TIDMCKN

RNS Number : 9223R

Clarkson PLC

06 March 2023

6 March 2023

Clarkson PLC ('Clarksons') is the world's leading provider of

integrated shipping services. From offices in 24 countries on six

continents, we play a vital intermediary role in the movement of

the majority of commodities around the world.

Preliminary results

Clarkson PLC today announces preliminary results for the 12

months ended 31 December 2022.

Summary

-- Record underlying profit before taxation(*) of GBP100.9m

(2021: GBP69.4m), an increase of 45.4%

-- Underlying earnings per share* increased 51.1% to 250.3p (2021: 165.6p)

-- Particularly strong performance in the Broking segment

-- Full year dividend of 93p, giving rise to a 20(th) consecutive year of dividend growth

-- Forward order book for invoicing in 2023 was US$216m (2022: US$165m), an increase of 30.9%

-- Strong balance sheet with free cash resources(*) of GBP130.9m

(2021: GBP92.3m) available for future investment

Year ended Year ended

31 December 31 December

2022 2021

Revenue GBP603.8m GBP443.3m

Underlying profit before taxation* GBP100.9m GBP69.4m

Reported profit before taxation GBP100.1m GBP69.1m

Underlying basic earnings per share* 250.3p 165.6p

Reported basic earnings per share 247.9p 164.6p

Dividend per share 93p 84p

* Classed as an Alternative Performance Measure ('APM'). See

'Other information' at the end of this announcement for further

information.

Andi Case, Chief Executive Officer, commented:

"2022 was a record year for Clarksons, and I thank all my

colleagues across every area of the business for their hard work,

dedication and commitment. This performance, driven by our

client-focused culture and consistent strategy of investing in the

best teams across all global segments, data, intelligence,

analytics, and the best tools for trade, has enabled us to deliver

a 20(th) consecutive year of dividend growth for our

shareholders.

"Whilst the global geo-political outlook for 2023 and beyond

remains uncertain, the green transition is driving significant

activity in our industry. This, coupled with a supply and demand

balance that will create meaningful supply-side constraints

supporting the market, and our strong forward order book, gives us

confidence in the outlook for Clarksons."

Enquiries:

Clarkson PLC:

Andi Case, Chief Executive Officer

Jeff Woyda, Chief Financial Officer & Chief Operating

Officer 020 7334 0000

Camarco:

Billy Clegg 020 3757 4983

Jennifer Renwick / 4994

Alternative performance measures ('APMs')

Clarksons uses APMs as key financial indicators to assess the

underlying performance of the Group. Management considers the APMs

used by the Group to better reflect business performance and

provide useful information. Our APMs include underlying profit

before taxation and underlying earnings per share. An explanation

and reconciliation of the term 'underlying' and related

calculations are included within the 'Other information' section at

the end of this announcement. All APMs used within this

announcement are denoted by an asterisk (*).

About Clarkson PLC

Clarkson PLC is the world's leading provider of integrated

services and investment banking capabilities to the shipping and

offshore markets, facilitating global trade.

Founded in 1852, Clarksons offers its diverse and growing client

base an unrivalled range of shipbroking services, sector research,

on-hand logistical support and full investment banking capabilities

in all key shipping and offshore sectors. Clarksons continues to

drive innovation across its business, developing digital solutions

which underpin the Group's unrivalled expertise and knowledge with

leading technology.

The Group employs over 1,800 people in 56 different offices

across its four divisions and is number one or two in all its

market segments.

The Company has delivered 20 years of consecutive dividend

growth. The highly cash-generative nature of the business,

supported by a strong balance sheet, has enabled Clarksons to

continue to invest to position the business to capitalise on

opportunities in its markets.

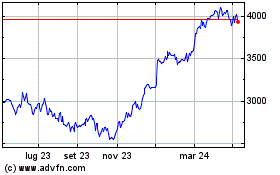

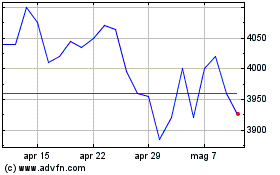

Clarksons is listed on the main market of the London Stock

Exchange under the ticker CKN and is a member of the FTSE 250

Index.

For more information, visit www.clarksons.com

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 as it forms part of domestic

law of the United Kingdom by virtue of the European Union

(Withdrawal) Act 2018, as amended (together, 'MAR'). Upon the

publication of this announcement, this inside information is now

considered to be in the public domain.

Chair's review

Overview

As I reflect at the end of my first year as Chair, various

observations spring to mind as to what makes Clarksons such an

exceptional business. First is the quality, energy and focus of all

of our employees worldwide, without whom the record results for

2022 we have delivered would not have been possible. Second is our

culture and values, which underpin the way we operate and behave

and which are reflected in our many strong and enduring client

relationships. Finally, and crucially, is our relentless focus on

investing in the future of our Company, be that through, for

example, the green transition, our continued investment in Sea/ and

the training of our people to ensure best-in-class service to our

clients.

2022 was a remarkable year for the shipping industry driven by a

number of significant "x" factors. As countries were at differing

stages of recovery from COVID-19 and China experienced a second

lockdown, congestion and disruption were already the key issues in

shipping. Then Russia's invasion of Ukraine caused another wave of

wide-reaching consequences, including sanctions and significant

changes in both commodity flow and availability, issues not just

for shipping but for the wider economy as well. The energy and cost

of living crises, combined with inflation and higher interest

rates, added further challenges to the global economy, and to the

asset-heavy shipping industry.

Against this backdrop, the Group continued to thrive, a

testament to both the strategy and the teams within Clarksons. The

decarbonisation journey, which is both complex and important for

shipping, is now well underway but will take time to complete.

Transition will require a number of different solutions,

significant investment and the provision of finance to the

industry. Clarksons is focused on ensuring we can add value within

this process.

We believe our long-term strategic commitment to continuing to

invest in our teams, products and services will continue to reap

dividends as the market evolves. In addition to extending the depth

and breadth of our broking teams, we continue to invest in

high-quality data within Clarksons Research, Sea/ - our maritime

technology platform, Support covering ports services and supplies,

and the Financial division sourcing financing across shipping,

offshore, renewables and real estate.

Results

I am delighted to report that underlying profit before taxation*

was GBP100.9m (2021: GBP69.4m) with underlying basic earnings per

share* of 250.3p (2021: 165.6p). Reported profit before taxation

was GBP100.1m (2021: GBP69.1m) with reported basic earnings per

share of 247.9p (2021: 164.6p).

Free cash resources* as at 31 December 2022 were GBP130.9m

(2021: GBP92.3m).

Dividend

We are extremely proud to confirm that this will be our 20th

consecutive year of dividend increases. The Board is recommending a

final dividend for 2022 of 64p (2021: 57p). Combined with the

interim dividend in respect of 2022 of 29p (2021: 27p), the

resulting full year dividend in respect of 2022 results is 93p

(2021: 84p). The dividend will be payable on 26 May 2023 to

shareholders on the register on 12 May 2023, subject to shareholder

approval.

People

I was delighted to take up the role of Chair on 2 March 2022 and

I greatly appreciate the generosity of my colleagues, who have

committed significant time and energy to immerse me in all aspects

of Clarksons' business. I have been hugely impressed by the energy,

agility and future-focused strategic activity across all

departments.

