One Heritage Group plc (OHG) One Heritage Group plc: Interim

Results 28-March-2023 / 07:00 GMT/BST

-----------------------------------------------------------------------------------------------------------------------

ONE HERITAGE GROUP PLC

(the "Company" or "One Heritage")

Interim report for

the six months ended

31 December 2022

28 March 2023

One Heritage Group PLC (LSE: OHG), the UK-based residential

developer focused on the North of England, is pleased to announce

its half-year results for the six months ended 31 December

2022.

Financial highlights

For the six-month period to 31 December 2022. Comparatives are

for the six month period to 31 December 2021 (H1 2022) unless

otherwise stated. FY 2023 refers to the Group's financial period 1

July 2022 to 30 June 2023. ? Revenue of GBP5.75 million (H1 2022:

GBP0.15million), driven mainly by the contributions from Lincoln

House,Bolton, which practically completed and delivered 27 sales

completions in the period. ? Gross profit reduced by GBP0.42

million to a loss of GBP0.28 million (H1 2022: profit GBP0.14

million) due toan impairment in the period of GBP1.10 million. ?

Loss before tax of GBP1.57 million (H1 2022: loss GBP0.53 million).

? Basic loss per share (pence) of 4.1 (H1 2022: 1.6). ? Net debt of

GBP17.73 million (H2 2022: GBP14.95 million) an increase of GBP2.79

million facilitating thecompletion of developments prior to legal

completions. ? Subscription with existing and new investors raised

GBP1.25 million, on 6 July 2022.

Operational highlights ? Completion of first major development

project, Lincoln House, Bolton with 27 apartments sold at

31December 2022. ? Planning permission granted for 24 houses at

Victoria Road, Eccleshill, West Yorkshire - pre-constructionphase

of development. ? Planning application submitted and decision

pending for Seaton House, Stockport. ? Completed Company strategic

review with focus now on our core discipline of residential

propertydevelopment in the North of England, acting as Developer

and Development Manager utilising fixed priced buildcontracts. ?

Agreements for sale on all 27 apartments at Oscar House,

Manchester. ? Sold 20 of 23 apartments at Bank Street,

Sheffield.

Post Period Events ? Practical completion of County House,

Oldham, our first project acting as Development Manager.

Outlook ? On track to deliver strong revenue for the FY 2023,

driven by robust pipeline of property sales expectedto start coming

through in the second quarter of 2023. ? 29 further sales at

Lincoln House, Bolton expected in 2023 calendar year and 32 remain

available for salefollowing the strategic decision to remarket the

units. ? Further practical completions on track to complete before

30 June 2023:? Oscar House, Manchester - 27 units. ? Bank Street,

Sheffield - 23 units. ? St. Petersgate, Stockport - 18 units.

Commenting on the Group's performance, Jason Upton, Chief

Executive Officer said:

"The Group has made further progress on our strategic objectives

during the first half of our financial year. We have adapted our

strategy to the current environment by implementing better internal

processes and controls to improve efficiencies whilst also focusing

our efforts as a residential Developer and Development Manager.

Importantly, our development pipeline is now delivering revenue

through sales, following the completion of Lincoln House, Bolton,

with 27 units legally completed, a further 29 are sold and the

remaining 32 unsold units are marketed for sale.

The second half of the financial year is looking strong, with

the practical completions of Oscar House, Manchester and Bank

Street, Sheffield, imminent. Nearly all units relating to these

projects have either been sold or sales have been agreed. St.

Petersgate, Stockport, is also expected to complete prior to our

financial year end, with all units pre-sold.

The overall outlook for the residential property sector within

our core region of the North of England remains positive. There is

still a shortage of quality, affordable homes and the focus of our

strategy is to address this segment where demand is the highest and

where our co-living proposition is growing in popularity. With

momentum building, I look forward to updating the market on further

progress in due course."

Contacts

One Heritage Group plc

Jason Upton

Chief Executive Officer

Email: jason.upton@one-heritage.com

Anthony Unsworth

Chief Financial Officer

Email: anthony.unsworth@one-heritage.com

Hybridan LLP (Financial Adviser and Broker)

Claire Louise Noyce

Email: claire.noyce@hybridan.com

Tel: +44 (0)203 764 2341

Yellow Jersey PR (Financial PR)

Charles Goodwin/Annabelle Wills/Bessie Elliot

Email: oneheritage@yellowjerseypr.com

Tel: +44 (0)203 004 9512

About One Heritage Group

One Heritage Group PLC is a property development and management

company. It focuses on the residential sector primarily in the

North of England, seeking out value and maximising opportunities

for investors. In 2020 One Heritage Group PLC became one of the

first publicly listed residential developers with a focus on

co-living.

