easyJet plc (EZJ) 12-Apr-2022 / 07:00 GMT/BST Dissemination of a

Regulatory Announcement, transmitted by EQS Group. The issuer is

solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

12 April 2022

easyJet plc

Trading statement for the six months ended 31 March 2022

H1 losses reduced year on year, ahead of market expectations,

driven by improved trading and boosted by self-help measures

-- Summer plans to reach near 2019 capacity unchanged

-- Strong, sustained recovery in trading since the relaxation of

travel restrictions, reflecting the pent-updemand coming out of the

pandemic

-- 64% of H2 fuel hedged at USD571 per metric tonne, reducing

exposure to current fuel price

-- Outperformed H1 expectations despite challenges from Omicron

and rising fuel prices

Summary

First half losses have reduced year on year, outperforming

expectations, as self-help measures including network optimisation,

ancillary products, and a continued cost focus deliver. This result

is despite ongoing challenges from Covid-19, rising fuel prices,

the removal of furlough support and incremental costs associated

with ramping up operations.

easyJet has ramped up capacity throughout the quarter, operating

at 80% of FY19 capacity in March. Since the announcement to remove

UK travel restrictions on 24 January, we have seen a strong and

sustained recovery in trading. Summer bookings for the last six

weeks have tracked ahead of the same period in FY19 as customers

book closer to departure.

Everyone at easyJet has been deeply shocked and saddened by the

Russian invasion of Ukraine and we have looked at the best ways we

can directly support those affected. We have been working closely

with the UN refugee agency UNHCR, to provide seats on flights

across our network as well as working with our charity partner

UNICEF to support their work on the ground as part of the response

effort.

easyJet has very little exposure in Eastern Europe, with no

routes into Ukraine, Russia or Belarus. Our nearest network points

are Budapest in Hungary and Krakow in Poland which only account for

1.4% of our total capacity. Additionally, due to our geographical

footprint, none of our flight routes need to operate into

Ukrainian, Belarusian or Russian airspace, and therefore we are not

exposed to re-routing and increased fuel burn.

Commenting, Johan Lundgren, easyJet Chief Executive said:

"easyJet's performance in the second quarter has been driven by

improved trading following the UK Government's decision to relax

testing restrictions with an extra boost from self-help measures

which saw us outperform market expectations.

"Since travel restrictions were removed, easyJet has seen a

strong recovery in trading which has been sustained, resulting in a

positive outlook for Easter and beyond, with daily booking volumes

for summer currently tracking ahead of those at the same time in

FY19.

"We remain confident in our plans which will see us reaching

near 2019 flying levels for this summer and emerge as one of the

winners in the recovery."

Bookings

Since the announcement to remove UK travel restrictions on 24

January, we have seen a strong and sustained recovery resulting in

the proportion of bookings between the UK and EU now being broadly

equal, which is where we would expect it to be based on our

capacity allocation, compared to last year when the split reached

around 70:30 EU vs UK with the strictest restrictions in place

within the UK.

We continue to see strong demand for Q4, especially on leisure

routes where easyJet will be the biggest it has ever been. This has

been boosted by the addition of a further five aircraft worth of

slots in Greece. easyJet will be the largest carrier into the main

Greek Islands this summer.

easyJet holidays also continues to strengthen its position as a

significant player in the holidays market, with over 70% of the

programme already sold and at significantly stronger margins

compared to 2019.

Capacity

During Q2 easyJet flew 67% of FY19 capacity in line with our

expectations. Our capacity forecasting has been accurate and

disciplined throughout the pandemic.

Load factor for Q2 was 78%, due to the impact that Omicron had

on customers' confidence and ability to travel during the early

part of the quarter. Load factor has built back during the second

quarter as travel restrictions eased across the network.

Passenger1 numbers in Q2 increased to 11.5 million (Q2 FY21: 1.2

million).