The enthusiasm and commitment to co-ordinated support of our

clients across all sectors and at all levels is what I believe

makes Clarksons so highly regarded by clients looking for

market-leading intelligence and insights across the industry. Our

continued focus is on expanding our global footprint and service

offering, and adding to what is the very best talent in the sector

across all divisions. I thank all our colleagues for their

exceptional efforts this year.

Giving back

It is of the utmost importance to us that Clarksons is a force

for good across our global community, and we ensure that both our

colleagues and the communities we are part of around the world are

valued, respected and supported. To that end, this year we have

extended the activities of our Green Transition team in every area

of the business, helping our clients to reduce the impact of

shipping on the environment, and reinforced our commitment to the

activities of The Clarkson Foundation to create positive change for

those in need around the world. The Clarkson Foundation has, for

example, made a tangible difference by donating to charities that

provided clean water facilities and hygiene education to five

schools in Kenya and funded hot meals over the Christmas period to

some experiencing homelessness in London.

Board

Peter Backhouse retired from the Board this year following the

completion of his nine-year tenure as an independent Non-Executive

Director. I would like to thank Peter for his outstanding service

to Clarksons. His perspective, insights and counsel have been

greatly valued as Clarksons has steered a successful course through

a period of considerable volatility, and we wish him the very best

for the future.

Outlook

We start 2023 confident in the outlook for Clarksons. The

successful execution of our long-term strategy to be best-in-class

across all segments of shipping, offshore and renewables means that

we are optimally positioned for what we believe will be a sustained

period of growth in the industry.

Whilst there are considerable uncertainties in the geo-political

landscape, we are confident that supply-side constraints brought

about by years of underinvestment and the pressure on shipowners

and charterers to decarbonise, will provide significant

opportunities for Clarksons long into the future.

We will continue our strategy of investing in the best people

and opportunities across the globe to ensure that we remain at the

very forefront of the industry, delivering growth for all

stakeholders.

Finally, I would like to thank every employee in every office of

the Group for their commitment and hard work during the past year.

It is truly appreciated.

Laurence Hollingworth

Chair

3 March 2023

Chief Executive Officer's review

2022 was a record year for Clarksons, and I thank all my

colleagues across every area of the business for their hard work,

dedication and commitment. Our performance this year is the result

of our consistent strategy, (i) to be best-in-class across each and

every vertical within shipping and offshore, (ii) to be

best-in-class in each geographic region globally, (iii) to have the

best data, intelligence and analysis, (iv) to invest in our teams

and the best tools for trade, (v) to have an integrated business

model meeting all the needs of our extensive client base, and most

importantly (vi) to add value to our clients and put their needs at

the heart of all that we do. This strategy has of course been

underpinned by our growing team of professionals and experts, and I

am proud to work alongside the very best in the industry.

We have for some time been signalling the evolution in maritime,

which we are now seeing and benefiting from. Demand and supply are

in constant motion; there is uncertainty of technology for the

green transition; fleet profiles are the oldest for over a decade;

the order book of new ships is historically low compared to the

overall fleet in most of the larger commodity verticals; financing

availability is tight; and interest rate rises together with

inflation are impacting on the cost of building. It is clear to see

there are still significant constraints on the scale of ship

building.

But without question, the green transition is the biggest change

in shipping and the drivers for change in our industry are

significant. Regulators, charterers, industry lobby groups and the

consumers of products shipped are demanding change in the

greenhouse gas emissions of shipping. The needs of participants to

predict, record and analyse emissions data in order to reduce their

footprint on an ongoing basis has never been higher, which means

that the services offered by our broking, research and technology

teams are in high demand. Importantly, our Green Transition

consultancy, linked with the intelligence offered by our execution

capability in newbuildings, is helping our clients drive change.

This activity will significantly alter the specifications of

vessels on the water and the value drivers in vessel chartering,

where emissions are becoming a key metric as to which vessel to

select.

The order book is increasingly comprised of alternate-fuelled

ships with evolving designs. A full understanding of all elements

of this transition is a key component of our service in helping

clients meet the needs of the industry. Nevertheless, overall the

newbuild order book is flat, with most of the activity in 2022 in

containerships, car carriers and gas carriers. Elevated newbuilding

prices, limited berth availability and uncertainty around fuelling

technology contributed to relatively lower order volumes,

increasing the likelihood of meaningful supply side constraints

over the coming years in many verticals. Further constraints arise

from environmental pressures, which are creating more scrutiny and

control over the existing fleet, impacting and constraining speed

and emissions.

Over the last few years there has been an increased need to

focus on Know Your Client ('KYC') and compliance with global

sanctions. We have invested in this area and we believe that this

has become increasingly important to clients following the onset of

the Russia-Ukraine conflict, which has created complex challenges

as businesses need to protect their reputations while complying

with sanctions. Our clients want to understand the implications of

dealing with all parties within their entire network, and their

recognition that wilful ignorance is not acceptable means that they

value Clarksons' market-leading systems and commitment to

transparency.

Broking

The maritime industry experienced a diversity of trends across

its major segments during the year. Major global disruption,

including the dislocation of trade brought about by the onset of

the Russia-Ukraine conflict and the continued impact from the

COVID-19 pandemic, tightened markets and impacted, not only

seaborne cargos, but also pipelines. This led the ClarkSea index to

increase 30% to an all-time high, before coming off in Q4 on the

back of a slowing world economy, inflation and an easing of

COVID-19-related port congestion. Indeed, these global economic and

geo-political stresses have put immense pressure on the shipping

industry to rapidly change, to ensure food and energy reach people

in need, irrespective of the changes in supply chains and sanctions

which have massively changed shipping routes and participants able

to transact with each other. Our ability to understand the changing

situation and react quickly has stood us in very good stead during

the period.

Against this backdrop, the Broking division, which has a

market-leading position in all key shipping sectors, had a

particularly strong year as volume and market share gains aligned

with high utilisation rates, driving higher freight rates. Despite

the rate environment not reaching record levels, the broking teams

broke all previous highs, giving us significant confidence for the

sector as supply-side constraints and inflationary pressures

support higher prices going forward.

The offshore oil, gas and renewables market also had a year of

change resulting in a notably stronger year, driven by increased

demand for energy in the short term and the drive towards energy

security. The team is seeing significant opportunities for assets

as nations and businesses seek to reduce their dependence on

Russian natural resources. Moreover, the long-term trend towards

renewable energy and its importance in the energy basket is driving

our continued investment in renewables across all areas of the

business.

Tankers, specialised products and gas markets, covering LNG, LPG

and other petrochemical gases, have had a strong year and continue

to perform well with good market fundamentals for the future. The

dry bulk market was also strong for much of the year, but freight

rates have come off more recently due to short-term factors which

we believe will reverse as the year progresses. The container

sector started off the year at record levels, but faced a sharp

decline in the second half due to a decrease in trade volumes and

congestion unravelling.

The S&P team had a very successful year as demand for

vessels was high, despite there being a significant volume of

transactions with respect to the much talked about shadow fleet

which was off limits to our teams.

Overall, segmental profit before taxation from Broking was

GBP117.6m, up GBP44.0m over the year, with a margin of 23.7%.

Financial

The Financial division faced tougher conditions in 2022 with an

adverse macro-economic and geo-political environment leading to a

pause in capital raising. Several transactions which were due to be

completed in the second half of 2022 are now expected to close in

the first half of 2023, and indeed many have already been

completed, or are close to being completed, at the time of

writing.

Our areas of focus in shipping, metals and mining, offshore oil

services and renewables means that our pipeline remains strong.

