TIDMBVIC

RNS Number : 2703H

Britvic plc

23 November 2022

Britvic plc Preliminary Results - 23 November 2022

For the year ended 30 September 2022

'A stronger, better Britvic'

Group Financial Headlines:

-- Revenue increased 15.5%(1) to GBP1,618.3m (statutory +15.2%), driven by both price and volume

-- Adjusted EBIT increased 16.0%(1) to GBP206.0m (statutory

+16.7%), statutory EBIT increased 26.2%

-- Adjusted EBIT margin increased 10bps(1) to 12.7% (statutory +10bps)

-- Profit after tax increased 45.3% to GBP140.2m

-- Adjusted earnings per share of 57.3p, up 29.3%

-- Free cash flow generation of GBP128.8m, enabling debt

reduction and GBP106m cash returned to shareholders through

dividends and share buyback

-- Strong balance sheet with a djusted net debt to EBITDA ratio down to 1.9x

-- Full year dividend +19.8% at 29p, reflecting the Board's

confidence in our prospects and strong balance sheet

Operational Highlights:

-- Revenue growth led by our portfolio of family favourite

brands, with growth in both retail and hospitality channels, which

benefited from the good summer weather and no lockdown restrictions

this year

-- Brands have demonstrated the strength to take price, while maintaining volume growth

-- Pricing activity, promotional strategy, management of our mix

and disciplined cost control has helped to mitigate the impact of

inflation

-- Margin growth while investing in our people, brands, and infrastructure

-- Supply chain resilience and capability a key enabler of growth

-- Continued investment in and progress against our strategic growth opportunities, including:

o Increased manufacturing capacity in GB, Brazil and France to

meet consumer demand

o 'Beyond the Bottle' growth through London Essence Freshly

Infused and Aqua Libra dispense innovation

o GBP108m revenue generated from innovation brands, +49% year on

year

o Further improvement in our sustainability metrics, as part of

our Healthier People, Healthier Planet programme, including

reducing our carbon emissions and calories per serve

-- Current trading remains robust and in line with our expectations

Year ended Year ended % change Underlying

30 September 30 September actual exchange % change

2022 2021(2) rate (AER) constant

GBPm GBPm exchange rate(1)

Revenue 1,618.3 1,405.1 15.2% 15.5%

Adjusted EBIT 206.0 176.5 16.7% 16.0%

Adjusted EBIT margin 12.7% 12.6% 10bps 10bps

Adjusting EBIT items (13.6) (24.1) 43.6%

(3)

Statutory EBIT 192.4 152.4 26.2%

Statutory EBIT margin 11.9% 10.8% 110bps

Profit after tax 140.2 96.5 45.3%

Basic EPS 52.6p 36.2p 45.5%

Adjusted EPS 57.3p 44.3p 29.3%

Full year dividend 29.0p 24.2p 19.8%

per share

Adjusted net debt/EBITDA 1.9x 2.1x 0.2x

ROIC 16.4% 15.0% 140bps

-------------- -------------- ----------------- ------------------

(1.) Adjusted for constant currency and the Ireland agency

brands which ceased trading in March 2021.

(2.) Please refer to note 11 of the financial statements for

details of SaaS arrangements restatement .

(3) (.) Adjusting EBIT items of GBP13.6m are detailed on page

33.

Simon Litherland, Chief Executive Officer commented:

"We have delivered excellent results, with strong growth in

volume, revenue and profit, in the face of significant headwinds.

Our strategy has momentum, delivering accelerated top-line growth

through consistent execution across our portfolio of trusted

brands. We recognise that there are significant inflationary

pressures on our consumers, customers and suppliers, and we remain

focused on mitigating costs in a responsible manner through

efficiency initiatives and revenue management, while continuing to

invest in our brands, people, sustainability and

infrastructure.

Looking forward, the uncertain environment makes it difficult to

forecast consumer demand in the near term. We draw confidence

however from the continued resilience and growth of our category,

our brands and our talented people. Our strategy is working, with

clear drivers to continue our consistent track record of growth and

delivery of superior returns for all our stakeholders."

For further information please contact:

Investors:

Joanne Wilson (Chief Financial Officer) +44 (0) 121 711 1102

Steve Nightingale (Director of Investor

Relations) +44 (0) 7808 097784

Media:

Steph Macduff-Duncan (Head of Corporate

Communications) +44 (0) 7808 097680

Stephen Malthouse (Headland) +44 (0) 7734 956201

There will be a webcast of the presentation given today at

09:00am by Simon Litherland (Chief Executive Officer) and Joanne

Wilson (Chief Financial Officer). The webcast will be available at

www.britvic.com/investors with a transcript available in due

course.

About Britvic

Britvic is an international soft drinks business rich in history

and heritage. Founded in England in the 1930s, it has grown into a

global organisation with 37 much-loved brands sold in over 100

countries. T he company combines its own leading brand portfolio

including Fruit Shoot, Robinsons, Tango, J2O, London Essence,

Teisseire and MiWadi with PepsiCo brands such as Pepsi, 7UP and

Lipton Ice Tea which Britvic produces and sells in Great Britain

and Ireland under exclusive PepsiCo agreements.

Britvic is the largest supplier of branded still soft drinks in

Great Britain and the number two supplier of branded carbonated

soft drinks in Great Britain. Britvic is an industry leader in the

island of Ireland with brands such as MiWadi and Ballygowan, in

France with brands such as Teisseire, Pressade and Moulin de

Valdonne and in its growth market, Brazil, with Maguary, Bela

Ischia and Dafruta. Britvic is growing its reach into other

territories through franchising, export, and licensing.

Britvic is a purpose-driven organisation with a clear vision and

a clear set of values. Our purpose, vision and values sit at the

heart of our company, driving us forward together to create a

better tomorrow. We want to contribute positively to the people and

world around us. This means ensuring that our sustainable business

practices, which we call Healthier People, Healthier Planet, are

embedded in every element of our business strategy.

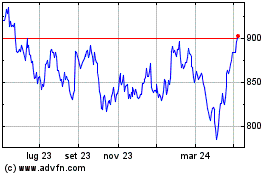

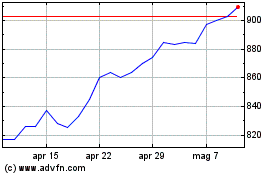

Britvic is listed on the London Stock Exchange under the code

BVIC and is a constituent of the FTSE 250 index. Find out more at

Britvic.com

Cautionary note regarding forward-looking statements

This announcement includes statements that are forward-looking

in nature. Forward-looking statements involve known and unknown

risks, uncertainties and other factors such as the COVID-19

pandemic, which may cause the actual results, performance, or

achievements of the Group to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Except as required by the Listing

Rules and applicable law, Britvic undertakes no obligation to

update or change any forward-looking statements to reflect events

occurring after the date such statements are published.

Market data

GB take-home market data referred to in this announcement is

supplied by Nielsen and runs to 24 September 2022. ROI take-home

market data referred to is supplied by Nielsen and runs to 24

September 2022. French market data is supplied by Nielsen and runs

to 11 September 2022. Brazil market data is supplied by Nielsen and

runs to 30 September 2022.

Next scheduled announcement

Britvic will publish its quarter one trading statement on 26

January 2023.

Chief Executive Officer's Review

Performance highlights

Today we report our results for the year ended 30 September

2022. Once again, I am incredibly proud of the entire Britvic team.

They have shown agility and resilience to deliver a strong

performance, progress our strategic priorities and support each

other and our communities in a challenging environment. I want to

thank them and their families for their continued commitment.

Despite the significant headwinds we have faced, I am delighted

with the performance we have delivered across our key metrics.

