TIDMCTEC

RNS Number : 3675S

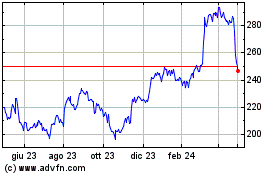

ConvaTec Group PLC

09 March 2023

9 March 2023

Convatec Group Plc

Annual Results for the twelve months ended 31 December 2022

Strong financial performance and continued strategic

progress

-- Delivered good revenue growth and positive margin expansion,

notwithstanding the challenging market backdrop

-- Continued to strengthen competitive position through

execution of FISBE (Focus, Innovate, Simplify, Build, Execute)

strategy, notably:

o Over 90% of revenue now derived from chronic care categories;

entered the attractive wound biologics(1) segment and exited

non-core hospital care and related sales

o Good progress with three new product launches: GentleCath(TM)

Air for Men, InnovaMatrix(R) and Extended Wear Infusion Sets

o Significantly advanced our simplification and productivity

agenda, reducing adjusted G&A(2) spend to 8.9% of sales (2021:

11.7%)

o Refreshed Convatec masterbrand launched, including new

'forever caring' promise reflected in strengthened digital presence

and improved packaging

o Continued progress embedding 'Convatec Cares', our

Environmental, Social & Governance (ESG) framework

Key financial highlights

Reported results Adjusted(2) results

FY 2022 FY 2021 Change FY 2022 FY 2021 Change CC Change(3)

Revenue $2,073m $2,038m 1.7% $2,073m $2,038m 1.7% 6.9%

$ 404

Operating profit $207m $204m 1.8% m $362m 11.6% 12.2 %

Operating profit 19.5

margin 10.0% 10.0% - % 17.7% 1.8%pts -

Diluted earnings 13.0

per share 3.1 cents 5.8 cents (46.6)% 12.6 cents cents (3.1)% -

Dividend per share 6.047 5.871 3.0%

========== ========== ======== =========== ======== ======== =============

-- Good revenue growth: reported +1.7% with significant FX

headwind. +6.9% on a constant currency(3) basis and +5.6% on an

organic(4) basis

o Strong organic(4) growth in Advanced Wound Care and Infusion

Care, good organic growth in Ostomy Care and Continence &

Critical Care

o There was additional revenue from the acquisition in the wound

biologics(1) segment, which was partially offset by the hospital

care exit

-- Adjusted operating profit(2) : +11.6% and +12.2% on a

constant currency(3) basis despite significant COGS inflation of

8.6% in line with guidance. Reported operating profit +1.8%

-- Adjusted operating profit(2) margin was 19.5% (2021: 17.7%)

with price and mix improvement, G&A spend reduction and 80bps

FX tailwind more than offsetting inflation and continued organic

investment in commercial capabilities

-- Adjusted(2) diluted EPS was 3.1% lower, primarily because of

a significant increase in the effective book tax rate to 23.9%

(2021: 15.0%), compared to a cash tax rate of 15.7%. Reported

diluted EPS was down 46.6% primarily owing to higher adjusting

items mostly relating to the exit of hospital care and Triad

acquisition.

-- Strategic investments in acquisitions, higher capex to

support future growth and increased inventory to improve resilience

led to an increase in net debt(5) of $187 million.

-- Leverage(6) at year end of 2.1x (2021: 1.9x) was in line with guidance.

-- Increased final dividend of 4.330 cents proposed, giving

total dividend of 6.047 cents (2021: 5.871 cents)

2023 outlook

For 2023 we expect organic(4) revenue growth to be between 4.5 -

6%, consistent with our medium-term target shared at our Capital

Markets Event in November.

We remain focused on expanding our operating margin by growing

revenue, improving our mix/price and delivering on our

simplification and productivity agenda. Inflation is expected to

remain a significant headwind in 2023 with COGS inflation of 5-7%.

In addition we anticipate labour inflation in opex of 5-7% which is

approximately double that of 2022. On this basis, we expect modest

further improvement in the adjusted operating margin in 2023 to at

least 19.7% on a constant currency basis (3) .

Karim Bitar, Chief Executive Officer, commented:

" Convatec achieved good sales growth and, despite the

challenging market backdrop, delivered positive adjusted operating

margin expansion, ahead of guidance. Over the course of the year,

we continued to make progress with our FISBE strategy, launching

three new products and improving our competitive positions. The

resulting financial performance is further proof that Convatec is

pivoting to sustainable and profitable growth.

"We remain focused on executing our FISBE 2.0 strategy and are

confident in Convatec's growth prospects and ability to increase

its operating margin to the mid-20s over the medium term."

(1) Wound Biologics segment as defined by SmartTRAK. Includes

skin substitutes, active collagen dressings and topical drug

delivery

(2) Certain financial measures in this document, including

adjusted results above, are not prepared in accordance with

International Financial Reporting Standards ("IFRS"). All adjusted

measures are reconciled to the most directly comparable measure

prepared in accordance with IFRS in the Non-IFRS Financial

Information below (pages 41 to 46).

(3) Constant currency growth is calculated by applying the

applicable prior period average exchange rates to the Group's

actual performance in the respective period.

(4) Organic growth presents period over period growth at

constant currency, adjusted for: Triad Life Sciences (Mar'22), Cure

Medical (Mar'21) and Patient Care Medical (Dec'21) acquisitions;

Incontinence divestment (Dec'21) and, from 31(st) May 2022, the

discontinuation of hospital care, related industrial sales and

associated Russia operations.

(5) Net debt (excluding lease liabilities)

(6) Net debt(5) /adjusted EBITDA(2)

( 7) Market size and growth based on aggregate of category

estimates, internal analysis and publicly available sources,

including SmartTRAK and Global Industry Analysts Inc. reports.

Contacts

Analysts & Investors Kate Postans, Vice President of +44 (0) 7826 447807

Investor Relations & Corporate

Communications +44 (0) 7805 011046

Sheebani Chothani, Investor Relations ir@convatec.com

& Corporate Communications Manager

Buchanan: Charles Ryland / Chris

Media Lane +44 (0)207 466 5000

Investor and analyst presentation

The results presentation will be held in person at The

Auditorium, Chartered Accountants' Hall, One Moorgate Place, London

EC2R 6EA at 9.30am (UK time) today. The event will be

simultaneously webcast and the link can be found here .

The full text of this announcement and the presentation for the

analyst and investors meeting can be found on the 'Results, Reports

& Presentations' page of the Convatec website

www.convatecgroup.com/investors/reports .

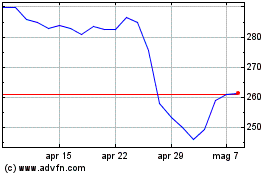

Forthcoming Events

AGM and Trading update (for 4 months) 18 May 2023

Interim Results 2 August

2023

Dividend calendar

Ex-dividend date* 6 April 2023

Dividend record date* 11 April

2023

Scrip dividend election date* 3 May 2023

Annual General Meeting 18 May 2023

Dividend payment date* 25 May 2023

* subject to approval at AGM.

About Convatec

Pioneering trusted medical solutions to improve the lives we

touch: Convatec is a global medical products and technologies

company, focused on solutions for the management of chronic

conditions, with leading positions in advanced wound care, ostomy

care, continence and critical care, and infusion care. With around

10,000 colleagues, we provide our products and services in almost

100 countries, united by a promise to be forever caring. Our

solutions provide a range of benefits, from infection prevention

and protection of at-risk skin, to improved patient outcomes and

reduced care costs. Group revenues in 2022 were over $2 billion.

The company is a constituent of the FTSE 100 Index (LSE:CTEC). To

learn more about Convatec, please visit

http://www.convatecgroup.com

Forward Looking Statements

This document includes certain forward-looking statements with

respect to the operations, performance and financial condition of

the Group. Forward-looking statements are generally identified by

the use of terms such as "believes", "estimates", "aims",

"anticipates", "expects", "intends", "plans", "predicts", "may",

"will", "could", "targets", continues", or their negatives or other

similar expressions. These forward-looking statements include all

matters that are not historical facts.