Whilst the macro-economic outlook for 2023 remains uncertain, we

expect to benefit as a number of large banks and other competitors

have left these markets and there remains pent-up demand for

capital.

Our project finance teams across shipping, offshore and real

estate have also continued to perform well.

Overall, our Financial division produced a segmental profit

before taxation of GBP7.8m in 2022 compared with GBP13.3m in

2021.

Support

The Support division had a very strong 2022 as our agency,

supplies, customs clearance and freight forwarding businesses all

benefited from the increasing focus on offshore renewables, as well

as increased activity through ports as COVID-19 congestion has

eased. We have, since the year-end, continued our investment in

this growth segment and I was delighted to recently announce

investment in DHSS, a renewables-focused port services business

based in mainland Europe.

The Support division produced a segmental profit before taxation

of GBP5.0m and a 12.8% margin in 2022 (2021: GBP3.3m and

11.1%).

Research

The performance of the Research division is testament to the

depth and quality of Clarksons' research and the high regard in

which it is held by clients. Its products have seen significant

growth from increased breadth and depth, particularly extensive

evolution in data and intelligence relating to the green transition

in shipping and the overall energy transition.

The division increased segmental profit before taxation by 14.8%

to GBP7.0m (2021: GBP6.1m).

Sea/

We welcomed Peter Schrøder as CEO of Maritech in April 2022 and

are delighted with client interest in, and adoption of, Sea/, the

intelligent platform for fixing freight. During the last year we

have evolved the management team, increased sales and client

adoption and acquired two businesses - Setapp, a business expert in

maritime software product development, and Chinsay, a contract

management platform particularly focused on the dry bulk sector

which integrates well into Sea/ and creates scale alongside

Sea/contracts. This business remains a key area of strategic focus

with 2023 being a pivotal year in rolling out Sea/ across all areas

of the dry bulk market and into other sectors as well.

Outlook

Whilst the global geo-political outlook for 2023 and beyond

remains uncertain, the strength of business and balance between

supply and demand, supported by our record level of forward order

book, gives us confidence in the outlook for Clarksons.

The green transition is an area of key importance for Clarksons

as clients recognise the significant steps they need to take

towards decarbonisation. Increased environmental regulation and

societal pressures will create opportunities across all our

divisions for many years to come.

We will continue to invest in our people, technology and

businesses across all segments, to ensure we have the expertise and

insights to provide the best advice, execution, data and technology

in the industry.

Regardless of the challenges of the global markets in recent

years, we have not deviated from our strategy of investing for

growth, ensuring that the breadth, depth and quality of our

ever-expanding offering maintains us at the forefront as we enter

this new phase of shipping.

Andi Case

Chief Executive Officer

3 March 2023

Financial review

Revenue: GBP603.8m (2021: GBP443.3m)

Underlying profit before taxation*: GBP100.9m (2021:

GBP69.4m)

Reported profit before taxation: GBP100.1m (2021: GBP69.1m)

Dividend per share: 93p (2021: 84 p)

Financial performance

2022 was another record year for the Group. Revenue increased

36.2% to GBP603.8m (2021: GBP443.3m) and underlying profit before

taxation* increased by 45.4% to GBP100.9m (2021: GBP69.4m).

The Broking division has been the main driver for this growth,

continuing to benefit from the long-term strategy to increase our

global footprint and be best-in-class across every segment of

shipping and offshore. As we went into 2022, the low level of order

book as a percentage of the world fleet combined with the high

utilisation highlighted last year, created the backdrop for

stronger freight rates and asset prices in many verticals. Overall,

Broking generated a segmental profit before taxation of GBP117.6m

in the year (2021: GBP73.6m), with an increased margin of 23.7%

(2021: 21.6%) driven by strong performances in dry bulk,

specialised and offshore, together with a much-improved performance

in tanker markets.

The Financial division experienced tougher markets compared to

2021, generating a segmental profit before taxation of GBP7.8m and

margin of 15.7% (2021: GBP13.3m and 23.8%), reflecting more muted

activity in capital markets across shipping, metals and minerals

and renewables, and more sporadic deal flow in shipping, offshore

and real estate project finance, particularly in the second half of

the year. The Support and Research divisions experienced good

revenue and profit growth, with our port services business

continuing its steady improvement following the COVID-19 pandemic,

and Clarksons Research benefiting from the investment in enhancing

its digital products.

The Group incurred underlying administrative expenses* of

GBP481.2m (2021: GBP355.7m) in the year, an increase of 35.3%,

largely due to an increase in variable remuneration as a result of

the improved business performance. Within these expenses, central

costs unallocated to business segments increased to GBP36.6m (2021:

GBP25.2m), reflecting an increase in variable remuneration from

higher profits, further investment into central IT systems,

website, branding and people, and increased Sea/ technology

amortisation costs as the platform increases maturity of use. Sea/

costs on a cash basis have also increased slightly from 2021 with

additional investment in management and sales capabilities to

support the growing business and fewer costs being capitalised in

2022 than in previous years.

Acquisitions

During the first half of the year, the Gibb Group acquired PPE

Suppliers Limited for GBP0.2m, broadening the reach of our tools

and supplies offering within the Support segment. The Group

completed two acquisitions under the Maritech brand during the

second half of the year: Chinsay, a business which enhances our

capabilities and client base within the dry cargo contract

management space, and Setapp, a business expert in maritime

software development, with a view to further growing and developing

Sea/. Chinsay was acquired for a total consideration of US$3.2m and

Setapp for EUR3.0m.

Acquisition-related costs include GBP0.2m (2021: GBP0.2m)

relating to amortisation of intangibles and GBP0.3m (2021: GBP0.1m)

of cash and share-based payments spread over employee service

periods. A further GBP0.3m (2021: nil) is included relating to the

Chinsay and Setapp acquisitions. We estimate acquisition-related

costs for 2023 to be GBP0.5m assuming no further acquisitions are

made.

Taxation

The Group's underlying effective tax rate* was 20.4% (2021:

21.2%), slightly lower than the prior year as a result of a one-off

tax credit in the US, though still reflecting the broad

international operations of the Group. The Group's reported

effective tax rate was 20.5% (2021: 21.2%).

Earnings per share

Underlying basic earnings per share* increased by 51.1% to

250.3p (2021: 165.6p) and is calculated as underlying profit after

taxation* attributable to equity holders of the Parent Company

divided by the weighted average number of ordinary shares in issue

during the year. The reported basic earnings per share was 247.9p

(2021: 164.6p).

Forward order book ('FOB')

The Group earns some of its commissions on contracts where the

duration extends beyond the current year. Where this is the case,

amounts that are able to be invoiced during the current financial

year are recognised as revenue accordingly. Those amounts which are

not yet invoiced, and therefore not recognised as revenue, are held

in the FOB. In challenging markets, such amounts may be cancelled

or deferred into later periods.

The Directors review the FOB at the year-end and only publish

the FOB items which will, in their view, be invoiced in the

following 12 months. At 31 December 2022, this estimate was 30.9%

higher than the prior year at US$216m (31 December 2021:

US$165m).

Dividend

The Board is recommending a final dividend in respect of 2022 of

64p (2021: 57p) which, subject to shareholder approval, will be

paid on 26 May 2023 to shareholders on the register at the close of

business on 12 May 2023.

Together with the interim dividend in respect of 2022 of 29p

(2021: 27p), this would give a total dividend of 93p for 2022, an

increase of 10.7% on 2021 (2021: 84p). In taking its decision, the

Board took into consideration the Group's 2022 performance, balance

sheet strength, ability to generate cash and FOB.