Underlying revenue grew 15.5% (statutory +15.2%), adjusted EBIT

increased 16.0% (statutory +16.7%) and margin increased 10bps

(statutory +10bps). Our focus and discipline on cash enabled us to

generate a free cash flow of GBP128.8 million, reducing our

leverage ratio to 1.9x, while continuing to invest in the business

and return cash to shareholders via both increasing dividends and

our first share buyback programme. Our Healthier People, Healthier

Planet programme is increasingly embedded in our business and

decision making, and we have made further progress against our

sustainability metrics. More detail is shared in the review of the

year below.

Our strategy is clear and has momentum

We refreshed our strategy in 2019, to ensure the business was

well-placed to access growth opportunities in the changing consumer

and retail landscape across our markets. Throughout the pandemic,

the strategy has served us well and this year, when we have all

faced the consequences of the tragic war in Ukraine, it has

continued to drive our performance. With a portfolio of

market-leading brands, a multi-channel route to market,

well-invested supply chain and strong customer relationships, we

believe we are well-placed to continue to deliver superior returns

to shareholders.

Our future focus remains on four key strategic priorities:

-- Build local favourites and global premium brands

-- Flavour billions of water occasions

-- Healthier People, Healthier Planet

-- Access new growth spaces

Each of our markets has a defined role to play delivering the

strategy:

-- Great Britain - to lead market growth

-- Brazil - to accelerate growth and expand our presence

-- Other international - to globalise premium brands and improve profitability in Western Europe

Underpinning this strategy are three critical enablers:

-- Generate fuel for growth through efficiency

-- Transform organisational capability and culture

-- Selective M&A to accelerate growth

Review of the year

Our strategy has driven consistent revenue growth over the past

five years of 5.1% compound annual growth rate (CAGR), and this

year we have accelerated growth to 15.5%. This was in part due to

the soft comparable in the first half of 2021 when lockdown

restrictions impacted the hospitality channel and the good weather

this summer. We have demonstrated that our portfolio of trusted

brands has been able to take and hold significant price, in

response to the extensive cost inflation prevalent across our

markets. Although France was a particularly challenging environment

to recover the inflationary cost pressure we faced. We have

successfully executed our joint business plans with our customers,

which incorporate branded in-store execution, price and promotional

activity, and ensuring on-shelf availability. The strength of our

customer relationships has been demonstrated through the recent

Advantage Group survey, which measures customer feedback from

retailers, wholesalers and suppliers in the UK. We are delighted

that Britvic has been ranked in the top three across all of

grocery, convenience and wholesale, and first for e-commerce.

We have continued to invest in our business to unlock growth and

deliver a great customer, shopper, and consumer experience. The

A&P investment we have made behind our compelling physical and

digital marketing increased by 6.4%, with a greater proportion

directed towards fully consumer-facing activity. Across our

markets, we have delivered continued success with innovation, the

detail of which is covered in the market highlights below.

Our continued business capability investment in both supply

chain and technology makes us better equipped to deliver improved

efficiency, price pack architecture flexibility, supply chain

resilience and promotional effectiveness. In the supply chain, we

invested further in both capacity and capability. In Great Britain,

we added an additional can line in Rugby, in addition to the three

lines we installed as part of our Business Capability Programme

completed in 2019. We are also upgrading the National Distribution

Centre to ensure it is well placed for future growth and to deliver

improved efficiency. In Brazil, we have added two additional carton

lines and contracted a grape processing facility to meet expanding

demand. In France, we recently signed a strategic production

partnership to support global demand for Mathieu Teisseire, one of

our premium brands participating in the cocktail and coffee mixers

category.

Our Healthier People, Healthier Planet programme is integral to

our strategy. In the year we have continued to make strong progress

in most areas. Our employee engagement score has remained firmly

above benchmark at 77, and our average calories per serve now sits

at 24, well below our 30 calories target. We have continued to

improve our water ratio and made further progress on decarbonising

the business. On a cumulative basis, we have now delivered a 34%

reduction in our Scope 1 and 2 market-based carbon emissions since

our baseline year, 2017. We are also pleased with the progress we

are making with our suppliers and customers to reduce our Scope 3

carbon emissions.

Great Britain highlights

We have continued to invest in our brands, with highly relevant

and effective marketing activation, alongside innovation to broaden

our consumer offering. Pepsi MAX was highly visible to consumers

through its continued sponsorship of the UEFA Champions League

earlier in the year. This summer saw the return of the taste

challenge for the first time in person since 2019. The eight-week

roadshow toured Great Britain and 70% of participants said they

preferred Pepsi MAX compared to the biggest selling full sugar

cola. Robinsons' Wimbledon association ended in 2021, and we took

our marketing in a new direction this year. The Big Fruit Hunt

digital competition ran across the summer, while Robinsons ready to

drink sponsored The Hundred cricket. Both campaigns allowed us to

engage with more consumers and enabled a more extended activation

period in store than before. We continued to extend our brands

through flavour innovation, with Berry Peachy for Tango, and

reformulated an old favourite, Apple, to be sugar free. We also

launched new flavours of Aqua Libra with Blood Orange & Mango

and Pepsi with Pepsi MAX Lime.

Alongside our core brands' growth momentum, we have continued to

invest in accessing future growth spaces. Following our acquisition

of Plenish in 2021, the brand has been able to leverage our strong

customer relationships and brand marketing expertise. Plenish was

relaunched in late Q2 with new packaging, highlighting its premium,

natural credentials. It also secured significant additional

distribution for the plant-based milks and shots ranges. Aqua Libra

Co, which we launched last year following the acquisition of The

Boiling Tap Company, has used our flavour concentrates expertise to

develop a unique tap proposition that offers flavoured water

alongside still, sparkling, and hot. It has been building a

pipeline of opportunities in both the workplace and retail

channels. Our premium tonics and sodas brand, London Essence, has

gained share in the retail channel and increased distribution in

pubs, bars, and restaurants of both packaged products and our

dispense offering, Freshly Infused. London Essence revenue grew

94.8% year on year, with over 1,000 Freshly Infused dispense fonts

installed and 11,000 points of retail distribution for the packaged

format across the retail and hospitality channels.

Everywhere in Britvic, our brand and business investment is

underpinned by our ESG agenda: Healthier People, Healthier Planet.

This programme ranges from employee wellbeing and healthier

consumer choices to community engagement and minimising our

packaging, water, and carbon footprint. Across our entire Great

Britain portfolio, we exited the year with an average of around 14

calories per serve and are continuing to fortify several of our

brands with added health benefits, for example the Robinsons Fruit

& Barley range and Robinsons Benefit Drops. Additionally, we

have continued in our mission to support young people by joining

forces with The Prince's Trust, through select Tango promotions,

with the aim of raising GBP100,000 for the charity in the first

year alone. On the planet side, we have continued our partnership

with The Rivers Trust, improving waterways close to our sites. We

have also made further progress towards our science-based targets

on carbon, and the Executive team has recently approved an

innovative solution to reduce carbon emissions at our Beckton site

using a heat recovery system. This system will decarbonise 70% of

the site's heat demand by shifting its heat source away from fossil

fuels.

Brazil highlights

We have continued to deliver strong growth in concentrates and

ready to drink juices, with Maguary, Dafruta and Bela Ischia

performing well in both categories. We have built on the core

ranges with recent innovations, such as Dafruta Tropical and Bela

Ischia syrups. Our grape juice has also been particularly

successful, offering quality products at a competitive price and

benefiting from our new grape processing facility to improve

margin. Fruit Shoot has also had a particularly successful year.

Since launching in Brazil, we have extended the flavour range and

launched new pack formats at different price points, specifically

to meet the needs of each region. This has included a 150ml carton,

which has performed especially strongly.

Coconut water has been more challenging this year, due to import

supply issues and rapidly escalating input costs. In response, we

have innovated to launch a new coconut nectar with lower raw

material content, facilitating more competitive pricing and

enabling us to meet value-based consumer demand amid continued high

inflation. We also continue to build recent innovations such as

Nuts, a non-dairy milk alternative, Natural Tea and Mathieu

Teisseire. We continue to expand and adapt our route to market and

channel presence to capture the growth opportunities in

wholesale/cash and carry and the on-trade.

