MARKET WRAPS

Watch For:

Existing Home Sales for December; University of Michigan

Preliminary Consumer Survey for January; Canada Retail Sales for

November

Today's Headlines/Must Reads

- A Hot Debt Market Is Slashing Borrowing Costs for Riskier

Companies

- AI Is the Talk of Davos. Is It Time to Sell?

- Trump and Biden Both Hate Pharma-Investors Shouldn't

- The Red Sea Conflict Is Scrambling Shipping. Europe Is Bearing

the Brunt

Opening Call:

Stock futures were pointing higher on Friday, with the S&P

500 eyeing fresh highs.

Tech stocks are expected to lend a hand, with enthusiasm for the

sector set to continue.

"Reflation trade is not happening, long technology is the most

crowded trade of the moment," Swissquote Bank said.

"The Nasdaq-100 net long positions are at the highest levels in

nearly two years. The stretched long positioning makes Nasdaq

stocks vulnerable to a selloff, but the softening Fed expectations

and robust AI-demand should keep the technology space well-funded,"

Swissquote Bank said.

A number of Federal Reserve officials will make appearances on

Friday, including Austan Goolsbee at 8:30 a.m., Michael Barr at 1

p.m. and Mary Daly at 4:15 p.m.

Premarket Movers

Advanced Micro Devices rose 2% and Nvidia was up 1.4% after

shares of both chip makers closed at all-time highs on Thursday.

AMD has risen 10% this year while Nvidia has jumped 15%.

Shares of iRobot fell 36% after The Wall Street Journal reported

the European Commission intends to block Amazon.com's acquisition

of the Roomba maker.

Macy's plans to lay off 3.5% of its workforce and close five

stores this year as the retailer looks to cut costs and reorganize

its corporate structure. The stock rose 0.2%.

Spirit Airlines was down 1.6% after closing down 7.5% on

Thursday following a Journal report that said the budget carrier

was planning to explore restructuring options with advisors

following the collapse of its merger with JetBlue Airways.

Super Micro Computer was up 13% after it said it expects fiscal

second-quarter adjusted earnings of $5.40 to $5.55 a share, higher

than analysts' estimates.

Wendy's named Kirk Tanner, who most recently served as CEO of

North American beverages at PepsiCo, as president and chief

executive. Wendy's rose 0.8%.

Post-Close Movers

AST SpaceMobile plans to sell $100 million of common stock in a

public offering, a move that came minutes after the company said it

had received investments from AT&T and Google, as well as a

additional funds from existing investor Vodafone. Shares of AST

fell 7.5%.

Mesa Air struck several agreements meant to bolster is liquidity

with partner United Airlines. The company said it amended an

agreement with United to increase its block-hour rate. Mesa's

shares rose 78%.

Economic Insight

The U.S. is hobbled by its lack of pro-trade majority on both

sides of the house, argues Jane Harman, chair of the U.S.

Commission on National Defense Strategy.

The Democratic and Republican parties alike have been taken over

by anti-trade wings, and that is stopping progress, Harman

added.

Forex:

The dollar is likely to stay stuck in a tight range for now as

market participants await key interest-rate announcements by

central banks over the next two weeks. Investors are likely to wait

for these key events "before riding more sustained trends,"

UniCredit Research

However, it expects the dollar will continue to retain a

"bullish bias," with the DXY dollar index remaining firm at close

to 103.50.

Sterling weakened slightly after data showed U.K. retail sales

fell by 3.2% during December, much more than expected.

The data suggest the U.K. economy "certainly isn't out of the

woods," Wealth Club said. "Whether December's weak retail sales are

a blip or the start of a more worrying trend remains to be

seen."

Energy:

Crude futures inched higher as extreme cold disrupts U.S. oil

production and Middle East tensions grow following more U.S.

strikes against Houthi anti-ship missiles.

"Sustained disruptions to Red Sea flows will increase the

pressure on energy markets over time," BMI Research said. Yet,

"energy-price action has been fairly muted in response to the

crisis."

According to BMI, the market sees risks of a broader conflict

and supply disruptions as unlikely or limited.

Metals:

Base metals were higher as the dollar eased back and gold made

gains on heightened geopolitical risks.

"But waning market expectations of early rate cuts by the Fed

and a rebound in the USD are likely to limit the upside," ANZ

Research said.