This increased dividend represents the 20th consecutive year

that the Board has raised the dividend.

Foreign exchange

The average sterling exchange rate during 2022 was US$1.23

(2021: US$1.38). At 31 December 2022, the spot rate was US$1.21

(2021: US$1.35).

Cash and borrowings

The Group ended the year with cash balances of GBP384.4m (2021:

GBP261.6m) and a further GBP3.1m (2021: GBP9.6m) held in short-term

deposit accounts and government bonds, classified as current

investments on the balance sheet.

Following correspondence this year with the Corporate Reporting

Review Team of the Financial Reporting Council, we agreed to

restate certain cash flows relating to equity-settled liabilities

within the Consolidated Cash Flow Statement both within 'net cash

flow from operating activities' and 'financing activities'. We have

restated the Consolidated Cash Flow Statement for the year ended 31

December 2021 to add back GBP11.3m of equity-settled liabilities as

'operating activities' and deduct GBP11.3m of shares acquired by

our Employee Benefit Trust ('EBT') as 'financing activities'. This

presentation has also been adopted for the year ended 31 December

2022.

Net cash and available funds*, being cash balances after the

deduction of accrued bonuses, at 31 December 2022 were GBP161.7m

(2021: GBP122.3m). The Board uses this figure as a better

representation of the net cash available to the business since

bonuses are typically paid after the year-end, hence an element of

the year-end cash balance is earmarked for this purpose. It should

be noted that accrued bonuses include amounts relating to the

current year and amounts held back from previous years which will

be payable in the future.

A further measure used by the Board in taking decisions over

capital allocation is free cash resources*, which deducts monies

held by regulated entities from the net cash and available funds*

figure. Free cash resources at 31 December 2022 were GBP130.9m

(2021: GBP92.3m).

In addition to these free cash resources*, the Group has a

strong balance sheet and has consistently generated an underlying

operating profit and good cash inflow. Management has stress tested

a range of scenarios, modelling different assumptions with respect

to the Group's cash resources and, as a result, continues to adopt

the going concern basis in preparing the financial statements.

Balance sheet

Net assets at 31 December 2022 were GBP413.2m (2021: GBP361.6m).

The balance sheet remains strong, with net current assets and

investments exceeding non-current liabilities (excluding pension

provisions and lease liabilities as accounted for under IFRS 16) by

GBP163.6m (2021: GBP120.2m).

The overall loss allowance for trade receivables was GBP19.6m

(2021: GBP12.9m).

The Group's pension schemes had a combined surplus before

deferred tax of GBP15.4m (2021: GBP22.0m).

Jeff Woyda

Chief Financial Officer & Chief Operating Officer

3 March 2023

Business review

Broking

Revenue: GBP495.5m (2021: GBP340.0m)

Segmental split of underlying profit before taxation: GBP117.6m

(2021: GBP73.6m)

Forward order book for 2023: US$216m^ (At 31 December 2021 for

2022: US$165m^)

^ Directors' best estimate of deliverable forward order book

('FOB')

Dry cargo

Supporting a range of important global industries including

construction, energy and agriculture, the dry cargo sector moved

more than five billion tonnes of cargo in 2022 across a range of

dry bulk commodities, including metals and minerals, agricultural

products and some semi-processed goods. The bulkcarrier shipping

market experienced a mixed 2022. Earnings remained strong in the

first half of the year, before easing back in the balance of the

year as trade volumes began to soften with weaker economic trends

globally and in China (where dry bulk imports fell 4% in 2022). The

overall Clarksons bulkcarrier earnings index averaged US$20,478 per

day across the year, 23% down year on year but remaining double the

10-year average. The market experienced a range of complexities and

impacts from global events, including post-COVID-19 demand rebound,

impacts from the Russia-Ukraine conflict, US monetary tightening

and a weaker Chinese economy. The sub-Capesize sectors generally

performed more strongly, with broadly supportive demand trends in

the first half of the year and logistical disruption related to the

Russia-Ukraine conflict and sanctions on Russia. Capesize earnings

of owners (down 58% year on year to US$11,877 per day, below the

long-term trend) were impacted by disruption from heavy rainfall in

key iron ore and coal exporting countries while pressures from

weaker Chinese steel demand due to the structural problems in the

property sector also impacted. The easing of port congestion

improved fleet availability and the easing of COVID-19 quarantine

protocols in China also reduced disruption on the key West

Australia-China route. The UN-led grain corridor facilitated the

restart of Ukraine Black Sea grain exports, although at

lower-than-normal levels.

Bulkcarrier markets are expected to experience some periods of

lower rates in 2023, with impacts from slower world economic growth

continuing. However, improvements are also expected through the

year supported by a range of factors including increases in grain

trade volumes and an anticipated post-COVID-19 rebound in China,

including impacts from stimulus on steel demand. Easing inflation

may also support improved dry bulk demand in Europe as the year

progresses, on top of ongoing longer-haul coal imports into the

region following embargos on Russian cargoes. Port congestion may

increase again as demand improves. On the supply side, deliveries

appear moderate; newbuild orderbooks are close to record lows at 7%

of the fleet; and new emissions regulations could lead to both

limits to vessel speeds and early retirements. Tiering of freight

and charter markets is expected with more efficient ships

commanding a premium. Our market-leading dry cargo team invested in

further headcount across its global team in 2022, supporting our

client base and achieving good growth in transactions.

Tankers

The tanker sector plays a crucial role in global energy supply

chains, moving crude oil and refined oil products to facilitate

their eventual use as transportation fuels, for heating and

electricity generation, and as industrial feedstocks. Overall, the

tanker shipping market saw a significant improvement in 2022 to

historically strong conditions, supported by post-COVID-19

improvements in global oil demand and supply and the impacts from

the Russia-Ukraine conflict, which included disruption of vessel

availability and trading patterns. The Clarksons average tanker

earnings index rose five-fold in 2022 to US$40,766 per day, the

highest level since 2008. The VLCC segment took longer to recover

than other sectors amid COVID-19-related disruption in China in the

first half. However, improved Chinese demand later in the year,

higher OPEC+ oil supply and increased long-haul US exports all

supported gains in the second half. The Suezmax and Aframax

segments were heavily impacted by the Russia-Ukraine conflict due

to shifts in trade patterns, including the supportive impact of

longer transport distances for European crude imports and Russian

exports, with Suezmax earnings rising significantly above long-run

averages and Aframax earnings reaching the highest levels on

record. Product tanker earnings also strengthened considerably

after the start of the conflict due to higher refinery margins and

output, as well as shifts in trade patterns, which exacerbated

longer-term structural changes in the global refining industry.

These changes were already expected to support products' tonne-mile

trade in 2022 (closures of older refineries in established demand

centres, while newer capacity has opened up elsewhere,

predominantly in the Middle East and Asia). LR2 and LR1 earnings

rose to well above long-run averages, while MR earnings increased

to record highs.