Forward-looking statements are necessarily based upon a number

of estimates and assumptions that, while considered reasonable by

the Company, are inherently subject to significant business,

economic and competitive uncertainties and contingencies that are

difficult to predict and many of which are outside the Group's

control. As such, no assurance can be given that such future

results, including guidance provided by the Group, will be

achieved. Forward-looking statements are not guarantees of future

performance and such uncertainties and contingencies, including the

factors set out in the "Principal Risks" section of the Strategic

Report in our Annual Report and Accounts, could cause the actual

results of operations, financial condition and liquidity, and the

development of the industry in which the Group operates, to differ

materially from the position expressed or implied in the

forward-looking statements set out in this document. Past

performance of the Group cannot be relied on as a guide to future

performance.

Forward-looking statements are based only on knowledge and

information available to the Group at the date of preparation of

this document and speak only as at the date of this document. The

Group and its directors, officers, employees, agents, affiliates

and advisers expressly disclaim any obligations to update any

forward-looking statements (except to the extent required by

applicable law or regulation).

Chief Executive's Review

Convatec continued to successfully execute its FISBE strategy,

strengthening its competitive position and delivering on our

forever caring promise for patients and customers. The various

strategic initiatives actioned during the period have enhanced the

quality of the business and improved our financial performance and

prospects.

Attractive growth prospects

Convatec operates in the structurally-growing, attractive

chronic care markets. We focus on four categories. These have a

combined market size (7) of $14 billion p.a. and market growth

rates (7) of between 4-8% p.a. We are leaders in the categories in

which we operate and expect to grow revenue in line with or faster

than each market.

We serve a diverse set of chronic care markets, producing

high-volume, high-quality consumables resulting in attractive

recurring revenues. This diversity provides resilience and

synergies, notably in areas such as: biomaterial sciences, product

and clinical development, automated manufacturing and shared supply

chain capabilities. Consistent with our FISBE strategy we have been

investing in our innovation pipeline, building mission-critical

capabilities, expanding capacity and increasing our resilience.

A chronic care focused business well positioned to deliver

sustainable and profitable growth

We continued to make progress executing our FISBE strategy,

thereby strengthening our competitive position and our ability to

consistently deliver sustainable and profitable growth.

Over the course of 2022, through acquisitions and exits, we

further focused the Group on chronic care categories - entering the

fast-growing wound biologics (1) segment while exiting our hospital

care business. Our continued focus on innovation has resulted in

three new products being launched (2021: one new launch), and the

R&D function has been strengthened by an increased emphasis on

intellectual property. We continue to invest in building core

capabilities. Our Centres of Excellence (in Marketing, Pricing and

Sales) are having a positive impact which, coupled with our

simplification and productivity agenda, are driving better

results.

The progress made under FISBE 1.0 has resulted in a stronger,

higher-quality business. Further details on the progress made under

each pillar can be found on pages 7 to 9. We hosted an Innovation

Day on 17 May 2022 and then a Capital Markets Event in November

where we outlined our refreshed strategy, FISBE 2.0. Details of

this next stage are set out below.

We delivered a strong financial performance

Group reported revenue of $2,073 million rose 1.7% (2021: $2,038

million). Adjusting for the significant FX headwind, revenue grew

6.9% on a constant currency (3) basis and 5.6% on an organic(4)

basis, slightly ahead of our initial guidance.

Adjusted operating profit(2) rose 11.6% and 12.2% on a constant

currency(3) basis despite significant COGS inflation of 8.6%.

Adjusted operating profit(2) margin was 19.5% (2021: 17.7%) with

mix/price, operations productivity, significant G&A spend

reduction and 80bps of foreign exchange tailwind more than

offsetting significant inflation and continued investment in

commercial capabilities.

Reported operating profit was broadly flat over the previous

year, as G&A savings were partially offset by higher operating

expenses arising from selling and distribution as well as costs

related to the exit of hospital care.

Adjusted diluted EPS(2) was down 3.1% with operating profit

growth more than offset by higher adjusted tax expenses and finance

expense from higher market interest rates.

Reported diluted EPS was down 46.6% impacted by higher adjusting

items mostly relating to the exit of hospital care and Triad

acquisition .

Capital expenditure during 2022 was $144.2 million as we

continued to invest for future growth, expanding our manufacturing

facilities in Infusion Care, beginning to increase the automation

at our production facilities and developing new digital

technologies to deliver enhanced customer experiences. We were able

to accelerate our plans, making good progress on several

significant projects, notably the expansion of capacity in Osted

and Reynosa for our Infusion Care business, and beginning to

increase automation at our Deeside wound care facility. We also

invested in acquiring intellectual property for our Ostomy Care

accessories portfolio.

Cash conversion was 55.6% (2021: 73.0%) primarily reflecting

increased capital expenditure and the strategic decision to build

inventory for resilience, coupled with the timing of receivables.

We expect phasing of some receivables to reverse in H1 2023 while

strategic capex investment and inventory will remain elevated in

2023.

Net debt(5) increased by $187 million after the acquisition of

Triad Life Sciences ($173 million) and investment in BlueWind

Medical ($31 million). Leverage(6) was 2.1x (2021: 1.9x) in line

with our guidance. We continue to target leverage(6) of 2x over

time but will be comfortable going up to c.2.5x for appropriate

M&A opportunities.

Revenue

Total Group revenue increased by 1.7 % on a reported basis to

$2,073 million. There was a significant FX headwind during the

period and on a constant currency (3) basis revenue rose 6.9% .

Given the largely reimbursed markets that we serve, there is

limited opportunity to pass on the significant inflation we have

seen in 2022. However, initiatives executed through our Pricing

Centre of Excellence (CoE) in collaboration with the business units

have successfully delivered positive price impact on revenue.

Adjusting for M&A and business restructuring (see footnote 4 on

page 2) Group revenue rose 5.6% on an organic (4) basis.

Twelve months ended 31 December

Reported Foreign Constant

growth Exchange Currency(3) Organic(4)

2022 2021 / (decline) impact growth growth

$m $m

Revenue by Category

Advanced Wound Care 621 592 4.8 % (7.9)% 12.7 % 6.8%

(4.5)

Ostomy Care 522 546 % (7.3)% 2.8 % 3.4 %

Continence and Critical

Care 546 543 0.6% (2.0)% 2.6 % 3. 6 %

Infusion Care 384 357 7.5 % (2.7)% 10.2 % 9.8 %

------------------------- ------ ------ ------------- ---------- ----------------- ------------

Total 2,073 2,038 1.7 % (5.2)% 6.9 % 5.6 %

========================= ====== ====== ============= ========== ================= ============

Advanced Wound Care (AWC)

During 2022, the business achieved strong growth in GEM and

Europe which more than offset a decline in North America where our

limited position in the foam segment and lower surgical volumes

continued to weigh on performance. As a result, the business saw

overall growth across all segments globally.

Revenue of $621 million increased 4.8% on a reported basis or

12.7% on a constant currency(3) basis. This performance reflected

the acquisition of Triad Life Sciences, now known as Advanced

Tissue Technologies (ATT) which generated $35 million of revenue.

On an organic(4) basis revenue rose by 6.8%.

We made continued strategic progress in AWC during the period.

In March 2022, we strengthened our position with our entry into the

wound biologics (1) segment through the acquisition of Triad Life

Sciences. Our commercial execution continued to improve, as we

leveraged our common Customer Relationship Management (CRM)

platform in North America and Europe. ConvaFoam was cleared for

launch at the end of 2022 and began the US roll out in early 2023,

which will strengthen our competitive position in the large and

rapidly growing foam segment.