In terms of Healthier Planet, the confluence of water

stewardship and biodiversity is of particular relevance to our

Brazil market. We have planted the Floresta Britvic, a

reforestation programme that so far covers two and a half acres in

Astolfo Dutra, Minas Gerais. Each tree represents one Brazilian

Britvic employee and is in an area located 5km from the company's

factory in the region. Separately, we have installed a biomass

boiler to replace a traditional gas boiler in Aracati, meaning we

now have biomass boilers at all four of our Brazilian sites, in

turn reducing our carbon emissions by 46% versus last year.

Other International highlights

In Ireland, we have continued to leverage the strength of our

brand portfolio with innovation. The Hint of Fruit flavoured water

from Ballygowan has been a huge success, achieving nearly 19%

market share of the flavoured water category only seven months

after launch. Revenue for our flavour concentrates brands,

Robinsons and MiWadi, was well ahead of last year. We also entered

the energy category with the launch of Club Loaded and the

extension of the Energise brand into the stimulant segment. Through

a combination of price, mix and promotional management and

simplifying the operating model with the closure of Counterpoint

last year, the Irish business has delivered a significant

improvement in operating margin, in line with our strategy.

In France, we have delivered growth across our entire brand

portfolio. We have continued to develop our Teisseire syrups range,

with the launch of Teisseire for Soda Machine and Fruits à Diluer

containing no added sugars. Teisseire Fruit Shoot has responded to

changing consumer preferences by moving to a transparent bottle to

broaden appeal and improve recycling rates, and the formulation now

contains fruit juice and water without preservatives. We have also

launched a range that includes 100% natural ingredients.

Mathieu Teisseire and London Essence have both had an excellent

year and I am delighted with their strong momentum. The pandemic

interrupted their growth, but we are now seeing great traction

globally. As the hospitality industry fully re-opened post-pandemic

this year, we have had our first real opportunity to deliver

against our growth strategy. Our consumer insight shows that demand

for premium, crafted, healthier soft drink experiences is growing,

and we are building considerable momentum.

London Essence is now available in the majority of the top 100

bars in the markets where we are distributed and 34 of the World's

Top 100 Bars and Restaurants, from Hong Kong to Barcelona. The

environmental benefits are compelling as our deliciously distilled

botanical flavours are served using micro-dosing technology without

the need for packaging or transportation of large volumes of

liquid, substantially reducing our packaging per serve and our

carbon emissions, in line with our Healthier Planet sustainability

strategy, and those of our customers.

Mathieu Teisseire is now available in 20 countries around the

world, including Brazil, served in a broad range of outlets from

coffee shops and bars to hotels and restaurants. We are growing

brand awareness and reputation through our own Mathieu Teisseire

studios, where our global brand ambassadors work in partnership

with our customers to co-create new drinks recipes using our unique

portfolio of syrup flavours, from Blackberry to Tiramisu and run

training events for their employees. So far, we have opened studios

in Belgium, Thailand, Vietnam, Paris, China, Holland, India, Oman,

Saudi Arabia, and the United Arab Emirates, unleashing creativity

across the globe.

Looking ahead

Economic forecasts suggest that 2023 will be another challenging

year, as inflationary pressures continue, and low consumer

confidence is anticipated to persist across our main markets. This

makes forecasting demand particularly challenging in the near

term.

However, we participate in a resilient and growing category,

which continues to outperform broader consumer goods, as it has for

many years. Consumption of non-alcoholic beverages continues to

increase and, even before the significant inflation of the past

couple of years, soft drinks have consistently increased their

value ahead of volume. The category is a regular staple and an

affordable treat, whose demand has proved resilient in previous

economic downturns, with limited down-trading to own label.

Britvic's success is founded upon the breadth of our portfolio

of strong, family favourite brands, the depth of our customer

relationships, our well-invested infrastructure, our long-term,

mutually beneficial partnership with Pepsi and the agility and

dedication of our fantastic workforce. Sustainability is embedded

in our business and our culture, informing our choices daily. Our

strategy is working, and we have well-established drivers to

continue our consistent track record of growth.

Near term we have clear priorities to deliver in 2023. With

continued high inflation, we will seek to mitigate the impact on

our business through both cost efficiency and revenue management to

optimise our pricing and promotions. We demonstrated our ability to

deliver in this regard in 2022 and we are confident we will do so

again in 2023 and beyond. Across our markets we will continue to

engage consumers with compelling marketing, exciting innovation and

strong in-store feature and display. We will also continue to

invest, not only in our brands but also in our people,

sustainability and infrastructure.

All this, combined with the momentum we have from our excellent

2022 performance, gives us confidence that despite the considerable

headwinds, we will deliver further strategic progress in 2023 and

continue to offer superior shareholder returns.

Chief Financial Officer's Review

Overview

We have delivered an excellent performance in the year , despite

the headwind of significant cost inflation. All key financial

metrics are on a positive trajectory, reflecting the resilience and

agility of our business and the Britvic team. Underlying Group

revenue increased 15.5% (statutory +15.2%) year on year, with

double-digit revenue growth across all our business units.

Adjusted EBIT increased 16.0% (statutory +16.7%) to GBP206.0

million, resulting in an adjusted EBIT margin of 12.7%, a 10 basis

points (bps) improvement year on year. Profit performance reflects

improved operating leverage as volumes increased, an improvement in

mix and continued discipline on discretionary spend, all of which

enabled us to rebuild investment in the business. Adjusted EPS

increased 29.3% year on year reflecting the adverse impact in

financial year 2021 from the one-off, non-cash revaluation of

deferred tax following the enactment of the 6% increase in the UK

corporation tax rate .

Our cash performance was strong with free cash flow of GBP128.8

million, driven by a continued focus on day to day cash management.

As a result, we have delivered an adjusted net debt/EBITDA ratio of

1.9x, which is our lowest year end leverage since 2015. The full

year dividend equates to 29.0p per share, which represents a year

on year increase of 19.8%, maintaining our 50% pay-out ratio. In

addition, we launched our first share buyback programme partway

through the year with GBP37.7 million shares repurchased and

subsequently cancelled in our financial year 2022.

Below is a summary of the segmental performance and explanatory

notes related to items including taxation, interest and free cash

flow generation.

Great Britain Year ended Year ended % change

30 September 30 September actual

2022 2021 exchange

GBPm GBPm rate

--------------------------- -------------- -------------- ----------

Volume (million litres) 1,790.8 1,697.2 5.5%

ARP per litre 61.4p 56.3p 9.1%

Revenue 1,100.4 956.1 15.1%

Brand contribution 426.0 381.0 11.8%

Brand contribution margin 38.7% 39.8% (110)bps

--------------------------- -------------- -------------- ----------

In Great Britain, we have made strong progress with both volume

and revenue growing in each quarter of the year. and both the

retail and hospitality channels delivering good growth year on

year. Across both channels we continue to focus on growing our

immediate consumption pack formats. This year immediate consumption

revenue increased 20.4% benefitting from the end of COVID-19

restrictions in 2021. ARP was particularly strong, up 9.1%, due to

a combination of mix and price realisation. Margin declined due to

the lag effect from the timing of price increases in early calendar

2022 to offset the high level of inflation experienced across the

full year.

All our scale brands performed strongly. Pepsi, 7UP and Tango,

led by low/no sugar variants were all in double digit revenue

growth, with Tango +27.2% year on year as a result of increased

distribution and successful flavour innovation. J2O and Fruit Shoot

benefited from increased socialising compared to 2021, with revenue

growth of 32.3% and 15.1% respectively. Robinsons remained in

revenue growth, in both squash and ready to drink formats, despite

consumers spending less time at home compared to 2021. Rockstar had

a challenging year and while the supply issues we highlighted last

year have now been resolved, the brand continued to underperform

our expectations and revenue declined year on year.

