Pound Appreciates On Easing Banking Concerns

27 Marzo 2023 - 8:21AM

RTTF2

The pound climbed against its most major counterparts in the

European session on Monday, as European shares rose following the

acquisition of Silicon Valley Bank by First Citizens Bank.

First Citizens Bank announced that it has agreed to buy all the

loans and deposits of Silicon Valley Bank and gave the Federal

Deposit Insurance Corp equity rights in its stock worth up to $500

million.

Comments from the U.S. Federal Reserve officials reduced

concerns about the turmoil in the banking sector.

St. Louis Federal Reserve President James Bullard said on Friday

that the stress in the banking sector will abate, and the Fed needs

to push interest rates higher than previously expected.

Elsewhere, the U.S. Financial Stability Oversight Council said

the U.S. banking system was "sound and resilient" despite stress on

some institutions.

The pound advanced to 1.2265 against the greenback and 0.8777

against the euro, off its early lows of 1.2218 and 0.8806,

respectively. The currency is seen finding resistance around 1.26

against the greenback and 0.86 against the euro.

The pound was up against the yen, at a 4-day high of 161.09. If

the pound continues its rise, 164.00 is possibly seen as its next

resistance level.

In contrast, the pound eased off to 1.1220 against the franc.

The pound is likely to challenge support around the 1.11 region, if

it drops again.

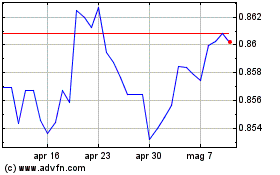

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Mar 2024 a Apr 2024

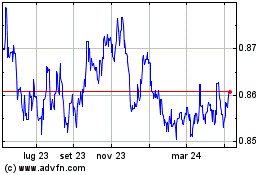

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Apr 2023 a Apr 2024