TIDMGLEN

RNS Number : 8225U

Glencore PLC

04 August 2022

NEWS RELEASE

Baar, 4 August 2022

2022 Half-Year Report

Highlights

Glencore's Chief Executive Officer, Gary Nagle, commented:

"Notwithstanding what has clearly been a very complex

environment for our markets, our operations, and the world in

general, we are pleased to report an exceptional financial

performance for Glencore over the period.

"Global macroeconomic and geopolitical events during the half

created extraordinary energy market dislocation, volatility, risk,

and supply disruption, resulting in record pricing for many coal

and gas benchmarks and physical premia, underpinning a

$10.3 billion increase (119%) in Group Adjusted EBITDA to $18.9

billion. Marketing Adjusted EBIT more than doubled to $3.7 billion,

with energy products the standout, while Industrial Adjusted EBITDA

increased $8.4 billion to $15.0 billion period-on-period.

"Allied to the record EBITDA, our net working capital

significantly increased during the period, with some $5 billion

invested into Marketing, primarily Energy, in line with the

materially higher oil, gas and coal prices, and their elevated

volatilities. Despite this build, significant cash was generated,

which reduced Net debt to $2.3 billion, allowing for today's

announcement of $4.5 billion of "top-up" shareholder returns,

comprising a $1.45 billion special distribution ($0.11 per share)

alongside a new $3.0 billion buyback program (c.$0.23 per share).

Today's additional returns lift total 2022 shareholder returns to

c.$8.5 billion.

"Looking ahead, tightening financial conditions and a

deteriorating macroeconomic environment present some uncertainty

for commodity markets through the second half of the year. However,

with few short-term solutions to rebalance global energy markets,

coal and LNG prices look set to remain elevated during this period,

particularly given the current challenge of securing sufficient and

reliable energy supply for the Northern hemisphere winter

ahead.

"For metals, the outlook is more complex, balancing supply

risks, amid labour, water and energy shortages, supply chain

disruptions, growing sovereign risk uncertainty and rising costs,

against likely weakening end-use markets ex-China. There are some

recent signs of China recovering from its Q2 trough, which could

help to offset potentially weaker conditions in other key consuming

markets.

"The combined strength of our diversified business model across

metals and energy industrial and marketing positions has proved

itself adept in all market conditions, which should allow us to

both successfully navigate the shorter-term challenges that may

arise, as well as meet the resource needs of the future. I would

like to thank all our employees for their efforts and tremendous

contribution during these turbulent times and as always, we remain

focused on creating sustainable long-term value for all our

stakeholders."

Change

US$ million H1 2022 H1 2021 % 2021

------------------------------------------ -------- ------- ------ --------

Key statement of income and cash flows

highlights(1) :

Revenue 134,435 93,805 43 203,751

Adjusted EBITDA 18,918 8,654 119 21,323

Adjusted EBIT 15,415 5,305 191 14,495

Income for the period attributable to

equity holders 12,085 1,277 846 4,974

Earnings per share (Basic) (US$) 0.92 0.10 820 0.38

Funds from operations (FFO)(2) 15,425 7,310 111 17,057

Cash generated by operating activities

before working capital changes, interest

and tax 18,290 7,181 155 16,725

Change

US$ million 30.06.2022 31.12.2021 %

----------------------------------- ----------- ---------- ------

Key financial position highlights:

Total assets 139,955 127,510 10

Total equity 44,451 36,917 20

Net funding(2,3) 27,987 30,837 (9)

Net debt(2,3) 2,308 6,042 (62)

----------------------------------- ----------- ---------- ------

Ratios:

FFO to Net debt(2,3,4) 1090.6% 282.3% 286

Net debt to Adjusted EBITDA(3,4) 0.07 0.28 (75)

1 Refer to basis of presentation on page 6.

2 Refer to page 10.

3 Includes $585 million (2021: $857 million) of Marketing

related lease liabilities.

4 H1 2022 ratios based on last 12 months' FFO and Adjusted

EBITDA, refer to APMs section for reconciliation.

Adjusted measures referred to as Alternative performance

measures (APMs) which are not defined or specified under the

requirements of International Financial Reporting Standards; refer

to APMs section on page 67 for definitions and reconciliations and

to note 3 of the financial statements for reconciliation of

Adjusted EBIT/EBITDA.

