TIDMGGP

RNS Number : 4474F

Greatland Gold PLC

21 March 2022

The following amendments have been made to the 'Interim Results'

announcement released on 21 March 2022 at 07:00 under RNS No

4131F.

The formatting of the first row of each financial table has been

amended to ensure that it is legible.

All other details remain unchanged.

21 March 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK MARKET ABUSE REGULATIONS. ON PUBLICATION OF THIS

ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION

IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

Greatland Gold plc

("Greatland" or "the Company")

Interim Results

Greatland Gold plc (AIM:GGP), a mining development and

exploration company with a focus on precious and base metals, is

pleased to announce its interim results for the six months ended 31

December 2021.

Operational highlights

The Company made significant progress in the first six months of

the financial year:

Havieron

-- The Stage 1 Pre-Feasibility Study ("PFS") on the South-East

Crescent of the Havieron deposit was released on 12 October

2021

-- PFS revealed the tip of the Havieron iceberg with a fraction

of the initial resource supporting the total capex of the project,

justifying a fast start approach to early cashflow generation and

reinvesting back into Havieron development and infrastructure.

-- In addition, Havieron completed a total of 219,561m of

drilling from 266 holes, with all the latest completed holes

continuing to intersect mineralisation, and 19 reporting

significant mineralisation.

-- Post period on 3 March 2022, announced an updated mineral

resource that substantially increased Havieron Resource and

Reserve

Juri Joint Venture ("Juri JV")

-- Juri JV maiden drilling programme was completed on the

Paterson Range East and Black Hills tenements

-- Comprised nine holes for 4,958m testing six targets

-- Gold assays found mineralisation at the Saddle Reefs target

within Black Hills and first gold identified at the Goliath

Prospect

-- Advanced to Stage 2 to expand the exploration programme at

the Juri JV

Further exploration in the Paterson region

-- Drilling multiple new targets within the Scallywag licence,

following analysis of results of an airborne Electromagnetic survey

conducted last year and further geological interpretation of

regional aeromagnetic and gravity datasets

-- Other exploration analysis and detailed target identification

on Greatland's other 100% owned tenements

-- On 16 September 2021 acquired the 100% owned Pascalle

tenement, the 100% owned Taunton tenement and two tenement

applications for exploration licences in the Paterson Province of

Western Australia for a consideration of cash and shares.

Corporate and financial highlights

-- In November 2021, the Company issued 82,000,000 new ordinary

shares at an issue price of GBP0.145 per share for a total

consideration of GBP11,195,067, net of costs.

-- Expanded the management team and Board of Directors with the

following appointments:

-- Christopher Toon as Chief Financial Officer on 8 July

2021

-- Otto Richter as Group Mining Engineer on 11 August 2021

-- Paul Hallam as a Non-Executive Director, effective 1

September 2021

Shaun Day, Chief Executive Officer of Greatland Gold plc,

commented:

"We are very pleased with the strides we have taken in the first

six months of the year as we continued to deliver outstanding

progress at Havieron, ensured the Company remained well capitalised

to accelerate exploration activities and built up of the breadth

and capability of the Greatland management team and Board.

At Havieron, our joint venture with Newcrest released the Stage

1 Pre-Feasibility Study. The study revealed that a segment of the

initial resource covers the total capex of the project, supporting

Greatland's belief that the profile of Havieron makes it a globally

unique opportunity for bringing a low risk, low capex tier-one

gold-copper mine into production. In addition, the rapid

development and growth potential at Havieron was demonstrated by

the recently released mineral resource and reserve update which, in

only 10 months of further drilling, added more than 50% in total

gold content.

Looking ahead, 2022 is set to be an exciting and busy time for

Greatland with the extensive growth drilling campaign continuing at

Havieron and a Feasibility Study due by the December 2022 quarter.

We are also preparing for the upcoming launch of the 2022

exploration programme at the Juri JV building upon the results from

the initial campaign and focusing on drilling several high-priority

targets, along with ramping up exploration activities across our

100% owned targets. Greatland is in a strong operational position

with an experienced team to execute our growth plans to increase

shareholder value and build a company of significant scale."

Operational review

HAVIERON PROJECT - HAVIERON JOINT VENTURE, WESTERN AUSTRALIA

(GREATLAND: 30%)

The Havieron Project ("Havieron" or "Project") is currently in

development under a Joint Venture with Newcrest Mining Limited

("Newcrest"), Australia's largest gold producer. Havieron is

located just 45km from Newcrest's Telfer mine. This allows Havieron

to leverage Telfer's existing infrastructure and processing plant

to significantly reduce the project's capital expenditure and

carbon impact for a low cost pathway to development under an ore

tolling arrangement.

Havieron was discovered by Greatland in 2018 and has become

established as one of the most exciting long life gold-copper

deposits in development worldwide. It provides Greatland with a

strategic position in the Paterson Province of Western Australia,

one of the leading frontiers for the discovery of tier-one

gold-copper deposits. Newcrest assumed management of the Joint

Venture in May 2019 and has since been undertaking the ore body

definition and technical studies required to support regulatory

approvals and investment decisions for a staged development

plan.

