TIDMHSBA

RNS Number : 2148M

HSBC Holdings PLC

10 January 2023

On 10 January 2023, HSBC submitted the below announcement to the

Stock Exchange of Hong Kong Limited regarding waivers from strict

compliance with Rules 17.03A, 17.07 and 17.09 of the amended

Chapter 17 of the Rules Governing the Listing of Securities in

relation to HSBC Employee Share Plans.

Hong Kong Exchanges and Clearing Limited and The Stock Exchange

of Hong Kong Limited take no responsibility for the contents of

this document, make no representation as to its accuracy or

completeness and expressly disclaim any liability whatsoever for

any loss howsoever arising from or in reliance upon the whole or

any part of the contents of this document.

Hong Kong Stock Code: 5

10 January 2023

HSBC HOLDINGS PLC

WAIVERS FROM STRICT COMPLIANCE WITH RULES 17.03A, 17.07 and

17.09: EMPLOYEE SHARE PLANS

1. Introduction

HSBC Holdings plc (the "Company") has applied for, and The Stock

of Exchange of Hong Kong Limited (the "Exchange") has granted,

certain waivers to the Company from strict compliance with Rules

17.03A, 17.07 and 17.09 of the amended Chapter 17 of the Rules

Governing the Listing of Securities on The Stock Exchange of Hong

Kong Limited (the "Listing Rules") (such amendments took effect on

1 January 2023).

The amendments expand the application of Chapter 17 of the

Listing Rules to all share plans operated by an issuer (rather than

only to share option plans) and introduce various new requirements

relating to share plans. All references in this announcement are to

the Listing Rules as amended.

Rule 17.03A states that the participants of a share plan may

only comprise employee participants, related entity participants or

service providers (known as "eligible participants"). Former

employees are not considered eligible participants under Rule

17.03A.

Rule 17.07 requires the issuer to include a table of specified

summary information (including the particulars of the awards or

options granted) in their interim and annual report for any options

and awards granted and to be granted to a list of specified persons

(including, among others, directors, chief executives, substantial

shareholders on an individual basis and employee participants,

related entity participants and service providers by category).

Rule 17.09 requires the issuer to include in their annual report

a summary of each share plan with certain specified information

(including but not limited to the purpose and participants of the

plan, as well as details of the awards).

2. Waiver from strict compliance with Rule 17.03A

2.1 Background

Under the HSBC Share Plan 2011 (the "2011 Plan"), the Company is

able to grant share awards to former employees of the Company and

its subsidiaries (the "Group") in various circumstances to comply

with legal and regulatory requirements.

One example would be the UK's Prudential Regulation Authority's

("PRA") requirements under their remuneration rules ("Remuneration

Rules") relating to the deferral of variable remuneration. Under

the Remuneration Rules, the Company must deliver variable

remuneration in the form of deferred share awards for certain

individuals. As the Remuneration Rules do not make a distinction

between current and former employees, the Company needs the

flexibility to grant awards to employees who may have left the

Company.

2.2 Reasons for the waiver

Rule 17.03A does not allow for grants of awards under share

plans to former employees. Awards can only be granted to the

eligible participants referred to above. The Company would not be

allowed to grant awards to former employees under the 2011 Plan to

meet legal and regulatory requirements without the grant of a

waiver from strict compliance with Rule 17.03A.

2.3 Terms of the waiver

The Exchange has granted the waiver from strict compliance with

Rule 17.03A such that the Company can grant options and awards

under the 2011 Plan to former employees of the Group in tightly

defined circumstances, meaning grants for the purpose of ensuring

compliance with various legal and/or regulatory requirements that

the Group may be subject to from time to time.

3. Waiver from strict compliance with Rules 17.07 and 17.09

3.1 Background

Under Rules 17.07 and 17.09, the Company must provide certain

summary information relating to both the share plans and the awards

under the plans in its interim and annual report. In a waiver dated

24 December 2010 (the "2010 Waiver"), the Exchange allowed the

Company to issue a separate document containing this information

(in the context of its option plans) instead of including it in its

interim or annual report. This waiver was subject to various

conditions, notably that details of any options granted to

directors must be included in the document, the full details

required by Rules 17.07 and 17.09 must be accessible on the

Company's website and the information must be accessible to

shareholders upon request.

The updated Chapter 17 now applies to all share plans and is not

limited to option plans. Further, Rules 17.07 and 17.09 have been

expanded to include new requirements relating to the disclosure of

specified information (such as vesting periods) and participants

(such as descriptions by category for eligible participants).

3.2 Reasons for the waiver

As the 2010 Waiver only related to descriptions of option grants

and their associated plans, the Company requested a waiver from

strict compliance with Rules 17.07 and 17.09 so that it could

continue to issue a separate document with descriptions of any

awards granted under the Company's share plans.

3.3 Terms of the waiver

The waiver was granted subject to the following conditions:

(1) the Company must disclose in its directors' remuneration

report within the annual report (or the additional information

section of the interim report) details of the options and awards

granted to directors (and connected persons, if any) in a manner

which complies with Rules 17.07 and 17.09; and

(2) the full details required under Rules 17.07 and 17.09 will

be provided on both the Company's website and the Exchange's

website together with the annual/interim report, and such

information will be sent to the shareholders on request.

The aforementioned waivers are granted on the condition that the

Company discloses details of the waivers in its announcement and/or

annual report.

For and on behalf of

HSBC Holdings plc

Aileen Taylor

Group Company Secretary and Chief Governance Officer

The Board of Directors of HSBC Holdings plc as at the date of

this announcement comprises: Mark Tucker*, Noel Quinn, Geraldine

Buckingham , Rachel Duan , Georges Elhedery, Carolyn Julie

Fairbairn , James Anthony Forese , Steven Guggenheimer , José

Antonio Meade Kuribreña , Eileen K Murray , David Nish and Jackson

Tai .

* Non-executive Group Chairman

Independent non-executive Director

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAXFEFDDDEEA

(END) Dow Jones Newswires

January 10, 2023 04:30 ET (09:30 GMT)

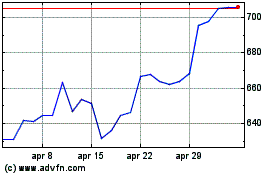

Grafico Azioni Hsbc (LSE:HSBA)

Storico

Da Mar 2024 a Apr 2024

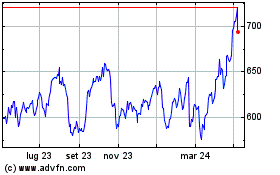

Grafico Azioni Hsbc (LSE:HSBA)

Storico

Da Apr 2023 a Apr 2024