January March Q2 Q2

February 2022

2022 2022 FY22 FY21

Number of flights 18,857 26,709 36,681 82,247 11,672

Peak operating aircraft 223 223 272 272 161

Passengers (thousand) 1 2,301 3,904 5,340 11,545 1,228

Seats flown (thousand) 2 3,398 4,831 6,615 14,844 2,062

% of FY'19 capacity flown 50% 68% 80% 67% 9%

Load factor 3 68% 81% 81% 78% 60%

Financials

Total group revenue and headline costs for the first half are

expected to be around GBP1,500 million and around GBP2,050 million

respectively. Pricing remained competitive during the first half,

although easyJet's ancillary products continue to deliver, with

revenue per seat sold of GBP19.56 (GBP12.47 in H1'19),

demonstrating the continued success of easyJet's ancillary

products.

easyJet continues to have one of the strongest, investment

grade, balance sheets in European Aviation. As at 31 March 2022 our

net debt position was c.GBP0.6 billion (30 September 2021: GBP0.9

billion) including cash and cash equivalents and money market

deposits of c.GBP3.5 billion.

Sale and leaseback

easyJet has entered into sale and leaseback transactions for 10

A319s, generating total gross cash proceeds of USD120 million and a

loss of c.GBP20 million during the six months to 31 March. easyJet

entered into these transactions as part of the ongoing strategy to

manage residual value risk.

Current operations

easyJet has flown 94% of the planned schedule in the last seven

days with daily flight volumes around 1,500 per day being 4x higher

than the same point last year. This is despite the recent increase

in the number of crew testing positive for Covid-19, together with

normal operational disruption such as weather and ATC delays. We

have proactively managed this in advance by making pre-emptive

cancellations as early as possible, enabling the majority of our

customers to rebook onto flights departing the same day.

Outlook

easyJet expects to report a group headline loss before tax in

the range of GBP535 million and GBP565 million for the six months

ended 31 March 2022.

easyJet expects Q3 capacity to be c.90% of Q3 2019 levels. Q4

FY22 capacity on sale remains at near Q4 2019 levels.

easyJet achieved an average effective fuel price in H1 FY22 of

c.USUSD599 per metric tonne.

easyJet is currently c.64% hedged for fuel in H2 of FY22 at

c.USUSD571 per metric tonne, c.42% hedged for H1 FY23 at c.USUSD654

and c.15% hedged for H2 FY23 at c.USUSD766. The spot price on 11

April 2022 was around USUSD1,100.

For further details please contact easyJet plc:

Institutional investors and analysts:

Michael Barker Investor Relations +44 (0) 7985 890 939

Adrian Talbot Investor Relations +44 (0) 7971 592 373

Media:

Anna Knowles Corporate Communications +44 (0) 7985 873 313

Edward Simpkins Finsbury +44 (0) 7947 740 551 / (0) 207 251 3801

Dorothy Burwell Finsbury +44 (0) 7733 294 930 / (0) 207 251 3801

A copy of this Trading Statement is available at

http://corporate.easyjet.com/investors

Notes 1. Represents the number of earned seats flown. Earned

seats include seats that are flown whether or not thepassenger

turns up as easyJet is a no-refund airline, and once a flight has

departed a no-show customer isgenerally not entitled to change

flights or seek a refund. Earned seats also include seats provided

for promotionalpurposes and to staff for business travel. 2.

Capacity based on actual number of seats flown. 3. Represents the

number of passengers as a proportion of the number of seats

available for passengers. Noweighting of the load factor is carried

out to recognise the effect of varying flight (or "sector")

lengths.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00B7KR2P84

Category Code: TST

TIDM: EZJ

LEI Code: 2138001S47XKWIB7TH90

Sequence No.: 154954

EQS News ID: 1325677

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1325677&application_name=news

(END) Dow Jones Newswires

April 12, 2022 02:00 ET (06:00 GMT)

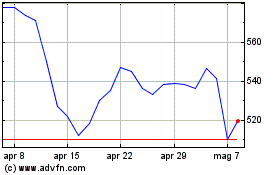

Grafico Azioni Easyjet (LSE:EZJ)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Easyjet (LSE:EZJ)

Storico

Da Apr 2023 a Apr 2024