Dollar Advances As Strong U.S. PPI Data Raises Fed Rate Hike Concerns

09 Dicembre 2022 - 12:11PM

RTTF2

The U.S. dollar rebounded against its major opponents in the

European session on Friday, as the nation's producer inflation rose

more than expected in November, raising concerns about the Federal

Reserve's outlook for interest rates.

Data from the Labor Department showed that the producer price

index for final demand rose by 0.3 percent in November, matching

upwardly revised increases in October and September.

Economists had expected producer prices to inch up by 0.1

percent compared to the 0.2 percent uptick originally reported for

the previous month.

Meanwhile, the report showed the annual rate of producer price

growth slowed to 7.4 percent in November from 8.1 percent in

October, in line with economist estimates.

The data fuelled concerns that the Fed may tighten policy for

longer and cause a slowdown in economic growth.

The Fed will hold its policy meeting on December 13-14, when it

is expected to raise rates by 50 basis points.

The greenback climbed to 1.0503 against the euro, from a 4-day

low of 1.0588 seen at 2:05 am ET. If the greenback rises further,

it may locate resistance around the 1.03 level.

The greenback advanced to 1.2200 against the pound, from a 4-day

low of 1.2297 it touched at 8:20 am ET. The greenback may test

resistance around the 1.18 region, should it rallies again.

The greenback edged up to 136.82 against the yen, from a 4-day

low of 135.60 it logged at 8:20 am ET. The currency is likely to

challenge resistance around the 138.00 level.

The greenback was up against the loonie, at a 2-day high of

1.3691. The greenback is seen finding resistance around the 1.38

level.

The greenback recovered to 0.6742 against the aussie and 0.6360

against the kiwi, off its early 4-day lows of 0.6800 and 0.6414,

respectively. The next possible resistance for the dollar is seen

around 0.66 against the aussie and 0.61 against the kiwi.

The greenback rose to 0.9382 against the franc, after hitting

0.9322 at 6:50 am ET, which was its weakest level since April 13.

On the upside, 0.96 is possibly seen as the next resistance

level.

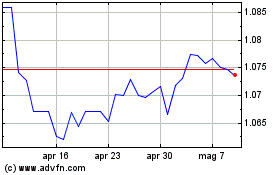

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Mar 2024 a Apr 2024

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Apr 2023 a Apr 2024