The Stage 1 Pre-Feasibility Study (PFS) on the South-East

Crescent of the Havieron deposit was released on 12 October 2021.

The study outcome was positive, showing that a fraction of the

initial resource supported the total capital of the project,

justifying a fast start approach to early cashflow generation and

reinvesting back into Havieron development and infrastructure. This

supports the Company's belief that the profile of Havieron makes it

a globally unique opportunity for bringing a low risk, low capital

tier-one gold-copper mine into production.

On 9 December 2021, the Company announced the joint venture had

completed a total of 219,561m of drilling from 266 holes, with all

the latest completed holes continuing to intersect mineralisation,

and 19 reporting significant mineralisation. Key updates to the

development and exploration of Havieron during the period were as

follows:

-- 24 new drill holes, including 20 holes from the Infill

Drilling programme and 4 from the Growth Drilling programme.

-- Significant mineralisation was reported in 19 of the new

holes.

-- A further 10 drill holes have been completed and are awaiting

assay.

-- Infill drilling within the South Eastern Crescent Zone

Inferred Mineral Resource supports the modelled grade and thickness

within the South East Crescent Zone Mineral Resource.

-- Growth drilling continued to show potential for resource

additions outside the existing Inferred Mineral Resource, including

a mineralised zone 100m below and 100m to the north-west of prior

grade holes.

-- Drilling to test geophysical targets outside of the known

Havieron system commenced at Havieron North, and Zipa.

-- All drilling is now focused on growth programs to continue

into 2022 with 6 drill rigs operational.

-- Construction activities are progressing well with exploration

decline advanced 245 metres.

-- Planning commenced for the first ventilation shaft.

In December 2021, Newcrest issued a notice to the Company to

begin the process under the Joint Venture Agreement ("JVA") to

exercise the option to acquire an additional 5% interest in the

Havieron Joint Venture from Greatland at fair market value, as

determined under the JVA principles. Under the JVA, if the option

exercise price cannot be agreed, each party is thereafter required

to notify the other of its assessment of fair market value. If both

parties' assessments are within 10% of each other, the option

exercise price will be the average of those assessments. If both

parties' assessments are not within 10% of each other, the parties

will proceed to independent expert valuer determination, with the

expert being required to determine which of the fair market values

nominated by the parties is to be the option exercise price.

Subsequent to the period end, on 2 March 2022 both parties

agreed to some minor modifications to the option process which

included increasing the valuation range noted above from 10% to

20%.

Following agreement or determination of the option exercise

price, Newcrest has 30 business days to exercise its option to

acquire the additional 5% interest. Proceeds from the exercise will

first be used to repay the outstanding balance under the existing

Newcrest loan facility.

As at the date of this report, both parties continue to have

discussions regarding the acquisition of the additional 5% interest

in the Havieron Joint Venture.

As outlined in previous announcements, most recently on 9

December 2021, following delivery of a Pre-Feasibility Study and

meeting the relevant expenditure commitment, Newcrest is entitled

(on the terms of the JVA) to an additional 10% joint venture

interest, and exercising this entitlement will result in an overall

joint venture interest of 70% Newcrest (30% Greatland). If the

option referred to above is exercised, Newcrest will be entitled to

an overall joint venture interest of 75% (Greatland 25%).

In addition, on 3 March 2022 Greatland announced a Havieron

Mineral Resource update. This increased the Mineral Resource,

including Ore Reserves, to 5.5 million oz Au and 218kt Cu or 6.5M

oz AuEq, an increase of 2.1 million oz Au Eq since the last Mineral

Resource update. Probable Ore Reserves now stand at 2.4 million oz

Au and 109kt Cu or 2.9M oz AuEq compared to the 1.7 million oz AuEq

in the Initial Ore Reserve estimation. In addition to the Mineral

Resources within the Havieron Breccia complex, growth drilling has

now defined an initial Mineral Resource within the separate Eastern

Breccia complex. This is the first Mineral Resource in a

mineralised system outside the Havieron Breccia system and remains

open at depth and to the south. This Eastern Breccia Mineral

Resource does not capture the recent high grade intercepts to its

south, which is of similar grade to the South East Crescent Zone.

The updated Mineral Resource incorporated an additional 10 months

of consistently impressive drilling results since the February 2021

drilling cut off used for the last Mineral Resource update.

100% OWNED PROJECTS

Greatland has multiple 100% owned projects across Australia:

-- Scallywag project - Adjacent to the Havieron mining lease,

containing a further 20km of strike of Yeneena Group metasediments

located directly to the north-west of Havieron.

-- The Rudall and Canning projects - Applications expand

Greatland's landholding in the Paterson region by over 46% to 564

square kilometres. Both licences are considered to be prospective

for Havieron style gold-copper mineralisation and fit Greatland's

strategy to increase its exposure to the discovery of new tier-1

gold-copper deposits.

-- The Ernest Giles project - Located in central Western

Australia, covering an area of approximately 1950 square kilometres

with around 180km of strike of rocks prospective for gold. The

eastern Yilgarn Craton is one of the most highly mineralised areas

in Western Australia and is considered prospective for large gold

deposits.

