U.S. Dollar Advances In Cautious Trade

05 Ottobre 2022 - 9:34AM

RTTF2

The U.S. dollar climbed against its major counterparts in the

European session on Wednesday, as optimism over a slowdown in the

pace of the Federal Reserve's monetary policy tightening

receded.

U.S. treasury yields rose, with the benchmark yield on 10-year

note touching 3.71 percent. Yields move inversely to bond

prices.

The Reserve Bank of New Zealand delivered a 50 basis point hike,

dampening expectations for a softening of an aggressive stance by

central banks.

ADP will release private sector jobs report for September at

8:15 am ET. Economists expect private sector employment to increase

by 200,000 jobs in September, after a gain of 132,000 jobs in

August.

Friday's U.S. non-farm payrolls report could offer more clues on

the Fed's rate hike trajectory in the future.

The greenback advanced to 144.56 against the yen and 1.1360

against the pound, after declining to a 9-day low of 143.53 and

near a 3-week low of 1.1495, respectively in early deals. The

greenback is seen finding resistance around 146.00 against the yen

and 1.10 against the pound.

The greenback appreciated to 0.9911 against the euro and 0.9849

against the franc, off its early lows of 0.9995 and 0.9785,

respectively. The greenback is likely to find resistance around

0.96 against the euro and 1.02 against the franc.

The greenback edged up to 1.3599 against the loonie and 0.6460

against the aussie, from its prior lows of 1.3503 and 0.6526,

respectively. The greenback may face resistance around 1.38 against

the loonie and 0.62 against the aussie.

The greenback rose to 0.5706 against the kiwi, from near a

2-week low of 0.5805 seen in the previous session. If the currency

rises further, 0.55 is likely seen as its next resistance

level.

Looking ahead, ADP private sector employment data for September

is scheduled for release at 8:15 am ET.

U.S. and Canadian trade data for August and ISM

non-manufacturing composite index for September are set for release

in the New York session.

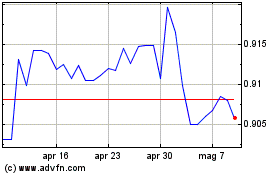

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Mar 2024 a Apr 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Apr 2023 a Apr 2024