Banco Santander S.A. Dividend Declaration (9072A)

27 Settembre 2022 - 7:19PM

UK Regulatory

TIDMBNC

RNS Number : 9072A

Banco Santander S.A.

27 September 2022

Banco Santander, S.A. ("Banco Santander" or the "Bank"), in

compliance with the Securities Market legislation, hereby communicates

the following:

inside information

In application of the Bank's current shareholder remuneration

policy, consisting of a total shareholder remuneration target

of c. 40% of the Group's underlying profit, split approximately

in equal parts in cash dividend payments and share buybacks,

the board of directors today approved the payment of an interim

cash dividend against 2022 results of 5.83 euro cents per share,

equivalent to c. 20 % of the Group's underlying profit in the

first half of 2022.

* The interim dividend will be paid from 2 November

2022; and

* The last day to trade shares with a right to receive

the interim dividend will be 28 October 2022, the

ex-dividend date will be 31 October 2022 and the

record date will be 1 November, 2022.

In addition, also in application of such policy, the board

has agreed to implement a share repurchase programme for an

amount equivalent to c. 20% of the Group's underlying profit

in the first half of 2022 (i.e. a programme of approximately

979 million euros), which is expected to start once the applicable

regulatory approval has been obtained. A further announcement

setting out additional information on the terms of the share

repurchase programme will be made before it commences.

The implementation of the remainder of the shareholder remuneration

policy for 2022 is subject to the appropriate corporate and

regulatory approvals.

Boadilla del Monte (Madrid), 27 September 2022

IMPORTANT INFORMATION

Non-IFRS and alternative performance measures

This document contains, in addition to the financial information

prepared in accordance with International Financial Reporting

Standards ("IFRS") and derived from our financial statements,

alternative performance measures ("APMs") as defined in the

Guidelines on Alternative Performance Measures issued by the

European Securities and Markets Authority (ESMA) on 5 October

2015 (ESMA/2015/1415en) and other non-IFRS measures ("Non-IFRS

Measures"). These financial measures that qualify as APMs and

non-IFRS measures have been calculated with information from

Santander Group; however those financial measures are not defined

or detailed in the applicable financial reporting framework

nor have been audited or reviewed by our auditors. We use these

APMs and non-IFRS measures when planning, monitoring and evaluating

our performance. We consider these APMs and non-IFRS measures

to be useful metrics for our management and investors to compare

operating performance between accounting periods, as these

measures exclude items outside the ordinary course performance

of our business, which are grouped in the "management adjustment"

line and are further detailed in Section 3.2. of the Economic

and Financial Review in our Directors' Report included in our

Annual Report on Form 20-F for the year ended 31 December 2021.

Nonetheless, these APMs and non-IFRS measures should be considered

supplemental information to, and are not meant to substitute

IFRS measures. Furthermore, companies in our industry and others

may calculate or use APMs and non-IFRS measures differently,

thus making them less useful for comparison purposes. For further

details on APMs and Non-IFRS Measures, including their definition

or a reconciliation between any applicable management indicators

and the financial data presented in the consolidated financial

statements prepared under IFRS, please see the 2021 Annual

Report on Form 20-F filed with the U.S. Securities and Exchange

Commission (SEC) on 1 March 2022, updated by Form 6-K filed

with the SEC on 8 April 2022 to incorporate the new organizational

and management structure, as well as the section "Alternative

performance measures" of the annex to the Banco Santander Q2

2022 Financial Report, published as Inside Information on 28

July 2022. These documents are available on Santander's website

(www.santander.com). Underlying measures, which are included

in this document, are non-IFRS measures.

