U.S. Dollar Higher On Prospects Of Faster Fed Tightening

08 Aprile 2022 - 6:26AM

RTTF2

The U.S. dollar appreciated against its major counterparts in

the Asian session on Friday, following hawkish remarks from a

Federal Reserve policy maker supporting aggressive interest rate

hikes to counter inflation.

St Louis Fed President James Bullard said on Thursday that the

central bank remained "behind the curve" on interest rates and

preferred to raise the federal funds rate by another 3 percentage

points by the end of the year.

Chicago Fed President Charles Evans and his Atlanta counterpart

Raphael Bostic said that it is appropriate to raise rates to

neutral but in a measured manner.

The Fed minutes released on Wednesday suggested that it plans to

start the balance sheet reduction next month and favored a

half-point liftoff in interest rates at one or more meetings in the

future.

According to the CME Group's FedWatch Tool, investors are

pricing in the Fed to raise interest rate to a target range of

between 2.5 percent and 2.75 percent by the end of the year.

The greenback firmed to more than a 3-week high of 1.3041

against the pound and more than a 4-week high of 1.0855 against the

euro, off its prior lows of 1.3082 and 1.0882, respectively.

Immediate resistance for the greenback is likely seen around 1.28

against the pound and 1.06 against the euro.

The greenback touched a 10-day high of 0.7460 against the aussie

and more than a 2-week high of 0.6870 against the kiwi, from its

early lows of 0.7493 and 0.6893, respectively. The greenback may

test resistance around 0.72 against the aussie and 0.66 against the

kiwi, if it gains again.

The greenback appreciated to a 10-day high of 0.9353 against the

franc, from a low of 0.9331 hit at 5 pm ET. On the upside, 0.95 is

likely seen as its next resistance level.

The greenback edged up to 1.2596 against the loonie, after

dropping to 1.2576 at 1:45 am ET. The greenback is likely to locate

resistance around the 1.28 region.

The greenback rose back to 124.15 against the yen, on track to

pierce a 10-day high of 124.23 seen at 6:45 pm ET. If the greenback

rises further, it may likely seek resistance around the 129.00

level.

Looking ahead, Canada jobs data for March and U.S. wholesale

inventories for February will be out in the New York session.

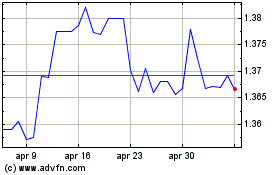

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

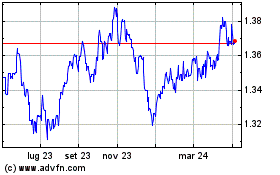

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024