TIDM94WP TIDMLLOY

RNS Number : 3340E

Lloyds Bank PLC

27 October 2022

Lloyds Bank plc

Q3 2022 Interim Management Statement

27 October 2022

Member of the Lloyds Banking Group

REVIEW OF PERFORMANCE

Income statement

In the nine months to 30 September 2022, the Group recorded a

profit before tax of GBP4,480 million compared to GBP5,103 million

in the same period in 2021, representing a reduction of GBP623

million as higher total income was more than offset by the impact

of a net impairment charge for the period compared to a net credit

for the first nine months of 2021. Profit after tax was GBP3,346

million.

Total income increased by GBP1,047 million, or 9 per cent, to

GBP12,119 million in the nine months to 30 September 2022 compared

to GBP11,072 million in the first nine months of 2021; there was an

increase of GBP1,209 million in net interest income and a decrease

of GBP162 million in other income.

Net interest income was GBP9,458 million, an increase of

GBP1,209 million compared to GBP8,249 million in the nine months to

30 September 2021. The increase in net interest income was driven

by an improved margin, as a result of UK Bank Rate increases and

continued funding and capital optimisation, partly offset by

mortgage margin reductions. Increased average interest-earning

assets reflecting continued growth in the open mortgage book also

contributed positively.

Other income was GBP162 million lower at GBP2,661 million in the

nine months to 30 September 2022 compared to GBP2,823 million in

the same period last year. Net fee and commission income increased

by GBP58 million to GBP971 million, compared to GBP913 million in

the first nine months of 2021, due to higher credit and debit card

fees, reflecting increased levels of customer activity, more than

offsetting some reduction from lower levels of corporate financing

activity. Net trading income was GBP305 million lower at GBP88

million in the nine months to 30 September 2022, in part reflecting

the change in fair value of interest rate derivatives and foreign

exchange contracts not mitigated by hedge accounting. Other

operating income increased by GBP85 million to GBP1,602 million

compared to GBP1,517 million in the nine months to 30 September

2021, in part due to improved gains on disposal of financial assets

at fair value through other comprehensive income.

Total operating expenses decreased by GBP131 million to GBP6,629

million compared to GBP6,760 million in the first nine months of

2021. Increased staff costs reflected salary increases and the

impact of a one-off GBP1,000 cost of living payment to staff,

partly offset by headcount reductions. In addition, there was an

increase in IT-related costs, as a result of the Group's strategic

investment programmes. Depreciation charges were lower reflecting

the continued strength in used car prices. The charge in respect of

regulatory provisions was GBP346 million lower at GBP67 million and

largely related to pre-existing programmes. There have been no

further charges relating to HBOS Reading since the end of 2021 and

the provision held continues to reflect the Group's best estimate

of its full liability, albeit significant uncertainties remain.

There was a net impairment charge in the nine months to 30

September 2022 of GBP1,010 million, compared to a net credit of

GBP791 million in the first nine months of 2021, largely reflecting

a low charge arising from observed credit performance and a charge

in the first nine months of 2022 as a result of updates to the

assessment of the economic outlook and associated scenarios,

compared to a significant credit in the first nine months of 2021.

The updated outlook includes elevated risks from a higher inflation

and interest rate environment, offset by a GBP400 million release

of the COVID-19 central adjustment in the nine months to 30

September 2022.

The Group's loan portfolio continues to be well-positioned,

reflecting a prudent through-the-cycle approach to lending with

high levels of security, also reflected in strong recovery

performance. Observed credit performance remains stable, with very

modest evidence of deterioration and the flow of assets into

arrears, defaults and write-offs at low levels and below

pre-pandemic levels. Stage 3 loans and advances have been stable

across the third quarter. Credit card minimum payers and overdraft

and revolving credit facility (RCF) utilisation rates have remained

low and in line with recent trends.

The Group's expected credit loss (ECL) allowance increased in

the first nine months of the year to GBP4,519 million (31 December

2021: GBP4,000 million). This reflects the balance of risks

shifting from COVID-19 to increased inflationary pressures and

rising interest rates within the Group's base case and wider

economic scenarios. The deterioration in the economic outlook is

now reflected in variables which credit models better capture. As a

result, the Group's reliance on judgemental overlays for modelling

risks in relation to inflationary pressures has reduced, with these

risks now captured more fully in models.

The Group recognised a tax expense of GBP1,134 million in the

period compared to GBP141 million in the first nine months of 2021.

During the first nine months of 2021 the Group had recognised a

deferred tax credit in the income statement of GBP1,189 million

following substantive enactment, in May 2021, of the UK

Government's increase in the rate of corporation tax from 19 per

cent to 25 per cent with effect from 1 April 2023.