-- The Panorama project - Consisting of three adjoining

exploration licences, covering 157 square kilometres, located in

the Pilbara region of Western Australia, in an area considered to

be highly prospective for gold and cobalt.

-- The Bromus project - Located 25 kilometres south-west of

Norseman in the southern Yilgarn region of Western Australia. It

consists of two licences, covering 87 square kilometres of

under-explored greenstone and intrusive granites of the Archean

Yilgarn Block at the southern end of the Kalgoorlie-Norseman

belt.

-- The Firetower project - Located in central north Tasmania,

Australia and covers an area of 62 square kilometres

-- The Warrentinna project - Located 60 kilometres north-east of

Launceston in north-eastern Tasmania and covers an area of 37

square kilometres with 15 kilometres of strike prospective for

gold.

Exploration and evaluation expenditure activity during the

period comprised of expenditure on the Group's projects, which

during the period predominately focussed on the following:

a) Drilling multiple new targets within the Scallywag licence,

following analysis of results of an airborne Electromagnetic survey

conducted last year and further geological interpretation of

regional aeromagnetic and gravity datasets; and

b) Other exploration analysis and detailed target identification

on Greatland's other 100% owned tenements.

Further details of the exploration projects can be found on

Company's website www.greatlandgold.com .

In addition, on 16 September 2021 Greatland entered into an

agreement with Province Resources Limited (ASX:PRL) to acquire the

100% owned Pascalle tenement, the 100% owned Taunton tenement and

two tenement applications for exploration licences in the Paterson

Province of Western Australia for a consideration of cash and

shares.

The Pascalle tenement is proximal to world class gold-copper

deposits with Havieron 20km to the East and Newcrest's Telfer Mine

14km to the West. All areas contain multiple magnetic and other

geophysical anomalies identified to date and which are untested by

drilling.

This is the Group's first licence acquisition since Havieron and

adds over 1,000km(2) of exploration ground in the Paterson region

expanding Greatland's strategic footprint in one of the most

prospective exploration areas for gold-copper deposits in

Australia.

The purchase agreement was as follows:

-- Greatland acquired the right, title and interest in the

Pascalle tenement from PRL for a consideration of A$50,000, free of

any encumbrance; and

-- PRL is the sole applicant of the applications for exploration

licences E45/5754 and E45/5755 (PRL Applications) and is the 100%

owner of Taunton tenement. Greatland will pay a consideration of

A$100,000 plus A$200,000 in cash or A$200,000 in fully paid

ordinary shares in the capital of Greatland in respect to the

withdrawal of the PRL Applications and sale and purchase of the

Taunton tenement, and if necessary, the sale and purchase of the

licences created if the PRL Applications are granted.

Settlement of the Pascalle tenement was finalised in December

2021 resulting in acquisition costs of GBP26,880 capitalised as an

exploration and evaluation asset during the six months ended 31

December 2021.

JURI JOINT VENTURE, WESTERN AUSTRALIA (GREATLAND: 49%)

The Juri Joint Venture consists of two exploration licences in

the prospective Paterson region, Black Hills and Paterson Range

East, under a Joint Venture with Newcrest. Newcrest has the right

to earn up to 75% interest by spending up to A$20m in total as part

of a two-stage farm-in over five years.

On 19 October 2021, Newcrest advanced to Staged 2 and earned an

additional 26% interest, resulting in Greatland's working interest

reducing from 75% to 49%. Greatland has currently continued in the

role of Manager for the Juri Joint Venture.

Key components of the Juri Joint Venture exploration activities

during the period were:

-- First phase of the drilling programme was completed on the

Paterson Range East and Black Hills tenements, which comprised nine

holes for 4,958m testing six targets.

-- All assay results received for the first phase.

-- Mineralisation found at Black Hills hole DHB003.

-- Ground Electromagnetic survey completed identifying several

promising EM conductor targets for 2022 drilling programme.

CORPORATE

Equity raising

In November 2021, the Company issued 82,000,000 new ordinary

shares at an issue price of GBP0.145 per share for a total

consideration of GBP11,195,067, net of costs.

Exchange losses

The Group has recognised a foreign exchange loss of GBP581,303

in the income statement as a result of the US$27,188,755 million

loan held by the Australian subsidiary with Newcrest Operations

Limited in respect of the Havieron Joint Venture. The functional

currency of the Australian subsidiary is Australian dollars while

the loan is denominated in US dollars. The unrealised foreign

exchange loss was incurred as result of the movements of the

Australian dollar against the US dollar during the period.

On consolidation, these balances are retranslated to sterling

(GBP) presentation currency.

People

On 8 July 2021 the Company announced the appointment of

Christopher Toon as Chief Financial Officer of the Company, in a

non-Board role with effect from 12 July 2021.

On 11 August 2021 the Company announced the appointment of Otto

Richter as Group Mining Engineer with effect from 16 August

2021.

On 25 August 2021 the Company announced the appointment of Paul

Hallam as a Non-Executive Director to the board, effective 1

September 2021.

Dividends

The Board of Directors do not recommend the payment of a

dividend (2020: Nil).

