UK Credit Card Borrowing Rises At Fastest Pace Since 2005

30 Agosto 2022 - 8:45AM

RTTF2

UK credit card borrowing increased the most since 2005 as the

cost of living crisis deepens, data published by the Bank of

England showed Tuesday.

Consumers borrowed an extra GBP 740 billion in July on their

credit cards. This was up 13.0 percent from the last year, marking

the biggest increase since October 2005. Other forms of consumer

credit gained 4.5 percent, the highest since March 2020.

Overall, individuals borrowed an additional GBP 1.4 billion in

consumer credit in July versus GBP 1.8 billion in the prior month.

Consumer credit logged an annual growth of 6.9 percent, which was

the fastest rate since March 2019.

Data showed that mortgage approvals rose to 63,770 in July from

63,184 in the previous month, while the level was forecast to fall

to 61,700.

However, this was well below the 12-month pre-pandemic average

up to February 2020 of 66,800.

The drag on buyer demand from the ongoing increase in mortgage

rates and surging energy bills will intensify over the winter and

ensure that mortgage lending resumes its downward trend, Capital

Economics economist Andrew Wishart, said.

The BoE data showed that secured lending decreased slightly to

GBP 5.1 billion in July from GBP 5.3 billion in June. At the same

time, gross lending increased to GBP 26.1 billion from GBP 24.6

billion a month ago.

Small and medium sized businesses repaid GBP 0.3 billion of

loans in July, which was less than the GBP 1.4 billion repaid in

June, and the 16th consecutive month of net repayments.

At the same time, large non-financial businesses repaid GBP 1.8

billion of bank loans in July, compared to GBP 4.1 billion of

borrowing in June.

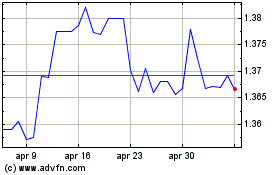

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

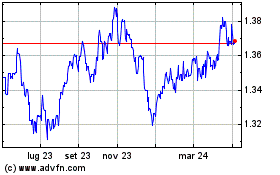

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024