TIDM88E

RNS Number : 1102F

88 Energy Limited

17 March 2022

This announcement contains inside information

17 March 2022

88 Energy Limited

Merlin-2 Drilling Ahead

Highlights

-- Merlin-2 surface hole successfully drilled to 2,005 feet, cased and BOP system tested.

-- Operations progressing as planned with the Arctic Fox rig

scheduled to commence drilling ahead to the reservoir targets

imminently.

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) ( 88 Energy or

the Company ) is pleased to report that the Merlin-2 surface hole

was successfully drilled to 2,005 feet, the surface casing

installed and cemented, and the Blow Out Preventer ( BOP ) system

tested.

Operations are progressing as planned with the Arctic Fox rig

scheduled to commence drilling ahead to the reservoir targets

imminently. The Company anticipates all target zones to be

intersected prior to reaching the permitted Total Depth ( TD ) of

approximately 8,000 feet, with drilling to TD at Merlin-2 expected

to take up to two weeks from this point.

The Merlin-2 well is designed to appraise the N18, N19 and N20

primary targets located in the Nanushuk Formation, which were

encountered in Merlin-1 and returned compelling evidence of

hydrocarbons across these three separate zones. Given the

suboptimal placement of the Merlin-1 well, with respect to

reservoir development (a necessary trade-off to maximise the number

of stacked targets), the Merlin-2 well represents a move east from

Merlin-1 towards the shelf edge where thicker and higher

porosity/permeability formations are anticipated.

During the current drilling phase, logging while drilling and

mudlogging are set to provide initial indications as to the

prospectivity of the target zones at the Merlin-2 location. After

reaching TD, a sophisticated wireline logging program is planned to

be run, which includes collection of down hole samples and side

wall cores. The wireline logging program is expected to take

approximately five to seven days to be completed.

The Company will provide further updates subsequent to Merlin-2

achieving TD.

The graphics below can be viewed in the pdf version of this

announcement, which is available on the Company's website

www.88energy.com:

-- Figure 1. Wireframe image showing respective Merlin-1 and

Merlin-2 well locations, facing east and overlain with predicted

reservoir sands profile.

-- Figure 2: Article Fox drill rig at the Merlin-2 drilling location

-- Map of Project Peregrine and Recent Nanushuk Discoveries

Media and Investor Relations:

88 Energy Ltd

Ashley Gilbert, Managing Director

Tel: +61 8 9485 0990

Email:investor-relations@88energy.com

Finlay Thomson , Investor Relations Tel: +44 7976 248471

Fivemark Partners , Investor and Tel: +61 410 276 744

Media Relations Tel: +61 422 602 720

Andrew Edge / Michael Vaughan

EurozHartleys Ltd Tel: +61 8 9268 2829

Dale Bryan

Cenkos Securities Tel: +44 131 220 6939

Neil McDonald / Derrick Lee

Pursuant to the requirements of the ASX Listing Rules Chapter 5

and the AIM Rules for Companies, the technical information and

resource reporting contained in this announcement was prepared by,

or under the supervision of, Dr Stephen Staley, who is a

Non-Executive Director of the Company. Dr Staley has more than 35

years' experience in the petroleum industry, is a Fellow of the

Geological Society of London, and a qualified

Geologist/Geophysicist who has sufficient experience that is

relevant to the style and nature of the oil prospects under

consideration and to the activities discussed in this document. Dr

Staley has reviewed the information and supporting documentation

referred to in this announcement and considers the resource and

reserve estimates to be fairly represented and consents to its

release in the form and context in which it appears. His academic

qualifications and industry memberships appear on the Company's

website and both comply with the criteria for "Competence" under

clause 3.1 of the Valmin Code 2015. Terminology and standards

adopted by the Society of Petroleum Engineers "Petroleum Resources

Management System" have been applied in producing this

document.