REVIEW OF PERFORMANCE (continued)

Balance sheet

Total assets were GBP24,590 million, or 4 per cent, higher at

GBP627,439 million at 30 September 2022 compared to GBP602,849

million at 31 December 2021. Cash and balances at central banks

rose by GBP13,223 million to GBP67,502 million reflecting the

placement of funds from increased available liquidity. Financial

assets at amortised cost were GBP14,947 million higher at

GBP505,263 million at 30 September 2022 compared to GBP490,316

million at 31 December 2021, as a result of a GBP2,456 million

increase in loans and advances to banks, GBP4,434 million increase

in loans and advances to customers, net of impairment allowances,

GBP2,780 million in debt securities, and GBP5,163 million in

reverse repurchase agreement balances. The increase in loans and

advances to customers, net of impairment allowances, was driven by

continued growth in the open mortgage book and increases in

Corporate and Institutional lending due to attractive growth

opportunities as well as foreign exchange movements, partially

offset by further reductions in the closed mortgage book and

hedging impacts. Other assets increased by GBP3,772 million mainly

due to a GBP2,272 million increase in deferred tax assets and a

GBP470 million increase in current tax recoverable. Financial

assets at fair value through other comprehensive income were

GBP6,787 million lower at GBP20,999 million as a result of asset

sales during the period.

Total liabilities were GBP28,395 million, or 5 per cent, higher

at GBP590,472 million compared to GBP562,077 million at 31 December

2021. Customer deposits increased by GBP5,771 million to GBP455,144

million compared to GBP449,373 million at 31 December 2021, as a

result of continued inflows to Retail current and savings accounts

and Commercial Banking balances. Repurchase agreements at amortised

cost increased GBP16,255 million to GBP46,361 million, as the Group

took advantage of favourable funding opportunities and amounts due

to fellow Lloyds Banking Group undertakings were GBP3,654 million

higher at GBP5,144 million, also reflecting funding arrangements.

Subordinated liabilities decreased by GBP2,675 million following

redemptions during the period.

Ordinary shareholders' equity decreased GBP3,794 million to

GBP32,616 million at 30 September 2022 as retained profit for the

period was more than offset by negative movements in the cash flow

hedging reserve as a result of increased interest rates and adverse

defined benefit post-retirement scheme remeasurements.

Capital

The Group's common equity tier 1 (CET1) capital ratio reduced

from 16.7 per cent at 31 December 2021 to 14.1 per cent on 1

January 2022, before increasing during the period to 15.0 per cent

at 30 September 2022. The reduction on 1 January 2022 reflected the

impact of regulatory changes (as previously reported), with the

subsequent increase during the first nine months of the year

reflecting profits for the period and a reduction in risk-weighted

assets (post 1 January 2022 regulatory changes) partly offset by

pension contributions made to the Group's defined benefit pension

schemes and an accrual for foreseeable ordinary dividends. The

total capital ratio reduced from 23.5 per cent at 31 December 2021

to 20.4 per cent at 30 September 2022, reflecting the reduction in

CET capital, increase in risk-weighted assets, the completion of

the transition to end-point eligibility rules for regulatory

capital on 1 January 2022 and movements in rates, partially offset

by sterling depreciation and eligible provisions.

Risk-weighted assets increased from GBP161.6 billion at 31

December 2021 to around GBP178 billion on 1 January 2022,

reflecting regulatory changes which include the anticipated impact

of the implementation of new CRD IV models to meet revised

regulatory standards for modelled outputs. Risk-weighted assets

subsequently reduced by GBP5 billion during the first nine months

of the year to GBP173.2 billion at 30 September 2022, largely

reflecting optimisation activity and Retail model reductions linked

to the resilient underlying credit performance, partly offset by

the growth in balance sheet lending. The new CRD IV models remain

subject to finalisation and approval by the PRA and therefore the

final risk-weighted asset impact remains subject to this.

The Group's UK leverage ratio of 5.2 per cent at 30 September

2022 has reduced from 5.3 per cent at 31 December 2021, reflecting

a reduction in total tier 1 capital, offset in part by a reduction

in the exposure measure principally related to off-balance sheet

items.

CONDENSED CONSOLIDATED INCOME STATEMENT (UNAUDITED)

Nine Nine

months months

ended ended

30 Sep 30 Sep

2022 2021

GBPm GBPm

Net interest income 9,458 8,249

Other income 2,661 2,823

--------------- ---------------

Total income 12,119 11,072

Operating expenses (6,629) (6,760)

Impairment (charge) credit (1,010) 791

--------------- ---------------

Profit before tax 4,480 5,103

Tax expense (1,134) (141)

--------------- ---------------

Profit for the period 3,346 4,962

--------------- ---------------

Profit attributable to ordinary shareholders 3,143 4,645

Profit attributable to other equity holders 177 290

--------------- ---------------

Profit attributable to equity holders 3,320 4,935

Profit attributable to non-controlling interests 26 27

--------------- ---------------

Profit for the period 3,346 4,962

--------------- ---------------

CONDENSED CONSOLIDATED BALANCE SHEET (UNAUDITED)