Significant events after the balance date

In December 2021, Newcrest issued a notice to the Company to

begin the process under the JVA to exercise the option to acquire

an additional 5% interest in the Havieron Joint Venture from

Greatland at fair market value, as determined under the JVA

principles. Under the JVA, if the option exercise price cannot be

agreed, each party is thereafter required to notify the other of

its assessment of fair market value. If both parties' assessments

are within 10% of each other, the option exercise price will be the

average of those assessments. If both parties' assessments are not

within 10% of each other, the parties will proceed to independent

expert valuer determination, with the expert being required to

determine which of the fair market values nominated by the parties

is to be the option exercise price.

Subsequent to the period end, on 2 March 2022 both parties

agreed to some minor modifications to the option process which

included increasing the valuation range noted above from 10% to

20%.

Following agreement or determination of the option exercise

price, Newcrest has 30 business days to exercise its option to

acquire the additional 5% interest. Proceeds from the exercise will

first be used to repay the outstanding balance under the existing

Newcrest loan facility.

As at the date of this report, both parties continue to have

discussions regarding the acquisition of the additional 5% interest

in the Havieron Joint Venture.

SAFETY PERFORMANCE

The Group's aim is to achieve and maintain a high standard of

workplace safety. In order to achieve this objective, the Group

provides training and support to employees and sets demanding

standards for workplace safety.

Enquiries:

Greatland Gold PLC +44 (0)20 3709 4900

Shaun Day info@greatlandgold.com

www.greatlandgold.com

SPARK Advisory Partners Limited (Nominated

Adviser)

Andrew Emmott/James Keeshan +44 (0)20 3368 3550

Berenberg (Joint Corporate Broker and Financial

Adviser)

Matthew Armitt/ Varun Talwar /Detlir Elezi +44 (0)20 3207 7800

Canaccord Genuity (Joint Corporate Broker

and Financial Adviser)

James Asensio/Patrick Dolaghan +44 (0)20 7523 8000

Hannam & Partners (Joint Corporate Broker

and Financial Adviser)

Andrew Chubb/Matt Hasson/Jay Ashfield +44 (0)20 7907 8500

SI Capital Limited (Joint Broker)

Nick Emerson/Alan Gunn +44 (0)14 8341 3500

Luther Pendragon (Media and Investor Relations)

Harry Chathli/Alexis Gore +44 (0)20 7618 9100

Notes for Editors:

Greatland Gold plc (AIM:GGP) is a mining development and

exploration company with a focus on precious and base metals . The

Company's flagship asset is the world-class Havieron gold-copper

deposit in the Paterson region of Western Australia, discovered by

Greatland and presently under development in Joint Venture with

Newcrest Mining Ltd.

Havieron is located approximately 45km east of Newcrest's Telfer

gold mine and, subject to positive decision to mine, will leverage

the existing infrastructure and processing plant to significantly

reduce the project's capital expenditure and carbon impact for a

low-cost pathway to development. An extensive growth drilling

programme is presently underway at Havieron with a maiden

Pre-Feasibility Study released on the South-East Crescent on 12

October 2021. Construction of the box cut and decline to develop

the Havieron deposit commenced in February 2021.

Greatland has a proven track record of discovery and exploration

success. It is pursuing the next generation of tier-one mineral

deposits by applying advanced exploration techniques in

under-explored regions. The Company is focused on safe, low-risk

jurisdictions and is strategically positioned in the highly

prospective Paterson region. Greatland has a total six projects

across Australia with a focus on becoming a multi-commodity mining

company of significant scale.

Condensed Consolidated statement of comprehensive income

for the six months ended 31 December 2021

Six months ended Six months ended

Note 31 Dec 2021 31 Dec 2020

GBP GBP

------------------------------------------------------------------------ ------ ----------------- -----------------

Continuing operations

Revenue - -

Exploration and evaluation expenses (1,793,379) (1,846,041)

Administration expenses (1,116,783) (842,171)

Operating loss (2,910,162) (2,688,212)

Other income - 12,902

Foreign exchange gains / (losses) 5 (581,303) -

Finance income 8 865

Finance costs (97,229) -

Loss before tax (3,588,686) (2,674,445)

Income tax expense - -

------------------------------------------------------------------------ ------ ----------------- -----------------

Loss for the period (3,588,686) (2,674,445)

------------------------------------------------------------------------ ------ ----------------- -----------------

Other comprehensive income:

Exchange differences on translation of foreign operations 6,927 56,780

Total comprehensive income for period attributable to equity holders of

parent (3,581,759) (2,617,665)

------------------------------------------------------------------------ ------ ----------------- -----------------

Earnings per share (EPS):

Basic EPS attributable to ordinary equity holders of the parent

(pence)(a) (0.09) (0.07)

Diluted EPS attributable to ordinary equity holders of the parent

(pence)(a) (0.09) (0.07)

------------------------------------------------------------------------ ------ ----------------- -----------------

The consolidated income statement should be read in conjunction

with the accompanying notes.

(a) For the purpose of calculating basic earnings per share, the

weighted average number of the Group shares outstanding during the

period was 3,978,408,767 (31 December 2020: 3,825,916,868). The

weighted average number of the Group shares including outstanding

options is 4,081,408,767 (31 December 2020: 3,977,666,868).

Dilutive earnings per share is not included on the basis inclusion

of potential ordinary shares would result in a decrease in loss per

share, and is considered anti-dilutive.

