rare protests against a zero-tolerance

approach that has kept the country largely isolated for three

years.

In recent days, officials in major cities-including Beijing and

other areas where protests broke out a week ago-said they were

lifting some curbs on residents' movements, such as by ending

mandatory Covid testing for people who want to use public transport

or enter parks and other public spaces.

Business-Software Companies Say Customers Are Pulling Back Amid

Economic Concerns

Business-software companies say customers are being more

cautious with their spending in response to a challenging economy,

adding to the tech industry's list of concerns.

Customers for companies such as Salesforce Inc., Okta Inc. and

CrowdStrike Holdings Inc. are taking longer to sign deals, and in

some cases slowing their hiring plans as they try to protect their

bottom lines, the software providers reported this past week. That

trend has created a cloudy outlook for many in the once-booming

business-software sector, which benefited from years of demand as

customers looked to use the products to trim costs and maintain

their businesses during the pandemic.

Economists Think They Can See Recession Coming-for a Change

If the economy shrinks next year, no one should be surprised.

We're facing the most widely forecast recession in history-and

investors don't seem to care.

Recession in Europe and the U.K. is already the average of

economic predictions, while the U.S. average forecast for next year

is growth of a miserly 0.2%, according to Consensus Economics, the

third lowest since 1989.

Must Inflation Be Brought Down All the Way to 2%?

"Why must inflation be around 2%?" is a question that obsessed

central bankers back when inflation was stubbornly below their

favorite target. It makes more sense to ask it now.

This past week, a string of data has suggested that inflation is

finally on a downward trend. The U.S. personal-consumption

expenditures price index excluding food and energy-the Federal

Reserve's preferred measure of inflation-recorded its

second-smallest monthly increase for the year, even as consumer

spending jumped and job growth continued. Meanwhile, eurozone

inflation receded to 10% in November, suggesting that October's

10.6% was the peak.

Why You Can't Find Wegovy, the Weight-Loss Drug

Novo Nordisk A/S flubbed the launch of its buzzy new weight-loss

drug Wegovy, missing out on hundreds of millions of dollars in

sales and squandering a head start before a rival could begin

selling a competing product.

Wegovy is among a new class of drugs that health regulators have

approved to cut the weight of people who are obese, a goal long

sought by doctors and patients. Their weight-dropping potential

became a viral sensation on social media. Elon Musk tweeted about

Wegovy in October. And a related drug for diabetes, Ozempic, is a

hot topic in Hollywood among celebrities seeking to stay thin,

according to doctors.

Iran Disbands Morality Police, Considers Changing Hijab Laws,

Official Says

Iran's attorney general said the country had disbanded its

so-called morality police and is considering altering the

requirement that women cover their heads in public, a move that

analysts said was aimed at peeling away support for antigovernment

protests.

Mohammad-Jafar Montazeri outlined the steps Saturday, saying the

law requiring veils, known as hijabs, was under review by Iran's

Parliament and judiciary, and that the morality police had been

abolished, according to government-run news agencies.

Ukraine Says Oil-Price Cap Won't Dent Russia's Ability to Fund

War

KYIV, Ukraine-Ukraine denounced a price cap on Russian oil

agreed to by the U.S. and its allies as a weak measure that would

fail to deprive Russia's military machine of funds, as Moscow said

it could stop supplying consumers in response.

The Group of Seven agreed Friday to cap the price of Russian oil

at $60 a barrel, moving forward with an unprecedented sanction

against one of the world's largest producers following its invasion

of Ukraine.

Russia Will Rely on 'Shadow' Tanker Fleet to Keep Oil

Flowing

Shipping companies have snapped up dozens of secondhand oil

tankers this year, paying record prices for ice-class ships that

can navigate frozen seas around Russia's Baltic ports in

winter.

A driving force behind the purchases, say people familiar with

the deals: To get Russian oil to market after the harshest

sanctions to date strike Russia's energy industry next week.

British Police Raid London Home of Russian Oligarch, Seizing

Cash and Devices

British police arrested a wealthy Russian businessman at his

upscale London home, officials said Saturday, amid stepped-up

pressure by the U.K. on Russian émigrés who are suspected of aiding

the rule of President Vladimir Putin.