At 30 At 31

Sep 2022 Dec 2021

GBPm GBPm

Assets

Cash and balances at central banks 67,502 54,279

Financial assets at fair value through profit or

loss 1,434 1,798

Derivative financial instruments 5,310 5,511

--------------- ---------------

Loans and advances to banks 6,934 4,478

Loans and advances to customers 435,263 430,829

Reverse repurchase agreements 54,871 49,708

Debt securities 7,342 4,562

Due from fellow Lloyds Banking Group undertakings 853 739

--------------- ---------------

Financial assets at amortised cost 505,263 490,316

Financial assets at fair value through other comprehensive

income 20,999 27,786

Other assets 26,931 23,159

--------------- ---------------

Total assets 627,439 602,849

--------------- ---------------

Liabilities

Deposits from banks 4,684 3,363

Customer deposits 455,144 449,373

Repurchase agreements at amortised cost 46,361 30,106

Due to fellow Lloyds Banking Group undertakings 5,144 1,490

Financial liabilities at fair value through profit

or loss 5,497 6,537

Derivative financial instruments 6,826 4,643

Debt securities in issue 49,724 48,724

Subordinated liabilities 5,983 8,658

Other liabilities 11,109 9,183

--------------- ---------------

Total liabilities 590,472 562,077

--------------- ---------------

Equity

Ordinary shareholders' equity 32,616 36,410

Other equity instruments 4,268 4,268

Non-controlling interests 83 94

--------------- ---------------

Total equity 36,967 40,772

--------------- ---------------

Total equity and liabilities 627,439 602,849

--------------- ---------------

ADDITIONAL FINANCIAL INFORMATION

1. Basis of presentation

This release covers the results of Lloyds Bank plc (the Bank)

together with its subsidiaries (the Group) for the nine months

ended 30 September 2022.

Changes in accounting policy

Except for the matter referred to below, the Group's accounting

policies are consistent with those applied by the Group in its

financial statements for the year ended 31 December 2021 and there

have been no changes in the Group's methods of computation.

In April 2022, the IFRS Interpretations Committee was asked to

consider whether an entity includes a demand deposit as a component

of cash and cash equivalents in the statement of cash flows when

the demand deposit is subject to contractual restrictions on use

agreed with a third party. It concluded that such amounts should be

included within cash and cash equivalents. Accordingly, the Group

includes mandatory reserve deposits with central banks that are

held in demand accounts within cash and cash equivalents disclosed

in the cash flow statement. This change has increased the Group's

cash and cash equivalents at 1 January 2020 by GBP1,682 million (to

GBP40,296 million) and decreased the adjustment for the change in

operating assets in 2020 by GBP974 million (to a reduction of

GBP5,882 million) resulting in an increase in the Group's cash and

cash equivalents at 31 December 2020 of GBP2,656 million (to

GBP51,622 million); and decreased the adjustment for the change in

operating assets in 2021 by GBP114 million (to an increase of

GBP5,174 million) and, as a result, the Group's cash and cash

equivalents at 31 December 2021 increased by GBP2,770 million (to

GBP55,960 million). The change had no impact on profit after tax or

total equity.

2. Capital

The Group's Q3 2022 Interim Pillar 3 Report can be found at

www.lloydsbankinggroup.com/investors/financial-downloads.

3. Base case and MES economic assumptions

The Group's base case economic scenario reflects the outlook as

of 30 September 2022 and was revised in light of developments in

energy pricing, changes in UK fiscal policy prior to the balance

sheet date and a continuing shift towards a more restrictive

monetary policy stance by central banks. The Group's updated base

case scenario was based upon three conditioning assumptions: first,

the war in Ukraine remains 'local', without overtly involving

neighbouring countries, NATO or China; second, the fiscal loosening

implied by the UK Government's 'Growth Plan' of 23 September 2022

would be offset principally by Government spending cuts; and third,

central bank reaction functions, including of the Bank of England,

are focused on controlling inflation, motivating a more rapid

tightening of UK monetary policy. The Group continues to assume

that no further UK COVID-19 national lockdowns are mandated. Based

on these assumptions and incorporating the macroeconomic

information published in the third quarter, the Group's base case

scenario comprises an economic downturn with a rise in the

unemployment rate, declining residential and commercial property

prices, and continuing increases in the UK Bank Rate against a

backdrop of elevated inflationary pressures. Risks to the base case

economic view exist in both directions and are partly captured by

the generation of alternative economic scenarios. Each of the

scenarios includes forecasts for key variables as of the third

quarter of 2022, for which data or revisions to history may have

since emerged prior to publication.

At 30 September 2022, the Group has included an adjusted severe

downside scenario to incorporate high CPI inflation and UK Bank

Rate profiles and has adopted this adjusted severe downside

scenario in calculating its ECL allowance. This is because the

historic macroeconomic and loan loss data upon which the scenario

model is calibrated imply an association of downside economic

outcomes with lower inflation rates, easier monetary policy, and

therefore low interest rates. This adjustment is considered to

better reflect the risks around the Group's base case view in a

macroeconomic environment in which supply shocks are the principal

concern.

ADDITIONAL FINANCIAL INFORMATION (continued)

3. Base case and MES economic assumptions (continued)

UK economic assumptions - Scenarios by year

Key annual assumptions made by the Group are shown below. Gross

domestic product and Consumer Price Index (CPI) inflation are

presented as an annual change, house price growth and commercial

real estate price growth are presented as the growth in the

respective indices within the period. Unemployment rate and UK Bank

Rate are averages for the period.