Condensed Consolidated Balance Sheet

as at 31 December 2021

Note 31 Dec 2021 30 Jun 2021

GBP GBP

---------------------------------- ------- -------------- --------------

ASSETS

Exploration and evaluation asset 26,880 -

Mine development 4 22,805,476 17,091,622

Right of use asset 306,642 341,912

Property, plant and equipment 100,076 120,356

Total non-current assets 23,239,074 17,553,890

Cash and cash equivalents 14,286,415 6,212,057

Trade and other receivables - 78,198

Other current assets 222,068 154,215

---------------------------------- ------- -------------- --------------

Total current assets 14,508,483 6,444,470

---------------------------------- ------- -------------- --------------

TOTAL ASSETS 37,747,557 23,998,360

---------------------------------- ------- -------------- --------------

LIABILITIES

Trade and other payables (1,063,690) (3,355,958)

Lease liabilities (69,245) (54,947)

Provisions (101,003) (102,607)

---------------------------------- ------- -------------- --------------

Total current liabilities (1,233,938) (3,513,512)

---------------------------------- ------- -------------- --------------

Borrowings 5 (20,149,282) (12,189,790)

Lease liabilities (248,017) (293,452)

Provisions (3,876,390) (3,846,713)

Total non-current liabilities (24,273,689) (16,329,955)

---------------------------------- ------- -------------- --------------

TOTAL LIABILITIES (25,507,627) (19,843,467)

---------------------------------- ------- -------------- --------------

NET ASSETS 12,239,930 4,154,893

---------------------------------- ------- -------------- --------------

EQUITY

Share capital 6 4,046,547 3,947,270

Share premium 6 35,593,273 24,064,307

Reserves 577,486 532,177

Retained earnings (27,977,376) (24,388,861)

---------------------------------- ------- -------------- --------------

TOTAL EQUITY 12,239,930 4,154,893

---------------------------------- ------- -------------- --------------

The consolidated balance sheet should be read in conjunction

with the accompanying notes.

Condensed Consolidated Statement of Changes in Equity

for the six months ended 31 December 2021

-------------------------------------------------------------------------------------------------------- ------------

Foreign Share

currency based

Share Share Merger translation payment Retained Total

capital premium reserve reserve reserves earnings equity

Note GBP GBP GBP GBP GBP GBP GBP

----------------------- ---------- ----------- ---------- -------------- ----------- ------------- ------------

At 1 July 2021 3,947,270 24,064,307 225,000 129,585 177,592 (24,388,861) 4,154,893

Loss for the

period - - - - - (3,588,686) (3,588,686)

Other

comprehensive

income - - - 6,927 - - 6,927

------------------- ---------- ----------- ---------- -------------- ----------- ------------- ------------

Total

comprehensive

loss for the

period - - - 6,927 - (3,588,686) (3,581,759)

Transactions with

owners

in their capacity

as

owners:

Share based

payments - - - - 38,553 - 38,553

Transfer on

exercise

of options - - - - (171) 171 -

Share capital

issued 6 99,277 12,223,899 - - - - 12,323,176

Cost of share

issue 6 - (694,933) - - - - (694,933)

------------------- ---------- ----------- ---------- -------------- ----------- ------------- ------------

Total

contributions

by and

distributions

to owners of the

Company 99,277 11,528,966 - - 38,382 171 11,666,796

------------------- ---------- ----------- ---------- -------------- ----------- ------------- ------------

Six months ended

on

31 December 2021 4,046,547 35,593,273 225,000 136,512 215,974 (27,977,376) 12,239,930

------------------- ---------- ----------- ---------- -------------- ----------- ------------- ------------

Foreign Share

currency based

Share Share Merger translation payment Retained Total

capital premium reserve reserve reserves earnings equity

Note GBP GBP GBP GBP GBP GBP GBP

---------------- ------ ---------- ----------- ---------- -------------- ---------- ------------- ------------

At 1 July 2020 3,760,207 19,878,782 225,000 178,320 372,953 (19,090,241) 5,325,021

Loss for the period - - - - - (2,674,445) (2,674,445)

Other comprehensive

income - - - 56,780 - - 56,780

------------------------ ---------- ----------- ---------- -------------- ---------- ------------- ------------

Total comprehensive

loss for the period - - - 56,780 - (2,674,445) (2,617,665)

Transactions

with owners

in their

capacity as

owners:

Share based payments - - - - 22,135 - 22,135

Transfer on exercise

of options - - - - (127,173) 127,173 -

Share capital issued 118,458 2,629,015 - - - - 2,747,473

------------------------ ---------- ----------- ---------- -------------- ---------- ------------- ------------

Total contributions

by and distributions

to owners of the

Company 118,458 2,629,015 - - (105,038) 127,173 2,769,608

------------------------ ---------- ----------- ---------- -------------- ---------- ------------- ------------

Six months ended on

31 December 2020 3,878,665 22,507,797 225,000 235,100 267,915 (21,637,513) 5,476,964

------------------------ ---------- ----------- ---------- -------------- ---------- ------------- ------------

The consolidated statement of changes in equity should be read

in conjunction with the accompanying notes.