The U.K.'s National Crime Agency said more than 50 of its

officers took part in the raid, seizing cash and digital devices.

Police also arrested a man employed at the residence after he was

seen leaving the building with a bag containing thousands of pounds

in cash.

Credit Suisse's Investment Bank Spinoff Attracts Saudi Crown

Prince

Saudi Arabia's crown prince and a U.S. private-equity firm run

by Barclays PLC's former chief executive are among investors

preparing to invest $1 billion or more into Credit Suisse's new

investment bank, people familiar with the matter said.

Crown Prince Mohammed bin Salman is considering an investment of

around $500 million to back the new unit, CS First Boston, and its

CEO-designate, Michael Klein, some of the people said. Additional

financial backing could come from U.S. investors including veteran

banker Bob Diamond's Atlas Merchant Capital, people familiar with

that potential investment said. Credit Suisse previously said it

had $500 million committed from an additional investor it hasn't

named.

New Zealand plans law to force Google, Meta to pay news

publishers for content

New Zealand intends to require large tech companies like Google

and Meta to compensate local media companies for content they use

and share on their platforms.

Willie Jackson, New Zealand's minister of broadcasting,

announced Sunday that legislation is being drawn up that will be

based on a similar law in Australia, as well as pending legislation

in Canada and measures in the U.K. and the EU.

Apple Makes Plans to Move Production Out of China

In recent weeks, Apple Inc. has accelerated plans to shift some

of its production outside China, long the dominant country in the

supply chain that built the world's most valuable company, say

people involved in the discussions. It is telling suppliers to plan

more actively for assembling Apple products elsewhere in Asia,

particularly India and Vietnam, they say, and looking to reduce

dependence on Taiwanese assemblers led by Foxconn Technology

Group.

Turmoil at a place called iPhone City helped propel Apple's

shift. At the giant city-within-a-city in Zhengzhou, China, as many

as 300,000 workers work at a factory run by Foxconn to make iPhones

and other Apple products. At one point, it alone made about 85% of

the Pro lineup of iPhones, according to market-research firm

Counterpoint Research.

Write to singaporeeditors@dowjones.com

Expected Major Events for Monday

00:01/UK: CBI Economic Forecast

01:01/IRL: Nov Ireland Services PMI

07:00/TUR: Nov PPI

07:00/TUR: Nov CPI

07:00/SWE: 3Q Balance of Payments

08:00/AUT: 3Q GDP

08:00/HUN: Oct Retail Sales

08:00/SVK: Oct Internal trade, incl Wholesale & Retail

08:00/CZE: 3Q Wages

08:15/SPN: Nov Spain Services PMI

08:45/ITA: Nov Italy Services PMI

08:50/FRA: Nov France Services PMI

08:55/GER: Nov Germany Services PMI

09:00/EU: Nov Eurozone Services PMI

09:00/UK: Nov UK monthly car registrations figures

09:30/UK: Nov S&P Global / CIPS UK Services PMI

09:30/UK: Nov UK Official Reserves

10:00/CYP: Nov Registered Unemployed

10:00/EU: Oct Retail trade

16:59/SWI: 2Q Locational & Consolidated banking

statistics

16:59/SWI: 3Q International debt securities statistics

16:59/SWI: 2Q Domestic debt securities statistics

16:59/SWI: 3Q Exchange-traded derivatives statistics

17:59/UK: 3Q Household Finance Review expected around now

All times in GMT. Powered by Onclusive and Dow Jones.

Write to us at newsletters@dowjones.com

We offer an enhanced version of this briefing that is optimized

for viewing on mobile devices and sent directly to your email

inbox. If you would like to sign up, please go to

https://newsplus.wsj.com/subscriptions.

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

December 05, 2022 00:22 ET (05:22 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

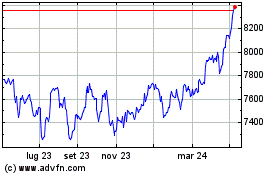

Grafico Indice FTSE 100

Da Mar 2024 a Apr 2024

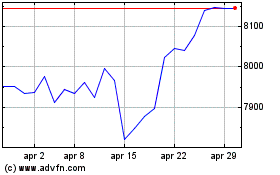

Grafico Indice FTSE 100

Da Apr 2023 a Apr 2024