Brazil % change

like for

Year ended Year ended % change like

30 September 30 September actual at constant

2022 2021 exchange exchange

GBPm GBPm rate rate

------------------------- -------------- -------------- ---------- -------------

Volume (million litres) 299.3 288.3 3.8% 3.8%

ARP per litre 47.8p 39.6p 20.7% 11.4%

Revenue 143.0 114.1 25.3% 15.7%

Brand contribution 22.7 21.1 7.5% (0.9)%

Brand contribution

margin 15.9% 18.5% (260)bps (260)bps

------------------------- -------------- -------------- ---------- -------------

In Brazil, we saw a continuation of strong growth, with revenue

at constant currency up 15.7%, which after adjusting for PIS/COFINS

tax benefits translates to underlying revenue growth of 17.2%. This

was driven by both volume and ARP growth. Our core categories of

concentrates and ready to drink juices were in growth, with

Maguary, Dafruta and Bela Ischia performing well in both

categories. The strongest performance was in Fruit Shoot, +93.0%

year on year, primarily due to the growth of the 150ml carton pack

format. Coconut water was more challenging, with revenue down

22.9%, due to the continued shortage and high cost of ingredients.

Other innovation brands, such as Nuts, Seleção and Natural Tea grew

strongly.

Price realisation and mix contributed to a margin improvement in

the second half of the year. While underlying margin (excluding

PIS/COFINS) in the first half declined 405bps, margin in the second

improved, limiting the full-year decline to 260bps.

Other International % change

like for

Year ended Year ended % change like

30 September 30 September actual at constant

2022 2021 exchange exchange

GBPm GBPm rate rate

------------------------- -------------- -------------- ---------- -------------

Volume (million litres) 428.0 389.9 9.8% 9.8%

ARP per litre 87.6p 85.9p 2.0% 6.1%

Revenue 374.9 334.9 11.9% 16.5%

Brand contribution 107.0 106.4 0.6% 3.0%

Brand contribution

margin 28.5% 31.8% (330)bps (370)bps

------------------------- -------------- -------------- ---------- -------------

Note: Other International consists of France, Ireland, and other

international markets. Volumes and ARP include own-brand soft

drinks sales and third-party product sales included within total

revenue and brand contribution. Concentrate sales are included in

both revenue and ARP but do not have any associated volume.

In Ireland revenue increased 18.7% driven by both volume and ARP

growth. All brands were in growth, including Pepsi +17.3%, MiWadi

+18.4% and Ballygowan +22.7%. In France revenue increased 12.3%,

led by Teisseire and Moulin de Valdonne. In other markets we

delivered growth across various sub-channels, including Benelux,

travel, export, and the Middle East. The decline in brand

contribution margin reflects the lag between inflation impacting

the P&L and the timing of our price increases landing with

customers, together with the particularly challenging retail

environment in France with respect to executing our planned price

increases in totality in that market.

Fixed costs - pre-adjusting % change

items like for

Year ended Year ended % change like

30 September 30 September actual at constant

2022 2021 exchange exchange

GBPm GBPm rate rate

----------------------------- -------------- -------------- ---------- -------------

Non-brand A&P (10.3) (8.3) (24.1)% (24.1)%

Fixed supply chain (126.0) (122.1) (3.2)% (3.7)%

Selling costs (82.0) (75.1) (9.2)% (9.0)%

Overheads and other (131.4) (126.5) (3.9)% (5.0)%

Total (349.7) (332.0) (5.3)% (5.9)%

----------------------------- -------------- -------------- ---------- -------------

Total A&P investment (61.7) (58.0)

A&P as a % of own brand

revenue 3.8% 4.1%

Total A&P was GBP3.7 million higher year on year, as we

continued to increase investment in our brands. Fixed supply chain

costs increased primarily due to higher energy and carbon dioxide

costs, partly offset by co-pack savings as production was brought

in-house. Selling costs increased due to the full-year effect of

vacancies filled in 2021 and further recruitment through 2022,

employee expenses as travel normalised, and wage and salary

inflation.

Interest

The net finance charge for the year ended 30 September 2022 is

GBP17.3 million, compared with GBP17.8 million in the comparative

year due to lower net debt levels through the year.

Adjusting items - pre-tax

In the year, the Group incurred, and has separately disclosed, a

net charge of GBP13.6 million (2021: GBP24.2 million) of pre-tax

adjusting items. Adjusting items comprises:

-- Implementation of an accounting policy change following an

IFRIC agenda decision in relation to customisation and

configuration costs of Software as a Service (SaaS) arrangements

which are now expensed as incurred, rather than capitalised. This

resulted in charges in the year of GBP7.5 million relating to IT

projects (see notes 2 and 11 of the financial statements for more

detail);

-- Strategic M&A credit of GBP1.0 million in relation to the

remeasurement and utilisation of historic provisions;

-- Strategic restructuring credit of GBP1.0 million from

historical provisions in relation to the closure of the

Counterpoint business, offset by costs for the closure of the

Norwich site; and

-- Acquisition-related amortisation of GBP8.4 million and other credits of GBP0.3 million.

Taxation

The adjusted tax charge was GBP36.1 million (2021: GBP40.7

million), which equates to an effective tax rate of 20.0% (2021:

27.0%). The statutory net tax charge was GBP34.9 million (2021:

GBP38.1 million), which equates to an effective tax rate of 19.9%

(2021: 28.3%).

Earnings per share (EPS)

Adjusted basic EPS for the year was 57.3p, an increase of 29.3%

(at actual exchange rates) on the prior year due to higher

operating profits and the adverse impact on the 2021 EPS from an

increase in deferred tax following the Government's enacted

increase in corporation tax effective from April 2023. Adjusted

diluted EPS improved 29.4%. Basic EPS for the year was 52.6p, an

increase of 45.5% on last year.

Dividends

The Board is declaring a final dividend of 21.2p per share with

a total value of GBP55.8 million, resulting in a full year dividend

of 29.0p (GBP76.5m). This is in line with our stated 50% pay-out.

The final dividend for 2022 will be paid on 8 February 2023 to

shareholders on record as of 23 December 2022. The ex-dividend date

is 22 December 2022.

Share buyback programme

As announced on 23 May 2022, the company has commenced an

initial share buyback programme to repurchase ordinary shares with

a market value of up to GBP75.0 million. The purpose of the

programme is to reduce share capital and, accordingly, the shares

repurchased are subsequently cancelled. Excluding transaction

costs, the company has returned GBP37.7 million to shareholders via

the buyback during the year ended 30 September 2022, with the

remaining GBP37.3 million to be completed during the first half of

financial year 2023. Adjusted net debt leverage at 30 September

2022 is 1.9x and within Britvic's long-term policy for leverage to

maintain a range of 1.5x to 2.5x.

In the context of Britvic's expected free cash flow and its

capital requirements over the next three years, the Board believes

it is appropriate to complete the current share buyback. Britvic

will continue to review its balance sheet on an annual basis to

assess the strength of the balance sheet, in the context of its

growth ambitions. The company's dividend policy remains

unchanged.

Free cash flow

Free cash flow (defined as cash generated from operating

activities, plus proceeds from sale of property, plant and

equipment, less capital expenditure, interest and repayment of

lease liabilities) was an inflow of GBP128.8m, compared with

GBP132.7 million in the previous year.

Net cash flow from operating activities was GBP239.6 million

compared to GBP225.3 million in the previous year as a result of

increased profit before tax and disciplined cash management during

the year.