2022

to 2026

2022 2023 2024 2025 2026 average

At 30 September 2022 % % % % % %

Upside

Gross domestic product 3.6 0.4 1.0 1.5 2.1 1.7

Unemployment rate 3.3 2.8 3.2 3.5 3.8 3.3

House price growth 6.1 (2.7) 7.2 8.5 6.1 5.0

Commercial real estate

price growth 8.7 (3.6) 0.1 1.0 1.9 1.6

UK Bank Rate 2.16 5.28 5.17 4.30 4.12 4.20

CPI inflation 9.0 6.1 2.9 3.2 2.6 4.8

Base case

Gross domestic product 3.4 (1.0) 0.4 1.4 2.0 1.2

Unemployment rate 3.7 4.9 5.4 5.5 5.5 5.0

House price growth 5.0 (7.9) (0.5) 2.5 2.3 0.2

Commercial real estate

price growth 2.8 (14.4) (2.7) 0.4 1.9 (2.6)

UK Bank Rate 2.06 4.00 3.38 2.56 2.50 2.90

CPI inflation 9.1 6.2 2.5 2.2 1.3 4.2

Downside

Gross domestic product 3.2 (2.3) (0.2) 1.2 1.9 0.8

Unemployment rate 4.1 6.6 7.5 7.3 7.2 6.5

House price growth 3.9 (12.9) (8.9) (5.4) (3.3) (5.5)

Commercial real estate

price growth (1.4) (23.0) (6.5) (2.5) (0.2) (7.1)

UK Bank Rate 2.00 2.93 1.76 1.04 1.07 1.76

CPI inflation 9.0 6.0 1.9 1.1 0.0 3.6

Severe downside

Gross domestic product 2.4 (4.5) (0.3) 1.0 1.8 0.0

Unemployment rate 4.9 9.8 10.5 10.0 9.5 8.9

House price growth 2.4 (17.9) (16.6) (10.3) (6.0) (10.0)

Commercial real estate

price growth (9.2) (35.7) (13.6) (6.4) (0.7) (14.1)

UK Bank Rate -

modelled 1.78 0.91 0.36 0.21 0.23 0.70

UK Bank Rate -

adjusted 2.44 7.00 4.88 3.00 2.75 4.01

CPI inflation -

modelled 9.1 5.9 1.0 (0.4) (1.9) 2.7

CPI inflation -

adjusted 9.9 14.3 9.0 4.1 1.3 7.7

Probability-weighted

Gross domestic product 3.3 (1.3) 0.3 1.4 2.0 1.1

Unemployment rate 3.8 5.3 5.9 5.9 5.9 5.4

House price growth 4.7 (8.8) (2.3) 0.6 0.9 (1.1)

Commercial real estate

price growth 2.1 (15.8) (4.1) (1.0) 1.0 (3.8)

UK Bank Rate -

modelled 2.04 3.75 3.13 2.39 2.33 2.73

UK Bank Rate -

adjusted 2.11 4.36 3.58 2.67 2.58 3.06

CPI inflation -

modelled 9.1 6.1 2.3 1.9 1.0 4.1

CPI inflation -

adjusted 9.1 6.9 3.1 2.4 1.3 4.6

ADDITIONAL FINANCIAL INFORMATION (continued)

3. Base case and MES economic assumptions (continued)

UK economic assumptions - Base case scenario by quarter

Key quarterly assumptions made by the Group in the base case

scenario are shown below. Gross domestic product is presented

quarter-on-quarter. House price growth, commercial real estate

price growth and CPI inflation are presented year-on-year, i.e from

the equivalent quarter in the previous year. Unemployment rate and

UK Bank Rate are presented as at the end of each quarter.

First Second Third Fourth First Second Third Fourth

quarter quarter quarter quarter quarter quarter quarter quarter

2022 2022 2022 2022 2023 2023 2023 2023

At 30 September 2022 % % % % % % % %

Gross domestic product 0.8 (0.1) (0.1) (0.3) (0.4) (0.3) (0.2) (0.1)

Unemployment rate 3.7 3.8 3.7 3.8 4.3 4.7 5.1 5.4

House price growth 11.1 12.5 10.4 5.0 (0.2) (5.8) (8.2) (7.9)

Commercial real estate

price growth 18.0 18.0 12.3 2.8 (5.6) (11.8) (13.7) (14.4)

UK Bank Rate 0.75 1.25 2.25 4.00 4.00 4.00 4.00 4.00

CPI inflation 6.2 9.2 10.2 10.7 9.8 6.5 5.2 3.2

4. ECL sensitivity to economic assumptions

The measurement of ECL reflects an unbiased probability-weighted

range of possible future economic outcomes. The Group achieves this

by generating four economic scenarios to reflect the range of

outcomes; the central scenario reflects the Group's base case

assumptions used for medium-term planning purposes, an upside and a

downside scenario are also selected together with a severe downside

scenario. If the base case moves adversely it generates a new, more

adverse downside and severe downside which are then incorporated

into the ECL. The base case, upside and downside scenarios carry a

30 per cent weighting; the severe downside is weighted at 10 per

cent. These assumptions can be found on pages 5 to 7.

