Swiss Franc Climbs As Recession Fears Weigh

06 Aprile 2023 - 9:32AM

RTTF2

The Swiss franc strengthened against its major counterparts

during the European session on Thursday, as disappointing U.S.

economic data stoked worries about a recession.

U.S. private employers hired far fewer workers than expected in

March and growth in the country's service sector activity slowed by

much more than expected in the month, adding to the gloom

surrounding the economic outlook.

Markets are pricing in a 58.2 percent chance that the U.S.

Federal Reserve will hold interest rates steady at its next policy

meeting in May.

Federal Reserve Bank of Cleveland President Loretta Mester said

that policymakers should move their benchmark rate above 5% this

year and hold it at restrictive levels for some time to quell

inflation.

Traders now look ahead to the release of the closely watched US

monthly jobs report for further cues on rate outlook.

The franc was up against the euro, at nearly a 2-week high of

0.9851. The currency is seen finding resistance around the

level.

The franc rose to 145.31 against the yen, from an early 1-week

low of 144.26. If the franc rises further, 148.00 is possibly seen

as its next resistance level.

The franc edged up to 0.9036 against the greenback and 1.1259

against the pound, off its early lows of 0.9075 and 1.1305,

respectively. The franc may find resistance around 0.89 against the

greenback and 1.11 against the pound.

Looking ahead, U.S. weekly jobless claims for the week ended

April 1 and Canada jobs data and Ivey PMI for March are due in the

New York session.

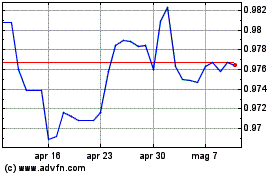

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Mar 2024 a Apr 2024

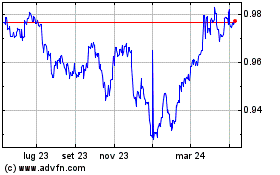

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Apr 2023 a Apr 2024