The Company is listed on the Standard List of the Main Market of

the London Stock Exchange, trading under the ticker OHG.

For further information, please visit the Company's website at

https://www.oneheritageplc.com/.

CHIEF EXECUTIVE'S REVIEW

We have made further progress on our strategic objectives during

the first half of our financial year, including, most notably, the

completion of our first major development project, Lincoln House,

Bolton, as announced in August 2022. Post period, in March 2023,

another milestone was achieved, with the practical completion of

County House, Oldham, our first project acting as Development

Manager. Our Full Year results statement, published in October

2022, noted that the Group had been affected by industry-wide

challenges, including the higher cost of building materials and a

shortage of sub-contractor labour. This consequently led to the

impairment of two of our development projects in that period. In

our January 2023 trading update, we confirmed that a further

development, Oscar House in Manchester, was also likely to be

impaired, with the higher cost of debt and construction-related

cost increases being prominent factors.

Our Construction Services Department has three principal revenue

streams: in-house refurbishment of two group developments (St

Petersgate, Stockport and Bank Street, Sheffield); development of

co-living properties; and the refurbishment of Queen Street,

Sheffield, a project where the group is appointed as Development

Manager. Following a strategic review, we have decided to cease our

participation in in-house construction of residential development

projects, and this will take effect upon the completion of our

current projects under construction in Q3 calendar year 2023. We

will continue to provide the development of co-living projects but

have chosen a new approach to the delivery of our development

projects by appointing a principal contractor, which we believe

will deliver the best shareholder value.

The results for the period reflect only one development

completion reached, and the legal completion of property sales has

taken longer than expected due to several factors. We are expecting

a strong second half to our financial year ending 30 June 2023, as

we benefit from the revenue of our property sales across our

completed development projects. Overall, I am pleased with how the

team has adapted to the challenges faced and there are some

important changes being planned upon which I look forward to

providing updates in due course. We are in a far stronger position

as we strengthen our internal processes and controls, adapt our

strategy, and refine our delivery. This bodes well for the future,

but we remain cautious concerning the economic challenges the

country continues to face and how this impacts our industry.

The following strategic objectives have been in place during the

period under review and the progress of each is set out below.

DELIVER OUR EXISTING DEVELOPMENT PROJECTS

Below is a current summary of existing development projects:

Gross Development Expected

Project Location Residential units Commercial units Reservations

Value (GBPm) Completion

Lincoln House Bolton 88 0 10.0 Complete 56

Churchgate Leicester 15 1 3.1 under assessment Not released

Oscar House Manchester 27 0 6.2 H1 2023 27

Bank Street Sheffield 23 0 3.9 H1 2023 20

St Petersgate Stockport 18 1 3.0 H1 2023 18

Seaton House Stockport 30 0 5.6 H2 2024 Not released

Victoria Road Eccleshill 24 0 6.5 H2 2024 Not released

225 2 38.3

Having completed Lincoln House, Bolton in September 2022, three

more of the Group's own developments are expected to complete

within the calendar year ending 31 December 2023. These are Bank

Street, Sheffield and Oscar House, Manchester, which are expected

to complete in April 2023 and St Petersgate, Stockport, where

completion is anticipated in June 2023.

There are three other projects within the development pipeline

and each is at a different stage. Churchgate, Leicester, had

planning permission granted in August 2022, but considering the

impact of higher construction costs and the size of the development

i.e. 15 units, the Board has decided to reassess whether the

delivery of the project is in the best interests of the business.

Victoria Road, Eccleshill, West Yorkshire, the Group's first

venture into new build housing, has the benefit of planning

permission for 24 houses and is in the pre-construction phase of

development. Seaton House, Stockport, has a planning application

pending with a decision expected imminently. Construction is now

expected to start in the second half of 2023.

Following the signing of the Group's fourth Development

Management agreement in April 2022 for One Victoria, Manchester,

construction of 129 apartments is expected to commence in April

2023.

Changes have been made to improve the delivery of our

development projects, in response to lessons learned from our

projects to date and to adapt to challenging market conditions.

