Imperial Brands Fiscal Year 2021 Profit Rose

16 Novembre 2021 - 8:52AM

Dow Jones News

By Jaime Llinares Taboada

Imperial Brands PLC on Tuesday reported an improved profit for

the year ended Sept. 30, mainly driven by one-offs, and said it is

well placed to manage inflation.

The FTSE 100 tobacco group made a pretax profit of 3.24 billion

pounds ($4.35 billion) in fiscal 2021, up from GBP2.17 billion in

fiscal 2020. This reflected gains on the disposal of the Premium

Cigar Division and lower amortization and impairment costs.

Adjusted earnings before interest and tax rose 2.1% to GBP3.57

billion, slightly above a market consensus of GBP3.56

billion--taken from Vuma and based on 14 analysts' estimates.

Imperial Brands declared a dividend of 139.08 pence a share for

the financial year, up from 137.7 pence a year earlier.

As for fiscal 2022, the company said that it is well positioned

to manage inflation through its purchasing strategy, high margins

and pricing. In addition, it forecast net revenue growth at a

similar rate to fiscal 2021, while adjusted operating profit growth

is anticipated to be slightly slower than revenue.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

November 16, 2021 02:37 ET (07:37 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

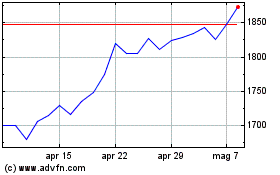

Grafico Azioni Imperial Brands (LSE:IMB)

Storico

Da Mar 2024 a Apr 2024

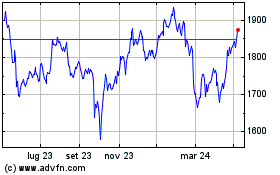

Grafico Azioni Imperial Brands (LSE:IMB)

Storico

Da Apr 2023 a Apr 2024