Condensed Consolidated Statement of Cash Flows

for six months ended 31 December 2021

Six months Six months

ended ended

31 Dec 2021 31 Dec

GBP 2020

GBP

-------------------------------------------- ------------- ------------

Cash flows from operating activities

Loss for the period (3,588,686) (2,674,445)

Depreciation 20,280 55,319

Amortisation 35,270 -

Rehabilitation unwind 89,429 -

Share option charge 38,553 22,135

Unrealised foreign exchange loss 581,303 -

Lease liability interest expense 7,149 -

Increase in other receivables 78,198 (164,124)

Increase in payables and other liabilities (1,288,760) 1,154,217

Net cash inflow from operating activities (4,027,264) (1,606,898)

--------------------------------------------- ------------- ------------

Cash flows from investing activities

Interest received 8 865

Payments for exploration and evaluation (26,880) -

assets

Payments for mine development and

fixed assets (5,887,255) (61,107)

Net cash outflow from investing activities (5,914,127) (60,242)

--------------------------------------------- ------------- ------------

Cash flows from financing activities

Proceeds from issue of shares 12,323,175 2,747,473

Transaction costs from issue of shares (694,933) -

Proceeds from borrowings 6,443,147 -

Financing for joint venture assets - (1,224,282)

Repayment of lease obligations (38,286) (38,373)

Other income - 12,902

Net cash outflow from financing activities 18,033,103 1,497,720

--------------------------------------------- ------------- ------------

Net increase (decrease) in cash and (169,420

cash equivalents 8,091,712 )

Net foreign exchange differences (17,354) 43,004

Cash and cash equivalents at the beginning

of the period 6,212,057 6,022,745

--------------------------------------------- ------------- ------------

Cash and cash equivalents at the end

of the period 14,286,415 5,896,329

--------------------------------------------- ------------- ------------

The consolidated statement of cash flows should be read in

conjunction with the accompanying notes.

notes to the interim financial report

for the six months ended 31 December 2021

1 Corporate information

The interim condensed consolidated financial statements of

Greatland Gold plc and its subsidiaries (collectively, the Group)

for the six months ended 31 December 2021 were authorised for issue

in accordance with a resolution of the Directors on 21 March

2022.

Greatland Gold plc is a company incorporated in England and

Wales whose shares are publicly traded on the AIM (AIM: GGP). The

nature of the operations and principal activities of the Company

are described in the Directors' report.

2 Basis of preparation

The interim consolidated financial statements for the six months

ended 31 December 2021 are general purpose condensed financial

statements prepared in accordance with IAS 34 Interim Financial

Reporting and prepared in accordance with UK-adopted international

accounting standards and are presented in sterling. The financial

information does not constitute statutory accounts within the

meaning of section 434 of the Companies Act 2006. The information

relating to the six month periods to 31 December 2021 and 31

December 2020 are unaudited.

The interim consolidated financial statements do not include all

the information and disclosures required in the annual financial

statements, and should be read in conjunction with the Group's

annual financial statements as at 30 June 2021 and considered

together with any public announcements made by Greatland Gold plc

during the half-year ended 31 December 2021. The annual report of

the Group as at and for the year ended 30 June 2021 is available at

www.greatlandgold.com . The report of auditors on those financial

statements was unqualified.

The accounting policies adopted are consistent with those

applied by the Group in the preparation of the annual consolidated

financial statements for the year ended 30 June 2021. The Group has

not early adopted any standard, interpretation or amendment that

has been issued but is not yet effective. Several amendments and

interpretations apply for the first time in 2021, but these do not

have a material impact on the interim condensed consolidated

financial statements of the Group.

Going Concern

The consolidated entity has incurred a loss before tax of

GBP3,588,686 for the six months ended 31 December 2021 and had a

net cash outflow of GBP9,941,391 from operating and investing

activities. At that date there were net current assets of

GBP12,239,930, with cash of GBP14,286,415. The loss resulted from

exploration costs and associated administrative related costs.

Given the Group's current positive cash position, the Directors

have a reasonable expectation that the Group has adequate resources

to continue in operational existence for the foreseeable future. In

addition, the Group has access to a loan facility for its share of

Havieron Joint Venture expenditure up to US$50 million and is able

to significantly reduce expenditure on its own exploration programs

if it wishes to do so. The Group also has the ability to raise

capital for expansion purposes, if required and has demonstrated a

consistent ability to do so in the past, as well as potential to

debt fund its share of Havieron development.

Should the directors not achieve the matters set out above,

there is significant uncertainty whether the Group will continue as

a going concern and therefore whether they will realise their

assets and extinguish their liabilities in the normal course of

business and at the amounts stated in the financial report.

Having prepared forecasts based on current resources, assessing

methods of obtaining additional finance and assessing the possible

impact of COVID-19, the Directors believe the Group has sufficient

resources to meet its obligations for a period of 12 months from

the date of approval of these financial statements. Taking these

matters into consideration, the Directors continue to adopt the

going concern basis of accounting in the preparation of the

financial statements. The financial statements do not include the

adjustments that would be required should the going concern basis

of preparation no longer be appropriate.