Since the departure of the development director, our development

team has been restructured and in January 2023 we brought in a

highly experienced Interim Development Director. Further senior

appointments have been made in the form of a Head of Projects and

an Acquisitions Lead, with more hires expected over the coming

months to further strengthen the team.

SECURE PRE-SALES WHERE WE CAN THROUGH OUR SALES NETWORK

At our completed development, Lincoln House, Bolton, there were

27 completed sales by the end of December 2022. A further 29

completions are expected in the first half of 2023 and 32 remain

available for sale. These available units are fully let and

generating rental income for the Group whilst we consider offers.

Importantly, the completed unit sales have enabled us to reduce the

Lincoln House construction finance debt to GBP0.28m at H1 FY23

(June FY22: GBP2.44m). This residual debt of GBP0.28m has been

fully repaid post half year end.

It is encouraging to report that sales on our projects under

construction have been strong. There is an agreement for sale of

all 27 apartments at Oscar House, Manchester. Bank Street,

Sheffield, has 20 of 23 apartments sold and at St Petersgate,

Stockport, all 18 units are pre-sold.

INCREASE REVENUE GENERATED THROUGH THE GROUP'S SERVICES

Our property services team continues to establish the

infrastructure needed to accommodate the increase in volume of

properties under management. Investment has been made in a new

Customer Relationship Management system and accreditations have

been gained for industry-recognised Money Shield and Property

Ombudsman schemes. The property management function of the business

has become well established and I expect the properties under

management to continue to grow and generate increased revenue.

Additional sources of revenue include property sourcing which

has seen steady growth over recent months with marketing for our

services commencing in Hong Kong. This sourcing service is specific

to overseas investors and tailored to their particular needs.

Development Management revenue for the Group increased following

our appointment to deliver One Victoria, Manchester, which is a new

build development of 129 units. Development Management continues to

offer a strong source of revenue for the Group, and also includes

construction finance arrangement fees and a profit share on the

conclusion of each project. The first development management

project completed post half year end, was a conversion of Oldham

County Court into 42 residential apartments.

The Group provides Co-Living services which generate revenue

through sourcing, property transactions and project management. We

have restructured how we deliver these services, which saw some

delays for a few months towards the end of 2022 as we paused

operations to renegotiate contracts with external suppliers.

GROW THE DEVELOPMENT PIPELINE

During the period under review, the Group acquired land at

Victoria Road, Eccleshill, West Yorkshire with planning consent for

24 houses comprising a mixture of 2, 3 and 4 bedrooms. The project

is the first new build housing development for the Group and adds

diversification to the portfolio.

Work to grow the development pipeline is ongoing and the timing

of future acquisitions will be important to deliver best value.

OUTLOOK

The outlook remains positive for the property market, with the

North of England continuing to perform well. Savills' long term

forecast to 2027 for the UK rental market projects a 6.2% increase

in the capital value of the UK second-hand market. The North West

and Yorkshire are in the top three leading regions for growth each

with forecasted increases of 11.7%. Over the five-year period, the

rental value for the UK excluding London is forecast to grow by

18.3%. There also continues to be demand emanating from a long-term

lack of supply of new housing throughout the country. With

inflation continuing to increase construction prices over the last

year, and with land prices remaining stable, there is pressure on

the industry, but we are seeing signs of improvement that give us

confidence moving into the second half of 2023.

Whilst we remain cautious of the challenging market conditions,

the changes made to the business, including adding even greater

property development experience and different skills to our team,

put us in a stronger position as we look to the future. We remain

on track to deliver strong revenue for the FY 2023, driven by our

robust pipeline of property sales expected to start coming through

in the second quarter of 2023.

FINANCE REVIEW

For the six months ended 31 December 2022, revenue increased by

GBP5.60m (+3,760%) to GBP5.75m (H1 2022: GBP0.15m). This primarily

reflects significant growth in sales along with construction

services.

H1 FY23 H1 FY22 Change Change

Revenue

GBPm GBPm GBPm %

Development management fee 0.23 0.12 0.11 +94%

Development sales 3.29 0.00 3.29 -

Construction * 1.89 0.00 1.89 -

Property Services 0.28 0.03 0.25 +784%

Corporate 0.06 0.00 0.06 -

TOTAL 5.75 0.15 5.60 +3,760% * Construction revenue in in-house residential development projects to be discontinued from Q3 calendar year 2023. Construction revenues from the refurbishment of co-living properties will continue.