There was a working capital outflow of GBP1.3 million (2021:

GBP17.4 million inflow), comprising an outflow from increases in

inventory of GBP26.0 million (2021: GBP15.4 million outflow), an

outflow from increases in trade and other receivables of GBP56.4m

(2021: GBP44.2m outflow), an inflow from increases in trade and

other payables of GBP84.3 million (2021: GBP75.5 million inflow),

an outflow from decreases in provisions of GBP3.2 million (2021:

GBP8.5 million outflow) and no change in other current assets

(2021: GBP10.0 million inflow).

The outflow in trade and other receivables and inflow in trade

and other payables were due to an increase in purchases as trade

increased following the removal of COVID-19 restrictions and a

strong quarter four which benefitted from a hot summer across

Europe.

The outflow in inventories, which were up year on year, is due

to inflation, an increased level of both raw materials and finished

goods stock to protect our customer service levels across the Group

and further vertical integration of fruit processing in Brazil.

Net tax paid in the year of GBP18.4 million is higher than the

GBP15.4 million net tax paid in the year to 30 September 2021 as

2021 benefited from a cash tax rebate in France of GBP7.0 million

following the disposal of the juice business.

Capital expenditure increased to GBP84.6 million (2021: GBP66.7

million) following deferral of investment during the COVID-19

restrictions.

Treasury management

The financial risks faced by the Group are identified and

managed by a central treasury department, whose activities are

carried out in accordance with Board approved policies and subject

to regular Audit and Treasury Committee reviews. The department

does not operate as a profit centre and no transaction is entered

into for trading or speculative purposes. Key financial risks

managed by the treasury department include exposures to movements

in interest rates, foreign exchange rates and commodities, while

managing the Group's debt and liquidity profile. The Group uses

financial instruments to hedge against raw materials, interest rate

and foreign currency exposures.

On 30 September 2022, the Group had GBP962.4 million of

committed debt facilities, consisting of a GBP400.0 million bank

facility, undrawn, and a series of private placement notes, with

maturities between December 2022 and May 2035. A one-year extension

to the maturity of the Group's GBP400.0 million bank facility was

approved by six of the seven lenders in February 2022 extending the

maturity of GBP366.7 million of this facility to February 2027. The

remaining GBP33.3 million will mature in February 2025.

On 30 September 2022, the Group's adjusted net debt, including

the fair value of interest rate currency swaps hedging the balance

sheet value of the private placement notes, was GBP474.8 million,

which compares with GBP488.5 million at 30 September 2021.

Statutory net debt of GBP517.7 million (excluding derivative

hedges) comprised GBP604.4 million of private placement notes and

GBP3.5 million of accrued interest, offset by net cash and cash

equivalents of GBP87.6 million and unamortised debt issue costs of

GBP2.6 million.

Pensions

On 30 September 2022, the Group had IAS 19 pension surpluses in

Great Britain, Ireland and Northern Ireland totalling GBP138.9

million and IAS 19 pension deficits in France totalling GBP1.4

million, resulting in a net pension surplus of GBP137.5 million (30

September 2021: net surplus of GBP131.6 million).

The defined benefit section of the Great Britain plan was closed

to new members on 1 August 2002 and closed to future accrual for

active members from 1 April 2011, with new employees being invited

to join the defined contribution scheme. The Northern Ireland

scheme was closed to new members on 28 February 2006 and future

accrual from 31 December 2018, and new employees are eligible to

join the defined contribution scheme. All new employees in Ireland

join the defined contribution plan.

Contributions are ordinarily paid into the defined benefit

section of the Plan as determined by the Trustee, agreed by the

company and certified by an independent actuary in the Schedule of

Contributions. No deficit funding payments were paid during the

year except for the GBP5.0 million annual partnership payment which

will continue until 2025. This is being reviewed as part of the

triennial valuation as of 31 March 2022, which remains in progress

as of the date of approving these financial statements.

Guaranteed Minimum Pension (GMP)

Following the Lloyds GMP equalisation case in October 2018,

which ruled that treatment of men and women be brought in line for

schemes with a guaranteed minimum pension, the Group recognised a

charge of GBP6.2 million in its 2019 financial statements to

provide for the impact of GMP equalisation. In November 2020, a

further ruling on the Lloyds case took place requiring that

individual transfer payments made since 17 May 1990 would also need

to be equalised for the effects of GMP. During the year ended 30

September 2021, the Group recorded a charge of GBP0.7 million as

part of adjusting items for the estimated cost of GMP equalisation

arising from this latest judgment and no additional charge was made

in 2022.

Glossary

A&P is a measure of marketing spend including marketing,

research and advertising.

Adjusted earnings per share is a non-GAAP measure calculated by

dividing adjusted earnings by the average number of shares during

the year. Adjusted earnings is defined as the profit/(loss)

attributable to ordinary equity shareholders before adjusting

items. Average number of shares during the year is defined as the

weighted average number of ordinary shares outstanding during the

period excluding any own shares held by Britvic that are used to

satisfy various employee share-based incentive programmes.

Adjusted EBIT is a non-GAAP measure and is defined as operating

profit before adjusting items. EBIT margin is EBIT as a proportion

of Group revenue.

Adjusted EBITDA is a non-GAAP measure calculated by taking

Adjusted EBIT and adding back depreciation, amortisation and loss

on disposal of property, plant and equipment and deducting payments

of lease liabilities as an estimate for pre-IFRS16 rental

charges.

Adjusted net debt is a non-GAAP measure and is defined as net

debt, adding back the impact of derivatives hedging the balance

sheet debt.

Adjusted profit after tax is a non-GAAP measure and is defined

as profit after tax before adjusting items, with the exception of

acquisition related amortisation.

Adjusted profit before tax and acquisition related amortisation

is a non-GAAP measure and is defined as profit before tax and

adjusting items, with the exception of acquisition related

amortisation.

Aqua Libra Co is the Britvic Aqua Libra Co Limited, previously

known as The Boiling Tap Company Limited (TBTC).

ARP is defined as average revenue per litre sold, excluding

factored brands and concentrate sales.

BPS is basis points and is a measure used to describe the

percentage change in a value. One basis point is equivalent to

0.01%.

Brand contribution is a non-GAAP measure and is defined as

revenue, less material costs and all other marginal costs that

management considers to be directly attributable to the sale of a

given product. Such costs include brand specific advertising and

promotion costs, raw materials and marginal production and

distribution costs.

Brand contribution margin is a non-GAAP measure and is a

percentage measure calculated as brand contribution divided by

revenue. Each business unit's performance is reported down to the

brand contribution level.

Constant exchange rate is a non-GAAP measure of performance in

the underlying currency to eliminate the impact of foreign exchange

movements.

EBIT is earnings before interest and taxation.

EBITDA is earnings before interest, taxation, depreciation, and

amortisation.

EPS is Earnings Per Share.

Free cash flow is defined as cash generated from operating

activities, plus proceeds from the sale of property, plant and

equipment, less capital expenditure, interest and repayment of

lease liabilities.

GB is Great Britain.

GMP is Guaranteed Minimum Pension.

Group is Britvic plc, together with its subsidiaries.

Immediate Consumption is defined as pack formats to be consumed

on purchase, rather than deferred packs which are purchased and

consumed later.

Innovation is defined as new launches over the last five years,

excluding new flavours and pack sizes of established brands.

M&A is mergers and acquisitions.

NI is Northern Ireland.

Non-GAAP measures are provided because they are closely tracked

by management to evaluate Britvic's operating performance and to

make financial, strategic and operating decisions.

Plenish is Plenish Cleanse Ltd, a company acquired on 1 May

2021.

RCF is revolving credit facility.

Revenue is defined as sales achieved by the Group net of price

promotional investment and retailer discounts.

ROI is Republic of Ireland.

rPET is recycled polyethylene terephthalate plastic.

SaaS is Software-as-a-Service.

Volume is defined as number of litres sold, excluding factored

brands sold by Counterpoint in Ireland. No volume is recorded in

respect of international concentrate sales.