The principal risks and uncertainties for the six month period

up to 31 December 2021 remained consistent with trends reported in

2021 Annual Report. Greatland continue to monitor areas of

increasing uncertainty, namely the evolving impacts of

COVID-19.

3 Segmental information

An operating segment is a component of the Group that engage in

business activities from which it may earn revenue and incur

expenditure and about which separate financial information is

available that is evaluated regularly by the Group's Chief

Operating Decision Makers (CODM) in deciding how to allocate

resources and in assessing performance.

Segment name Description

UK The UK sector consists of the parent company which

provides administrative and management services

to the subsidiary undertaking based in Australia.

------------------------------------------------------

Australia This segment consists of the development activities

for the Havieron Joint Venture in Western Australia

and exploration and evaluation activities throughout

Australia.

------------- ------------------------------------------------------

Segment information is evaluated by the executive management

team and is prepared in conformity with the accounting policies

adopted for preparing the financial statements of the Group.

Segment results

Income statement for the half-year ended UK Australia Group

31 December 2021 GBP GBP GBP

------------------------------------------ ---------- ------------ ------------

Revenue - - -

Exploration and evaluation costs - (1,774,469) (1,774,469)

Administration and other costs (572,845) (511,955) (1,084,800)

Operating loss (572,845) (2,286,424) (2,859,269)

Depreciation and amortisation expenses (12,567) (38,326) (50,893)

Other income - - -

Finance income 6 2 8

Foreign exchange losses - (581,303) (581,303)

Finance expense (1,992) (95,237) (97,229)

------------------------------------------ ---------- ------------ ------------

Loss before income tax (587,398) (3,001,288) (3,588,686)

Income tax expense - - -

------------------------------------------ ---------- ------------ ------------

Net loss for the half-year (587,398) (3,001,288) (3,588,686)

------------------------------------------ ---------- ------------ ------------

Adjustments and eliminations

Net finance income, finance costs and taxes are not allocated to

individual segments as they are managed on a Group basis.

Assets and Liabilities as at 31 December UK Australia Group

2021 GBP GBP GBP

------------------------------------------ ----------- ------------- -------------

Segment assets 12,990,667 24,756,890 37,747,557

Segment liabilities (346,032) (25,161,595) (25,507,627)

Income statement for the half-year ended UK Australia Group

31 December 2020 GBP GBP GBP

------------------------------------------ ---------- ------------ ------------

Revenue - - -

Exploration and evaluation costs - (1,790,722) (1,790,722)

Administration and other costs (498,775) (343,396) (842,171)

Operating loss (498,775) (2,134,118) (2,632,893)

Depreciation and amortisation expenses - (55,319) (55,319)

Other income 10,000 2,902 12,902

Finance income 10 855 865

Finance expense - - -

------------------------------------------ ---------- ------------ ------------

Loss before income tax (488,765) (2,185,680) (2,674,445)

Income tax expense - - -

------------------------------------------ ---------- ------------ ------------

Net loss for the half-year (488,765) (2,185,680) (2,674,445)

------------------------------------------ ---------- ------------ ------------

Assets and Liabilities as at 30 June UK Australia Group

2021 GBP GBP GBP

-------------------------------------- ---------- ------------- -------------

Segment assets 5,359,105 18,639,255 23,998,360

Segment liabilities (426,530) (19,416,937) (19,843,467)

4 Mine Development

31 Dec 30 Jun

2021 2021

GBP GBP

------------------------------------ ----------- -----------

Opening net carrying amount 17,091,622 -

Additions 4,770,961 16,827,186

Capitalised facility fees 182,644 -

Capitalised interest 933,650 264,436

Adjustment of currency translation (173,401) -

Closing net carrying amount 22,805,476 17,091,622

5 Borrowings

31 Dec 30 Jun

2021 2021

GBP GBP

---------------------------------------- ----------- -----------

Opening balance 12,189,790 -

Additions 6,398,238 11,572,961

Facility fees 182,644 -

Capitalised interest 933,650 264,436

Effect of foreign exchange revaluation 581,280 352,393

Adjustment of currency translation (136,320) -

---------------------------------------- ----------- -----------

Closing balance 20,149,282 12,189,790

The above amounts owing relate to a loan agreement with Newcrest

Operations Limited dated 29 November 2020 in respect of the

Havieron Joint Venture.

The loan has two parts being Facility A and Facility B with

values of US$20 million and US$30 million respectively. Facility B

came into effect in October 2021, when the Stage 4 commitment was

satisfied by Newcrest. Interest is calculated on the LIBOR rate

plus a margin of 8% pa. Interest is calculated every 90 days.

