AB Foods Plans More Than 130 New Primark Stores in Next Five Years -- 2nd Update

09 Novembre 2021 - 11:27AM

Dow Jones News

By Jaime Llinares Taboada

Associated British Foods PLC said on Tuesday that it will

accelerate the expansion of its Primark clothing chain in the U.S.

and Europe and that it has enough stock to cover the important

Christmas trading period.

The British conglomerate expects to grow its retail-store estate

from the 398 sites it had in September to 530 over the next five

years.

The company plans to increase its selling space by 0.5 million

square feet in the current fiscal year, with eleven store openings

confirmed, mostly in Europe. ABF said it also sees considerable

growth potential in the U.S.

"This financial year we are committed to opening a store on

Jamaica Avenue, Queens and have already signed four further leases

to expand our reach in the greater New York area and a lease for a

store in Tyson's Corner, Washington," it said.

The group had 13 Primark stores in the U.S. as at Sept. 18, up

from nine a year earlier.

ABF disclosed its plans as the company reported higher profits

for the fiscal year ended Sept. 18, as Primark earnings rose, and

declared a special dividend alongside the ordinary payment.

ABF--which also houses the Twinings tea, Ovaltine and Patak's

brands in its grocery portfolio--made a pretax profit of 725

million pounds ($983.4 million) in fiscal 2021, up from GBP686

million a year earlier. Revenue was broadly flat at GBP13.88

billion.

Adjusted operating profit fell 1% to GBP1.01 billion. Primark's

adjusted operating profit was up 15% at GBP415 million. Analysts at

RBC Capital Markets said that earnings for the entire group and for

the Primark business were better than expected.

Shares at 0950 GMT were up 6.2% at 1,974 pence.

AB Foods said that it expects Primark trading to continue to

improve, with sales recovering at least the GBP2 billion lost due

to store closures in the last fiscal year, which should lead to

Primark's adjusted operating margin rising above 10%.

The FTSE 100 group warned that the retail unit is seeing

supply-chain issues and raw material and labor inflation, but it

expects this to be broadly mitigated by currency gains arising from

a weaker U.S. dollar. ABF added that it is working to offset these

impacts through cost savings and that its food businesses will

implement price increases where necessary. The company said that

supply chain disruption is causing limited availability on some

lines, but inventories provide enough stock cover for the Christmas

period.

"Taking these factors into account, we expect significant

progress, at both the half and full year, in adjusted operating

profit and adjusted earnings per share for the group," it said.

The company declared a final dividend of 20.5 pence a share and

a special dividend of 13.8 pence, bringing combined full-year

payments to 40.5 pence. The special distribution is in connection

with a new capital cash allocation policy which is based on the

group's strong balance sheet and confidence in the future, ABF

said.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

November 09, 2021 05:12 ET (10:12 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

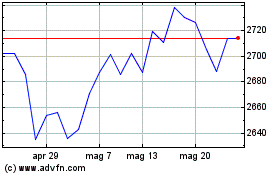

Grafico Azioni Associated British Foods (LSE:ABF)

Storico

Da Mar 2024 a Apr 2024

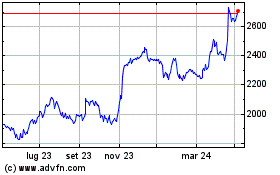

Grafico Azioni Associated British Foods (LSE:ABF)

Storico

Da Apr 2023 a Apr 2024