CONSOLIDATED INCOME STATEMENT

Restated*

Year ended Year ended

30 September 30 September

2022 2021

Note GBPm GBPm

------------------------------------------------------------ ---- ------------- -------------

Revenue 4 1,618.3 1,405.1

Cost of sales (952.4) (822.1)

------------------------------------------------------------ ---- ------------- -------------

Gross profit 665.9 583.0

Selling and distribution expenses (266.8) (222.1)

Administration expenses (206.7) (208.5)

------------------------------------------------------------ ---- ------------- -------------

Operating profit 192.4 152.4

Finance income 0.9 0.9

Finance costs (18.2) (18.7)

------------------------------------------------------------ ---- ------------- -------------

Profit before tax 175.1 134.6

Income tax 5 (34.9) (38.1)

------------------------------------------------------------ ---- ------------- -------------

Profit for the year attributable to the equity shareholders 140.2 96.5

------------------------------------------------------------ ---- ------------- -------------

Earnings per share

Basic earnings per share 6 52.6p 36.2p

Diluted earnings per share 6 52.5p 36.1p

------------------------------------------------------------ ---- ------------- -------------

* Restated for new accounting policy relating to

Software-as-a-Service arrangements (see note 11).

All activities relate to continuing operations.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Restated*

Year ended Year ended

30 September 30 September

2022 2021

GBPm GBPm

-------------------------------------------------------------------------------------- ------------- -------------

Profit for the year attributable to the equity shareholders 140.2 96.5

Other comprehensive income/(expense):

Items that will not be reclassified to profit or loss

Remeasurement (losses)/gains on defined benefit pension plans (2.1) 34.1

Current tax on pension contributions 0.1 -

Deferred tax on defined benefit pension plans 2.3 (12.0)

-------------------------------------------------------------------------------------- ------------- -------------

0.3 22.1

-------------------------------------------------------------------------------------- ------------- -------------

Items that may be subsequently reclassified to profit or loss

Gains in respect of cash flow hedges 56.6 0.1

Amounts reclassified to the income statement in respect of cash flow hedges (23.8) 6.3

Current tax in respect of cash flow hedges accounted for in the hedging reserve 0.5 0.2

Deferred tax in respect of cash flow hedges accounted for in the hedging reserve (6.8) (1.1)

Exchange differences reclassified to profit or loss on disposal of foreign operations (0.8) -

Exchange differences on translation of foreign operations 28.9 (9.7)

Tax on exchange differences accounted for in the translation reserve 0.5 (0.6)

-------------------------------------------------------------------------------------- ------------- -------------

55.1 (4.8)

-------------------------------------------------------------------------------------- ------------- -------------

Other comprehensive income for the year, net of tax 55.4 17.3

-------------------------------------------------------------------------------------- ------------- -------------

Total comprehensive income for the year attributable to the equity shareholders 195.6 113.8

-------------------------------------------------------------------------------------- ------------- -------------

* Restated for new accounting policy relating to

Software-as-a-Service arrangements (see note 11).

CONSOLIDATED BALANCE SHEET

Restated* Restated*

30 September 30 September 1 October

2022 2021 2020

Note GBPm GBPm GBPm

--------------------------------- ---- ------------ ------------- ----------

Non-current assets

Property, plant and equipment 513.9 472.4 462.7

Right-of-use assets 68.7 71.7 78.1

Intangible assets 416.4 406.5 400.0

Other receivables 6.0 5.8 6.0

Derivative financial instruments 9 45.9 22.2 25.2

Deferred tax assets 4.4 4.0 4.8

Pension assets 138.9 141.2 101.8

--------------------------------- ---- ------------ ------------- ----------

1,194.2 1,123.8 1,078.6

--------------------------------- ---- ------------ ------------- ----------

Current assets

Inventories 172.0 135.0 118.5

Trade and other receivables 445.2 376.1 335.5

Current income tax receivables 10.9 7.2 13.1

Derivative financial instruments 9 38.9 4.0 12.1

Cash and cash equivalents 87.6 71.1 109.2

Other current assets 3.1 - 10.0

--------------------------------- ---- ------------ ------------- ----------

757.7 593.4 598.4

Assets held for sale 16.8 16.8 20.3

--------------------------------- ---- ------------ ------------- ----------

774.5 610.2 618.7

--------------------------------- ---- ------------ ------------- ----------

Total assets 1,968.7 1,734.0 1,697.3

--------------------------------- ---- ------------ ------------- ----------

Current liabilities

Trade and other payables (508.8) (417.8) (358.8)

Commercial rebate liabilities (137.0) (122.3) (107.3)

Lease liabilities (8.6) (8.9) (9.6)

Interest-bearing loans and borrowings 8 (42.2) (2.2) (78.7)

Derivative financial instruments 9 (11.2) (1.4) (2.2)

Current income tax payables (0.2) (1.4) (2.4)

Provisions (1.9) (5.3) (13.6)

Other current liabilities (11.1) (5.5) (10.2)

-------------------------------------------------------------- --------- --------- ---------

(721.0) (564.8) (582.8)

Liabilities directly associated with the assets held for sale - - (0.1)

-------------------------------------------------------------- --------- --------- ---------

(721.0) (564.8) (582.9)

-------------------------------------------------------------- --------- --------- ---------

Non-current liabilities

Interest-bearing loans and borrowings 8 (563.1) (576.9) (586.0)

Lease liabilities (65.3) (66.2) (70.2)

Deferred tax liabilities (123.1) (98.5) (68.1)

Pension liabilities (1.4) (9.6) (10.7)

Derivative financial instruments 9 (0.4) (0.6) (3.3)

Provisions (0.9) (0.5) (1.1)

Other non-current liabilities (5.5) (6.2) (2.4)

-------------------------------------------------------------- --------- --------- ---------

(759.7) (758.5) (741.8)

-------------------------------------------------------------- --------- --------- ---------

Total liabilities (1,480.7) (1,323.3) (1,324.7)

-------------------------------------------------------------- --------- --------- ---------

Net assets 488.0 410.7 372.6

-------------------------------------------------------------- --------- --------- ---------

Restated* Restated*

30 September 30 September 1 October

2022 2021 2020

Note GBPm GBPm GBPm

---------------------- ---- ------------ ------------- ----------

Capital and reserves

Issued share capital 10 52.7 53.5 53.4

Share premium account 157.2 156.2 154.1

Own shares reserve 10 (7.2) (1.5) (3.7)

Other reserves 106.0 53.7 59.8

Retained earnings 179.3 148.8 109.0

---------------------- ---- ------------ ------------- ----------

Total equity 488.0 410.7 372.6

---------------------- ---- ------------ ------------- ----------

* Restated for new accounting policy relating to

Software-as-a-Service arrangements (see note 11).