In 2023 we will focus on:

-- Successfully launching ConvaFoam in the US and preparing for

a European launch in 2024; driving development of ConvaVac and

preparing to launch in 2024

-- Growing the InnovaMatrix(TM) platform in the US and developing the product outside the US.

-- Continuing to strengthen commercial execution globally

Ostomy Care (OC)

Under the new leadership of Bruno Pinheiro, our OC business

continued to make good strategic progress during 2022. He and the

team increased the focus on driving an improved experience across

the continuum of care. The highly-rated Home Services Group is

helping to grow the number of new US ostomy patients, while in

Europe, during the year, we launched new digital services to

support both health care professionals and patients better.

Revenue of $522 million declined 4.5% on a reported basis but

increased 2.8% on a constant currency(3) basis and 3.4% on an

organic(4) basis.

The business achieved continued strong growth in GEM,

particularly in Latin America and China, while Europe achieved a

robust performance with some pricing initiatives helping to offset

the continued planned rationalisation of lower-margin non-Convatec

products at Amcare UK. In North America, new patient starts

remained stable, supported by HSG ostomy sales.

Overall, we have continued to improve our mix and expand our

margins. We saw good demand for Convatec products, for example our

accessories sales saw strong growth in 2022, following the relaunch

of the Esenta brand. Across all geographies, revenue from Convatec

ostomy products grew 5.5% on an organic basis.

In 2023 we will focus on:

-- Driving new patient starts and continuing collaboration with HSG

-- Improving consistency of commercial execution across the continuum of care

-- Preparing to launch Esteem 2.0 in H1 2024

Continence & Critical Care (CCC)

Revenue of $546 million rose 0.6% on a reported basis, 2.6% on a

constant currency(3) basis and 3.6% on an organic(4) basis. A good

operating performance in Continence Care was supported by

contributions from the Cure Medical and Patient Care Medical

acquisitions, as well as an improving pricing environment in North

America.

Continence Care achieved revenue of $409 million in 2022, up

5.0% on an organic(4) basis, with continued strength in new patient

starts and high customer retention. This was complemented by good

demand for our Cure and GentleCath(TM) portfolios in the US and

Latin America, and our developing presence in France and the UK

following the launch of the GentleCath(TM) Air for Men compact

catheter.

During 2022 the strategic decision was taken to exit hospital

care and related industrial sales. The hospital care activities,

reported as part of CCC, generated $72 million of revenue in 2022

(2021: $79 million). From 31 May, when we closed the Belarus

factory, revenue has been excluded from organic(4) calculations.

The related industrial sales, reported as part of IC, generated $26

million of revenue in 2022 (2021: $22 million).

Critical Care revenue of $137 million declined 1.3% on an

organic(4) basis with Flexi-Seal(TM) , which remains in the Group

portfolio, declining following strong COVID-19 impacted

comparatives.

In 2023 Continence Care will focus on:

-- Continuing to drive US growth via

o Exceptional service,

o Both Cure Medical and GentleCath(TM) portfolios (including the

new GC Air for Men)

-- Expanding in Europe and Global Emerging Markets

-- Preparing to launch GentleCath(TM) Air for Women in late 2023/early 2024

From 2023 onwards, Flexi-Seal(TM) (2022 revenue: $66 million),

our faecal management system, will move from Critical Care to

Ostomy Care. The remaining industrial sales, predominantly

continence related supplies for B2B customers (2022 revenue: $17

million), will move from Infusion Care into Continence Care. Going

forward the CCC category will be renamed Continence Care and we

will restate comparatives.

Infusion Care (IC)

Our Infusion Care business continued to strengthen in 2022. To

respond to the underlying demand for automated insulin delivery

systems and their accessories, during 2022, we built additional

capacity at our Osted, Denmark and Reynosa, Mexico plants. We

continued to innovate, launching our MioAdvance Extended Wear

Infusion Sets (EWIS) in the US, and are diversifying our customer

base by growing applications outside of diabetes, such as

Parkinson's.

Revenue of $384 million increased 7.5% on a reported basis,

10.2% on a constant currency (3) basis and 9.8% on an organic (4)

basis. The difference between constant currency and organic growth

was due to the impact of the industrial sales exit. This strong

growth was primarily driven by continued demand for our infusion

sets used by diabetic patients. Growth was also supported by

increasing demand for differentiated infusion sets for alternative

therapies, such as pain management, albeit off a small base.

In 2023 we will focus on:

-- Scaling up production of MioAdvance EWIS

-- Expanding the usage of infusion sets for the delivery of

other subcutaneous therapies, including launching with AbbVie, once

regulatory approval is received for their Parkinson's drug

therapy

-- Successfully launching a tailored infusion set for Tandem

Mobi once regulatory approval is received

Delivering continued strategic progress

The execution of our FISBE strategy is progressing well. We

continue to make progress in each of the five pillars as we drive

towards our vision of pioneering trusted medical solutions to

improve the lives we touch. In November, at our Capital Markets

Event, we announced that in 2023 our strategy will evolve to FISBE

2.0.

Focus

We further reshaped the business to focus on our four chronic

care categories through bolt-on acquisitions, notably the Triad

Life Sciences acquisition which gives us a foothold in the

important wound biologics(1) segment. This, coupled with the

withdrawal from non-core hospital care activities and related

industrial sales, means that over 90% of our revenue now comes from

chronic care markets.

We continued to focus and invest in our 12 key markets which

cumulatively delivered constant currency (3) revenue growth of

9.6%, ahead of the overall group growth.

Looking ahead to 2023, with FISBE 2.0, we will become even more

focused on strengthening customer loyalty in our key markets and

categories, measuring and tracking our net promoter scores. We will

continue to invest in the US and China, our most important markets

and continue to evaluate appropriate bolt-on M&A opportunities

to further strengthen the business in our core categories.

Innovate

Innovation remains at the heart of our business. We have made

significant progress advancing our pipeline and strengthened our

Technology & Innovation capabilities. The R&D expenditure

for the year increased 3.7% on a constant currency basis. On a

reported basis R&D expenditure was $92 million (2021: $95

million), and additional capital expenditure of $14 million was

incurred over the period. We invested a further $10 million in

Intellectual Property licenses relating to accessories products,

accounted for as capital expenditure.

We began launching three new products during 2022, a step up

from our historical level:

- ATT's porcine placenta-derived extracellular matrix product,

InnovaMatrix(TM) , in the US, which has contributed meaningfully to

the growth in AWC during 2022

- GentleCath(TM) Air for Men, our new hydrophilic compact male

catheter (utilising our proprietary FeelClean(TM) Technology),

began rolling-out in France and the UK, with plans to roll out in

the US and other key markets in 2023, and has been well

received

- The Extended Wear Infusion Set (EWIS), our innovative

seven-day wear technology improving value and use to customers

whilst also reducing its environmental impact, available in Europe

and now the US

It is by continually refreshing our product portfolio and

ensuring it is differentiated that we can deliver sustained and

profitable growth over time.

In addition, we acquired a minority stake in BlueWind Medical

Ltd, the developer of an innovative implantable tibial

neuromodulation device for the over-active bladder segment,

securing a relationship with a company developing a proprietary and

differentiated solution to treat over-active bladders in the

continence space.

We have also made progress on product sustainability as it

relates to technology & innovation, part of our wider ESG

agenda. Green Design Guidelines are an important part of our

development process, and we are systematically examining the

environmental footprint of our solutions and considering ways to

reduce waste.

We are developing a much richer longer-term pipeline, as

mentioned at the Capital Markets Day, and have further visibility

on product launches - for example, we're already working on the

next generation hydrofiber (R) technology platform.

We continue to pursue our R&D without walls approach; as

well as driving organic projects we will pursue inorganic activity.

We will continue leveraging the IDEAL process, launched in 2021,

and are seeking to improve cycle time. Our goal is to more

frequently refresh our portfolio to provide an improved customer

experience. This deeper and broader innovation pipeline will

underpin our growth in the future. To measure progress against this

ambition we are targeting that by the end of 2025, 30% of our

revenue will be generated from new products launched in the

previous five years.

