Swiss Franc Drops Despite SNB Rate Hike

22 Settembre 2022 - 7:45AM

RTTF2

The Swiss franc fell against its major counterparts in the

European session on Thursday, after the Swiss National Bank hiked

its policy rate by 75 basis points, as anticipated.

The central bank hiked the SNB policy rate by 0.75 percentage

points to 0.5 percent. This was the second consecutive rate

hike.

"It cannot be ruled out that further increases in the SNB policy

rate will be necessary to ensure price stability over the medium

term," the bank said in the statement.

To provide appropriate monetary conditions, the SNB is also

willing to be active in the foreign exchange market as necessary,

the SNB added.

The inflation projection for this year was raised to 3.0 percent

from 2.8 percent. The outlook for 2023 was lifted to 2.4 percent

from 1.9 percent and that for 2024 to 1.7 percent from 1.6

percent.

European markets dropped as the U.S. Federal Reserve signalled

more aggressive rate increases despite growing headwinds to

economic growth and the labor market.

The franc dropped to a fresh 2-week low of 0.9800 against the

greenback, after rising to 0.9620 at 3:15 am ET. The franc may face

support around the 1.00 level, if it falls again.

The franc depreciated to a 1-week low of 1.1098 against the

pound, from near a 48-year high of 1.0814 seen at 3:15 am ET. The

franc is seen finding support around the 1.23 area.

The franc slipped to a 2-day low of 0.9681 against the euro,

following a record high of 0.9465 set at 3:15 am ET. Next key

support for the franc is likely seen around the 0.98 level.

The franc weakened to more than a 2-week low of 144.34 against

the yen, down from a 42-1/2-year high of 151.47 hit at 3:15 am ET.

Should the franc falls further, it is likely to test support around

the 131.00 region.

Looking ahead, the Bank of England's monetary policy

announcement is due at 7:00 am ET. The BoE is widely expected to

raise its key rate by 50 basis points to 2.25 percent from 1.75

percent.

Canada new housing price index for August, U.S. weekly jobless

claims for the week ended September 17 and leading index for August

will be featured in the New York session.

At 10:00 am ET, Eurozone flash consumer sentiment index for

September is due.

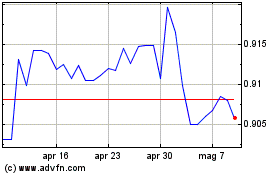

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Mar 2024 a Apr 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Apr 2023 a Apr 2024