The tanker sector is expected to see generally strong market

conditions in 2023 with continued volatility this year, although

the VLCC sector may see some short-term headwinds from OPEC+

production cuts implemented in late 2022 and the ending of

large-scale releases from the US Strategic Petroleum Reserve. There

remain uncertainties around the exact impact of EU and G7 measures

affecting Russian trade. A lengthening of average oil trade

distances appears likely although a decline in Russian export

volumes is also possible. Improved Chinese oil demand seems likely

to support tanker demand in 2023. Meanwhile, the rapidly thinning

tanker orderbook (now only 5% of fleet capacity) points to limited

fleet growth ahead. Active fleet supply is expected to be further

constrained by new emissions regulations which appear likely to

restrain the ability of the fleet to speed up significantly, whilst

the early retirement of some tonnage is possible as the decade

progresses. Considerations around lower emission vessel designs may

also lead to continued restraint in newbuild orders.

Our shipbroking team play a vital role in the freight supply

chain and has deep long-term relationships with all major oil

companies, traders and shipowners. Supported by our scale, regional

breadth, expert analysis and technology tools, our tanker team

performed exceptionally in 2022 as we supported our clients through

disrupted and volatile markets.

Containers

The container shipping sector facilitates transportation of a

wide spectrum of manufactured goods, often high-value, and includes

consumer and industrial goods, foodstuffs and chemicals. 2022 was a

year with two distinctly different phases for the container

shipping markets. The first half saw continued extraordinary market

conditions amid severe port congestion following a robust trade

rebound in 2021. However, a major market softening occurred

throughout the second half as box trade came under increased

pressure alongside easing of congestion, leaving spot box freight

rates and containership time charter earnings back in 'normalised'

territory by the end of 2022 after a sharp correction. Indices of

spot box freight rates closed 2022 down approximately 80% from the

start-year record and close to the start-2020 level, whilst average

containership charter earnings reached around US$27,000 per day by

the end of 2022, down 70% from the April 2022 peak but still almost

double the start of the 2020 level.

Container trade fell by 3% in TEU terms in 2022, amid broad

macro-economic headwinds and impacts on consumer activity from

inflation and a cost of living crisis, as well as pressure from

excess retail inventories. Port congestion remained severe in the

first half, reflecting impacts from labour strikes, COVID-19

lockdowns in China, the Russia-Ukraine conflict and liner network

recalibration to avoid prior disruption hotspots. The level of

containership capacity at port rose to a peak of 38% of the fleet

in July 2022 (2016-19 average: 32%), before falling to

approximately 33% by the end of 2022 as faltering demand allowed

logistical bottlenecks to ease. On the supply side, fleet capacity

growth stood at 4% in 2022, whilst containership speeds began to

trend lower in the second half. Newbuild contracting fell from the

2021 record but remained firm at 2.7m TEU, with a record 69% of

capacity ordered accounted for by alternative fuel capable vessels.

In 2023, container shipping markets look set to see continued

softening from strong supply expansion, continuing pressure on box

trade and reduced port congestion. New emissions regulations may

have some supply side impacts (eg speed adjustments, retrofit time

and support to demolition), although appear unlikely to transform

soft markets alone.

In 2022, our containership broking teams executed major

transactions with a wide range of operators and owners across

chartering, newbuilding and secondhand. Our multi-national global

broking resources have been in strong demand, backed by

unprecedented requirements for analysis and research. We continue

to support our clients in navigating the decarbonisation of our

industry, with these efforts likely to become an increasingly

important feature of our offering.

Gas

The LPG carrier fleet ships liquified petroleum and

petrochemical gases, supporting a wide range of industries, from

plastics and rubber production to industrial and domestic energy

markets. The LPG carrier fleet transported circa 120m tonnes of LPG

in 2022, as well as smaller quantities of ethane, ammonia and

petrochemical gases. 2022 was generally a strong year for the

larger-sized LPG carriers, with spot VLGC earnings on the benchmark

AG-Japan route averaging US$1,649,000 per month across the year,

the highest annual average since 2015. Market strength was due

partly to growth in seaborne trade, which rose by an estimated 5%

year on year globally. Increased market inefficiencies, notably

Panama Canal delays, also supported rates, while a slight reduction

in speed was also noted. Divergent trends emerged in other vessel

sizes. In the Midsizes (25-45,000 cbm), TC earnings started 2023 at

US$890,000 per month, up from US$830,000 per month at the start of

2022. Support was received from an influx of tonnage into ammonia

trades as the market adjusted to the absence of volumes from the

Baltic and Black Sea (amid the Russia-Ukraine conflict).

Additionally, the Handysize (15-25,000 cbm) market continued to

receive support from growth in Ethylene exports out of the US,

which breached the one million tonne mark in 2022. Consequently,

12-month timecharter rates rose from just over US$590,000 per month

over 2021 to US$730,000 per month at the start of 2023. In the

smaller segments, a limited orderbook and ageing fleet continue to

support freight rates, which also rose across 2022.

Looking ahead, 46 VLGCs newbuilds are expected to be delivered

this year, alongside 20 MGCs, which may generate some market

pressure in the larger sizes, although continued trade growth and

an expected slowdown in vessel speeds (following the introduction

of IMO carbon regulations in January 2023) should provide support.

The outlook for the smaller segments appears more positive, with

continued growth in US ethylene exports expected in conjunction

with limited fleet growth.

With the continued drive towards decarbonisation, both on the

shipping and production side, the gas team has been active in

supporting initiatives towards the production and transportation of

green ammonia and CO(2) . This is expected to shape developments in

the market over the next decade.

LNG

The LNG carrier sector shipped over 400m tonnes of liquified

natural gas in 2022, a record high, on a fleet of highly

specialised vessels. This sector is critical to both energy

transition and energy security, particularly in the wake of the

Russia-Ukraine conflict and subsequent diminishing Russia-Europe

gas pipeline trade.

The LNG shipping market saw very strong rates in 2022 with our

index of spot rates for a 160,000 cbm TFDE unit averaging a record

US$131,500 per day, up 47% year on year. The market became

exceptional as the year developed with spot rates surging through

the third and fourth quarters, supported by tight spot tonnage

availability as European demand for transportation, storage and

regasification escalated. In the fourth quarter, short-term day

rates averaged all-time highs of US$330,300 per day. Global LNG

trade volumes rose by 4.8% to 407.7m tonnes in 2022, largely on the

back of an increase in export volumes from the US. On the importer

side, elevated European demand shaped the market, as the continent

looked to rapidly substitute away from Russian pipeline gas.

Imports into Europe surged by 62% to 130m tonnes in 2022, a record

high. Meanwhile, imports into Asia dropped by 7% to 257m tonnes, on

the back of elevated competition from Europe and a shift in trade

flows. LNG carrier newbuild orders reached a record 182 vessels and

overall fleet capacity grew at 4.3%.

Another generally strong rate environment is expected in 2023,

with support from tight relet tonnage availability, robust trade

growth and reduced average vessel speeds following the

implementation of IMO carbon regulations from January 2023.

Relatively strong newbuild investment is also expected, supported

by project requirements and fleet renewal.

Clarksons has remained central to a number of newbuilding

contracts whilst the chartering team has restructured to provide

solutions on both short and medium-term charters to their expanding

client base.

Specialised products

The chemical tanker fleet consists of vessels able to transport

a wide range of specialised liquid chemicals, contributing to a

diverse range of sectors, including manufacturing and agriculture.

2022 marked an extraordinary year for the chemical tanker sector,

with the freight market breaking through previous records and

posting consistently strong month-on-month highs. A combination of

factors including an exceptional deep sea CPP market, elevated

levels of port congestion in China and increased biofuels trade

were key in supporting the freight environment.