TODAY'S TOP HEADLINES

Wendy's CEO Todd Penegor to Exit, PepsiCo Executive Kirk Tanner

Named Successor

Wendy's Chief Executive Todd Penegor is departing and will be

succeeded by PepsiCo executive Kirk Tanner in the role.

The Dublin, Ohio-based fast-food chain on Thursday said that

Penegor, who has served as CEO since 2016 and joined the company a

decade ago, will leave in February.

BASF Sales, Earnings Miss Forecasts on Lower Margins,

Write-Downs

BASF said Friday that its 2023 results missed expectations,

dragged by impairments and lower margins that weren't offset by

cost cuts.

The European chemicals giant's key profit figure-earnings before

interest, taxes and special items-fell to 3.81 billion euros ($4.14

billion) from EUR6.88 billion, compared with a EUR4 billion-EUR4.4

billion forecast range and an analyst consensus estimate of EUR3.93

billion.

Why India Isn't the New China

China's economy is struggling, but another Asian giant,

neighboring India, is suddenly squarely on investors' and

manufacturers' radar. The first two decades of the 21st century

were largely the story of China's rise. Will the next two be the

story of India's?

There are plenty of reasons for optimism. The country's

population surpassed China's last year. More than half of Indians

are under 25. And at current growth rates, it could become the

world's third-largest economy in less than a decade, having

recently overtaken the U.K., its old colonial ruler, for the no. 5

spot. India's equity market has now seen eight straight years of

gains. Worsening trade relations between the West and China only

helps its case.

Don't Watch the CPI. Inflation Is Lower, Says Blackstone's Steve

Schwarzman.

DAVOS, Switzerland-Blackstone CEO Stephen Schwarzman has seen a

lot in a half-century in finance, but right now he sees something

stark in his empire of portfolio companies: Inflation is already

near 2%, lower than what the consumer price index shows, he says.

If the Fed sticks to its current policy stance, relying on the

official numbers, it could mean that interest rates stay higher for

longer than they need to.

While markets expect six or seven rate cuts from the Fed this

year as inflation wanes, officials at the central bank have pushed

back against that dovish view. After all, the annual gain in the

CPI rose to 3.4% in December from 3.1% in November, a discouraging

move that leaves the number firmly above the Fed's 2% target. Core

CPI, the Fed's preferred metric, was at 3.9%.

Americans Are Finally Feeling Better About the Economy

Americans' gloomy mood about the economy is showing signs of

lifting.

Persistently high inflation, the lingering shock from the

pandemic's destruction and fears that a recession was around the

corner put a damper on feelings about the economy in recent years,

despite solid growth and consistent hiring.

North Korea's Missiles Are Being Tested on the Battlefields of

Ukraine

SEOUL-One of the world's biggest illicit-arms suppliers just got

a major advertisement.

In recent weeks, Russian forces have fired short-range ballistic

missiles in Ukraine provided by North Korea, according to

assessments from Washington, Seoul and Kyiv. Pyongyang has provided

Moscow with dozens of the weapons, the U.S. says.

China's Strongest Ally in Taiwan Is Weaker Than Ever

TAIPEI-Beijing's closest political partner in Taiwan is fighting

to remain relevant in an island democracy where voters increasingly

see a future that is detached from an authoritarian China.

The Kuomintang, or Nationalist Party, once governed China and

had dominated Taiwanese politics for decades. It is now on its

longest losing streak in presidential elections since this

self-ruled island started choosing its leader by popular vote,

consigned to a third straight term in opposition.

Fani Willis, Prosecutor in Trump Georgia Case, Takes Swing at

Affair Allegations

Fulton County District Attorney Fani Willis is seeking to avoid

being deposed in the divorce proceeding of a colleague she is

accused of having an affair with, calling a recent subpoena for her

testimony a form of harassment meant to derail her criminal case

against former President Donald Trump and others.

In an emergency motion Thursday, Willis asked a judge to block

the subpoena in the divorce case of Nathan Wade, a lawyer in

private practice whom she hired as a special prosecutor in the

Trump case. His wife, Joycelyn Wade, filed the subpoena for

Willis's testimony.

