Australian Dollar Falls Amid Trump Trades Optimism

06 Novembre 2024 - 3:38AM

RTTF2

The Australian dollar weakened against other major currencies in

the Asian session on Wednesday, as optimism over the U.S.

presidential election as early results show Republican candidate

Donald Trump surging ahead of Democratic candidate Kamala

Harris.

Traders also remain cautious ahead of the U.S Fed's interest

rate decision tomorrow.

The Fed is widely expected to lower interest rates by another 25

basis points, but traders will be looking to the accompanying

statement for clues about the likelihood of future rate cuts.

Tuesday, the Australian dollar strengthened against other major

currencies in the Asian session, after Australia central bank

maintained its interest rate for the eighth straight session at a

13-year high, as underlying inflation remains too high.

The policy board of the Reserve Bank of Australia governed by

Michele Bullock decided to hold the cash rate target at 4.35

percent. The bank had previously changed its rate in November 2023,

when it was lifted by 25 basis points to the highest level since

late 2011.

In the Asian trading today, the Australian dollar fell to nearly

a 3-month low of 0.6512 against the U.S. dollar, from an early

nearly a 2-week high of 0.6642. The aussie may test support around

the 0.63 region.

Against the Canadian dollar, the aussie slid to nearly a 2-month

low of 0.9073 from yesterday's closing value of 0.9174. On the

downside, 0.93 is seen as the next support level for the

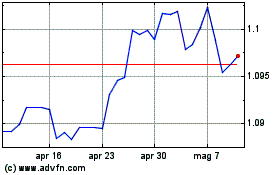

The aussie edged down to 1.1002 against the NZ dollar, from

Tuesday's closing value of 1.1045. The next possible support level

for the aussie is seen around the 1.11 region.

Against the euro and the yen, the aussie edged down to 1.6494

and 100.28 from an early 8-day highs of 1.6416 and 101.02,

respectively. If the aussie extends its downtrend, it is likely to

find support around 1.67 against the euro and 98.00 against the

yen.

Looking ahead, PMI reports from European economies and U.K. for

October and Eurozone PPI for September are slated for release in

the European session.

In the European session, U.S. MBA weekly mortgage approvals

data, Canada Ivey PMI for October and U.S. EIA crude oil data are

scheduled for release.

Grafico Cross AUD vs NZD (FX:AUDNZD)

Da Ott 2024 a Nov 2024

Grafico Cross AUD vs NZD (FX:AUDNZD)

Da Nov 2023 a Nov 2024