ENERGY MARKET VOLATILITY and HIGH prices drive record first half

earnings

- Elevated energy market dislocation, volatility, risk and

supply disruption, led to record prices for many coal and gas

benchmarks and physical premia, underpinning a $10.3 billion

increase in Group Adjusted EBITDA to $18.9 billion

- Industrial Adjusted EBITDA increased $8.4 billion to $15.0

billion period-on-period, benefitting primarily from record coal

prices, augmented by the incremental 66.7% contribution from

Cerrejón, acquired in January 2022

- Marketing Adjusted EBIT more than doubled to $3.7 billion,

with energy products performing exceptionally well amid the

complex, volatile and elevated market risk backdrop, characterised

by extreme dislocations and price movements

- We currently expect more normal Marketing conditions to

prevail in the second half of the year

Industrial unit costs HIGHER, primarily due to the broad

INFLATIONARY environment and lower by-product credits

- H1 unit costs were: Copper 54c/lb, zinc 9c/lb (48c/lb

ex-gold), nickel (ex Koniambo) 370c/lb and thermal coal $75.4/t

- Full year estimated unit costs: Copper 93c/lb, zinc 29c/lb

(63c/lb ex-gold), nickel (ex Koniambo) 359c/lb and thermal coal

$79.4/t (all including updated by-product credits, as

appropriate)

- H1 Industrial capex was $2.0 billion (H1 2021: $1.8 billion);

full year guidance unchanged at $5.4 billion

income for the period attributable to equity holders of $12.1

billion

- Including a $1.5 billion gain on acquiring the remaining

66.67% interest in Cerrejón and disposal of Ernest Henry

Strong balance sheet

- Allied to the record EBITDA, our net working capital

significantly increased during the period, with some $5 billion

invested into Marketing, primarily Energy, in line with the

materially higher oil, gas and coal prices, and their elevated

volatilities

- Despite the working capital build, significant cash was

generated during the half, which reduced Net funding and Net debt

to $28.0 billion and $2.3 billion respectively from prior period

levels of $30.8 billion and $6.0 billion.

- Period-end Net debt of $2.3 billion allows for "top-up"

returns under our shareholder returns framework, where Net debt is

managed around a $10 billion cap, with sustainable deleveraging

below the cap periodically returned to shareholders

- Announced today "top-up" shareholder returns of $4.5 billion,

comprising a $1.45 billion special distribution ($0.11/share) and a

$3.0 billion share buyback (c.$0.23 per share)

- Total shareholder returns for 2022 of c.$8.5 billion,

including the $3.4 billion base distribution and $0.6 billion

buyback announced in February 2022

- Spot illustrative free cash flow generation of c.$18 billion

from Adjusted EBITDA of c.$32.3 billion.

To view the full report please click

https://www.glencore.com/dam/jcr:507b9273-f06c-4362-970c-3a1c8be272d6/GLEN-2022-Half-Year-Report.pdf

For further information please contact:

Investors

Martin Fewings t: +41 41 709 2880 m: +41 79 737 5642 martin.fewings@glencore.com

Media

Charles Watenphul t: +41 41 709 2462 m: +41 79 904 3320 charles.watenphul@glencore.com

www.glencore.com

Glencore LEI: 2138002658CPO9NBH955

Please refer to the end of this document for disclaimers

including on forward-looking statements.

Notes for Editors

Glencore is one of the world's largest global diversified

natural resource companies and a major producer and marketer of

more than 60 responsibly-sourced commodities that advance everyday

life. Through a network of assets, customers and suppliers that

spans the globe, we produce, process, recycle, source, market and

distribute the commodities that enable decarbonisation while

meeting the energy needs of today.

Glencore companies employ around 135,000 people, including

contractors. With a strong footprint in over 35 countries in both

established and emerging regions for natural resources, our

marketing and industrial activities are supported by a global

network of more than 40 offices.

Glencore's customers are industrial consumers, such as those in

the automotive, steel, power generation, battery manufacturing and

oil sectors. We also provide financing, logistics and other

services to producers and consumers of commodities.