Such was the strength of these drivers, the Clarksons Bulk

Chemical Spot Rate Index recorded an average increase of 67%

compared to 2021, whilst the Clarksons Edible Oils Spot Rate Index

saw an equally impressive 81% average increase over the same

period. Depending on trade lane and tonnage requirements, we have

seen upward revisions to contract of affreightment rates of

anything from 10% to 15% to in excess of 100%.

Looking ahead, limited growth in the chemical tanker fleet is

expected to provide significant support to the freight market.

Across 2022, annual fleet growth stood at around 2%, and there is

potential for the fleet to contract in coming years. A lack of yard

space, high newbuilding prices and softer earnings historically

means that securing financing and support for new projects is

scarce. That said, we do expect volume requirement growth to remain

very modest considering macro-economic pressures in 2023, with

overall seaborne trade expected to grow by 1.8% and by a further

3.3% in 2024.

The extensive capability of our specialised products broking

business has helped our clients navigate through today's complex

and volatile marketplace, supported by a global network of offices.

With the rapidly accelerating decarbonisation agenda, our unique

depth and breadth of knowledge, supported by our carbon broking

desk, Green Transition team and Research division, has allowed us

to partner stakeholders in developing their decarbonisation

pathways.

Sale and purchase

Secondhand

The global secondhand vessel sale and purchase ('S&P')

markets remained very active in 2022, with sales volumes standing

at the second highest level on record after 2021 (over 134m dwt and

US$57bn in 2022). Strong levels of activity were supported by

positive underlying shipping and charter markets, whilst firm asset

prices supported overall sales figures in value terms.

Transaction volumes notably increased in the tanker sector amid

strong underlying markets and firming asset values, with a record

US$18bn of sales (more than 700 ships) reported and over 10% of

fleet capacity changing hands. Activity in the containership

S&P market remained firm in the first half of 2022 following a

very strong 2021. Although activity slowed through the second half

of the year in line with a softening rate environment, total

transaction volumes still reached more than 220 ships selling for

an aggregate of US$8bn. The bulkcarrier S&P market generally

saw continued strong activity, especially in the first half, though

total volumes were down on the 2021 record at more than 740 ships

(US$15bn).

Asset values remained generally firm in 2022, with the

cross-sector Clarksons Secondhand Price Index reaching 213 points

in July, the highest level since 2008, although this has since

eased back with containership and bulkcarrier pricing softening in

the second half. Tanker values rose sharply through 2022 (our

10-year-old Aframax index increased from US$27m to US$50m) as

tanker earnings rose, with ice class tonnage especially in demand.

Recent S&P trends amongst the major shipowning countries

continued, with Greek owners still the biggest buyers and sellers

of tonnage in 2022, although Chinese entities were also active in

acquiring vessels.

Across all offices we were able to benefit from the high volumes

of secondhand vessel transactions with our teams experiencing

another successful year overall.

Newbuilding

The newbuilding market remained active in 2022, with ordering

volumes easing (down 20% from 2021 to 45m CGT) but remaining above

2015-20 levels. Total newbuild investment reached US$128bn, the

highest level since 2013.

Contracting in 2022 was led by the LNG carrier sector amid

record earnings and an increased focus on energy security, with 182

units (US$39.1bn) ordered during the year, more than any other

shipping sector in terms of CGT and newbuild value. There was also

strong activity in the containership sector, especially in the

first half of the year, with 367 orders (US$35bn) placed. We also

saw strong ordering in the car carrier sector amid an exceptional

earnings environment and a focus on fleet renewal. Contracting in

other sectors was limited by high newbuild prices, reduced slot

availability at yards, and continued uncertainty over fuelling

technologies. However, our continued breadth of service to our

industrial client base enabled our participation in a healthy level

of contracting activity and validation across the markets, in spite

of such challenges.

Newbuild prices stood at firm levels in 2022, supported by

global inflationary pressures, rising commodity prices and

increasing forward cover at yards. Our Newbuilding Price Index

ended 2022 at 162 points, up from 154 points at the start of the

year and the highest level since 2008. Despite healthy ordering

volumes, the global orderbook remains relatively low in historic

terms at 10% of fleet capacity in dwt terms. Shipyard output

remained relatively steady year on year, totalling 31m CGT, with

Chinese yards (47% market share) and South Korean yards (25% market

share) delivering the majority of tonnage.

Our global newbuilding team delivered market-leading

performances across multiple asset sectors in 2022 and we remain

well positioned as a service provider and partner to our client

base in a continually evolving macro newbuilding environment. There

were significant market-leading transactions, particularly for the

car carriers team, arranged by our Oslo desk, as well as major

industrial-backed projects in tankers and gas vessels. Our scale

and depth of transactional activity continues to give us real-time

information and insights as the industry evolves against regulatory

pressure and environmental compliance. We remain well positioned

going into 2023 to continue to leverage this knowledge.

Offshore

The offshore sector supports the development, production and

support of offshore oil and gas fields and renewables, with over

13,000 mobile assets playing a vital role in supporting operations

across the lifecycle of offshore energy projects. Overall, 2022 was

a year of positive progress for the offshore markets, with the

offshore oil and gas business recovering strongly amid a backdrop

of generally high oil and gas prices, whilst the offshore

renewables (wind) sector continued to expand rapidly. Although the

increase in underlying E&P spending was relatively moderate,

activity levels increased across all offshore sub-sectors and most

geographical regions, and further improvements in activity, fleet

utilisation and day rates are expected in 2023. Our offshore

broking teams have continued to utilise their extensive industry

relationships and technical expertise to support our client base

through evolving markets.

Drilling market

Mobile drilling units (comprising jack-ups, semisubmersible

units and drillships) drill wells in the sea floor to locate and

facilitate extraction of oil and gas. Rig markets tightened

materially in 2022, with an increasing number of rigs on contract,

higher utilisation and rising day rates. The floater segment,

particularly for ultradeepwater/deepwater high-end units, is now

generally tight, whilst the jack-up segment has continued to

strengthen, particularly in the Middle East, resulting in global

active utilisation closing in on 90%. Prospects for 2023 and beyond

for the drilling market appear positive amid increasing offshore

activity.

Subsea field development market

The subsea sector involves the usage of a range of assets, with

capabilities in lifting, pipelay, cable lay, diving and ROV

support, to install and maintain subsea production infrastructure.

The subsea field development market continued to improve through

2022, with an increasing backlog for the major EPC contractors. The

subsea vessel market also saw significant improvement with rates

and contract durations generally increasing. This has been driven

by both improved subsea oil and gas demand, as well as requirements

for many of the same vessels from the offshore wind sector.

Prospects for 2023 appear positive, with increased activity

generating project opportunities, including for smaller

contractors, and supporting vessel demand.

Offshore support vessels

The OSV sector provides towage and support duties to drilling

rigs, mobile production units and fixed production platforms. The

OSV market strengthened significantly in 2022 amid increasing

drilling and field development activity. Demand increased across

most regions, and with limited availability, vessels are

increasingly likely to start migrating between regions. There has

been virtually no ordering activity since 2014, and rates are

expected to continue to increase with capacity availability limited

and continued firm demand.

