BoE On High Alert Since SVB Collapse, Says Bailey

28 Marzo 2023 - 10:53AM

RTTF2

Bank of England Governor Andrew Bailey said the UK central bank

was on high alert since the failure of the U.S. technology sector

focused lender Silicon Valley Bank in the past few weeks.

"We are in a period of very heightened, frankly, tension and

alertness," Bailey said at the Treasury Select Committee hearing on

the Silicon Valley Bank collapse.

However, the UK was not experiencing any stress in connection

with the collapse of SVB and Credit Suisse, the banker added.

BoE Chief observed that the demise of the SVB was the fastest

since the collapse of Barings Bank in 1995. Bailey admitted that he

was surprised by the speed of the SVB's collapse.

Further, Bailey said that guarantee to all bank deposits should

not be the norm.

The governor pointed out that the UK is not in a position

similar to the 2008 global financial crisis.

At the London School of Economics on Monday, Bailey said the

monetary policy committee will focus on returning inflation back to

the target even in the face of the recent banking sector

turmoil.

The BoE Chief observed that the UK banking system is resilient,

with robust capital and liquidity positions, and well placed to

support the economy. Moreover, there is a strong macroprudential

policy regime in the country, Bailey added.

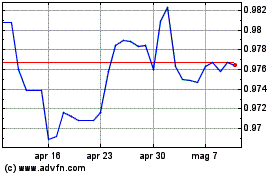

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Mar 2024 a Apr 2024

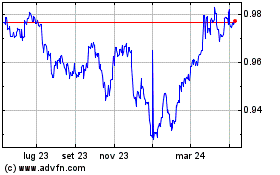

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Apr 2023 a Apr 2024