The businesses included in each of our geographic segments

and the accounting principles under which their results are

presented here may differ from the included businesses and

local applicable accounting principles of our public subsidiaries

in such geographies. Accordingly, the results of operations

and trends shown for our geographic segments may differ materially

from those of such subsidiaries

Forward-looking statements

Banco Santander advises that this document contains "forward-looking

statements" as per the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. These statements may be identified

by words like "expect", "project", "anticipate", "should",

"intend", "probability", "risk", "VaR", "RoRAC", "RoRWA", "TNAV",

"target", "goal", "objective", "estimate", "future" and similar

expressions. Found throughout this document, they include (but

are not limited to) statements on our future business development,

economic performance and shareholder remuneration policy. However,

a number of risks, uncertainties and other important factors

may cause actual developments and results to differ materially

from our expectations. The following important factors, among

others, could affect our future results and could cause materially

different outcomes from those anticipated in forward-looking

statements: (1) general economic or industry conditions of

areas where we have significant operations or investments (such

as a worse economic environment; higher volatility in the capital

markets; inflation or deflation; changes in demographics, consumer

spending, investment or saving habits; and the effects of the

COVID-19 pandemic in the global economy); (2) exposure to various

market risks (particularly interest rate risk, foreign exchange

rate risk, equity price risk and risks associated with the

replacement of benchmark indices); (3) potential losses from

early repayments on our loan and investment portfolio, declines

in value of collateral securing our loan portfolio, and counterparty

risk; (4) political stability in Spain, the United Kingdom,

other European countries, Latin America and the US; (5) changes

in legislation, regulations or taxes, including regulatory

capital and liquidity requirements, especially in view of the

UK exit from the European Union and increased regulation in

response to financial crisis; (6) our ability to integrate

successfully our acquisitions and related challenges that result

from the inherent diversion of management's focus and resources

from other strategic opportunities and operational matters;

and (7) changes in our access to liquidity and funding on acceptable

terms, in particular if resulting from credit spreads shifts

or downgrade in credit ratings for the entire group or significant

subsidiaries.

Numerous factors could affect our future results and could

cause those results deviating from those anticipated in the

forward-looking statements. Other unknown or unpredictable

factors could cause actual results to differ materially from

those in the forward-looking statements.

Forward-looking statements speak only as of the date of this

document and are informed by the knowledge, information and

views available on such date. Santander is not required to

update or revise any forward-looking statements, regardless

of new information, future events or otherwise.

No offer

The information contained in this document is subject to, and

must be read in conjunction with, all other publicly available

information, including, where relevant any fuller disclosure

document published by Santander. Any person at any time acquiring

securities must do so only on the basis of such person's own

judgment as to the merits or the suitability of the securities

for its purpose and only on such information as is contained

in such public information having taken all such professional

or other advice as it considers necessary or appropriate in

the circumstances and not in reliance on the information contained

in this document. No investment activity should be undertaken

on the basis of the information contained in this document.

In making this document available Santander gives no advice

and makes no recommendation to buy, sell or otherwise deal

in shares in Santander or in any other securities or investments

whatsoever.

Neither this document nor any of the information contained

therein constitutes an offer to sell or the solicitation of

an offer to buy any securities. No offering of securities shall

be made in the United States except pursuant to registration

under the U.S. Securities Act of 1933, as amended, or an exemption

therefrom. Nothing contained in this document is intended to

constitute an invitation or inducement to engage in investment

activity for the purposes of the prohibition on financial promotion

in the U.K. Financial Services and Markets Act 2000.

Historical performance is not indicative of future results

Statements about historical performance or accretion must not

be construed to indicate that future performance, share price

or future earnings (including earnings per share) in any future

period will necessarily match or exceed those of any prior

period. Nothing in this document should be taken as a profit

forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVLRMRTMTBTBRT

(END) Dow Jones Newswires

September 27, 2022 13:19 ET (17:19 GMT)

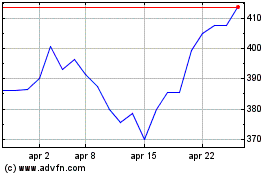

Grafico Azioni Banco Santander (LSE:BNC)

Storico

Da Mar 2024 a Apr 2024

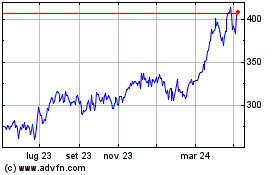

Grafico Azioni Banco Santander (LSE:BNC)

Storico

Da Apr 2023 a Apr 2024