HSBC Shareholders Likely to Reject Special Spinoff, Dividend Resolutions -- AGM Preview

04 Maggio 2023 - 6:18PM

Dow Jones News

By Elena Vardon

HSBC Holdings shareholders will gather for the bank's annual

general meeting on Friday to vote on 18 resolutions, including

special resolutions requested by shareholders.

The meeting comes as Chinese insurer Ping An--a majority

shareholder with a stake of more than 8% in the bank and which has

support of some Hong-Kong-based retail investors--has recently been

vocal about reforming the lender and suggested restructuring

options to enhance shareholder value. HSBC responded by saying that

spinning off its Asian business would result in high costs and be

value destructive.

The meeting will take place days after HSBC published

first-quarter results where it reported better-than-expected

profits, even after one-time gains, and said it has established a

50% dividend payout ratio for 2023 and 2024 as it is confident it

will return to prepandemic dividend levels.

There is further evidence that the integrated business and

capital returns that HSBC is proposing are exceptionally high

numbers, said analyst Alastair Ryan of Bank of America Securities,

which forecasts it to return a quarter of its market

capitalization, or $34 billion, to shareholders over the next two

years.

A group represented by Ken Lui Yu Kin, who leads the 'Spin Off

HSBC Asia Concern Group', has proposed two resolutions which the

bank has advised shareholders to vote against as it considers them

not to be in the best interests of the company or shareholders.

Analysts expect both special resolutions 17 and 18 not to be

voted through by shareholders as no support from institutional

investors has been seen.

Here's what you need to know:

RESOLUTION 17: It proposes the creation and implementation of a

quarterly strategy review of structural reforms aimed at the bank's

Asia business, which would include its spinoff and strategic

reorganization and restructuring.

"We do not expect shareholder proposals seeking to restructure

HSBC to receive support, given the value of HSBC's connected global

businesses. Improved shareholder returns also reduce the perceived

need to create shareholder value through restructuring," Berenberg

analyst Peter Richardson wrote in a note.

The push to isolate the Asian business to unlock further value

"remains contrary to HSBC's tradition of a globally interconnected

bank and one which it fully intends to continue to resist,"

Interactive Investor's head of markets Richard Hunter said in a

note, adding that the turmoil in the sector has enabled HSBC to

flex its financial muscles and reiterate its power.

The request to carve out a still integrated but separately

identified entity is a very particular request and it has seen

little institutional support, BofA's Ryan said.

"In my view, Ping An's objective remains the partial listing of

the Hong Kong subsidiary, not to create value but to ringfence

depositors against the impact of U.S. sanctions (what Ping An

refers as geopolitical risk in its statement)," AlphaValue analyst

David Grinsztajn said.

RESOLUTION 18: A dividend policy was proposed through which the

bank would commit to distribute quarterly payouts that amount to no

less than $0.51 a year, its prepandemic level.

The resolution is asking for something that the company already

intends to deliver, Ryan said. HSBC is now in a position in which

it can restore its distribution to its traditionally high levels on

a recurring basis, he noted. With the current share buybacks,

planned special dividend from the disposal of its Canadian business

and the final 2023 dividend---which BofA estimates at $0.55 a

share--the bank can significantly catch up on total capital

distributions that were missed since the decision to cancel

quarterly dividends during the pandemic, he said.

"I think that requesting management to commit to a minimum

payout ratio does not make sense especially since the regulator as

a final say on capital distribution," AlphaValue's Grinsztajn

said.

The proposal is likely to be rejected as the bank declared its

first quarterly dividend since 2019 at 1Q results and will likely

to want to retain its flexibility over dividend distribution.

Write to Elena Vardon at elena.vardon@wsj.com

(END) Dow Jones Newswires

May 04, 2023 12:03 ET (16:03 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

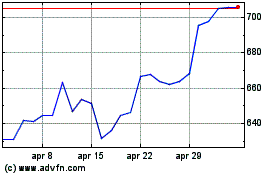

Grafico Azioni Hsbc (LSE:HSBA)

Storico

Da Mar 2024 a Apr 2024

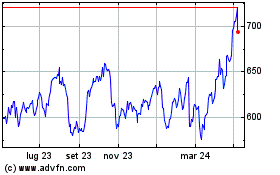

Grafico Azioni Hsbc (LSE:HSBA)

Storico

Da Apr 2023 a Apr 2024