6 Share capital

Share Share premium

Balance as at 31 December 2021 capital GBP

GBP

--------------------------------------------- ---------- --------------

Movement in ordinary shares

As at the beginning of the reporting period 3,947,270 24,064,307

Shares issued during the period 99,277 12,223,899

Transaction costs on share issue - (694,933)

---------------------------------------------- ---------- --------------

As at the end of the reporting period 4,046,547 35,593,273

(a) The number of ordinary shares on issue was 4,046,547,171 at the end of the period

(b) The following issues of shares were made during the year:

(i) On 29 July 2021, 250,000 new ordinary shares at GBP0.03 per

share for a total consideration of GBP7,500 to Clive Latcham as a

result of a binding option exercise notice received

(ii) On 2 August 2021, 6,216,216 new ordinary shares at GBP0.025

per share for a total consideration of GBP155,405 from a block

listing authority of 10 February 2020

(iii) On 1 September 2021, 10,810,812 new ordinary shares at

GBP0.025 per share for a total consideration of GBP270,270 from a

block listing authority of 10 February 2020

(iv) 19 November 2021, the Company issued 82,000,000 new

ordinary shares at an issue price of GBP0.145 per share for a total

consideration of GBP11,890,000, with associated transaction costs

of GBP694,933

Contingently issuable shares

(i) As disclosed on 26 September 2016, as part of the

acquisition of the Havieron Project, the Company entered into a

purchase agreement with Pacific Trends Resources Pty Ltd (as

assigned) for an upfront payment of GBP13,500 in cash and

65,490,000 fully paid ordinary shares in the Company, and a

deferred payment of 145,530,000 fully paid ordinary shares in the

Company contingent on:

-- a bankable feasibility study having been completed and a

decision to mine having been made on Havieron; or

-- the Company assigning 75% or more of its right or interest in

Havieron to an unrelated third party.

(ii) As disclosed on 16 September 2021, the Company entered into

an agreement with Province Resources Limited to acquire the 100%

owned Taunton tenement and two tenement applications for

exploration licences in the Paterson Provision of Western Australia

for a consideration of cash and shares. Greatland will pay a

consideration of GBP80,640 plus GBP107,520 in cash or GBP107,520 in

fully paid ordinary shares in the capital of Greatland in respect

to the withdrawal of the PRL applications and sale and purchase of

the Taunton tenement, and if necessary, the sale and purchase of

the licences created if the PRL applications are granted.

The conditions attached to the contingently issued shares had

not yet been satisfied at the end of the reporting period, and as

such were not included in the diluted earnings per share

calculation at 31 December 2021.

7 Related Parties

(a) On 29 July 2021 the Company received a binding option

exercise notice from Clive Latcham for 250,000 options at GBP0.03

pence per share for a total consideration of GBP7,500.

(b) The following directors and officers of the Company

participated in the share subscription in November 2021 at an issue

price of GBP0.145 per share, as follows:

Director / Officers Number

of Shares GBP

Subscribed

-------------------------------------------- ------------ -------

Shaun Day (Chief Executive Officer) 375,000 54,400

Christopher Toon (Chief Financial Officer) 110,000 15,958

(c) There have been no other significant changes in the nature

of related parties or amounts during the period.

8 Dividends paid and proposed

No dividends were paid or proposed by the Directors. (2020:

GBPNil)

9 Capital Commitments

Exploration commitments

Ongoing exploration expenditure is required to maintain title to

the Group mineral exploration permits. No provision has been made

in the financial statements for these amounts as the expenditure is

expected to be fulfilled in the normal course of the operations of

the Group.

As disclosed on 16 September 2021, the Company entered into an

agreement with Province Resources Limited to acquire the 100% owned

Taunton tenement and two tenement applications for exploration

licences in the Paterson Provision of Western Australia for a

consideration of cash and shares. Refer to Note 6 for further

information.

There have been no other significant changes in capital

commitments during the period.

10 Significant events after the reporting date

In December 2021, Newcrest issued a notice to the Company to

begin the process under the JVA to exercise the option to acquire

an additional 5% interest in the Havieron Joint Venture from

Greatland at fair market value, as determined under the JVA

principles. Under the JVA, if the option exercise price cannot be

agreed, each party is thereafter required to notify the other of

its assessment of fair market value. If both parties' assessments

are within 10% of each other, the option exercise price will be the

average of those assessments. If both parties' assessments are not

within 10% of each other, the parties will proceed to independent

expert valuer determination, with the expert being required to

determine which of the fair market values nominated by the parties

is to be the option exercise price.

Subsequent to the period end, on 2 March 2022 both parties

agreed to some minor modifications to the option process which

included increasing the valuation range noted above from 10% to

20%.

Following agreement or determination of the option exercise

price, Newcrest has 30 business days to exercise its option to

acquire the additional 5% interest. Proceeds from the exercise will

first be used to repay the outstanding balance under the existing

Newcrest loan facility.

As at the date of this report, both parties continue to have

discussions regarding the acquisition of the additional 5% interest

in the Havieron Joint Venture.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUQCWUPPGUG

(END) Dow Jones Newswires

March 21, 2022 06:52 ET (10:52 GMT)

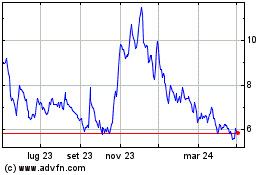

Grafico Azioni Greatland Gold (LSE:GGP)

Storico

Da Mar 2024 a Apr 2024

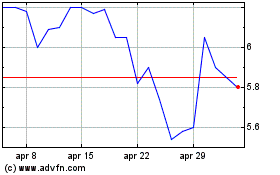

Grafico Azioni Greatland Gold (LSE:GGP)

Storico

Da Apr 2023 a Apr 2024