In 2023, we will continue to strengthen our product pipeline,

innovation capabilities and improve our cycle time. In AWC we began

the US roll out of ConvaFoam in January 2023, which will strengthen

our competitive position in the large foam segment. We intend to

roll-out ATT's new products, InnovaBurn(TM) and InnovaMatrix(TM)

PD, for which we have already received clearance. In CC, we will be

preparing for the launch of GentleCath(TM) Air for Women in late

2023/early 2024, ahead of schedule, whilst in IC, during 2023, we

expect to launch tailored infusion sets for Tandem's new Mobi

hybrid micro-pump and for AbbVie's Parkinson's therapy, both of

which are subject to regulatory approval. The other major new

products are progressing well. The Esteem 2.0 ostomy product and

AWC's ConvaVac are expected to launch in 2024.

Simplify

We made significant progress on our simplification and

productivity agenda in 2022. Adjusted G&A expenditure was

reduced by 22.2% to $185 million, down 16.4% on a constant currency

(3) basis, or 8.9% of sales (2021: 11.7%) as positive progress with

initiatives brought forward benefits. We transitioned more finance

and IT activities to our Global Business Services (GBS) centres in

Lisbon and Bogota. 2022 was the first complete year of GBS activity

and we have started to see early benefits of standardised processes

and automation, lowering finance and IT costs. An increasing number

of activities are also now being resourced by internal talent, thus

reducing spend on external consultants. The foundations are now in

place to build additional in-house expertise to further streamline

processes and reduce additional spend.

During 2022 we also initiated a review of our facilities

footprint and are in the process of closing some underutilised

offices, replacing them with flexible working alternatives which

will improve our colleagues' experience.

In 2023, as part of FISBE 2.0, we will look to improve

productivity further across the organisation, reducing low value

activity and driving economies of scale. On the commercial front we

will leverage the Salesforce CoE and our CRM system more broadly

across the organisation. In quality and operations, we will

increase automation and drive our continuous improvement agenda. In

G&A we will expand the scope of GBS and build more end-to-end

processes. For example, we have started our HR transformation,

which will see us leverage central processes such as payroll,

training and onboarding transitioning to GBS.

Build

We strengthened the Convatec Executive Leadership Team (CELT)

during 2022. Jonny Mason joined us as CFO of the Group during Q1,

while Kjersti Grimsrud took over leadership of our Infusion Care

business and consequently Seth Segel added Continence Care to his

existing HSG responsibilities. Anne Belcher joined the Group from

GSK to lead our Global Emerging Markets business and Bruno

Pinheiro, who led our successful LATAM business before acting as

Interim President for GEM, took over Ostomy Care. John Haller

joined us as EVP, Chief Quality and Operations Officer, having

previously been at Stryker Corporation.

We developed and embedded our Pricing CoE, which in

collaboration with our business units, achieved 50 bps of pricing

improvement on gross margin over the period.

Our refreshed brand and new company promise of 'forever caring'

was launched in May. It has been well received by customers and

HCPs. In the second half of the year we rolled-out new websites and

social media digital interfaces reflecting the refreshed brand

across all of our focus markets.

Our Salesforce CoE has now established a single CRM platform in

North America and Europe, and we have begun rolling it out across

GEM. This is driving enhanced salesforce productivity by increasing

call rates and improving account targeting.

Going forward we will leverage the Marketing CoE more broadly

across the Group and build new capabilities, particularly focused

on customer experience and measurement of Net Promoter Scores.

Culture is a critical element in building high performing teams

and creating a motivating work environment. Results from our latest

Organisational Health Index (OHI) survey were strong, sustaining

our top performance from 2020. We will continue to cultivate

talent, recognise colleagues and focus on Diversity, Equity &

Inclusion (DE&I) and Wellbeing over the next year.

Execute

We continue to execute well on our strategic initiatives,

following a consistent methodology that identifies metrics and

tracks milestones regularly.

We delivered positive manufacturing productivity improvements in

the face of significant COGS inflation and continued to improve the

resilience of the supply chain. We are committed to sustaining our

strong safety record while improving the quality of our products

and services for our customers. Complaints per million decreased by

13% over the period.

One year on since launching 'Convatec Cares', our refreshed

Environmental, Social & Governance (ESG) approach, we have made

good progress integrating ESG practices across our business and

value chain:

o Elevated ESG through our strategic planning process and

engaging all business units and functional areas on priorities,

targets and commitments

o Emissions reduction: In line with our net zero commitment, we

reduced Scope 1 and Scope 2 greenhouse gas emissions by 32% in

2022. We are on track to validate our Scope 1, 2 and 3 (near term)

Science Based Targets in 2023. Our manufacturing sites increasingly

use renewable electricity, and we expect that to reach 100% by the

end of 2023

o Progress in DE&I and Wellbeing approach where now 36% of

our CELT are women, 40% of our Board are women, and we are on track

to ensure 40% of our senior management (CELT member plus their

direct reports) are women by the end of 2024

o Elevated our focus on supply chain sustainability , improving

the average EcoVadis score of our suppliers by 6.5%

o We committed more than $2 million in both product and cash

donations in 2022, including a humanitarian relief response for

Ukraine valued at over $1.5 million. This year, we've also

committed more than $100k in response to the earthquakes in Turkey

and Syria in both product and cash donations.

We announced today a new $2 million health partnership with

Partners In Health (PIH), a leading international NGO focused on

building equitable health systems globally. The innovative

partnership expands recruitment and support of Community Health

Workers and improves their training on chronic conditions. Living

in the communities where they work, Community Health Workers are

trusted neighbours who are able to provide high-quality health

services. Over three years, Convatec's support - through cash,

product donation and training - will enable PIH to reach over

250,000 children and adults, with a particular focus on programmes

in Mexico, Peru and the United States.

Dividend

The Board is pleased to recommend a 3.0% increase in the full

year dividend reflecting the improved underlying performance of the

business and confidence in its future growth prospects. This

equates to a proposed final dividend of 4.330 cents to bring FY

dividend to 6.047 cents (2021: 5.871 cents).

Group 2023 outlook

We are pleased with the growth we achieved in 2022 and are

focused on pivoting to sustainable and profitable growth.

We expect organic(4) revenue growth to be between 4.5 - 6%,

consistent with our medium-term target shared at our Capital

Markets Event in November. Growth will be H2 weighted because of

stronger comparatives in H1 2022, especially in Infusion Care, and

because ATT will contribute to organic growth following the

anniversary of the acquisition.

The reported revenue will be impacted by the exit of hospital

care and related sales, which generated $102 million in 2022.

We remain focused on expanding our operating margin by growing

revenue, improving our mix/price and delivering on our

simplification and productivity agenda. Inflation is expected to

remain a significant headwind in 2023 with COGS inflation of 5-7%.

In addition we anticipate labour inflation in opex of 5-7% which is

approximately double that of 2022. On this basis, we expect modest

improvement in the adjusted operating margin in 2023 to at least

19.7% on a constant currency (3) basis. Furthermore, our

medium-term target of mid-20s operating margin remains

unchanged.

Based on current interest rates, we expect adjusted net finance

expense for the full year to be $70-80 million. The cash tax rate

for the year is expected to be around 19%, while the adjusted book

tax rate is expected to be approximately 25%. Capex will remain

elevated at around $120-140 million for the full year reflecting

the continued growth investments we are making across the Group and

we intend to increase inventory by c.$20 million to further

strengthen supply chain resilience.

We are confident about the future prospects for the Group as we

continue to pivot to sustainable and profitable growth.

