NatWest Group plc Financial Impact of Tender Offers (6282V)

10 Agosto 2022 - 7:18PM

UK Regulatory

TIDMNWG TIDMTTM

RNS Number : 6282V

NatWest Group plc

10 August 2022

,

August 10, 2022

NATWEST GROUP PLC AND NATWEST MARKETS N.V. - FINANCIAL IMPACT OF

SEPARATE CASH TENDER OFFERS FOR CERTAIN OF THEIR RESPECTIVE

OUTSTANDING NOTES

NatWest Group plc ("NatWest Group") and NatWest Markets N.V.

("NWM N.V.") (each an "Offeror" and, together, the "Offerors")

announced on 9 August 2022 the results of their separate cash

tender offers (with respect to the tender offers launched by

NatWest Group, the "NatWest Group Offer", and with respect to the

tender offers launched by NWM N.V., the "NWM N.V. Offer", each an

"Offer") in respect of any and all of certain series of their

respective U.S. dollar denominated notes pursuant to separate

offers to purchase dated August 1, 2022 (each an "Offer to

Purchase").

NatWest Group estimates the aggregate impact of the NatWest

Group Offer and the NWM N.V. Offer will be a charge to income in

its Q3 2022 results of approximately GBP56 million, with the final

charge dependent on the foreign exchange rate on August 10, 2022.

After taking into account the estimated effect of taxation, and

based on risk weighted assets of GBP179.8 billion as reported for

June 30, 2022, this would equate to a reduction in NatWest Group's

CET1 capital ratio of approximately 3bps.

NWM N.V. estimates the impact of the NWM N.V. Offer will be a

charge to income in its Q3 2022 results of approximately EUR83

million. After taking into account the estimated effect of

taxation, and the effect of the unwinding of a related hedging

transaction with NatWest Group, NWM N.V. does not expect a material

impact on its CET1 capital ratio.

FORWARD-LOOKING STATEMENTS

From time to time, the Offerors may make statements, both

written and oral, regarding our assumptions, projections,

expectations, intentions or beliefs about future events. These

statements constitute "forward-looking statements". The Offerors

caution that these statements may and often do vary materially from

actual results. Accordingly, the Offerors cannot assure you that

actual results will not differ materially from those expressed or

implied by the forward-looking statements. You should read the

sections entitled "Risk Factors" in the relevant Offer to Purchase,

in the Annual Report and H1 2022 Interim Report of the relevant

Offeror which is incorporated by reference therein and

"Forward-Looking Statements" in the Annual Report and H1 2022

Interim Report of the relevant Offeror, which is incorporated by

reference in the relevant Offer to Purchase.

Any forward-looking statements made herein, including in

connection with the expected charge to income and CET1 ratio impact

of each Offer, or in the documents incorporated by reference herein

speak only as of the date they are made. Except as required by the

U.K. Financial Conduct Authority (the " FCA ") or the Dutch

Authority for the Financial Markets (the " AFM "), as applicable,

any applicable stock exchange or any applicable law, the Offerors

expressly disclaim any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statement

contained in the relevant Offer to Purchase or the documents

incorporated by reference herein to reflect any changes in

expectations with regard thereto or any new information or any

changes in events, conditions or circumstances on which any such

statement is based. The reader should, however, (i) with respect to

NatWest Group consult any additional disclosures that NatWest Group

has made or may make in documents that NatWest Group has filed or

may file with the U.S. Securities and Exchange Commission and (ii)

with respect to NWM N.V. consult any additional disclosures that

NWM N.V. has made or may make in documents that NWM N.V. has filed

or may file with the AFM.

Legal Entity Identifiers

NatWest Group plc 2138005O9XJIJN4JPN90

NatWest Markets N.V. X3CZP3CK64YBHON1LE12

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPMMRTMTBBBMT

(END) Dow Jones Newswires

August 10, 2022 13:18 ET (17:18 GMT)

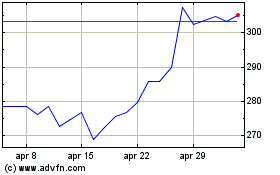

Grafico Azioni Natwest (LSE:NWG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Natwest (LSE:NWG)

Storico

Da Apr 2023 a Apr 2024