Pound Slides; U.S. Dollar Advances Amid Russia-Ukraine War

24 Febbraio 2022 - 9:29AM

RTTF2

The pound fell sharply against its major counterparts in the

European session on Thursday, while the U.S. dollar appreciated, as

Russia's attack on Ukraine and the possibility of retaliatory

sanctions from the West spooked global markets.

European stock markets fell, tracking declines in Asia,

following Russia's invasion of Ukraine, with bombings and strikes

reported in cities across the country.

Ukrainian President Volodymyr Zelenskyy introduced martial law

following Russia's attacks from several directions, including

Donbas, Crimea and the northeastern region.

"This is an act of war, an attack on the sovereignty and

territorial integrity of Ukraine, a gross violation of the UN

Charter and fundamental norms and principles of international law,"

Ukraine's Foreign Ministry said in a statement.

European Commission President Ursula von der Leyen said that

European leaders are planning to announce a package of massive

sanctions that target strategic sectors of the Russian economy by

blocking the access to technologies and markets that are key for

Russia.

The pound depreciated to more than a 4-week low of 153.46

against the yen and near a 4-week low of 1.3383 against the

greenback, off its early highs of 155.89 and 1.3549, respectively.

The pound is poised to challenge support around 149.00 against the

yen and 1.32 against the greenback.

The pound weakened to 1.2357 against the franc, its lowest level

since January 25, and down from a high of 1.2440 hit at 8:45 pm ET.

Should the pound slides further, 1.22 is likely seen as its next

support level.

The pound, however, rose back to 0.8319 against the euro, not

far from a 3-week high of 0.8306 seen in the previous session. The

currency is likely to locate resistance around the 0.82 region.

Rebounding from its prior lows of 0.9171 against the franc and

1.1309 against the euro, the greenback jumped to an 8-day high of

0.9247 and more than a 3-week high of 1.1155, respectively. On the

upside, 0.94 and 1.10 are possibly seen as its next resistance

levels against the franc and the euro, respectively.

The greenback moved up to near a 2-month high of 1.2847 against

the loonie, 1-week high of 0.7161 against the aussie and a 2-day

high of 0.6690 against the kiwi, following its previous lows of

1.2726, 0.7233 and 0.6776, respectively. The greenback is seen

finding resistance around 1.30 against the loonie, 0.68 against the

aussie and 0.645 against the kiwi.

The greenback, meanwhile, held steady against the yen with the

pair trading at 114.91. This followed a 3-week low of 114.41 hit at

1:45 am ET. At yesterday's close, the pair was valued at

114.98.

U.S. GDP data for the fourth quarter, weekly jobless claims for

the week ended February 19 and new home sales for January will be

featured in the New York session.

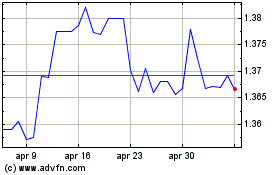

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

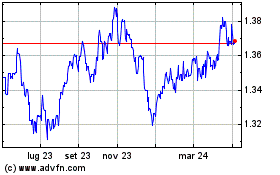

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024