TIDMBNC

RNS Number : 6308K

Banco Santander S.A.

22 December 2022

Banco Santander, S.A., ("Santander") in accordance with the

provisions of the securities market legislation, communicates the

following:

INSIDE INFORMATION

The results of the Supervisory Review and Evaluation Process

("SREP") have now been confirmed and Santander has been informed by

the European Central Bank ("ECB") of its decision regarding the

minimum prudential capital requirements effective as of 1 January

2023.

The ECB's decision establishes a Pillar 2 requirement ("P2R") of

(i) of 1.58% at a consolidated level (which entails an increase of

8 basis points with respect to the last SREP decision effective on

1 March 2022, due to the ECB's prudential expectations on calendar

provisioning in connection with non-performing loans), of which at

least 0.89% must be covered with Common Equity Tier 1 capital

("CET1"); and (ii) of 1.50%, at an individual level, of which at

least 0.84% must be covered with CET1, this remaining unchanged

from the last SREP decision effective on 1 March 2022.

The minimum requirement ratio of CET1 at consolidated level

consists of: (a) the Pillar 1 requirements, (b) P2R, (c) the

capital conservation buffer, (d) the requirement derived from the

consideration of Santander as a global systemic financial

institution, and (e) the countercyclical capital buffer. The

following table shows the minimum CET1 and total capital

requirements, as well as Santander's such phased-in [1] ratios as

of 30 September 2022, both at a consolidated and an individual

level.

MINIMUM REQUIREMENT DATA AS OF 30/09/2022

Consolidated Individual Consolidated Individual

-------------- ----------- ------------- -----------

CET1 8.91% [2] 7.85% 12.24%1 15.98%

-------------- ----------- ------------- -----------

CAPITAL

TOTAL 13.11% [3] 12.01%3 16.18%1 20.95%

-------------- ----------- ------------- -----------

As described in the table above, Santander maintains a surplus

of capital over these requirements, both at a consolidated and an

individual level. Therefore, these capital requirements do not

imply any limitation to the distribution or payment to the holders

of Santander's Additional Tier 1 securities.

Boadilla del Monte (Madrid), 22 December 2022

IMPORTANT INFORMATION

No offer

The information contained in this document is subject to, and

must be read in conjunction with, all other publicly available

information, including, where relevant any fuller disclosure

document published by Santander. Any person at any time acquiring

securities must do so only on the basis of such person's own

judgment as to the merits or the suitability of the securities for

its purpose and only on such information as is contained in such

public information having taken all such professional or other

advice as it considers necessary or appropriate in the

circumstances and not in reliance on the information contained in

this document. No investment activity should be undertaken on the

basis of the information contained in this document. In making this

document available Santander gives no advice and makes no

recommendation to buy, sell or otherwise deal in shares in

Santander or in any other securities or investments whatsoever.

Neither this document nor any of the information contained

therein constitutes an offer to sell or the solicitation of an

offer to buy any securities. No offering of securities shall be

made in the United States except pursuant to registration under the

U.S. Securities Act of 1933, as amended, or an exemption therefrom.

Nothing contained in this document is intended to constitute an

invitation or inducement to engage in investment activity for the

purposes of the prohibition on financial promotion in the U.K.

Financial Services and Markets Act 2000.

Historical performance is not indicative of future results

Nothing in this document should be taken as a profit

forecast.

Third Party Information

In particular, regarding the data provided by third parties,

neither Santander, nor any of its administrators, directors or

employees, either explicitly or implicitly, guarantees that these

contents are exact, accurate, comprehensive or complete, nor are

they obliged to keep them updated, nor to correct them in the case

that any deficiency, error or omission were to be detected.

Moreover, in reproducing these contents in by any means, Santander

may introduce any changes it deems suitable, may omit partially or

completely any of the elements of this document, and in case of any

deviation between such a version and this one, Santander assumes no

liability for any discrepancy.

[1] Data calculated by applying the transitional provisions of

the applicable regulation, of which the most significant are those

related to IFRS 9. Without the application of these provisions, the

fully loaded CET1 ratio and the consolidated total capital, at 30

September 2022, would be 12.10% and 16.00%, respectively.

[2] The minimum requirement ratio of CET1 at consolidated level

consists of: (a) the minimum capital requirement of Pillar 1

(4.50%), (b) P2R (0.89%), (c) the capital conservation buffer

(2.50%), (d) the requirement arising from the consideration of

Santander as a global systemic financial institution (1%), and (e)

the countercyclical capital buffer requirement (0.0253%),

calculated as of 30 September 2022.

3 In addition to the CET1 requirements, the minimum total

capital requirements at both consolidated and individual level

include: (i) Pillar 1 requirements of Additional Tier 1 (1.5%) and

Tier 2 (2%), and (ii) part of the P2R requirements that can be

covered by Additional Tier 1 and Tier 2 ( 0.30% and 0.40%,

respectively, at a consolidated level, and 0.28% and 0.38%

respectively at an individual level) .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCTTBMTMTBTBJT

(END) Dow Jones Newswires

December 22, 2022 05:17 ET (10:17 GMT)

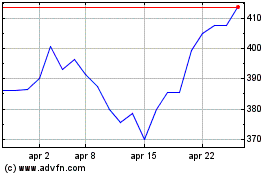

Grafico Azioni Banco Santander (LSE:BNC)

Storico

Da Mar 2024 a Apr 2024

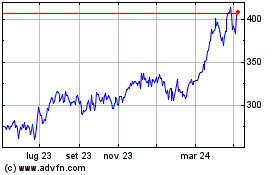

Grafico Azioni Banco Santander (LSE:BNC)

Storico

Da Apr 2023 a Apr 2024