The table below shows the Group's ECL for the

probability-weighted, upside, base case, downside and severe

downside scenarios, the severe downside scenario incorporating

adjustments made to CPI inflation and UK Bank Rate paths. The stage

allocation for an asset is based on the overall scenario

probability-weighted PD and hence the staging of assets is constant

across all the scenarios. In each economic scenario the ECL for

individual assessments and post-model adjustments is constant

reflecting the basis on which they are evaluated.

Probability- Base Severe

weighted Upside case Downside downside

GBPm GBPm GBPm GBPm GBPm

UK mortgages 1,163 463 734 1,375 3,914

Credit cards 682 594 649 742 866

Other Retail 952 903 937 984 1,048

Commercial

Banking 1,721 1,339 1,544 1,857 2,985

Other 1 1 1 1 1

---------------- ---------------- ---------------- ---------------- ----------------

At 30

September

2022 4,519 3,300 3,865 4,959 8,814

---------------- ---------------- ---------------- ---------------- ----------------

UK mortgages 837 637 723 967 1,386

Credit cards

(1) 521 442 500 569 672

Other Retail

(1) 825 760 811 863 950

Commercial

Banking (1) 1,416 1,281 1,343 1,486 1,833

Other (1) 401 401 402 401 400

---------------- ---------------- ---------------- ---------------- ----------------

At 31

December

2021 4,000 3,521 3,779 4,286 5,241

---------------- ---------------- ---------------- ---------------- ----------------

(1) Reflects the new organisation structure, with Business

Banking and Commercial Cards moving from Retail to Commercial

Banking and Wealth moving from Other to Retail.

ADDITIONAL FINANCIAL INFORMATION (continued)

5. Loans and advances to customers and expected credit loss allowance

Stage Stage

2 3

Stage Stage Stage as % as %

At 30 September 1 2 3 POCI Total of of

2022 GBPm GBPm GBPm GBPm GBPm total total

Loans and advances to customers

UK mortgages 257,915 40,575 3,411 9,993 311,894 13.0 1.1

Credit cards 12,018 2,526 292 - 14,836 17.0 2.0

Loans and

overdrafts 8,723 1,339 255 - 10,317 13.0 2.5

UK Motor

Finance 12,335 1,949 169 - 14,453 13.5 1.2

Other 13,294 650 158 - 14,102 4.6 1.1

--------------- --------------- --------------- --------------- --------------- -----------

Retail 304,285 47,039 4,285 9,993 365,602 12.9 1.2

--------------- --------------- --------------- --------------- --------------- ----------- --------

Small and

Medium

Businesses 31,783 6,266 2,279 - 40,328 15.5 5.7

Corporate and

Institutional

Banking 31,692 4,727 1,626 - 38,045 12.4 4.3

--------------- --------------- --------------- --------------- --------------- -----------

Commercial

Banking 63,475 10,993 3,905 - 78,373 14.0 5.0

Other(1) (4,471) - - - (4,471)

--------------- --------------- --------------- --------------- --------------- ----------- --------

Total gross

lending 363,289 58,032 8,190 9,993 439,504 13.2 1.9

----------- --------

ECL allowance

on drawn

balances (610) (1,654) (1,672) (305) (4,241)

--------------- --------------- --------------- --------------- ---------------

Net balance

sheet

carrying value 362,679 56,378 6,518 9,688 435,263

--------------- --------------- --------------- --------------- ---------------

Customer related ECL allowance (drawn and undrawn)

UK mortgages 48 516 294 305 1,163

Credit cards 182 382 118 - 682

Loans and

overdrafts 175 273 138 - 586

UK Motor

Finance(2) 107 85 93 - 285

Other 15 18 48 - 81

--------------- --------------- --------------- --------------- ---------------

Retail 527 1,274 691 305 2,797

--------------- --------------- --------------- --------------- ---------------

Small and

Medium

Businesses 104 292 153 - 549

Corporate and

Institutional

Banking 99 233 832 - 1,164

--------------- --------------- --------------- --------------- ---------------

Commercial

Banking 203 525 985 - 1,713

Other - - - - -

--------------- --------------- --------------- --------------- ---------------

Total 730 1,799 1,676 305 4,510

--------------- --------------- --------------- --------------- ---------------

Customer related ECL allowance (drawn and undrawn) as a percentage

of loans and advances to customers(3)

UK mortgages - 1.3 8.6 3.1 0.4

Credit cards 1.5 15.1 54.4 - 4.6

Loans and

overdrafts 2.0 20.4 72.6 - 5.7

UK Motor

Finance 0.9 4.4 55.0 - 2.0

Other 0.1 2.8 30.4 - 0.6

--------------- --------------- --------------- --------------- ---------------

Retail 0.2 2.7 16.7 3.1 0.8

--------------- --------------- --------------- --------------- ---------------

Small and

Medium

Businesses 0.3 4.7 13.0 - 1.4

Corporate and

Institutional

Banking 0.3 4.9 51.2 - 3.1

--------------- --------------- --------------- --------------- ---------------

Commercial

Banking 0.3 4.8 35.2 - 2.2

Other - - -

--------------- --------------- --------------- --------------- ---------------

Total 0.2 3.1 24.1 3.1 1.0

--------------- --------------- --------------- --------------- ---------------

(1) Contains centralised fair value hedge accounting adjustments.