Write to paul.larkins@dowjones.com TODAY IN CANADA

Earnings:

None scheduled

Economic Calendar (ET):

0830 Nov Employment Insurance

0830 Nov Retail Sales

Stocks to Watch:

Mithaq Extends Offer for Aimia to Feb. 15; Believes That

Following Departures of Phil Mittleman and Michael Lehmann 'There

Is an Opportunity for Improved Engagement' With Aimia Board

Organigram Shareholders Approve C$124.6M Investment From BAT

Expected Major Events for Friday

04:30/JPN: Nov Tertiary Industry Index

07:00/GER: Dec PPI

07:00/UK: Dec UK monthly retail sales figures

13:30/CAN: Nov Employment Insurance

13:30/CAN: Nov Retail trade

13:30/US: U.S. Weekly Export Sales

15:00/US: Jan University of Michigan Survey of Consumers -

preliminary data

15:00/US: Dec Existing Home Sales

21:00/US: Nov Treasury International Capital Data

All times in GMT. Powered by Kantar Media and Dow Jones.

Expected Earnings for Friday

Ally Financial Inc (ALLY) is expected to report $0.43 for

4Q.

Citizens Community Bancorp (CZWI) is expected to report $0.26

for 4Q.

Clearday Inc (CLRD) is expected to report for 3Q.

Comerica Inc (CMA) is expected to report $0.90 for 4Q.

Environmental Tectonics Corp (ETCC) is expected to report for

3Q.

Fifth Third Bancorp (FITB) is expected to report $0.77 for

4Q.

Huntington Bancshares Inc (HBAN) is expected to report $0.12 for

4Q.

Infinity Pharmaceuticals Inc (INFIQ) is expected to report $0.03

for 3Q.

MetroCity Bankshares Inc (MCBS) is expected to report for

4Q.

National American University Holdings Inc (NAUH) is expected to

report for 2Q.

Regions Financial Corp (RF) is expected to report $0.42 for

4Q.

Schlumberger Ltd (SLB) is expected to report $0.84 for 4Q.

Southern States Bancshares Inc (SSBK) is expected to report for

4Q.

State Street Corp (STT) is expected to report $0.46 for 4Q.

The Travelers Companies (TRV) is expected to report $5.08 for

4Q.

Timberland Bancorp Inc (TSBK) is expected to report for 1Q.

World Acceptance Corp (WRLD) is expected to report $1.88 for

3Q.

Powered by Kantar Media and Dow Jones.

ANALYST RATINGS ACTIONS

Adobe Cut to Underperform From Neutral by Exane BNP Paribas

Apple Raised to Buy From Neutral by B of A Securities

Century Casinos Cut to Market Perform From Market Outperform by

JMP Securities

Charles Schwab Cut to Market Perform From Outperform by Keefe,

Bruyette & Woods

eHealth Cut to Hold From Buy by Craig-Hallum

Fannie Mae Raised to Market Perform From Underperform by Keefe,

Bruyette & Woods

Freddie Mac Raised to Market Perform From Underperform by Keefe,

Bruyette & Woods

Hertz Global Raised to Overweight From Equal-Weight by Morgan

Stanley

Microchip Tech Raised to Outperform From Peer Perform by Wolfe

Research

Microsoft Raised to Outperform From Neutral by Exane BNP

Paribas

Pinterest Raised to Buy From Hold by Argus Research

Spirit Airlines Cut to Sell From Neutral by Citigroup

Tempur Sealy Raised to Overweight From Neutral by Piper

Sandler

Varonis Systems Cut to Neutral From Buy by DA Davidson

Wells Fargo Cut to Hold From Buy by Odeon Capital

Zoom Video Communications Cut to Underperform From Neutral by

Exane BNP Paribas

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

January 19, 2024 06:13 ET (11:13 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

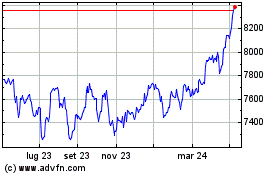

Grafico Indice FTSE 100

Da Ott 2024 a Nov 2024

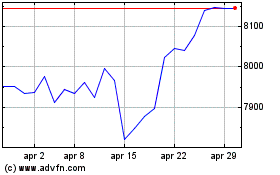

Grafico Indice FTSE 100

Da Nov 2023 a Nov 2024