China Keeps Benchmark Rates Unchanged As Expected

20 Aprile 2023 - 3:34AM

RTTF2

China's central bank maintained its benchmark rates on Thursday,

as widely expected, as the economy logged a strong growth after the

unwinding of zero-Covid policy.

The People's Bank of China left its one-year loan prime rate, or

LPR, unchanged at 3.65 percent. Similarly, the five-year LPR, the

benchmark for mortgage rates, was retained at 4.30 percent.

Earlier, the bank had reduced the five-year LPR rate by 15 basis

points each in May and August 2022, and by 5 basis points in

January 2022. The one-year LPR was last lowered in August 2022.

The LPR is fixed monthly based on the submission of 18 banks,

though Beijing has influence over the rate-setting. The LPR

replaced the central bank's traditional benchmark lending rate in

August 2019.

Markets widely anticipated the PBoC to hold the LPR today as the

medium-term lending facility, or MLF, which acts as a guide to the

LPR, was kept unchanged early this week.

On Monday, the PBoC had added CNY 170 billion via one-year MLF

at an interest rate of 2.75 percent. The bank also conducted

seven-day reverse repo operations worth CNY 20 billion at a rate of

2.00 percent.

In the first quarter, the second-largest economy logged an

annual growth of 4.5 percent, stronger than the 2.9 percent

expansion registered in the fourth quarter of 2022, official data

showed early this week.

After a weaker 3.0 percent economic growth in 2022, the Chinese

government set a moderate growth target of around 5.0 percent for

this year.

The International Monetary Fund had projected growth outlook for

China at 5.2 percent this year and 4.5 percent in 2024.

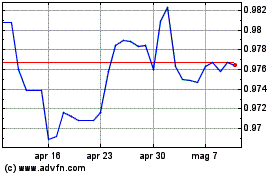

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Mar 2024 a Apr 2024

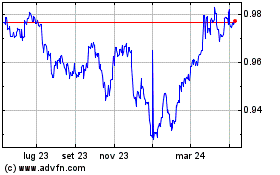

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Apr 2023 a Apr 2024