Developments sales revenue remained the largest contributor to

Group revenue, accounting for 57% of total revenue. This

significant growth was driven mainly by the contributions from

Lincoln House, Bolton, which practically completed and delivered 27

legal sales completions in the period.

Construction Services delivered revenue of GBP1.89m in the

period (H1 2022: GBP0.0m), reflecting building activity supplied to

related parties Robin Hood Ltd on Co-living properties and Queen

Street, Sheffield, a refurbishment project where the group is

Development Manager. There was also an increase in development

management fee income of GBP0.11m to GBP0.23m (H1 2022: GBP0.12m),

and this was delivered from three projects: North Church House,

Sheffield; the Tower, Salford and One Victoria, Salford.

Property Services also saw an increase over the same period last

year from GBP0.03m in H1 2022 to GBP0.28m in H1 2023. This was

driven by management fees and transaction fees.

Gross profit reduced by GBP0.42m to a loss of GBP0.28m (H1 2022:

profit GBP0.14m) due to an impairment in the period of GBP1.10m.

This was as a result of a number of factors: delays across three of

our projects during the period under review; cost increases, mostly

attributed to rising construction costs on projects where we act as

principal contractor; and increased financing costs impacted by the

delays and fees for extensions. There has been a number of

significant changes implemented to reporting, risk management and

operational delivery, to better protect the Group from similar

challenges in the future. Gross margin was 4.87% (H1 2022: +95.3%),

which is predominantly due to the impact of the impairment to

profits in the period.

Administrative expenses were GBP1.13m in the period (H1 2022:

GBP0.71m). This represents an overall GBP0.42m increase in

overheads arising from an increase in average headcount of 28

employees (H1 2022: 23) along with increased recruitment costs. The

Group remains focused on tight control of overheads, whilst

introducing some investment in cost to benefit revenue streams.

Administrative expenses as a proportion of revenue were 19.7% in H1

2023. H1 2022 administrative expenses were 476.94% on lower

revenues.

The operating loss increased by GBP0.90m to a loss of GBP1.41m

(H1 2022: loss of GBP0.52m). Finance costs were GBP0.16m (H1 2022:

GBP0.01k). The increase in finance cost is attributable to the

Lincoln House development reaching practical completion in August

2022, and all finance costs since then are to be expensed and not

capitalised. Basic loss per share was 4.1 pence (H1 2022: loss 1.6

pence).

Net debt at 31 December 2022 was GBP17.73m (30 June 2022:

GBP14.95m). The increase over the six-month period primarily

reflects an increase in working capital, with significant

work-in-progress at the period end for delivery in the second half

of the year and in the next financial year. The Group continues to

have a very strong relationship with the majority shareholder, One

Heritage Hong Kong (OHHK), and the funding facility provided by

OHHK had a drawn down amount of GBP9.04m at the period end. On 17th

January 2023, the loan facility was increased to GBP11.00m, to

provide extra short-term headroom to December 2024. It is expected

that the utilisation of this facility will reduce as our

completions and sales crystallise over the remainder of H2

FY23.

On 7 July 2022 the Group issued 6.25m new ordinary share of 1.0

pence each at an issue price of 20.0 pence per share, raising gross

proceeds of GBP1.25m.

RISK MANAGEMENT AND PRINCIPAL RISKS

The ability of the Group to operate effectively and achieve its

strategic objectives is subject to a range of potential risks and

uncertainties. The Board and the broader management team take a

pro-active approach to identifying and assessing internal and

external risks. The potential likelihood and impact of each risk is

assessed and mitigation policies are set against them that are

judged to be appropriate to the risk level. Management constantly

updates plans and these are monitored by the Audit and Risk

Committee and reported to the Board.

The principal risks that the Board sees as impacting the Group

in the coming period are divided into six categories, and these are

set out below together with how the Group mitigates such risks.

1. Strategy: Government regulation, planning policy and land

availability.

2. Delivery: Inadequate controls or failures in compliance will

impact the Group's operational and financial performance.

3. Operations: Availability and cost of raw materials,

sub-contractors and suppliers.

4. People and culture: Attracting and retaining high-calibre

employees.

5. Finance & Liquidity: Availability of finance and working

capital.

