Imperial Brands PLC Trading Statement (3994H)

06 Aprile 2022 - 8:01AM

UK Regulatory

TIDMIMB

RNS Number : 3994H

Imperial Brands PLC

06 April 2022

IMPERIAL BRANDS PLC

Legal Entity Identifier (LEI) No. 549300DFVPOB67JL3A42

6 April 2022

Pre-close trading update

-- Good progress in delivering on our strategic objectives

-- Growth in aggregate market share in top-five priority markets

-- First-half adjusted Group operating profit ahead of last year on constant currency basis

-- Full-year outlook in line with revised guidance issued on 15 March

-- NGP trials progressing well, further update on next steps to

be given at the interim results

-- Cash conversion remains strong supporting year-on-year deleverage

Imperial Brands continues to perform in line with its five-year

strategy launched in 2021. Focused investment in our top-five

combustible markets, which account for around 70 per cent of

adjusted operating profit, has driven an increase in aggregate

market share for those markets. Gains in the US, UK and Australia

more than offset declines in Germany and Spain. These share gains

were achieved while maintaining strong pricing discipline, and

overall tobacco volumes are in line with expectations.

Consumers have responded positively to the pilots of our Pulze

heated tobacco system in Greece and the Czech Republic and an

improved consumer marketing proposition for our blu vapour product

in the US. We are making good progress against our strategic

objective of building a sustainable, consumer-centric Next

Generation Product (NGP) business and we will provide an update on

our next steps at the interim results. First-half NGP revenues are

expected to be slightly ahead of the prior period, driven by growth

in Europe.

We are on track to deliver full-year results in line with our

revised guidance issued on 15 March, with expected full-year net

revenue growth of around 0-1 per cent on a constant currency basis

and adjusted operating profit growth of around 1 per cent.

First-half Group net revenue is expected to be broadly flat on

last year on a constant currency basis, in line with our

expectations. This reflects a weaker tobacco performance in Europe,

which offsets growth in other regions. Europe's performance has

been driven by the return to pre-COVID purchasing patterns as

Northern Europeans resume international travel, as well as price

phasing in some markets. However, price increases during the latter

part of the first half will support a stronger revenue performance

in the second half.

First-half Group adjusted operating profit is expected to grow

by around 2 per cent on a constant currency basis, benefiting

primarily from reduced losses in NGP. As expected, tobacco

performance will be weighted to the second half. First-half tobacco

operating profit will be broadly flat on last year on a constant

currency basis, with increased investment behind our strategy

offsetting the benefit of reduced US litigation costs compared to

last year.

At current exchange rates, translation foreign exchange is

expected to be a c. 2 per cent headwind on first-half earnings per

share and a 1 per cent headwind on full year earnings per

share.

Our adjusted operating cash conversion remains strong on a

12-month basis and we are on track to deliver in line with

expectations at the half and full year. Our first-half leverage

(adjusted net debt to EBITDA) will improve year on year, with

12-month leverage expected to be c. 2.4 times at the half year

(HY21: 2.6x), reflecting the usual seasonal variations in cash

flow. We expect to deliver a further year-on-year improvement in

leverage at the full year.

We continue negotiations with a local third party about an

orderly transfer of our Russian assets and operations as a going

concern. Meanwhile, we also continue to support our Ukrainian

colleagues and their families, including with transport and

accommodation to enable them to escape the areas most severely hit

by conflict, as well as resettlement assistance for those who have

left Ukraine.

The interim results for the six months ended 31 March 2022 will

be announced on 17 May 2022.

ENDS

Notes:

The Group uses 'adjusted' (non-GAAP) measures as we believe they

provide a better comparison between reporting periods. The

definition of our adjusted measures is unchanged from our full-year

results. We also use the term 'constant currency', which removes

the effect of exchange rate movements on the translation of the

results of our overseas operations.

Investor Contacts Media Contacts

+44 (0)7970 328 +44 ( 0)7740 096

Peter Durman 903 Jonathan Oliver 018

+44 (0)7581 052

James King 880

+44 (0)7974 615

Jennifer Ramsey 739

Cautionary Statement

Certain statements in this announcement constitute or may

constitute forward-looking statements. Any statement in this

announcement that is not a statement of historical fact including,

without limitation, those regarding the Company's future

expectations, operations, financial performance, financial

condition and business is or may be a forward-looking statement.

Such forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially

from those projected or implied in any forward-looking statement.

These risks and uncertainties include, among other factors,

changing economic, financial, business or other market conditions.

These and other factors could adversely affect the outcome and

financial effects of the plans and events described in this

announcement. As a result, you are cautioned not to place any

reliance on such forward-looking statements. The forward-looking

statements reflect knowledge and information available at the date

of this announcement and the Company undertakes no obligation to

update its view of such risks and uncertainties or to update the

forward-looking statements contained herein. Nothing in this

announcement should be construed as a profit forecast or profit

estimate and no statement in this announcement should be

interpreted to mean that the future earnings per share of the

Company for current or future financial years will necessarily

match or exceed the historical or published earnings per share of

the Company. This announcement has been prepared for, and only for

the members of the Company, as a body, and no other persons. The

Company, its Directors, employees, agents or advisers do not accept

or assume responsibility to any other person to whom this

announcement is shown or into whose hands it may come and any such

responsibility or liability is expressly disclaimed.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDDGDSUXGDGDU

(END) Dow Jones Newswires

April 06, 2022 02:01 ET (06:01 GMT)

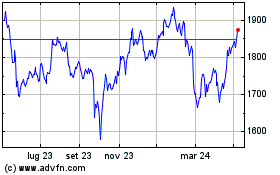

Grafico Azioni Imperial Brands (LSE:IMB)

Storico

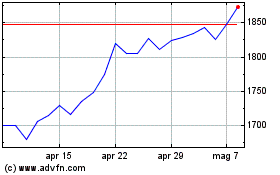

Da Mar 2024 a Apr 2024

Grafico Azioni Imperial Brands (LSE:IMB)

Storico

Da Apr 2023 a Apr 2024