Principal risks

The Board reviews and agrees our principal risks on a bi --

annual basis, taking account of our risk appetite together with our

evolving strategy, current business environment and any emerging

risks that could impact the business. Our system of risk management

and internal control continues to develop and updates to the

principal risks and mitigation plans are made as required in

response to changes in our risk landscape. Details of our

enterprise risk management framework will be set out in the Group's

2022 Annual Report and Accounts to be published later in the

month.

The Board has reviewed the principal risks as at 31 December

2022 and made a number of changes to reflect our assessment of

their movement from those identified in 2021, the effect on the

Group, our evolving strategy and the current business environment.

The principal risks have been assessed against the context of the

global inflationary cost pressures that are continuing to impact

all businesses at present. The overall profile for the risks set

out below remains largely unchanged over the financial year in

terms of their potential impact on our ability to successfully

deliver on our strategy:

-- Operational Resilience and Quality;

-- Information Systems, Security and Privacy;

-- Customer and Markets;

-- Legal and Compliance;

-- Strategy and Change Management;

-- Environment and Communities; and,

-- Tax and Treasury.

The risk landscape, however, has changed for the following

principal risks, since the publication of the 2021 Annual Report

and Accounts:

-- Innovation and Regulatory -- has reduced in risk level

following the delivery of three key new products, the increased

robustness of our development pipeline and the continued delivery

of the EU-MDR compliance programme.

-- Political and Economic Environment - has been elevated

reflecting the continuing global inflationary pressure challenges

on all aspects of the business cost base, as well as ongoing global

supply chain constraints.

-- People - has increased as we see rising cost of living

pressures for our workforce and increased competition for talent

across our markets, which could impact our ability to attract,

recruit and retain key talent and skills.

The Board assesses the overall risk profile of the Group to

ensure it is within our risk appetite. In making this assessment

the Board considered the continued upward pressure from the

macro-economic environment and broader risk landscape (including

the ongoing supply chain and commercial impact of the war in

Ukraine and the fallout from the pandemic) on the business

environment and any continued or additional impact on the Group's

business and principal risks, coupled with the controls and

mitigations in place to address these challenges. In the main, as

our processes and risk mitigations further develop and mature, we

have continued to manage the challenges facing the wider business

landscape and build further resilience into our operations.

Principal risks continue to be appropriately mitigated and work

continues to reduce the net exposure to the business to ensure that

each risk remains within our risk appetite.

Financial review

We made good progress in 2022 in executing or FISBE strategy and

demonstrated that we are pivoting to sustainable and profitable

growth. Revenue grew by 1.7% on a reported basis and 6.9% on a

constant currency basis. We delivered an adjusted operating profit

margin of 19.5%, representing expansion of 180bps over the previous

year with mix/price, operations productivity, significant G&A

spend reduction and 80bps of foreign exchange tailwind more than

offsetting significant inflation and continued investment in

commercial capabilities.

Adjusted basic earnings per share reduced year-on year primarily

due to adjusted operating profit growth being more than offset by

increases in adjusted net finance, non-operating and income tax

expenses. These are explained in further detail on page 13.

The competitive position of the Group was further strengthened

during the year, entering the attractive wound biologics(1) segment

through our acquisition of Triad Life Sciences whilst exiting the

lower-margin and lower-growth hospital care and industrial sales

activities. We also made good progress with our simplification and

productivity initiatives, most notably reducing G&A spend in

the year.

In November 2022, we successfully refinanced our bank facilities

with $1.2 billion committed for five years at slightly improved

margins over base rates compared to the previous facilities. The

Group's $500.0 million senior unsecured notes remain in place and

are committed until 2029. The Group's financial prospects are

attractive, and we have confidence in our ability, over the medium

term, to deliver sustainable annual mid-single-digit organic

revenue growth and to expand our adjusted operating profit margin

into the mid-20s.

1. Wound biologics segment as defined by SmartTRAK. Includes

skin substitutes, active collagen dressings and topical drug

delivery.

Reported and Adjusted results

The Group's financial performance, measured in accordance with

IFRS, is set out in the Financial Statements and Notes thereto on

pages 21 to 40 and referred to in this Annual Report as "reported"

measures.

The commentary in this Financial review includes discussion of

the Group's reported results and alternative performance measures

(or adjusted measures) ('APMs'). Management and the Board use APMs

as meaningful measures in monitoring the underlying performance of

the business. These measures are disclosed in accordance with the

ESMA guidelines and are explained and reconciled to the most

directly comparable reported measures prepared in accordance with

IFRS on pages 41 to 46.

Constant Currency Growth

Management and the Board review revenue on a constant currency

basis which removes the effect of fluctuations in exchange rates to

focus on the underlying revenue performance. Constant currency

information is calculated by applying the applicable prior period

average exchange rates to the Group's reported revenue performance

in the current period. Revenue and the revenue growth on a constant

currency basis are non-IFRS financial measures and should not be

viewed as replacements of IFRS reported revenue.

Group financial performance

Reported Reported Adjusted(1) Adjusted(1)

2022 2021 2022 2021

$m $m $m $m

---------------------------------- -------- -------- ----------- -----------

Revenue 2,072.5 2,038.3 2,072.5 2,038.3

-----------

Gross profit 1,103.9 1,123.1 1,245.6 1,233.3

---------------------------------- -------- -------- ----------- -----------

Operating profit 207.3 203.6 403.7 361.7

---------------------------------- -------- -------- ----------- -----------

Profit before income taxes 81.9 151.3 337.6 309.4

---------------------------------- -------- -------- ----------- -----------

Net profit 62.9 117.6 256.8 263.0

---------------------------------- -------- -------- ----------- -----------

Basic earnings per share (cents

per share) 3.1c 5.9c 12.7c 13.1c

---------------------------------- -------- -------- ----------- -----------

Diluted earnings per share (cents

per share) 3.1c 5.8c 12.6c 13.0c

---------------------------------- -------- -------- ----------- -----------

Dividend per share (cents) 6.047c 5.871c

---------------------------------- -------- -------- ----------- -----------

1. These non-IFRS financial measures are explained and

reconciled to the most directly comparable financial measures

prepared in accordance with IFRS on pages 41 to 46.

Revenue

Group revenue for the year ended 31 December 2022 of $2,072.5

million (2021: $2,038.3 million) increased 1.7% year-on-year on a

reported basis or 6.9% on a constant currency basis.

The Group experienced significant foreign exchange headwinds of

5.2% on its reported revenue growth. The majority of the Group's

2022 revenue was denominated in US Dollar (52%), however there are

other significant currencies in which revenue is denominated,

notably EUR (20%), GBP (6%) and DKK (2%). These currencies

depreciated significantly against the US Dollar during the

year.

Adjusting for the foreign exchange headwind and acquisition and

divestiture-related activities(1) , Group revenue grew by 5.6% on

an organic basis. This was driven by continued strong growth in

Advanced Wound Care and Infusion Care, with good growth seen in

Ostomy Care and Continence & Critical Care. Given the largely

reimbursed markets that we serve, there was limited opportunity to

pass on the significant inflation we have seen in 2022. However,

initiatives executed through our Pricing Centre of Excellence have

successfully delivered positive price impact on revenue. Further

detail of the Group's revenue is discussed above on pages 5 to 6

.

1. Acquisitions were Triad Life Sciences in 2022 and Cure

Medical and Patient Care Medical in 2021. Divestiture-related

activities in 2022 were the discontinuation of hospital care,

related industrial sales and associated Russia operations , whilst

in 2021 it was the divestment of incontinence activities .

Revenue impact of strategic exits during 2022

The strategic exit of hospital care and industrial sales will

impact revenues as we move into 2023. The table below shows the

2022 revenue attributable to these activities. The ongoing

activities are more focused on higher-margin and higher-growth

chronic-care categories.