About Project Peregrine

Project Peregrine is located in the NPR-A region of the North

Slope of Alaska and encompasses approximately 195,000 contiguous

acres. It is situated on trend to recent discoveries in a newly

successful play type in topset sands in the Nanushuk formation. 88

Energy has a 100% working interest in the project.

The Merlin-1 well was spudded in March 2021 with drilling

operations completed in April 2021. Interpretation of results was

completed in August 2021 with post-well evaluation successfully

demonstrating the presence of oil in N20, N19 and N18 targets, with

41 feet of net log pay across the three reservoir intervals noted

and geochemical analysis determining the oil to have an estimated

API gravity between mid-30 to low-40 API (light oil).

A second well, the Merlin-2 appraisal well, spudded in early

March 2022 as a follow-up well to the Merlin-1 exploration well.

Merlin-2 is targeting a net entitlement mean Prospective Resource

of 652 million barrels (unrisked)(1,2.)

To view the Company's video and animated presentations of

Project Peregrine, as well as the Merlin-1 well results and details

of the Merlin-2 well, please click on the link to the 88 Energy

website www.88energy.com.

Independent oil and gas reservoir evaluation consultancy, ERCE

Australia Pty Ltd (ERCE), conducted an updated assessment of the

Project Peregrine prospective resources post the Merlin-1 well

results. The updated prospective resource estimates and risking

assessments for Project Peregrine are noted below.

Revised Project Peregrine Prospective Resources

Project Peregrine: Alaska North Unrisked Net Entitlement to 88E (1,

Slope 4) Prospective Oil Resources (MMstb)

Prospects (Probabilistic Calculations) Low (1U) Best High Mean COS (3)

(2U) (3U)

---------

Merlin-2 (Nanushuk - N20, N19

and N18) 64 329 1,467 652 56%

========= ====== ====== ========= ========

Merlin-1A (Nanushuk - N14S) 25 87 282 132 17%

======================================== ========= ====== ====== ========= ========

Harrier (Nanushuk) 41 175 796 353 24%

======================================== ========= ====== ====== ========= ========

Harrier Deep (Torok) 35 226 1,132 486 20%

======================================== ========= ====== ====== ========= ========

Prospects Total 1,624(2)

---------------------------------------- --------- ------ ------ --------- --------

1. The Prospective Resources presented here are the result of a

risked probabilistic aggregation of the individual stacked

prospective layers in each prospect; the success case estimates

present the distribution of possible outcomes in the event that at

least one prospective layer is successful.

2. Unrisked mean total is not representative of the expected

total from the four prospects and assumes a success case in all

four wells.

3. COS represents the geological chance of success of at least

one of the stacked layers which comprise each prospect. This

excludes phase risk which ERCE has estimated to be 70% oil (30%

gas). The Prospective Resources have also not been adjusted for the

chance of development, which is estimated by 88 Energy to be 60%

(including phase risk), ERCE sees this as reasonable based on the

data available. Quantifying the chance of development (COD)

requires consideration of both economic contingencies and other

contingencies, such as legal, regulatory, market access, political,

social license, internal and external approvals and commitment to

project finance and development timing. As many of these factors

are out-with the knowledge of ERCE they must be used with

caution.

4. Gross Prospective Resources include off-block volumes over

which 88 Energy has no mineral rights. Net working interest

Prospective Resources are based on the on-block volumes and 88

Energy's 100% working interest. Net entitlement Prospective

Resources are the net working interest Prospective Resources less

royalties payable to others. The net entitlement interest to 88

Energy is calculated as 84.7% of net working interest after

deduction of state royalty (12.5%) and overriding royalty interests

(1.3%and 1.5%).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCJRMFTMTJBMIT

(END) Dow Jones Newswires

March 17, 2022 03:00 ET (07:00 GMT)

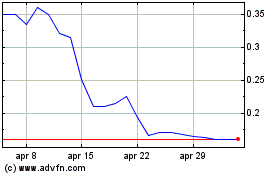

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Apr 2023 a Apr 2024