Offshore renewables

The offshore renewables industry is continuing its rapid growth

phase, and going forward is expected to account for a growing share

of the global energy mix supported by the increased focus on

decarbonisation and energy security. The offshore wind market

continued to grow in 2022. More projects reached the FID stage and

investment flowed into the sector. Construction activity in key

European markets is firm, and globalisation of the industry

continues to develop, with new markets such as Poland, the US and

South Korea emerging. Several countries strengthened renewables

targets after the onset of the Russia-Ukraine conflict enhanced

focus on energy security, whilst investor focus on ESG and

infrastructure investments continues to increase. The outlook

remains positive with significant growth expected in the coming

years. Although uncertainty remains around cost inflation, supply

chain issues and delays, and FID activity was slower in 2022,

projects will continue to develop through the phases in the coming

years. Offshore wind remains competitive, secured offtake

development is still strong and 2022 was a record year for European

project awards. The pipeline of projects until 2025-26 is starting

to firm up, providing good visibility on future offshore

demand.

Our offshore and renewables team has been at the forefront of

market developments, completing several initiatives during the year

to help the sector support decarbonisation targets. We have been

instrumental in adding wind support vessels to the market and have

been involved in several large-scale wind projects. We continue to

look for ways to improve and innovate, with clients choosing to

work with us for our reputation as a leading player, our commitment

to decarbonisation and our ability to deliver high-quality

solutions. 2022 was a busy year for our specialised renewables

consultancy, AIR, led by experienced industry professionals, and

delivering several projects across a range of clients. It is well

positioned for further growth in 2023.

Futures

Our Futures business is the leading provider of freight

derivative products, helping shipping companies, banks, investment

houses and other institutions seeking to manage freight exposure by

increasing or reducing risk. It leverages the expertise and market

understanding of the wider Group to offer best-in-class execution

services to derivatives markets across freight, iron ore and

carbon. Against the backdrop of increased regulatory requirements,

Futures has, with support from the wider Group, positioned itself

at the forefront of the sector. 2022 was a positive year for the

Futures business. Tanker FFA revenue rose strongly. Efforts

continue to bring new participants to the market as well as service

existing clients to the highest standard. In the dry futures

business, it was another busy year with new offices established in

Dubai, focusing on Far East activity, and in Oslo, providing access

to EU business. The swaps business, in a highly competitive space,

saw revenue down from a particularly strong 2021 but still well

above 2019/20 levels. The options business maintained its

market-leading position and had another excellent year overall,

remaining the lead broker for most of the major accounts. Work

continues in developing wet FFA options.

Financial

Revenue: GBP49.8m (2021: GBP56.0m)

Segmental split of underlying profit before taxation: GBP7.8m

(2021: GBP13.3m)

Securities

Clarksons Securities is a sector-focused investment bank for the

shipping, offshore energy, renewables and minerals industries, with

deep sector knowledge and global reach driven by research and

relationships. In 2022, against a backdrop of a difficult year for

capital markets with volatility resulting from global events and

macro-economic headwinds and deal volume slowing, activity in

Clarksons Securities' core sectors was positive in relative terms,

with risk sentiment and capital markets activity appearing to

improve moving into 2023. Despite volatile and uncertain markets,

secondary trading activity was strong with equities especially

active, private equity realising positions and creditors selling

equity in restructured oil services companies.

Shipping

In 2022, strong cashflow and upward pressure on asset pricing

drove shipping stock performance and trading liquidity in several

equities increased significantly throughout the year. Capital

markets activity remained in line with historical trends in the

first half of 2022, but issuance activity in the second half of

2022 was muted due to equity market volatility. Clarksons

Securities participated in several capital markets transactions,

including initial public offerings of Cool Company and Gram Car

Carriers and follow-on offerings in Hafnia, Cool Company and

American Shipping Company. Although shipping bond issuance activity

remained muted, Clarksons Securities acted as financial advisor in

several bilateral loan and leasing transactions.

Energy

Oil services stocks saw positive trends in 2022 on the back of

increased offshore E&P investments, and improved utilisation

and day rates across most offshore segments. Capital markets

activity within the energy services space picked up during the year

as investors sought exposure to the sector. Clarksons Securities

placed several equity raises, including a private placement for

Borr Drilling.

Metals and minerals

2022 started strongly for metals and mining stocks but the

challenging macro-economic backdrop led to significant pressure by

the end of the year. Clarksons Securities participated in multiple

transactions within the metals and minerals space in 2022, among

them equity raisings in Nordic Mining, Canada Nickel Company and

Piedmont Lithium and a bond issuance for Nordic Mining. Continued

firm activity is anticipated and Clarksons Securities remains well

positioned to assist clients in meeting demand for commodities

driven by the green transition.

Renewables

The renewable energy sector continues to see impressive

expansion across the board with traditional technologies such as

wind and solar continuing to grow while emerging technologies such

as hydrogen and carbon capture and storage have developed

significantly. Market sentiment in the offshore wind sector remains

strong, driven by continued strong growth in installed capacity,

despite some supply chain bottlenecks. The expansion of the

dedicated offshore wind fleet requires substantial capital funding.

Nonetheless, 2022 was a challenging year for stocks related to

renewable energies, against a backdrop of inflationary pressures,

increasing interest rates and geo-political instability. Capital

markets activity slowed, with some companies turning towards

private markets which have shown willingness to support energy

transition-related companies. Clarksons Securities has been

particularly active around hydrogen, carbon capture and various

e-fuels, offering synergies across the Group, including acting as

advisor in the raising of equity by Ocean Geoloop and Liquid

Wind.

Debt capital markets

With markets broadly closed for significant periods of 2022, and

investors demanding considerably higher returns to take on risk,

primary issuance across the Nordics, Europe and the US fell by

70-80% compared to 2021. Despite this, Clarksons saw pockets of

funds available for select public and private debt activity and

completed several transactions.

Project finance

Our project finance business is a leading Nordic player within

shipping and real estate project finance, which has in recent years

offered investment opportunities in modern fuel (and carbon)

efficient shipping and offshore assets, with an overall focus on

assisting the shipping and offshore industry in transitioning to

more sustainable and less carbon-intensive transportation. 2022 was

an active year in the Norwegian project finance market with our

team concluding new projects in the dry bulk, tanker and offshore

sectors, and establishing a good pipeline of projects including

zero emission shipping investments.

The first half of 2022 saw positive trends in the real estate

market in Norway, but with increasing interest rates and general

macro-economic headwinds the second half of 2022 proved turbulent.

Although the decline in commercial property values has so far been

limited, as interest rates increased banks became stricter on

financing terms, contributing to fewer transactions. That said, the

first half of 2022 was one of the busiest ever periods for our real

estate team. Activity included the establishment of a new

industrial real estate company focussing on properties near the

centres of the largest cities in Norway and several exciting

development projects in co-operation with reputable partners. Our

business continues to expand its operational platform by

strengthening the property management and project development

teams.

Our real estate funds continued to expand with the launch of a

new fund with a special focus on environmental improvements to

existing buildings.

Structured asset finance

Our structured asset finance business maintains relationships

with asset financiers globally including around their activities

and headline terms, with a view to helping our broking clients

understand the sources of finance available to them and providing

introductions where relevant. It acts as an exclusive mandated

financial advisor, structurer and arranger working closely with the

newbuilding, strategy and structuring teams on large long-term

strategic procurement projects for end-users and cargo

interests.

