Canadian Dollar Climbs Against Most Majors

14 Marzo 2023 - 6:18AM

RTTF2

The Canadian dollar advanced against its most major counterparts

in the European session on Tuesday, as investors await key U.S.

consumer price inflation data later in the day for clues on the

path for interest rates.

The consumer price index is expected to have risen by 6 percent

year-over-year in February compared to 6.4 percent in January.

Traders shifted back to betting Fed rate cuts amid the fallout

from SVB and lingering worries about contagion.

Some economists now expect no rate increase at all when the

Federal Reserve delivers its interest-rate decision later this

month.

The loonie climbed to 1.3702 against the greenback and 97.82

against the yen, from its prior lows of 1.3748 and 96.83,

respectively.

The loonie up against the euro, at a 4-day high of 1.4641.

Next near term resistance for the currency is likely seen around

1.36 against the greenback, 99.00 against the yen and 1.46 against

the euro.

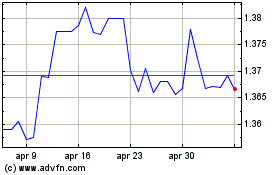

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

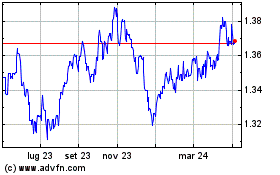

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024