Banco Santander S.A. Tender Offer (6881D)

21 Ottobre 2022 - 8:00AM

UK Regulatory

TIDMBNC

RNS Number : 6881D

Banco Santander S.A.

21 October 2022

Banco Santander, S.A. , ("Banco Santander") in compliance with

the Spanish, Mexican and U.S. securities legislation, hereby

communicates the following:

OTHER RELEVANT INFORMATION

Banco Santander announces that it intends to make concurrent

cash tender offers in Mexico and the United States to acquire

all of the issued and outstanding (i) Series B shares (the "Series

B Shares") of Banco Santander México, S.A., Institución

de Banca Múltiple, Grupo Financiero Santander México

("Santander Mexico") and (ii) American Depositary Shares (each

of which represents five Series B Shares) of Santander Mexico

(the "ADSs"), in each case, other than any Series B Shares or

ADSs owned, directly or indirectly, by Banco Santander, which

amount to approximately 3.76% of Santander Mexico's share capital

(the "Tender Offers"). Following the Tender Offers, Banco Santander

intends to (a) cancel the registration of the Series B Shares

in the National Securities Registry of the Mexican National

Banking and Securities Commission (the "CNBV") and delist such

Series B Shares from the Mexican Stock Exchange ("BMV"), and

(b) remove the ADSs from listing on the New York Stock Exchange

and the Series B Shares from registration with the U.S. Securities

and Exchange Commission (the "SEC") (items (a) and (b), collectively,

the "Delisting").

The consideration for the shareholders tendering their Series

B Shares will be equal to the book value of each Series B Share

(and the equivalent with respect to each ADS) in accordance

with Santander Mexico's last quarterly report filed with the

CNBV and the BMV prior to the launch of the Tender Offers pursuant

to applicable law (the "Offer Price") .

Consummation of the Delisting will be subject to the approval

by shareholders holding at least 95% of Santander Mexico's share

capital at an extraordinary shareholders' meeting of Santander

Mexico. Banco Santander currently holds, directly and indirectly,

more than 96% of Santander Mexico's share capital and, therefore,

expects to obtain such approval at the extraordinary shareholders'

meeting of Santander Mexico, which we expect will be called

for such purposes shortly.

Considering the foregoing, the Tender Offer in Mexico will be

a mandatory tender offer in terms of article 108 of the Mexican

Securities Market Law.

Commencement of the Tender Offers and consummation thereof is

subject to certain conditions, including regulatory authorizations

from and review by the CNBV and the SEC, respectively, the absence

of any material adverse change in the financial condition, results

of operations or prospects of Santander Mexico, and that the

trading price of the Series B Shares (which, pursuant to the

Mexican Securities Market Law, is equal to the volume weighted

average price of the transactions completed during the last

30 days on which the Series B Shares were negotiated, prior

to the beginning of the Tender Offers, for a period not to exceed

6 months) is not greater than the Offer Price.

The Tender Offers are expected to be launched and settled no

later than the first quarter of 2023.

The Tender Offers are consistent with Banco Santander's strategy

of increasing its weight in growth markets and reflects Banco

Santander's confidence in Mexico and Santander Mexico as well

as their long-term growth potential. The impact of the Tender

Offers on Santander Group's capital will not be material.

Boadilla del Monte (Madrid), 21 October 2022

IMPORTANT INFORMATION FOR INVESTORS ABOUT THE PROPOSED TRANSACTION

The tender offers described in this communication have not yet

commenced. This communication is provided for informational

purposes only and does not constitute an offer to purchase or

the solicitation of an offer to sell any common stock (including

any American Depositary Share representing any common stock)

or other securities. If and at the time a tender offer is commenced

in the United States, Banco Santander (and/or one or more of

its affiliates, as applicable) intends to file with the U.S.

Securities and Exchange Commission (the "SEC") a Tender Offer

Statement on Schedule TO containing an offer to purchase, a

form of letter of transmittal and other documents relating to

the tender offer, and Santander Mexico will file with the SEC

a Solicitation/Recommendation Statement on Schedule 14D-9 with

respect to the tender offer. Banco Santander will also file

before the Comisión Nacional Bancaria y de Valores ("CNBV")

an informative brochure in connection with the transaction and

the prospective offer as required under applicable law.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE TER

OFFER STATEMENT, OFFER TO PURCHASE, SOLICITATION/RECOMMATION

STATEMENT AND ALL OTHER RELEVANT DOCUMENTS THAT WILL BE FILED

WITH THE SEC AND THE CNBV REGARDING THE PROPOSED TRANSACTION

CAREFULLY BEFORE MAKING A DECISION CONCERNING THE TER OFFERS

AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TER

OFFERS.