The shipping asset finance landscape continues to evolve and by

the close of 2022, there were few signs of any additional stress

amongst lending portfolios, although many lenders exposed to the

container shipping sector are seeing an increased risk profile. The

'Poseidon Principles' group of banks, aligning their portfolios to

key emissions targets, has seen additional signatories, and

appetite from these banks remains almost exclusively focused on new

'green' vessels and/or sustainability-focussed projects. Outside of

this group, other large banks together with the smaller regional

shipping banks, especially those in Cyprus, Greece and Scandinavia,

continue to grow in terms of capital deployed and to see

opportunities to finance or refinance tonnage, especially for

slightly older vessels and/ or for projects with less 'green'

credentials. Chinese leasing remains an additional source of

capital to the industry, though there appears to be a two-tier

market developing. The leading providers are able to reduce margins

for the right projects closer to those being offered by the

shipping banks. The remainder is mostly either inactive

internationally or trying to compete with the smaller shipping

banks and alternative lenders with only limited degrees of success.

Japanese leasing continued to offer an attractive alternative for

those able to access this market, albeit with limited flexibility.

The alternative lender landscape remains largely unchanged. There

is plenty of capital available to be deployed, although there

remains no real emergence of insurance companies and pension funds

at an asset level, with participation generally limited to

investments in alternative funds platforms.

The business concluded further mandates in 2022 and continues to

fulfil a specific highly value-adding role, particularly post-IFRS

16, with an excellent reputation and track record. A strong

commitment to decarbonisation is a central part of our clients'

strategies and their long-term investment in newbuilding projects

is at the forefront of their efforts and respective commitments in

this regard.

Support

Revenue: GBP39.0m (2021: GBP29.6m)

Segmental split of underlying profit before taxation: GBP5.0m

(2021: GBP3.3m)

Stevedoring

In 2022, our stevedoring business, highly experienced in loading

and discharging bulk cargoes, performed strongly. Export volumes

increased by 148,000 tonnes to 284,000 tonnes, and although total

imports were down by 39,000 tonnes, half of this decrease was made

up by low margin biomass imports. This increase in tonnage handled

directly bolstered performance with higher ancillary income as

rental income, handling charges and other revenues expanded in line

with additional volumes. Our grain elevators in Portsmouth also

made a notable contribution. The cost base remained controlled

although fuel costs for machinery increased, caused by a change in

government taxation policy; and property costs were lower than

normal due to the timing of local government COVID-19 relief.

Short sea broking

2022 was a strong year for the short sea broking business which,

with specialist skills, in-depth knowledge and strong

relationships, is market-leading in brokerage services for short

sea dry cargo shipping. The business continued to grow its

chartering base and handle larger parcel sizes than previously.

This performance was supported by exceptional freight rates for

much of the year, in addition to exchange rate trends, although

freight rates are generally expected to ease down going forward.

The business plans to expand further, including leveraging agency

activity to broaden the charterer client base.

Gibb Group

Gibb Group is the industry's leading provider of PPE, MRO

products and services as well as one of the offshore renewable

energy sector's most experienced, qualified suppliers. In 2022, the

business achieved growth in the face of significant headwinds,

including the cost of container freight, exchange rate trends and

supply chain issues hampering the ability to get product in a

timely manner. In recent years the business has been reshaped with

the addition of the Safety and Survival business, first in Great

Yarmouth and subsequently in Aberdeen and Middlesbrough. The

growing hire and service centre business is continuing to meet

evolving client demand patterns. The traditional core oil and gas

business saw a boost in volumes following the onset of the

Russia-Ukraine conflict, which saw countries increase their focus

on security of energy supply and ramp up local oil and gas

production. Supply chain issues have impacted Gibb Netherlands but

a local service centre and new premises should provide the

opportunity for growth from early 2023. Offshore wind activity

through Ijmuiden grew as the port began to support new offshore

wind farms. Further overall expansion is planned for 2023.

Agency

Through exceptional port agency and first-class logistics

services, our business provides a range of solutions for clients in

the marine and energy sectors. Although the UK saw limited

construction traffic in 2022 (expected to return in 2023), the

building of large offshore wind farms is providing growing

opportunities. Our customs clearance business supports clients

globally with our comprehensive compliance capabilities, and

performed strongly in 2022. The year also saw gains from bunker

supply activity. Following a weaker 2021, our bulks business

experienced improvement in 2022, with our Ipswich and Southampton

locations in particular seeing a firm increase in activity, the

latter also expanding its profile across offshore energy, coastline

protection and scrap. Our North East England presence grew markedly

with a new office in Middlesbrough servicing a rapidly expanding

client base in bulk and offshore renewal energy.

In early February 2023, we were delighted to announce the

acquisition of DHSS. DHSS has built an enviable reputation for

world-leading service levels in the Netherlands and further afield

with a particular focus on offshore wind energy. Combined with our

port services business' existing 20-year history in this sector, we

offer best-in-class service to our growing customer base in the UK,

mainland Europe and further afield. 2023 will see strong growth in

this area as there will be considerable investment in offshore wind

in the UK, Dutch and German sectors. We expect to see this

capability expand beyond the current geography.

Egypt agency

The Suez Canal provides a vital trade route between Europe and

Asia, and our regional experts in Egypt deliver on-the-ground

expertise around transit. Our Egypt agency business proved

successful in 2022 in the face of challenges impacting local port

activity from general macro-economic headwinds, disruption to

regional imports from the Russia-Ukraine conflict (grain,

fertilizer volumes), increased commodity prices and exchange rate

trends. Transit agency business saw increased volumes in 2022 and

continues to progress whilst liner business remained positive. The

Egypt agency business continues to explore increasing opportunities

in Egypt and around the Suez Canal region related to green energy

and shipping's green transition.

Research

Revenue: GBP19.5m (2021: GBP17.7m)

Segmental split of underlying profit before taxation: GBP7.0m

(2021: GBP6.1m)

Research provides a unique flow of powerful, highly relevant and

wide-ranging research and data to clients, as well as to the

Broking, Financial, Support and technology businesses in the Group.

Our market-leading content was again extremely well received by

clients across 2022 and achieved excellent profile for the Group.

Furthermore, data provision and synergies were enhanced, including

support to the end-to-end freight Sea/ platform developed by

Maritech, the Clarksons technology business. Continuing its

long-term growth, our Research division performed robustly during

the year.

Clarksons Research, the Group's data and analytics arm, remains

market leader in the provision of independent data, intelligence

and analysis around shipping, trade, offshore and energy. Millions

of data points are processed and analysed each day to provide

trusted and insightful intelligence to a global client base,

typically via recurring revenue agreements. This uniquely powerful

data and intelligence underpins the workflows and decision-making

of thousands of organisations across the complex and dynamic global

maritime industry, including shipowners, financiers, shipyards,

suppliers, charterers, class societies, insurers, universities and

governments. The use of innovative technology and algorithms has

continued to expand the depth and quality of our proprietary

database, supporting a strong pipeline of product development and a

firm flow of sales enquiries. Targeted headcount growth and

internationalisation continues, with the successful start-up of a

data team in New Delhi during 2022, leveraging local maritime

expertise and helping take our Asian share of headcount to 30%.

Our long-term strategy to focus and invest in data, intelligence

and insights around the vital maritime energy transition continues.

Firstly, we are focused on the fuelling transition that will be

fundamental to reducing shipping's 2.3% contribution to global

CO(2) emissions. Our offering provides detailed tracking of

emissions policies, alternative fuel adoption, fleet renewal, the

speed of ships and the uptake of Energy Saving Technologies. Across

2022 we also released a series of market impact assessments around

the IMO's new 2030 policy measures to reduce emissions, a hugely

significant milestone in shipping's decarbonisation pathway (as

will be the EU's Emissions Trading Scheme from 2024). New modules

on green investments at ports and vessel activity analytics

dashboards are under development for release in the first half of