Pound Rises After U.K. Labor Data

15 Ottobre 2024 - 8:00AM

RTTF2

The British pound strengthened against most major currencies in

the European session on Tuesday, after data showed that the

nation's unemployment rate fell slightly in three months to August,

while it was forecast to remain unchanged.

Data from the Office for National Statistics showed that the

U.K. unemployment rate fell slightly to 4.0 percent in three months

to August, while it was forecast to remain unchanged at 4.1

percent.

Payroll employment decreased 15,000 from the prior month to 30.3

million in September.

U.K. wage growth softened to the lowest in more than two years

in the three months to August, adding support to expectations that

the central bank will cut interest rates further at the next

meeting.

In the three months to August, average earnings excluding bonus

increased 4.9 percent from the previous year, slower than the 5.1

percent increase in the three months to July.

This was the slowest rise since June 2022 and also matched

expectations.

European stocks traded higher amid investor optimism about

corporate earnings.

After beats by JP Morgan and Wells Fargo, the focus now shifts

to earnings from Bank of America, Citigroup, Goldman Sachs, Johnson

& Johnson, UnitedHealth and Walgreens later in the day.

Thursday's ECB meeting also remains on investors' radar, with

the central bank likely to deliver another interest rate cut after

recent data signaled continued weakness in the euro zone

economy.

In the European trading today, the pound rose to nearly a 2-week

high of 0.8336 against the euro and a 5-day high of 1.3087 against

the U.S. dollar, from early lows of 0.8352 and 1.3035,

respectively. If the pound extends its uptrend, it is likely to

find resistance around 0.81 against the euro and 1.34 against the

greenback.

Against the Swiss franc, the pound edged up to 1.1276 from an

early low of 1.1248. The pound may test resistance around the 1.13

region.

Meanwhile, the pound dropped to 194.67 against the yen, from an

early high of 195.68. The next possible downside support for the

pound is seen around the 192.00 region.

Looking ahead, Canada CPI data for September, U.S. NY Empire

State manufacturing index for October, U.S. Redbook report and U.S.

consumer inflation expectations for September are set to be

released in the New York session.

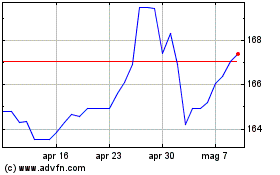

Grafico Cross Euro vs Yen (FX:EURJPY)

Da Ott 2024 a Nov 2024

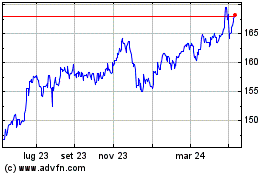

Grafico Cross Euro vs Yen (FX:EURJPY)

Da Nov 2023 a Nov 2024