The financial statements were approved by the Board of Directors

and authorised for issue on 22 November 2022. They were signed on

its behalf by:

Simon Litherland Joanne Wilson

Chief Executive Officer Chief Financial Officer

CONSOLIDATED STATEMENT OF CASH FLOWS

Restated*

Year ended Year ended

30 September 30 September

2022 2021

Note GBPm GBPm

------------------------------------------------------------------------------- ---- ---------------- -------------

Cash flows from operating activities

Profit before tax 175.1 134.6

Net finance costs 17.3 17.8

Other financial instruments 0.8 0.6

Depreciation of property, plant and equipment 40.9 42.7

Depreciation of right-of-use assets 10.9 10.5

Amortisation 15.6 14.8

Loss on disposal of property, plant and equipment and intangible assets 0.9 2.8

Share-based payments charge, net of cash settlements 4.2 3.8

Net pension charge less contributions (7.6) (5.4)

Net foreign exchange differences 2.0 0.7

Exchange differences reclassified to profit or loss from other comprehensive

income (0.8) -

Increase in inventories (26.0) (15.4)

Increase in trade and other receivables (56.4) (44.2)

Decrease in other current assets - 10.0

Increase in trade, other payables and commercial rebate liabilities 84.3 75.5

Decrease in provisions (3.2) (8.5)

Other adjustments for which cash effects are investing cash flows - 0.4

Income tax paid (18.4) (15.4)

------------------------------------------------------------------------------- ---- ---------------- -------------

Net cash flows from operating activities 239.6 225.3

------------------------------------------------------------------------------- ---- ---------------- -------------

Cash flows from investing activities

Proceeds from sale of property, plant and equipment - 0.1

Purchases of property, plant and equipment (72.9) (56.4)

Purchases of intangible assets (11.7) (10.3)

Interest received 0.2 0.6

Acquisition of subsidiaries, net of cash acquired - (31.2)

------------------------------------------------------------------------------- ---- ---------------- -------------

Net cash flows used in investing activities (84.4) (97.2)

------------------------------------------------------------------------------- ---- ---------------- -------------

Cash flows from financing activities

Interest paid, net of derivative financial instruments (14.8) (15.4)

Other loans repaid 8 - (0.1)

Payment of principal portion of lease liabilities (9.3) (8.7)

Payment of interest portion of lease liabilities (2.1) (1.9)

Repayment of private placement notes, net of derivative financial instruments 8 - (65.4)

Other derivative cash (payments)/receipts (0.8) 1.3

Issue costs paid 8 (0.3) (0.3)

Issue of shares relating to incentive schemes for employees 1.0 2.2

Purchase of own shares related to share schemes (9.0) -

Share buyback programme (36.7) -

Dividends paid to equity shareholders (67.9) (74.8)

------------------------------------------------------------------------------- ---- ---------------- -------------

Net cash flows used in financing activities (139.9) (163.1)

------------------------------------------------------------------------------- ---- ---------------- -------------

Net increase/(decrease) in cash and cash equivalents 15.3 (35.0)

Cash and cash equivalents at the beginning of the year 71.1 109.2

Net foreign exchange differences on cash and cash equivalents 1.2 (3.1)

------------------------------------------------------------------------------- ---- ---------------- -------------

Cash and cash equivalents at the end of the year 87.6 71.1

------------------------------------------------------------------------------- ---- ---------------- -------------

* Restated for new accounting policy relating to

Software-as-a-Service arrangements (see note 11).

CONSOLIDATED STATEMENt OF CHANGES IN EQUITY

Other reserves

--------------------------------

Issued Share Own

share premium shares Hedging Translation Merger Retained

capital account reserve reserve reserve reserve earnings Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------- -------- -------- -------- --------- ----------- -------- --------- --------

At 1 October 2020 (as

previously reported) 53.4 154.1 (3.7) 0.3 (27.8) 87.3 111.9 375.5

Adjustment on change of

accounting policy* - - - - - - (2.9) (2.9)

----------------------------- -------- -------- -------- --------- ----------- -------- --------- --------

At 1 October 2020 (restated*) 53.4 154.1 (3.7) 0.3 (27.8) 87.3 109.0 372.6

Profit for the year

(restated*) - - - - - - 96.5 96.5

Other comprehensive

income/(expense) - - - 5.5 (10.3) - 22.1 17.3

----------------------------- -------- -------- -------- --------- ----------- -------- --------- --------

Total comprehensive

income/(expense) - - - 5.5 (10.3) - 118.6 113.8

----------------------------- -------- -------- -------- --------- ----------- -------- --------- --------

Issue of shares 0.1 2.1 (1.5) - - - - 0.7

Own shares utilised for share

schemes - - 3.7 - - - (7.6) (3.9)

Movement in share-based

schemes - - - - - - 3.1 3.1

Current tax on share options

exercised - - - - - - 0.3 0.3

Deferred tax on share options

granted to employees - - - - - - 0.2 0.2

Transfer of cash flow hedge

reserve to inventories - - - (1.3) - - - (1.3)

Payment of dividend - - - - - - (74.8) (74.8)

----------------------------- -------- -------- -------- --------- ----------- -------- --------- --------

At 30 September 2021

(restated*) 53.5 156.2 (1.5) 4.5 (38.1) 87.3 148.8 410.7

----------------------------- -------- -------- -------- --------- ----------- -------- --------- --------

* Restated for new accounting policy relating to

Software-as-a-Service arrangements (see note 11)

Other reserves

--------------------------------------------------

Issued Share Own Capital

share premium shares redemption Hedging Translation Merger Retained

capital account reserve reserve reserve reserve reserve earnings Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------- -------- -------- -------- ----------------- -------- ----------- -------- --------- ------

At 1 October 2021

(restated*) 53.5 156.2 (1.5) - 4.5 (38.1) 87.3 148.8 410.7

Profit for the

year - - - - - - - 140.2 140.2

Other

comprehensive

income - - - - 26.5 28.6 - 0.3 55.4

----------------- -------- -------- -------- ----------------- -------- ----------- -------- --------- ------

Total

comprehensive

income - - - - 26.5 28.6 - 140.5 195.6

----------------- -------- -------- -------- ----------------- -------- ----------- -------- --------- ------

Issue of shares 0.1 1.0 (1.1) - - - - - -

Share buyback

programme (0.9) - (1.1) 0.9 - - - (36.7) (37.8)

Own shares

purchased for

share schemes - - (9.0) - - - - 3.2 (5.8)

Own shares

utilised for

share schemes - - 5.5 - - - - (12.5) (7.0)

Movement in

share-based

schemes - - - - - - - 4.1 4.1

Current tax on

share options

exercised - - - - - - - 0.3 0.3

Deferred tax on

share options

granted to

employees - - - - - - - (0.5) (0.5)

Transfer of cash

flow hedge

reserve to

inventories - - - - (3.7) - - - (3.7)

Payment of

dividend - - - - - - - (67.9) (67.9)

----------------- -------- -------- -------- ----------------- -------- ----------- -------- --------- ------

At 30 September

2022 52.7 157.2 (7.2) 0.9 27.3 (9.5) 87.3 179.3 488.0

----------------- -------- -------- -------- ----------------- -------- ----------- -------- --------- ------

* Restated for new accounting policy relating to

Software-as-a-Service arrangements (see note 11).

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. General information

The preliminary consolidated financial information was

authorised for issue by the Board of Directors on 22 November

2022.

The preliminary consolidated financial information for the year

ended 30 September 2022 has been prepared in accordance with the

Companies Act 2006 and UK-adopted international accounting

standards. The preliminary consolidated financial information does

not constitute statutory consolidated financial statements as

defined by section 434 of the Companies Act 2006.

The Annual Report and Accounts for the year ended 30 September

2022 was approved by the board on 22 November 2022. The report of

the auditor on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under section 498 of the Companies Act 2006. The Annual Report and

Accounts for 2022 will be filed with the Registrar of Companies in

due course.

The Annual Report and Accounts for the year ended 30 September

2021 was approved by the board on 23 November 2021 and has been

delivered to the Registrar of Companies. The report of the auditor

on those accounts was unqualified, did not contain an emphasis of

matter paragraph and did not contain any statement under section

498 of the Companies Act 2006.

2. Accounting policies

The preliminary consolidated financial information for the year

ended 30 September 2022 has been prepared in accordance with the

accounting policies described in the company's Annual Report and

Accounts for the year ended 30 September 2021, except for the

changes arising on the adoption of new accounting standards and

amendments explained further below.

New standards, amendments and interpretations adopted in the

current year

With effect from 1 October 2021, the Group applied for the first

time the standards and amendments as set out below. These amended

standards and interpretations have not had a significant impact on

the Group's financial statements.

Interest Rate Benchmark Reform - Phase 2: Amendments to IFRS 9, IAS

39, IFRS 7, IFRS 4 and IFRS 16

---------------------------------------------------------------------

Covid-19-Related Rent Concessions beyond 30 June 2021 - Amendments to

IFRS 16

---------------------------------------------------------------------

The Group has not early adopted any other standard,

interpretation or amendment that has been issued but is not yet

effective.