(2) UK Motor Finance for Stages 1 and 2 include GBP93 million

relating to provisions against residual values of vehicles subject

to finance leasing agreements. These provisions are included within

the calculation of coverage ratios.

(3) Total and Stage 3 ECL allowances as a percentage of drawn

balances exclude loans in recoveries in Credit cards of GBP75

million, Loans and overdrafts of GBP65 million, Small and Medium

Businesses of GBP1,104 million and Corporate and Institutional

Banking of GBP1 million.

ADDITIONAL FINANCIAL INFORMATION (continued)

5. Loans and advances to customers and expected credit loss allowance (continued)

Stage Stage

2 3

Stage Stage Stage as % as %

At 31 December 1 2 3 POCI Total of of

2021 GBPm GBPm GBPm GBPm GBPm total total

Loans and

advances

to customers

-------------- --------------- --------------- --------------- -------------- ----------- --------

UK mortgages 273,629 21,798 1,940 10,977 308,344 7.1 0.6

Credit

cards(1) 11,918 2,077 292 - 14,287 14.5 2.0

Loans and

overdrafts 8,181 1,105 271 - 9,557 11.6 2.8

UK Motor

Finance 12,247 1,828 201 - 14,276 12.8 1.4

Other(1) 11,198 593 169 - 11,960 5.0 1.4

-------------- --------------- --------------- --------------- -------------- -----------

Retail 317,173 27,401 2,873 10,977 358,424 7.6 0.8

-------------- --------------- --------------- --------------- -------------- ----------- --------

Small and

Medium

Businesses(1) 36,134 4,992 1,747 - 42,873 11.6 4.1

Corporate and

Institutional

Banking(1) 29,526 2,491 1,786 - 33,803 7.4 5.3

-------------- --------------- --------------- --------------- -------------- -----------

Commercial

Banking 65,660 7,483 3,533 - 76,676 9.8 4.6

Other(2) (467) - - - (467) - -

-------------- --------------- --------------- --------------- -------------- ----------- --------

Total gross

lending 382,366 34,884 6,406 10,977 434,633 8.0 1.5

----------- --------

ECL allowance

on drawn

balances (909) (1,112) (1,573) (210) (3,804)

-------------- --------------- --------------- --------------- --------------

Net balance

sheet carrying

value 381,457 33,772 4,833 10,767 430,829

-------------- --------------- --------------- --------------- --------------

Customer related ECL allowance (drawn and undrawn)

UK mortgages 49 394 184 210 837

Credit

cards(1) 144 249 128 - 521

Loans and

overdrafts 136 170 139 - 445

UK Motor

Finance(3) 108 74 116 - 298

Other(1) 15 15 52 - 82

-------------- --------------- --------------- --------------- --------------

Retail 452 902 619 210 2,183

-------------- --------------- --------------- --------------- --------------

Small and

Medium

Businesses(1) 104 176 179 - 459

Corporate and

Institutional

Banking(1) 56 120 780 - 956

-------------- --------------- --------------- --------------- --------------

Commercial

Banking 160 296 959 - 1,415

Other 400 - - - 400

-------------- --------------- --------------- --------------- --------------

Total 1,012 1,198 1,578 210 3,998

-------------- --------------- --------------- --------------- --------------

Customer related ECL allowance (drawn and undrawn) as a percentage

of loans and advances to customers(4)

UK mortgages - 1.8 9.5 1.9 0.3

Credit

cards(1) 1.2 12.0 56.9 - 3.7

Loans and

overdrafts 1.7 15.4 67.5 - 4.7

UK Motor

Finance 0.9 4.0 57.7 - 2.1

Other(1) 0.1 2.5 30.8 - 0.7

-------------- --------------- --------------- --------------- --------------

Retail 0.1 3.3 22.6 1.9 0.6

-------------- --------------- --------------- --------------- --------------

Small and

Medium

Businesses(1) 0.3 3.5 14.5 - 1.1

Corporate and

Institutional

Banking(1) 0.2 4.8 43.7 - 2.8

-------------- --------------- --------------- --------------- --------------

Commercial

Banking 0.2 4.0 31.8 - 1.9

Other(5) - - - - -

-------------- --------------- --------------- --------------- --------------

Total 0.3 3.4 27.4 1.9 0.9

-------------- --------------- --------------- --------------- --------------

(1) Reflects the new organisation structure, with Business

Banking and Commercial Cards moving from Retail to Commercial

Banking and Wealth moving from Other to Retail.

(2) Contains centralised fair value hedge accounting adjustments.

(3) UK Motor Finance for Stages 1 and 2 include GBP95 million

relating to provisions against residual values of vehicles subject

to finance leasing agreements. These provisions are included within

the calculation of coverage ratios.

(4) Total and Stage 3 ECL allowances as a percentage of drawn

balances exclude loans in recoveries in Credit cards of GBP67

million, Loans and overdrafts of GBP65 million, Small and Medium

Businesses of GBP515 million and Corporate and Institutional

Banking of GBP3 million.