6. External Factors: Economic environment, including housing

demand and mortgage availability.

1. Strategy: Government regulation, planning policy and land

availability

A risk exists that changes in the regulatory environment may

affect the conditions and time taken to obtain planning approval

and technical requirements including changes to Building

Regulations or Environmental Regulations, increasing the challenge

of providing quality homes where they are most needed. Such changes

may also impact our ability to meet our margin or site return on

capital employed (ROCE) hurdle rates (this ratio can help to

understand how well a company is generating profits from its

capital as it is put to use). An inability to secure sufficient

consented land and strategic land options at appropriate cost and

quality in the right locations to enhance communities, could affect

our ability to grow sales volumes and/or meet our margin and site

ROCE hurdle rates. The Group mitigates against these risks by

liaising regularly with experts and officials to understand where

and when changes may occur. In addition, the Group monitors

proposals by Westminster to ensure the achievement of implementable

planning consents that meet local requirements and that exceed

current and expected statutory requirements. The Group regularly

reviews land currently owned, committed and pipeline prospects,

underpinned with robust key business control where all land

acquisitions are subject to formal appraisal and approved by the

senior executive team.

2. Delivery: Inadequate controls or failures in compliance will

impact the Group's operational and financial performance

A risk exists of failure to achieve excellence in construction,

such as design and construction defects, deviation from

environmental standards, or through an inability to develop and

implement new and innovative construction methods. This could

increase costs, expose the Group to future remediation liabilities,

and result in poor product quality, reduced selling prices and

sales volumes.

To mitigate this the Group liaises with technical experts to

ensure compliance with all regulations around design and materials,

along with external engineers through approved panels. It also has

detailed build programmes supported by a robust quality

assurance.

3. Operations: Availability and cost of raw materials,

sub-contractors and suppliers

A risk exists that not adequately responding to shortages or

increased costs of materials and skilled labour or the failure of a

key supplier, may lead to increased costs and delays in

construction. It may also impact our ability to achieve disciplined

growth in the provision of high quality homes.

Following a strategic review, the Group has taken the

opportunity to cease our participation in in-house construction of

residential development projects, and this will take effect upon

the completion of our current projects under construction. We will

continue to provide the development of co-living projects but have

chosen a new approach to the delivery of our development projects

by appointing a principal contractor after a period of due

diligence, which we believe will deliver the best shareholder

value.

4. People and culture: Attracting and retaining high-calibre

employees

A risk exists that increasing competition for skills may mean we

are unable to recruit and/or retain the best people. Having

sufficient skilled employees is critical to delivery of the Group's

strategy whilst maintaining excellence in all of our other

strategic priorities.

To mitigate this the Group has a number of People Strategy

programmes which include development, training and succession

planning, remuneration benchmarking against competitors, and

monitoring of employee turnover, absence statistics and feedback

from exit interviews.

5. Finance & Liquidity: Availability of finance and working

capital

A risk exists that lack of sufficient borrowing and surety

facilities to settle liabilities and/or an ability to manage

working capital, may mean that we are unable to respond to changes

in the economic environment, and take advantage of appropriate land

buying and operational opportunities to deliver strategic

priorities.

To minimise this risk the Group has a disciplined operating

framework with an appropriate capital structure, and management

have stress tested the Group's resilience to ensure the funding

available is sufficient. This process has regular management and

Board attention to review the most appropriate funding strategy to

drive the Group's growth ambitions. We have regular monthly

Treasury updates, and we gain market intelligence and availability

of finance from experienced sector Treasury advisers.

6. External Factors: Economic environment, including housing

demand and mortgage availability

A risk exists that changes in the UK macroeconomic environment

may lead to falling demand or tightened mortgage availability, upon

which most of our customers are reliant, thus potentially reducing

the affordability of our homes. This could result in reduced sales

volumes and affect our ability to deliver profitable growth.

To mitigate this risk the wider Group has a significant presence

in Hong Kong, China and Singapore and the majority of overseas

purchasers are cash buyers. The Group continually monitors the

market at Board, Executive Committee and team levels, leading to

amendments in the Group's forecasts and planning, as necessary. In

addition there are comprehensive sales policies, regular reviews of

pricing in local markets and development of good relationships with

mortgage lenders. This is underpinned by a disciplined operating

framework with an appropriate capital structure and strong balance

sheet.

