Halifax Predicts 8% Fall in UK House Prices in 2023

16 Dicembre 2022 - 11:56AM

Dow Jones News

By Ian Walker

Halifax predicts that U.K. house prices will fall around 8% in

2023, after a year of two halves in 2022 where the cost of living

crisis and higher interest rates hit growth in the second half.

Halifax, which is part of Lloyds Banking Group PLC, said that

based on Lloyds' economic projections the average house price will

fall back next year to April 2021 levels, reversing gains made

during the coronavirus pandemic.

"There is still uncertainty around this forecast, with the

trajectory for base rate--now expected to peak at 4%--and

unemployment levels key to determining any future changes," Halifax

Homes Director Andrew Asaam said.

House prices rose more than 17,500 pounds ($21,313) in the first

half of the year through to June on the back of low interest rates,

as well as pandemic-driven shifts as buyers sought bigger

properties after periods of being cooped up during lockdowns and

home working.

However, prices have since fallen as inflation started to creep

up and the Bank of England began hiking interest rates to control

the economy, subsequently raising mortgage rates and causing many

lenders to withdraw their fixed rate offers.

The average house price currently stands at GBP285,579 compared

with GBP272,778 a year ago, and a peak of GBP293,992 in August.

"Though the limited supply of properties for sale will continue

to support prices, the pandemic-driven surge in demand has receded,

and we're emerging out of more than a decade of record low interest

rates," Mr. Asaam said.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

December 16, 2022 05:41 ET (10:41 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

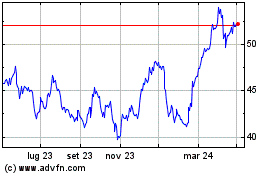

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Apr 2023 a Apr 2024