(5) Other excludes the GBP400 million ECL central adjustment.

ADDITIONAL FINANCIAL INFORMATION (continued)

6. Stage 2 loans and advances to customers and expected credit loss allowance

Up to date

---------------------------------------------------

1 to 30 Over 30

days days

PD movements Other(1) past due(2) past due Total

------------------------ -------------------------

Gross Gross Gross Gross Gross

At 30 September lending ECL(3) lending ECL(3) lending ECL(3) lending ECL(3) lending ECL(3)

2022 GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

UK mortgages 31,885 195 6,331 159 1,599 82 760 80 40,575 516

Credit cards 2,275 291 132 47 90 28 29 16 2,526 382

Loans and

overdrafts 943 169 232 45 121 39 43 20 1,339 273

UK Motor

Finance 854 27 927 23 136 25 32 10 1,949 85

Other 166 4 394 8 54 4 36 2 650 18

---------- ------------ ----------- ------------ ------------ ------------ ----------- ------------ ----------

Retail 36,123 686 8,016 282 2,000 178 900 128 47,039 1,274

---------- ------------ ----------- ------------ ------------ ------------ ----------- ------------ ---------- -----------

Small and

Medium

Businesses 4,408 246 1,235 26 399 13 224 7 6,266 292

Corporate

and

Institutional

Banking 4,612 233 18 - 10 - 87 - 4,727 233

---------- ------------ ----------- ------------ ------------ ------------ ----------- ------------ ----------

Commercial

Banking 9,020 479 1,253 26 409 13 311 7 10,993 525

Total 45,143 1,165 9,269 308 2,409 191 1,211 135 58,032 1,799

---------- ------------ ----------- ------------ ------------ ------------ ----------- ------------ ---------- -----------

At 31 December

2021

------------ ----------- ------------ ------------ ------------ ----------- ------------ ---------- -----------

UK mortgages 14,845 132 4,133 155 1,433 38 1,387 69 21,798 394

Credit

cards(4) 1,755 176 210 42 86 20 26 11 2,077 249

Loans and

overdrafts 505 82 448 43 113 30 39 15 1,105 170

UK Motor

Finance 581 20 1,089 26 124 19 34 9 1,828 74

Other(4) 194 4 306 7 44 2 49 2 593 15

---------- ------------ ----------- ------------ ------------ ------------ ----------- ------------ ----------

Retail 17,880 414 6,186 273 1,800 109 1,535 106 27,401 902

---------- ------------ ----------- ------------ ------------ ------------ ----------- ------------ ---------- -----------

Small and

Medium

Businesses(4) 3,570 153 936 14 297 6 189 3 4,992 176

Corporate

and

Institutional

Banking(4) 2,447 118 15 2 4 - 25 - 2,491 120

---------- ------------ ----------- ------------ ------------ ------------ ----------- ------------ ----------

Commercial

Banking 6,017 271 951 16 301 6 214 3 7,483 296

Total 23,897 685 7,137 289 2,101 115 1,749 109 34,884 1,198

---------- ------------ ----------- ------------ ------------ ------------ ----------- ------------ ---------- -----------

(1) Includes forbearance, client and product-specific indicators

not reflected within quantitative PD assessments.

(2) Includes assets that have triggered PD movements, or other

rules, given that being 1-29 days in arrears in and of itself is

not a Stage 2 trigger.

(3) Expected credit loss allowance on loans and advances to customers (drawn and undrawn).

(4) Reflects the new organisation structure, with Business

Banking and Commercial Cards moving from Retail to Commercial

Banking and Wealth moving from Other to Retail.

FORWARD LOOKING STATEMENTS

This document contains certain forward-looking statements within

the meaning of Section 21E of the US Securities Exchange Act of

1934, as amended, and section 27A of the US Securities Act of 1933,

as amended, with respect to the business, strategy, plans and/or

results of Lloyds Bank plc together with its subsidiaries (the

Group) and its current goals and expectations. Statements that are

not historical or current facts, including statements about the

Group's or its directors' and/or management's beliefs and

expectations, are forward looking statements. Words such as,

without limitation, 'believes', 'achieves', 'anticipates',

'estimates', 'expects', 'targets', 'should', 'intends', 'aims',

'projects', 'plans', 'potential', 'will', 'would', 'could',

'considered', 'likely', 'may', 'seek', 'estimate', 'probability',

'goal', 'objective', 'deliver', 'endeavour', 'prospects',

'optimistic' and similar expressions or variations on these

expressions are intended to identify forward looking statements.