2022 revenue

from ongoing

2022 reported Impact (1) activities

$m $m $m

--------------------------- ------------- ---------- -------------

Advanced Wound Care 620.7 - 620.7

Ostomy Care 522.1 (4.9) 517.2

Continence & Critical Care 546.3 (71.8) 474.5

Infusion Care 383.4 (25.6) 357.8

--------------------------- ------------- ---------- -------------

Total 2,072.5 (102.3) 1,970.2

--------------------------- ------------- ---------- -------------

1. Sales related to discontinuation from hospital care, related

industrial sales and associated Russia operations.

Reported net profit

Reported operating profit was $207.3 million, an increase of

$3.7 million to the prior year. Reported gross margin decreased

year-on-year from 55.1% to 53.3%, driven by inflationary headwinds

on raw materials and freight. The reported gross margin was also

impacted by increases in one-time divestiture and termination costs

(primarily relating to the exit from hospital care and industrial

sales activities) of $21.4 million and the release of the fair

value uplift of inventory arising from the acquisition of Triad

Life Sciences of $8.7 million. These were partly offset by foreign

exchange tailwinds and mix/price benefits.

Reported operating expenses decreased by $22.9 million, which

was primarily due to a reduction of $70.4 million in general and

administrative expenses partly offset by increases in selling and

distribution expenses of $36.2 million and other operating expenses

of $13.8 million. The improvement in G&A reflected the Group's

increasing focus on simplifying its global processes and improving

productivity. The increase in selling and distribution expenses was

primarily driven by increases in headcount associated with higher

revenue, the inclusion of acquired businesses and inflationary

impacts on distribution costs. Other operating expenses of $13.8

million (2021: nil) largely reflected impairments arising from the

exit from hospital care and related industrial sales activities in

2022.

Reported net finance costs and non-operating expenses totalled

$125.4 million (2021: $52.3 million). Reported net finance costs

increased by $24.2 million to $67.7 million, reflecting an

additional $8.6 million of net finance expenses and $15.6 million

(2021: nil) for the unwind of discount relating to the contingent

consideration arising from the acquisitions of Cure Medical in 2021

and Triad Life Sciences in 2022. Reported non-operating expenses of

$57.7 million (2021: $8.8 million) principally arose from the

remeasurement charges in the year relating to the contingent

consideration payable in respect of the Cure Medical and Triad Life

Sciences acquisitions of $29.5 million (2021: nil), foreign

exchange losses of $14.2 million (2021: loss of $9.3 million), the

recycling of cumulative translation losses from reserves following

the closure activities associated with the hospital care and

industrial sales exit of $12.2 million (2021: nil) and a loss on

divestiture related activities of $2.0 million (2021: $0.5 million

gain).

After income tax expense of $19.0 million (2021: $33.7 million),

reported net profit was $62.9 million (2021: $117.6 million)

generating basic earnings per share of 3.1 cents (2021: 5.9

cents).

Adjusted net profit

Adjusted gross profit increased by 1.0% to $1,245.6 million

(2021: $1,233.3 million). The adjusted gross margin of 60.1% was

broadly flat to the previous year (2021: 60.5%), with the

significant inflationary pressures on both raw materials and

freight costs partly offset by foreign exchange tailwinds and

mix/price benefits.

The Group achieved adjusted operating profit of $403.7 million

(2021: $361.7 million) with an adjusted operating profit margin of

19.5% (2021: 17.7%). There was a decrease in operating expenses in

the year, with adjusted G&A reduced by $52.8 million, to 8.9%

of revenue (2021: 11.7%). This was partially offset by an increase

of $25.7 million in adjusted selling and distribution expenses.

Adjusted net profit fell 2.4% to $256.8 million (2021: $263.0

million) given the $8.6 million increase in adjusted net finance

expense from higher market interest rates coupled with a $34.4

million increase in the adjusted income tax expense (which is

explained below).

Adjusted basic and diluted EPS were 12.7 cents and 12.6 cents

respectively (2021: 13.1 cents and 13.0 cents), calculated on the

basic weighted average ordinary shares of 2,024 million shares

(2021: 2,009 million shares) and 2,040 million diluted shares

(2021: 2,026 million) respectively.

Taxation and tax strategy

Reported Reported Adjusted(1) Adjusted(1)

2022 2021 2022 2021

$m $m $m $m

--------------------------- -------- -------- ----------- -----------

Profit before income taxes 81.9 151.3 337.6 309.4

Income tax expense (19.0) (33.7) (80.8) (46.4)

Effective tax rate 23.2% 22.3% 23.9% 15.0%

--------------------------- -------- -------- ----------- -----------

1. These non-IFRS financial measures are explained and

reconciled to the most directly comparable financial measure

prepared in accordance with IFRS on pages 41 to 46.

The Group's reported income tax expense was $19.0 million (2021:

$33.7 million). The Group's reported effective tax rate of 23.2%

for the year was higher than the prior year (2021: 22.3%) mainly

due to the increase in US tax expenses following the acquisition of

Triad Life Sciences and non-deductible contingent consideration

relating to the acquisition of both Triad Life Sciences and Cure

Medical, partially offset by the recognition of deferred tax assets

for previously unrecognised tax losses of $20.1 million in the US

(2021: $6.8 million related to recognition of deferred tax assets

following the acquisition of Cure Medical). For further

information, see Note 6 - Income taxes to the Financial

Statements.

After adjusting items, the adjusted effective tax rate was 23.9%

(2021: 15.0%). The increase in adjusted effective tax rate was

principally driven by the non-cash deferred tax expenses due to the

utilisation of US Federal tax losses which are now fully recognised

as deferred tax assets following the acquisition of Triad Life

Sciences, based on stronger future taxable profitability forecasts,

and the impact of profit mix between jurisdictions in which the

Group has a taxable presence. The adjusted effective tax rate of

23.9% was in line with guidance provided in the interim results for

the period ended 30 June 2022.

In 2021, the adjusted effective tax rate of 15.0% was

principally because of the lower incidence of taxes in the US, and

a net tax benefit in the UK for additional tax reliefs claimed in

respect of prior years. These factors were partially offset by the

impact of profit mix between jurisdictions in which the Group has a

taxable presence. Strategy has been published, which is available

on the corporate website

(www.convatecgroup.com/corporate-responsibility/socio-economic-contribution/tax-statement).

Convatec is a responsible business and promotes the highest

standards of compliance and ethical behaviour. Management takes a

responsible attitude to tax, recognising that it affects all of our

stakeholders. The Group had on average more than 10,000 employees

worldwide during 2022 and operated in over 100 countries through

direct sales and local distributors. As a result, our business

activities generated a substantial amount of taxes. These included

both corporate income taxes and non-income taxes such as payroll

taxes, property taxes, VAT/Sales & Use taxes, and other taxes.

In order to provide transparency on the Group's approach to tax,

the Global Tax Strategy has been published, which is available on

the corporate website (

www.convatecgroup.com/corporate-responsibility/socio-economic-contribution/tax-statement

).

Alternative performance measures ("APMs")

In line with the Group's APM policy, the following adjustments

were made to derive adjusted operating profit and adjusted profit

before tax.

Non-operating

Operating profit Finance expense expense

$'m $'m $'m

2022 2021 2022 2021 2022 2021

------------------------------ -------- -------- -------- ------- -------- -----

Reported 207.3 203.6 (67.7) (43.5) (57.7) (8.8)

Amortisation of acquired

intangibles 131.3 130.4 - - - -

Acquisitions and divestitures 56.6 17.8 15.6 - 43.7 -

Termination benefits and

related costs 7.1 4.3 - - - -

Impairment of assets 1.4 - - - - -

Litigation expenses - 5.6 - - - -

------------------------------ -------- -------- -------- ------- -------- -----

Adjusted 403.7 361.7 (52.1) (43.5) (14.0) (8.8)

------------------------------ -------- -------- -------- ------- -------- -----

Adjustments made to derive adjusted operating profit in 2022

included the amortisation of acquired intangibles of $131.3 million

(2021: $130.4 million), of which $93.0 million (2021: $96.8

million) resulted from intangible assets arising from the spin-out

from Bristol-Myers Squibb in 2008 and will be fully amortised by

December 2026, divestiture-related costs of $39.7 million

principally related to the exit from the hospital care and

industrial sales activities and acquisition-related costs of $16.9

million primarily related to the acquisition of Triad Life

Sciences. Termination costs of $7.1 million were in respect of the

exit from hospital care and industrial sales activities and an

impairment charge of $1.4 million related to a legacy

acquisition-related customer relationship asset.

