Euro Drops Amid Energy Crisis

22 Agosto 2022 - 12:16PM

RTTF2

The euro fell against its major counterparts in the European

session on Monday amid risk aversion, as natural gas prices surged

and indications of aggressive monetary policy tightening by major

central banks sparked recession concerns.

Russia's state-owned energy company Gazprom announced on Friday

that gas supplies through the Nord Stream 1 pipeline will be

stopped for three days for maintenance.

The disruption of natural gas supplies to the European Union

triggered a further surge in prices in the region.

Over the weekend, Bundesbank President Joachim Nagel said that

the German economy is "likely" to fall into a recession during the

winter, if the energy crisis worsens further.

Investors worry that inflation and further policy tightening

could fuel a recession.

The euro declined to near a 6-week low of 0.9989 against the

greenback and a 4-day low of 136.60 against the yen, down from its

early highs of 1.0047 and 137.94, respectively. The euro is seen

finding support around 0.97 against the greenback and 134.00

against the yen.

The euro touched a record low of 0.9575 against the franc. The

pair had closed Friday's deals at 0.9625.

Retreating from its prior highs of 1.3050 against the loonie and

1.4609 against the aussie, the euro dipped to near a 4-week low of

1.2981 and a 6-day low of 1.4456, respectively. The currency is

likely to face support around 1.27 against the loonie and 1.41

against the aussie.

The euro fell to 0.8461 against the pound, off an early high of

0.8494. Against the kiwi, it was down at 1.6116. The next possible

support for the euro is seen around 0.82 against the pound and 1.59

against the kiwi.

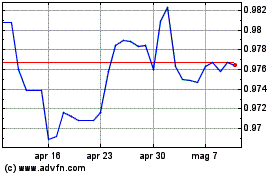

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Mar 2024 a Apr 2024

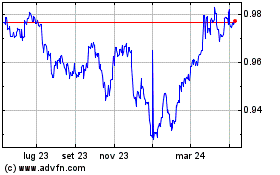

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Apr 2023 a Apr 2024