U.S. Dollar Falls As Alibaba's Breakup Plan Lifts Sentiment

29 Marzo 2023 - 11:49AM

RTTF2

The U.S. dollar declined against its most major counterparts in

the European session on Wednesday, as Alibaba's plan to split into

six business units signalled an easing of Beijing's crackdown on

the tech sector.

Alibaba decided to break up the company into six smaller

entities and noted that most units will have the ability to raise

outside capital and potentially seek an IPO.

The restructuring plan eased concerns about China's crackdown on

private enterprises and triggered a rally in European stocks.

Worries about a banking crisis eased after top U.S. finance

officials promised to use all tools for any size institution, as

needed, to keep the financial system safe and sound.

The regulators defended decisions they made both before and

after the collapse of SVB, noting the bank failed because its

management failed to appropriately address clear interest rate

risks and clear liquidity risks.

The benchmark yield on the 10-year note fell to 3.56 percent.

Yields move inversely to bond prices.

The greenback touched 1.2361 against the pound, its lowest level

since February 2. Next key support for the currency is likely seen

around the 1.26 level.

The greenback was down against the franc, at 0.9164. On the

downside, 0.90 is possibly seen as its next support level.

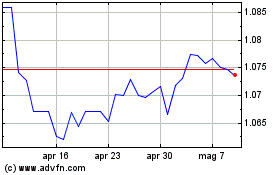

The greenback weakened to a 6-day low of 1.0871 against the euro

and near a 4-week low of 1.3571 against the loonie, from its early

highs of 1.0817 and 1.3616, respectively. The greenback may find

support around 1.10 against the euro and 1.33 against the

loonie.

In contrast, the greenback advanced to 132.39 against the yen,

setting a 1-week high. The greenback is likely to find resistance

around the 137.00 level.

The greenback edged up to 0.6661 against the aussie and 0.6228

against the kiwi, off its early 6-day lows of 0.6713 and 0.6270,

respectively. The greenback is seen finding resistance around 0.64

against the aussie and 0.61 against the kiwi.

U.S. pending home sales for February are set for release in the

New York session.

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Mar 2024 a Apr 2024

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Apr 2023 a Apr 2024