Canadian Dollar Slides As Oil Prices Drop

10 Maggio 2022 - 6:17AM

RTTF2

The Canadian dollar weakened against its major counterparts in

the Asian session on Tuesday amid falling oil prices, as the

European Union has rejected a plan to prevent the bloc's vessels

from carrying Russian oil to third countries.

Bloomberg reported that EU officials discarded the proposed ban

on transporting oil, but supported curbs for insurers.

Concerns that lockdowns in China would hurt demand also

underpinned oil prices.

Shanghai and Beijing tightened COVID-19 curbs on Monday amid

compliance to a strict "zero-Covid" policy to combat the

outbreak.

The move by the US Federal Reserve and other central banks to

tighten monetary policies in the wake of high inflation is sparking

fears about an economic slowdown and hurting equities.

The loonie reached as low as 1.3769 against the euro, its

weakest level since April 4. On the downside, 1.41 is possibly seen

as its next support level.

The loonie fell below the key 1.30 level against the greenback,

touching a 1-1/2-year low of 1.3037. The loonie may find support

around the 1.32 area.

The loonie retreated to 0.9076 against the aussie, from more

than a 3-month high of 0.9008 seen at 9 pm ET. The loonie is likely

to test support around the 0.92 level, if it drops further.

In contrast, the loonie rebounded to 100.47 against the yen,

from nearly a 2-week high of 99.60 it touched at 9 pm ET. The

loonie is seen finding resistance around the 102.5 level.

Looking ahead, German ZEW economic sentiment index for May is

due in the European session.

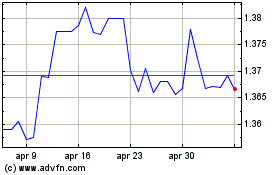

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

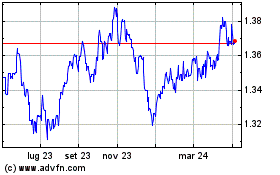

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024