Glencore is proud to be a member of the Voluntary Principles on

Security and Human Rights and the International Council on Mining

and Metals. We are an active participant in the Extractive

Industries Transparency Initiative.

Glencore recognises our responsibility to contribute to the

global effort to achieve the goals of the Paris Agreement. Our

ambition is to be a net zero total emissions company by 2050. In

August 2021, we increased our medium-term emission reduction target

to a 50% reduction by 2035 on 2019 levels and introduced a new

short-term target of a 15% reduction by 2026 on 2019 levels.

Important notice concerning disclaimers including on forward

looking statements

This document contains statements that are, or may be deemed to

be, "forward looking statements" which are prospective in nature.

These forward looking statements may be identified by the use of

forward looking terminology, or the negative thereof such as

"outlook", "plans", "expects" or "does not expect", "is expected",

"continues", "assumes", "is subject to", "budget", "scheduled",

"estimates", "aims", "forecasts", "risks", "intends", "positioned",

"predicts", "anticipates" or "does not anticipate", or "believes",

or

variations of such words or comparable terminology and phrases

or statements that certain actions, events or results "may",

"could", "should", "shall", "would", "might" or "will" be taken,

occur or be achieved. Forward-looking statements are not based on

historical facts, but rather on current predictions, expectations,

beliefs, opinions, plans, objectives, goals, intentions and

projections about future events, results of operations, prospects,

financial condition and discussions of strategy.

By their nature, forward-looking statements involve known and

unknown risks and uncertainties, many of which are beyond

Glencore's control. Forward looking statements are not guarantees

of future performance and may and often do differ materially from

actual results. Important factors that could cause these

uncertainties include, but are not limited to, those disclosed in

the last published annual report and half-year report, both of

which are freely available on Glencore's website.

For example, our future revenues from our assets, projects or

mines will be based, in part, on the market price of the commodity

products produced, which may vary significantly from current

levels. These may materially affect the timing and feasibility of

particular developments. Other factors include (without limitation)

the ability to produce and transport products profitably, demand

for our products, changes to the assumptions regarding the

recoverable value of our tangible and intangible assets, the effect

of

foreign currency exchange rates on market prices and operating

costs, and actions by governmental authorities, such as changes in

taxation or regulation, and political uncertainty.

Neither Glencore nor any of its associates or directors,

officers or advisers, provides any representation, assurance or

guarantee that t he occurrence of the events expressed or implied

in any forward-looking statements in this document will actually

occur. You are cautioned not to place undue reliance on these

forward-looking statements which only speak as of the date of this

document. Except as required by applicable regulations or by law,

Glencore is not under any obligation and Glencore and its

affiliates expressly disclaim any intention, obligation or

undertaking, to update or revise any forward looking statements,

whether as a result of new information, future events or otherwise.

This document shall not, under any circumstances, create any

implication that there has been no change in the business or

affairs of Glencore since the date of this document or that the

information contained herein is

correct as at any time subsequent to its date.

No statement in this document is intended as a profit forecast

or a profit estimate and past performance cannot be relied on as a

guide to future performance. This document does not constitute or

form part of any offer or invitation to sell or issue, or any

solicitation of any offer to purchase or subscribe for any

securities.

The companies in which Glencore plc directly and indirectly has

an interest are separate and distinct legal entities. In this

document, "Glencore", "Glencore group" and "Group" are used for

convenience only where references are made to Glencore plc and its

subsidiaries in general. These collective expressions are used for

ease of reference only and do not imply any other relationship

between the companies. Likewise, the words "we", "us" and "our" are

also used to refer collectively to members of the Group or to those

who work for them. These expressions are also used where no useful

purpose is served by identifying the particular company or

companies.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SSIFLDEESEFA

(END) Dow Jones Newswires

August 04, 2022 02:00 ET (06:00 GMT)

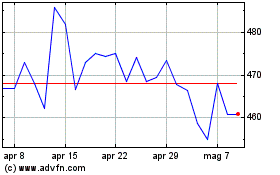

Grafico Azioni Glencore (LSE:GLEN)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Glencore (LSE:GLEN)

Storico

Da Apr 2023 a Apr 2024