In 2021, acquisition and divestiture costs of $17.8 million

related to potential and actual strategic transactions which were

executed, aborted or in-flight and sought to improve the strategic

positioning on the Group. Termination costs of $4.3 million were in

respect of the Group's Transformation Initiative whilst litigation

expenses of $5.6 million related to a one-off claim that was also

settled in 2021.

The adjustment of $15.6 million made to derive adjusted finance

expenses in 2022 wholly related to the discount unwind in respect

of the contingent consideration payable on the Triad Life Sciences

and Cure Medical acquisitions.

Adjustments made to derive adjusted non-operating expenses in

2022 included remeasurement charges of $29.5 million in respect of

the contingent consideration payable on the Triad Life Sciences and

Cure Medical acquisitions and divestiture-related costs of $14.2

million principally related to cumulative translation adjustments

and a loss on disposal from the exit of the hospital care and

industrial sales activities.

Of the total of $255.7 million of adjusting items in the year,

$244.6 million were non-cash items. For further information on

Non-IFRS financial information, see pages 41 to 46.

The Board, through the Audit and Risk Committee, continuously

reviews the Group's APM policy to ensure that it remains

appropriate and represents the way in which the performance of the

Group is managed.

Strategic transformation

During 2022, the Group completed the first phase of its FISBE

strategy ('FISBE 1.0'), a global multi-year transformation

programme which commenced in 2019. FISBE 1.0 started to position

the Group for sustainable and profitable growth and in 2022, we saw

improved organic revenue growth performance and adjusted operating

profit margin growth. Transformation costs associated with FISBE

1.0, treated as an adjusting item, were minimal in 2022 (2021: $4.3

million).

FISBE 1.0 strengthened the Group, with the business becoming

more focused on chronic care, developing a deeper and broader

innovation pipeline, notably delivering three new product launches

during 2022, and improving commercial and operational execution,

for example the significant reduction in complaints per million

across the past three years.

The Group has explored and executed acquisitions and

divestitures to strengthen the strategic positioning of the Group

and increase its focus on the four key categories. During 2022,

this included the acquisition of Triad Life Sciences, the equity

investment in the preference shares of BlueWind Medical Ltd

(BlueWind Medical), the strategic decision to withdraw from

hospital care activities and related industrial sales as announced

on 12 May 2022 and other potential transactions. Further details

are provided in Note 8 - Investment in financial assets, Note 9 -

Acquisitions, Note 10 - Divestitures and the Non-IFRS financial

information section to the Financial Statements.

As announced at the Capital Markets Event on 17 November 2022,

following the completion of FISBE 1.0, our strategy is now evolving

to deliver the pivot ('FISBE 2.0'). This is discussed further on

pages 7 to 9. Medium-term targets associated with FISBE 2.0 include

delivering sustainable mid-single-digit organic revenue growth per

annum and expanding the adjusted operating margin into the mid-20s.

This is to be delivered through simplification and productivity

initiatives, improving the product margin mix and operating

leverage. Furthermore, there may be potential M&A opportunities

to further strengthen the Group. The outcome of delivering on these

targets will be sustainable and profitable growth with double-digit

adjusted EPS and adjusted free cash flow compound annual growth

over the medium term.

Acquisitions and investments

As noted above, in line with our strategic transformation and

consistent with the "Focus" pillar of FISBE (see page 7), we

acquired Triad Life Sciences, a US based medical device company on

14 March 2022 for an initial consideration of $125.3 million. The

acquisition of Triad Life Sciences strengthens the Group's Advanced

Wound Care position in the US, securing access to a complementary

and innovative technology platform that enhances advanced wound

management and patient outcomes. In addition to the initial

consideration, there is further contingent consideration payable of

up to $325.0 million, based on the achievement of two short-term

milestones (totalling $50.0 million) and sales performance during

the first two years post-completion (maximum earnout of $275.0

million based on stretching financial performance over the period).

The two short-term milestones were successfully achieved in 2022,

resulting in $50.0 million being paid during the year. Based on the

latest available information, the discounted fair value of the

remaining contingent consideration as at 31 December 2022 was

$130.8 million. Refer to Note 9 - Acquisitions to the Financial

Statements for further details.

Management have identified that reasonably possible changes in

certain key assumptions and forecasts may cause the calculated fair

value of the contingent consideration to vary materially within the

next financial year and accordingly, management have deemed this to

be a key estimate. See Note 1.2 - Critical accounting judgements

and key sources of estimation uncertainty to the Financial

Statements for further details.

The Group also has contingent consideration of up to $10.0

million in respect of the acquisition of Cure Medical in 2021,

which is based upon post-acquisition performance targets and due to

be paid within three years of the acquisition date. Based on the

latest available information, the discounted fair value of the

remaining contingent consideration as at 31 December 2022 was $9.2

million (2021: $3.1 million).

On 9 May 2022, the Group invested $30.7 million in preference

shares of BlueWind Medical, inclusive of transaction costs. This

represents an investment into an innovative technology in the large

and growing overactive bladder market, related to the Continence

space. Refer to Note 8 - Investment in financial assets to the

Financial Statements for further details.

Strategic decision to exit from hospital care and industrial

sales

On 12 May 2022, it was announced that the Group would be

withdrawing from its hospital care activities and related

industrial sales during the remainder of 2022. The withdrawal from

these lower-margin and lower-growth activities is consistent with

the Group's FISBE strategy, with the Group focusing on

higher-growth chronic care markets with higher margins and higher

levels of recurring revenue.

The manufacturing plant in Belarus which produced hospital care

goods ceased manufacturing on 31 May 2022 alongside the

discontinuation of associated Russia activities. The remainder of

the hospital care and industrial sales activities were mostly

phased out in the second half of 2022. The majority of the exit and

closure activities have been completed at the end of the year, with

minimal residual sales expected in 2023. Further details are

provided in Note 10 - Divestitures to the Financial Statements.

Dividends

Dividends are distributed based on the distributable reserves of

the Company, which are primarily derived from the dividends

received from subsidiary companies and are not based directly on

the Group's retained earnings. The distributable reserves of the

Company at 31 December 2022 were $1,562.9 million (2021: $1,590.3

million).

The Board declared an interim dividend of 1.717 cents per share

in August 2022 and has recommended a final 2022 dividend of 4.330

cents per share, which would bring the full year dividend to 6.047

cents per share (2021: 5.871 cents per share), an increase of 3%

and a pay-out ratio when compared to adjusted net profit of 48%.

Our stated policy is a pay-out ratio of 35% to 45% of adjusted net

profit but this is interpreted flexibly over time to reflect the

underlying performance of the business and the Board's confidence

in its future growth prospects.

Refer to Note 7 - Dividends to the Financial Statements for

further information.

Sources of cash and free cash flow

Sources of cash

One of the Group's primary sources of cash is net cash generated

from operations.

Net cash generated from operations Reported Reported

2022 2021

$m $m

--------------------------------------- -------- --------

EBITDA(1) 432.0 420.1

Share based payments 16.7 16.4

Working capital movement (62.5) (31.6)

(Loss) on foreign exchange derivatives (1.7) (4.3)

--------------------------------------- -------- --------

Net cash generated from operations 384.5 400.6

--------------------------------------- -------- --------

1. EBITDA is reconciled to the most directly comparable

financial measure prepared in accordance with IFRS in the cash

conversion table on page 45.