Such documents, and other documents filed by Banco Santander

and Santander Mexico, may be obtained without charge after they

have been filed at the SEC's website at www.sec.gov a nd through

the CNBV's website at www.cnbv.gob.mx . The offer to purchase

and related materials may also be obtained (when available)

for free by contacting the information agent for the tender

offers.

This communication shall not constitute a tender offer in any

country or jurisdiction in which such offer would be considered

unlawful or otherwise violate any applicable laws or regulations,

or which would require Banco Santander or any of its affiliates

to change or amend the terms or conditions of such offer in

any manner, to make any additional filing with any governmental

or regulatory authority or take any additional action in relation

to such offer.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains "forward-looking statements" as

per the meaning of the US Private Securities Litigation Reform

Act of 1995. These statements may be identified by words like

expect, project, anticipate, should, intend, probability, risk,

target, goal, objective, estimate, future and similar expressions

and include, but are not limited to, statements that are predictive

in nature and depend upon or refer to future events, conditions,

circumstances or the future performance of Banco Santander or

Santander Mexico or their respective affiliates, including as

a result of the implementation of the transactions described

herein. These statements are based on management's current expectations

and are inherently subject to uncertainties and changes in circumstance

and a number of risks, uncertainties and other important factors

may cause actual developments and results to differ materially

from Banco Santander's or Santander Mexico's expectations. Risks

and uncertainties include, among other things, risks related

to the tender offers, including uncertainties as to the availability

of certain statutory relief under the U.S. securities laws;

how many of Santander Mexico shareholders will tender their

shares in the tender offers; general economic or industry conditions

of areas where Banco Santander or Santander Mexico have significant

operations or investments (such as a worse economic environment,

higher volatility in the capital markets, inflation or deflation,

changes in demographics, consumer spending, investment or saving

habits, and the effects of the war in Ukraine or the COVID-19

pandemic in the global economy); exposure to various market

risks (particularly interest rate risk, foreign exchange rate

risk, equity price risk and risks associated with the replacement

of benchmark indices); potential losses from early repayments

on loan and investment portfolios, declines in value of collateral

securing loan portfolios, and counterparty risk; political stability

in Spain, the United Kingdom, other European countries, Latin

America and the US; changes in legislation, regulations, taxes,

including regulatory capital and liquidity requirements, especially

in view of the UK exit of the European Union and increased regulation

in response to financial crises; the ability to integrate successfully

acquisitions and related challenges that result from the inherent

diversion of management's focus and resources from other strategic

opportunities and operational matters; and changes in access

to liquidity and funding on acceptable terms, in particular

if resulting from credit spreads shifts or downgrade in credit

ratings; and other risks and uncertainties discussed in (i)

Santander Mexico's filings with the SEC, including the "Risk

Factors" and "Special Note Regarding Forward-Looking Statements"

sections of Santander Mexico's most recent annual report on

Form 20-F and subsequent 6-Ks filed with, or furnished to, the

SEC and (ii) Banco Santander's filings with the SEC, including

the "Risk Factors" and "Cautionary Statement Regarding Forward-Looking

Statements" sections of Banco Santander's most recent annual

report on Form 20-F and subsequent 6-Ks filed with, or furnished

to, the SEC. You can obtain copies of Banco Santander's and

Santander Mexico's filings with the SEC for free at the SEC's

website ( www.sec.gov ). Other factors that may cause actual

results to differ materially include those that will be set

forth in the Tender Offer Statement on Schedule TO, the Solicitation/Recommendation

Statement on Schedule 14D-9 and other tender offer documents

filed by Banco Santander and Santander Mexico. All forward-looking

statements in this communication are qualified in their entirety

by this cautionary statement.

Numerous factors could affect our future results and could cause

those results deviating from those anticipated in the forward-looking

statements. Other unknown or unpredictable factors could cause

actual results to differ materially from those in the forward-looking

statements. Our forward-looking statements speak only as at

date of this communication and are informed by the knowledge,

information and views available as at the date of this communication.

Banco Santander is not required to update or revise any forward-looking

statements, regardless of new information, future events or

otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TENBKDBKPBDKDKB

(END) Dow Jones Newswires

October 21, 2022 02:00 ET (06:00 GMT)

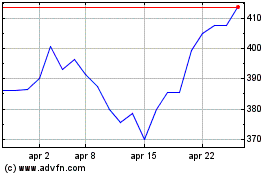

Grafico Azioni Banco Santander (LSE:BNC)

Storico

Da Mar 2024 a Apr 2024

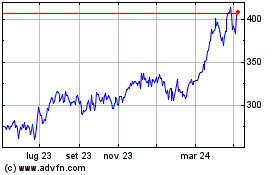

Grafico Azioni Banco Santander (LSE:BNC)

Storico

Da Apr 2023 a Apr 2024