These statements concern or may affect future matters, including

but not limited to: projections or expectations of the Group's

future financial position, including profit attributable to

shareholders, provisions, economic profit, dividends, capital

structure, portfolios, net interest margin, capital ratios,

liquidity, risk-weighted assets (RWAs), expenditures or any other

financial items or ratios; litigation, regulatory and governmental

investigations; the Group's future financial performance; the level

and extent of future impairments and write-downs; the Group's ESG

targets and/or commitments; statements of plans, objectives or

goals of the Group or its management and other statements that are

not historical fact; expectations about the impact of COVID-19; and

statements of assumptions underlying such statements. By their

nature, forward looking statements involve risk and uncertainty

because they relate to events and depend upon circumstances that

will or may occur in the future. Factors that could cause actual

business, strategy, plans and/or results (including but not limited

to the payment of dividends) to differ materially from forward

looking statements include, but are not limited to: general

economic and business conditions in the UK and internationally;

market related risks, trends and developments; risks concerning

borrower and counterparty credit quality; fluctuations in interest

rates, inflation, exchange rates, stock markets and currencies;

volatility in credit markets; volatility in the price of the

Group's securities; changes in consumer behaviour; any impact of

the transition from IBORs to alternative reference rates; the

ability to access sufficient sources of capital, liquidity and

funding when required; changes to the Group's or Lloyds Banking

Group plc's credit ratings; the ability to derive cost savings and

other benefits including, but without limitation, as a result of

any acquisitions, disposals and other strategic transactions;

inability to capture accurately the expected value from

acquisitions; potential changes in dividend policy; the ability to

achieve strategic objectives; insurance risks; management and

monitoring of conduct risk; exposure to counterparty risk; credit

rating risk; tightening of monetary policy in jurisdictions in

which the Group operates; instability in the global financial

markets, including within the Eurozone, and as a result of ongoing

uncertainty following the exit by the UK from the European Union

(EU) and the effects of the EU-UK Trade and Cooperation Agreement;

political instability including as a result of any UK general

election and any further possible referendum on Scottish

independence; operational risks; conduct risk; technological

changes and risks to the security of IT and operational

infrastructure, systems, data and information resulting from

increased threat of cyber and other attacks; natural pandemic

(including but not limited to the COVID-19 pandemic) and other

disasters; inadequate or failed internal or external processes or

systems; acts of hostility or terrorism and responses to those

acts, or other such events; geopolitical unpredictability; the war

between Russia and Ukraine; the tensions between China and Taiwan;

risks relating to sustainability and climate change (and achieving

climate change ambitions), including the Group's and/or Lloyds

Banking Group plc's ability along with the government and other

stakeholders to measure, manage and mitigate the impacts of climate

change effectively; changes in laws, regulations, practices and

accounting standards or taxation; changes to regulatory capital or

liquidity requirements and similar contingencies; assessment

related to resolution planning requirements; the policies and

actions of governmental or regulatory authorities or courts

together with any resulting impact on the future structure of the

Group; failure to comply with anti-money laundering, counter

terrorist financing, anti-bribery and sanctions regulations;

failure to prevent or detect any illegal or improper activities;

projected employee numbers and key person risk; increased labour

costs; assumptions and estimates that form the basis of the Group's

financial statements; the impact of competitive conditions; and

exposure to legal, regulatory or competition proceedings,

investigations or complaints. A number of these influences and

factors are beyond the Group's control. Please refer to the latest

Annual Report on Form 20-F filed by Lloyds Bank plc with the US

Securities and Exchange Commission (the SEC), which is available on

the SEC's website at www.sec.gov, for a discussion of certain

factors and risks. Lloyds Banking Group plc may also make or

disclose written and/or oral forward-looking statements in other

written materials and in oral statements made by the directors,

officers or employees of Lloyds Banking Group plc to third parties,

including financial analysts. Except as required by any applicable

law or regulation,

the forward-looking statements contained in this document are

made as of today's date, and the Group expressly disclaims any

obligation or undertaking to release publicly any updates or

revisions to any forward looking statements contained in this

document whether as a result of new information, future events or

otherwise. The information, statements and opinions contained in

this document do not constitute a public offer under any applicable

law or an offer to sell any securities or financial instruments or

any advice or recommendation with respect to such securities or

financial instruments.

CONTACTS

For further information please contact:

INVESTORS AND ANALYSTS

Douglas Radcliffe

Group Investor Relations Director

020 7356 1571

douglas.radcliffe@lloydsbanking.com

Edward Sands

Director of Investor Relations

020 7356 1585

edward.sands@lloydsbanking.com

Nora Thoden

Director of Investor Relations - ESG

020 7356 2334

nora.thoden@lloydsbanking.com

CORPORATE AFFAIRS

Grant Ringshaw

External Relations Director

020 7356 2362

grant.ringshaw@lloydsbanking.com

Matt Smith

Head of Media Relations

020 7356 3522

matt.smith@lloydsbanking.com

Copies of this News Release may be obtained from:

Investor Relations, Lloyds Banking Group plc, 25 Gresham Street,

London EC2V 7HN

The statement can also be found on the Group's website -

www.lloydsbankinggroup.com

Registered office: Lloyds Bank plc, 25 Gresham Street, London

EC2V 7HN

Registered in England No. 2065

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTUBUWRUSURURA

(END) Dow Jones Newswires

October 27, 2022 07:01 ET (11:01 GMT)

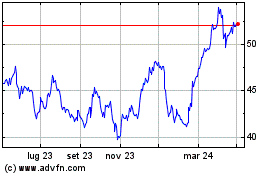

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Apr 2023 a Apr 2024