Reported net cash generated from operations decreased by $16.1

million to $384.5 million during the year, mainly due to working

capital movements. The increase in working capital in the year

ended 31 December 2022 was driven by increased inventory levels of

$36.3 million to build resilience across the Group and increases in

trade and other receivables of $63.6 million due to sales phasing

and the timing of receipts. This was partially offset by increases

in trade and other payables of $40.7 million primarily due to the

increase in derivative financial liabilities as a result of the

mark to market ("MTM") valuations at the year end and an increase

in restructuring provisions.

Free cash flow

Adjusted free cash flow (post-tax), is one of the four key

financial performance indicators we use to monitor the delivery of

our strategy.

Reported Reported Adjusted(2) Adjusted(2)

2022 2021 2022 2021

$m $m $m $m

--------------------------------------- -------- -------- ----------- -----------

EBITDA 432.0 420.1 500.0 464.2

Share-based payments 16.7 16.4 - -

Working capital movement (62.5) (31.6) (98.6) (32.3)

(Loss) on foreign exchange derivatives (1.7) (4.3) (1.7) (3.9)

Capital expenditure (net) (144.2) (94.1) (144.2) (94.1)

--------------------------------------- -------- -------- ----------- -----------

Net cash generated from operations,

net of capital expenditure 240.3 306.5 255.5 333.9

--------------------------------------- -------- -------- ----------- -----------

Cash conversion 55.6% 73.0% 51.1% 71.9%

--------------------------------------- -------- -------- ----------- -----------

Income taxes paid (52.9) (59.2) (52.9) (59.2)

--------------------------------------- -------- -------- ----------- -----------

Free cash flow (post tax) 187.4 247.3 202.6 274.7

--------------------------------------- -------- -------- ----------- -----------

2. Adjusted free cash flow, adjusted EBITDA, adjusted working

capital and adjusted non-cash items are explained and reconciled to

the most directly comparable financial measure prepared in

accordance with IFRS in the cash conversion table on page 45.

Adjusted free cash flow (post-tax), was $202.6 million (2021:

$274.7 million). The $35.8 million increase in adjusted EBITDA,

primarily driven by a reduction in adjusted operating costs (see

commentary in Adjusted net profit section), was more than offset by

the $50.1 million increase in capital programmes as well as the

increase in working capital.

Cash conversion was 55.6% (2021: 73.0%) and adjusted cash

conversion was 51.1% (2021: 71.9%). The decline in the ratio in

2022 primarily reflected the strategic decision to increase capital

expenditure and build inventory for resilience, coupled with the

timing of receipts from customers.

The $1.7 million loss (2021: $4.3 million loss) from foreign

exchange derivatives was a result of hedging activity to help

mitigate the impact on underlying exposures from volatility in

foreign exchange rates.

Liquidity and net debt

Net debt bridge

Reported Adjusted

2022 2022

$m $m

--------------------------------------- --------- ---------

Net debt(2) at 1 January (881.2) (881.2)

EBITDA(1,3) 432.0 500.0

Working capital(3) & FX on derivatives (64.2) (100.3)

Capital expenditure (144.2) (144.2)

Acquisitions and divestitures (173.4) (173.4)

Investment in financial assets (30.7) (30.7)

Debt servicing (77.2) (77.2)

Tax & others(3) (41.1) (73.0)

Dividends (88.1) (88.1)

Net debt(2) at 31 December (1,068.1) (1,068.1)

--------------------------------------- --------- ---------

1. Reported and Adjusted EBITDA are reconciled to the most

directly comparable financial measure prepared in accordance with

IFRS in the cash conversion table on page 45 and reconciliation of

earnings to adjusted earnings table on page 43 respectively.

2. Net debt is calculated as the carrying value of current and

non-current borrowings, net of cash and cash equivalents and

excluding lease liabilities.

3. EBITDA, working capital and tax & others are on an

adjusted basis. The reported numbers are disclosed above commented

on further below.

Adjusted EBITDA was $500.0 million and excludes $39.2 million in

respect of working capital movements arising from acquisitions and

divestitures, primarily driven by the Triad Life Sciences

acquisition and the exit from hospital care and related industrial

sales during the year. Other items excluded to derive adjusted

EBITDA were $5.0 million of acquisition and divestiture expenses,

$10.2 million of termination costs and $16.7 million of share-based

payments, offset by a decrease in termination accruals of $3.1

million. These numbers can be seen within the non-IFRS financial

information section on pages 45 to 46.

Adjusted working capital & FX on derivatives of $100.3

million included the $39.2 million working capital movement arising

from acquisitions and divestitures as explained above. A

reconciliation of adjusted working capital to reported working

capital is shown in the Non-IFRS financial information section on

page 46.

The Group continued to make significant investments to

strengthen and grow the business such as expanding the

manufacturing facilities in its Infusion Care business, adding more

automation to our production lines and developing new digital

technologies to deliver enhanced customer experiences.

Consequently, capital expenditure during 2022 was $144.2

million.

The Group made several strategic investments in 2022 to

strengthen its competitive position, including the acquisition of

Triad Life Sciences for an initial consideration of $123.3 million

and two additional payments totalling $50.0 million for the

successful achievement of two milestones in 2022 in relation to

that acquisition. The Group also made a $30.7 million equity

investment in BlueWind Medical, inclusive of transaction costs.

Debt servicing payments of $77.2 million are comprised of net

interest payments of $49.9 million, lease payments of $20.7 million

and the amortisation of financing fees of $6.6 million.

Tax & others of $73.0 million, on an adjusted basis,

consisted of income taxes paid of $52.9 million, foreign exchange

on cash and cash equivalents of $15.9 million, $5.0 million of

acquisition and divestiture expenses and $10.2 million of

termination costs, offset by foreign exchange on borrowings of

$11.0 million. Excluding $5.0 million of acquisition and

divestiture expenses, $10.2 million of termination costs and $16.7

million of share-based payments, tax & others, on a reported

basis, was $41.1 million.

Dividend cash payments of $88.1 million were made to

shareholders in the year. This represented 78.2% of total dividends

declared in the year, with the remaining 21.8% electing to settle

via scrip dividends.

Borrowings and net debt 2022 2021

$m $m

-------------------------------------------- --------- -------

Senior notes(1) (493.1) (492.1)

Credit facilities(1) (718.8) (852.5)

Cash and cash equivalents 143.8 463.4

-------------------------------------------- --------- -------

Net debt (excluding leases) (1,068.1) (881.2)

Lease liabilities (88.3) (90.5)

-------------------------------------------- --------- -------

Interest bearing liabilities net of cash (1,156.4) (971.7)

-------------------------------------------- --------- -------

Net debt (excluding leases)/adjusted EBITDA

At 31 December 2.1x 1.9x

-------------------------------------------- --------- -------

1. Senior notes of $493.1 million (2021: $492.1 million) are

stated net of financing fees of $6.9 million (2021: $7.9 million).

Credit facilities of $718.8 million (2021: $852.5 million) are

stated net of financing fees of $8.4 million (2021: $5.4

million).

As at 31 December 2022, the Group's cash and cash equivalents

were $143.8 million (31 December 2021: $463.4 million) and the debt

outstanding on borrowings was $1,211.9 million (31 December 2021:

$1,344.6 million).

The Group successfully refinanced its bank facilities in

November 2022, with $1.2 billion committed for five years at

slightly improved margins over base rates compared to the previous

facilities, comprising a multicurrency revolving credit facility of

$950.0 million and a term loan of $250.0 million, both with

maturity in November 2027. The Group's $500.0 million senior

unsecured notes, issued in October 2021, remain in place with

maturity in October 2029.

As at 31 December 2022, $472.8 million of the multicurrency

revolving credit facility remained undrawn. This, combined with

cash of $143.8 million, provided the Group with total liquidity of

$616.6 million at 31 December 2022 (31 December 2021: $663.4

million). Of this, $19.2 million was held in territories where