Change in accounting policy - Software-as-a-Service (SaaS)

arrangements

During the year, the Group revised its accounting policy in

relation to upfront configuration and customisation costs incurred

in implementing Software-as-a-Service (SaaS) arrangements in

response to the IFRIC agenda decision clarifying its interpretation

of how current accounting standards apply to these types of

arrangements.

The Group's accounting policy has historically been to

capitalise costs directly attributable to the configuration and

customisation of SaaS arrangements as intangible assets in the

balance sheet, irrespective of whether the services were performed

by the SaaS supplier or a third party. The Group has reviewed its

SaaS arrangements and has applied the guidance in the agenda

decision to determine whether the configuration and customisation

expenditure gives rise to an asset, including whether the Group has

control of the software that is being configured or customised or

whether the configuration or customisation activities create a

resource controlled by the Group that is separate from the

software. Where these recognition criteria are not met, the Group

recognises configuration and customisation costs, along with the

ongoing fees to obtain access to the SaaS provider's application

software, as operating expenses as the services are received. The

new software costs accounting policy is presented in the policies

below.

Historical financial information has been restated to account

for the impact of the change, refer to note 11. This change in

accounting policy has resulted in costs of GBP7.5m being expensed

to administration expenses during the year ended 30 September 2022

that would previously have been capitalised as intangible assets

under the former policy (2021: GBP8.3m). Intangible assets

recognised in the balance sheet at 30 September 2021 reduced by

GBP11.8m (1 October 2020: GBP3.5m). In the statement of cash flows

for the 30 September 2022, GBP9.3m has been presented within net

cash flows from operating activities that would previously have

been presented within net cash flows used in investing activities

under the former policy (2021: GBP7.0m).

New accounting policy for Software-as-a-Service (SaaS)

arrangements

SaaS arrangements are service contracts providing the company

with the right to access the cloud provider's application software

over the contract period. Costs incurred to configure or customise,

and the ongoing fees to obtain access to the cloud provider's

application software, are recognised as operating expenses when the

services are received. In a contract where the cloud provider

provides both the SaaS configuration and customisation, and the

SaaS access over the contract term, the company determines whether

these services are distinct from each other or not, and therefore,

whether configuration and customisations incurred are expensed as

the software is configured or customised (i.e. upfront), or over

the SaaS contract term. Specifically, where the configuration and

customisation activities significantly modify or customise the

cloud software, these activities will not be distinct from the

access to the cloud software and are therefore expensed over the

SaaS contract term. When implementing SaaS arrangements, costs

incurred may include those that relate to the development of

software code

that enhances or modifies, or creates additional capability to,

existing on-premise systems and meet the definition of and

recognition criteria for an intangible asset. These costs are

recognised as intangible software assets and amortised over the

useful life of the software on a straight-line basis. The useful

lives of these assets are reviewed at least annually and any change

accounted for prospectively as a change in accounting estimate.

3. Going concern

The Directors are satisfied that the Group has adequate

resources to continue to operate as a going concern for the

foreseeable future and that no material uncertainties exist with

respect to this assessment. In making this assessment, the

Directors have considered the Group's balance sheet position and

forecast earnings and cash flows for the period from the date of

approval of these financial statements to 31 March 2024. Further

details of the Directors' assessment are set out below.

Following the outbreak of COVID-19 in early 2020, the subsequent

global pandemic and implementation of government restrictions on

commercial activity and social movement, Britvic implemented a wide

range of measures to ensure the ongoing stability and going concern

status of the company.

Britvic has proven resilient with volume and revenue now ahead

of pre-COVID-19 levels. During the first half of the financial

year, almost all COVID-19 restrictions were lifted in the countries

that Britvic operates, and the Group's strategy has been built on

the plan of living with COVID-19 and no restrictions going

forward.

Since the pandemic, the investments the business has made have

resulted in more agile and resilient procurement, production and

sales capability and we are more able to respond to changed buying

and selling patterns as required. Moreover, the business has been

able to offset inflationary pressures in 2022 by successfully

implementing revenue growth management actions, including price

increases and promo optimisation. Inflationary pressures are

expected to persist in financial years 2023 and 2024, which will

require further price increases and other actions. This has been

reflected in Britvic's strategic plan and stress test

sensitivities.

As part of the going concern assessment, inflation scenarios

have been combined with the potential impact of key risks that

could reasonably arise in the period, including supply constraints

and increased regulation. These have been modelled to assess the

extent to which further mitigating actions would be required, and

are all within management control. Mitigating actions can be

initiated as they relate to discretionary and investment spend,

without significantly impacting the ability to meet demand.

As of 30 September 2022, the consolidated balance sheet reflects

a net asset position of GBP488.0m and the liquidity of the Group

remains strong. In the first half of 2022, the Group successfully

secured a one-year extension of its GBP400.0m revolving credit

facility with six of the seven participating banks. As a result,

GBP366.7m of this facility now matures in February 2027, with the

remaining GBP33.3m maturing in February 2025. The revolving credit

facility remains committed and undrawn at 30 September 2022. The

Group's next debt maturity is in December 2022 when $43m of private

placement notes mature (GBP27.8m, net of derivative financial

instruments). Both the Group's revolving credit facility and

private placement notes have a net debt/EBITDA covenant limit of

3.5x, excluding IFRS 16 impact. Based on the full year adjusted net

debt of GBP474.8m and adjusted EBITDA of GBP254.5m, the net

debt/EBITDA ratio was 1.9x and well within the covenant limit.

Under all the scenarios modelled, including the impact of the

share buyback programme, and after taking available mitigating

actions, our forecasts did not indicate a covenant breach or any

liquidity shortages.

On the basis of these reviews, the Directors consider it is

appropriate for the going concern basis to be adopted in preparing

the Annual Report and Accounts.

4. Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the plc Executive team and Board

of Directors of the company.

For management purposes, the Group is organised into business

units and has five reportable segments:

-- GB (United Kingdom excluding Northern Ireland)

-- Brazil

-- Ireland (Republic of Ireland and Northern Ireland)

-- France

-- International

These business units sell soft drinks into their respective

markets. Management monitors the operating results of its business

units separately for the purpose of making decisions about resource

allocation and performance assessment. Segment performance is

evaluated based on brand contribution. This is defined as revenue

less material costs and all other marginal costs that management

considers to be directly attributable to the sale of a given

product. Such costs include brand specific advertising and

promotion costs, raw materials and marginal production and

distribution costs. All other costs, including net finance costs

and income taxes, are managed on a centralised basis and are not

allocated to reportable segments.

The 'Other International' subtotal comprising the Ireland,

France and International reportable segments has been presented to

provide linkage to the Chief Financial Officer's Review section of

this preliminary results announcement.

Other International

----------------------------------------

Year ended 30 September 2022 GB Brazil Ireland France International Subtotal Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------------------------------- ------- ------ ------- ------ ------------- -------- -------

Revenue from external customers 1,100.4 143.0 143.9 179.4 51.6 374.9 1,618.3

---------------------------------------- ------- ------ ------- ------ ------------- -------- -------

Brand contribution 426.0 22.7 49.6 45.9 11.5 107.0 555.7

Non-brand advertising and promotion(ii) (10.3)

Fixed supply chain(iii) (126.0)

Selling costs(iii) (82.0)

Overheads and other costs(ii) (131.4)

---------------------------------------- ------- ------ ------- ------ ------------- -------- -------

Adjusted EBIT(iv) 206.0

Net finance costs pre-adjusting items (17.3)

Adjusting items(iv) (13.6)

---------------------------------------- ------- ------ ------- ------ ------------- -------- -------

Profit before tax 175.1

---------------------------------------- ------- ------ ------- ------ ------------- -------- -------

Other International

----------------------------------------