Swiss Franc Declines Amid Risk Appetite

27 Aprile 2023 - 8:30AM

RTTF2

The Swiss franc was lower against its major counterparts in the

European session on Thursday, as a string of strong tech earnings

offset lingering concerns about the U.S. banking sector.

Facebook parent company Meta posted better-than-expected

earnings for the first quarter and issued a strong outlook for the

second quarter.

Investors await a preliminary reading on first quarter U.S. GDP

along with reports on weekly jobless claims and pending home sales

later today for more direction.

PCE inflation data due on Friday could offer hints on when the

Federal Reserve might consider pausing interest rate rises.

In another development, the U.S. House of Representatives on

Wednesday approved a bill to raise the government's debt ceiling,

but it is unlikely to be passed in the Senate. The franc was down

against the dollar, at a 6-day low of 0.8930. The franc is seen

finding support around the 0.91 level.

The franc fell to 149.70 against the yen, from an early high of

150.23. If the currency slides again, it may find support around

the area.

The franc depreciated to a fresh 2-week low of 0.9866 against

the euro and a 1-week low of 1.1134 against the pound, off its

early highs of 0.9823 and 1.1093, respectively. The next possible

support for the franc is seen around 1.00 against the euro and 1.15

against the pound.

Looking ahead, U.S. pending home sales for March, weekly jobless

claims for the week ended April 22 and GDP data for the first

quarter will be released in the New York session.

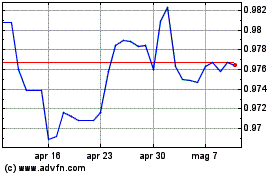

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Mar 2024 a Apr 2024

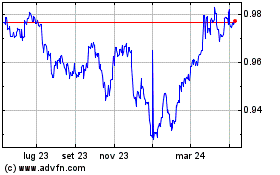

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Apr 2023 a Apr 2024