STATEMENT OF DIRECTOR'S RESPONSIBILITIES

in respect of the half-yearly financial report

We confirm that to the best of our knowledge: ? the condensed

set of financial statements has been prepared in accordance with

IAS 34 Interim FinancialReporting as adopted for use in the UK; ?

the interim management report includes a fair review of the

information required by:

-- DTR 4.2.7R of the Disclosure Guidance and Transparency Rules,

being an indication of important eventsthat have occurred during

the first six months of the financial year and their impact on the

condensed set offinancial statements; and a description of the

principal risks and uncertainties for the remaining six months

ofthe year; and

-- DTR 4.2.8R of the Disclosure Guidance and Transparency Rules,

being related party transactions that havetaken place in the first

six months of the current financial year and that have materially

affected the financialposition or performance of the entity during

that period; and any changes in the related party

transactionsdescribed in the last annual report that could do

so.

The directors of One Heritage Group PLC are listed on the

company website, www.oneheritageplc.com

By order of the Board

Jason Upton

Chief Executive Officer

27 March 2023

INDEPENT REVIEW REPORT TO ONE HERITAGE GROUP PLC

Report on the interim financial statements

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the interim report for the six months

ended 31 December 2022 which comprises the consolidated statements

of comprehensive income, financial position, changes in equity and

cash flows and the related explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the interim report for the six months ended 31 December 2022 is

not prepared, in all material respects, in accordance with IAS 34

Interim Financial Reporting as adopted for use in the UK and the

Disclosure Guidance and Transparency Rules ("the DTR") of the UK's

Financial Conduct Authority ("the UK FCA").

Basis of conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410 Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity ("ISRE (UK) 2410") issued for use in the UK. A review of

interim financial information consists of making enquiries,

primarily of persons responsible for financial and accounting

matters, and applying analytical and other review procedures. We

read the other information contained in the interim report and

consider whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of

financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis of conclusion

section of this report, nothing has come to our attention that

causes us to believe that the directors have inappropriately

adopted the going concern basis of accounting, or that the

directors have identified material uncertainties relating to going

concern that have not been appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410. However, future events or

conditions may cause the group to cease to continue as a going

concern, and the above conclusions are not a guarantee that the

group will continue in operation.

Directors' responsibilities

The interim financial report is the responsibility of, and has

been approved by, the directors. The directors are responsible for

preparing the interim report in accordance with the DTR of the UK

FCA.

As disclosed in note 2, the annual financial statements of the

group are prepared in accordance with UK-adopted international

accounting standards.

The directors are responsible for preparing the condensed set of

financial statements included in the interim report in accordance

with IAS 34 as adopted for use in the UK.

In preparing the condensed set of financial statements, the

directors are responsible for assessing the group's ability to

continue as a going concern, disclosing, as applicable, matters

related to going concern and using the going concern basis of

accounting unless the directors either intend to liquidate the

group or to cease operations, or have no realistic alternative but

to do so.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the interim report

based on our review. Our conclusion, including our conclusions

relating to going concern, are based on procedures that are less

extensive than audit procedures, as described in the Basis for

conclusion section of this report.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the DTR of the UK FCA. Our review has been

undertaken so that we might state to the company those matters we

are required to state to it in this report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the company for our

review work, for this report, or for the conclusions we have

reached.

Edward Houghton BA FCA

for and on behalf of KPMG Audit LLC

Chartered Accountants

Heritage Court

41 Athol Street

Douglas

Isle of Man

27 March 2023

FINANCIAL STATEMENTS

Consolidated statement of comprehensive income

For the six months ended 31 December 2022

Six months to Six months to

GBP unless stated Notes 31 December 31 December

2022 2021

Revenue 6 5,748,725 148,946

Revenue - Development management fee 228,117 117,628

Revenue - Development sales 3,292,524 -

Revenue - Construction 1,887,022 -

Revenue - Property services 276,729 31,318

Revenue - Corporate 64,333 -

(6,028,942) (6,977)

Cost of sales

Cost of sales - Development management fee 6 - -

Cost of sales - Development sales (3,086,903) -

Cost of sales - Construction (1,796,318) -

Cost of sales - Property services (42,980) (6,977)

Cost of sales - Impairment of inventory (1,102,741) -

Gross (loss)/profit (280,217) 141,969

Share of profits from associate - 24,368

Other income - 26,620

Administration expenses 7 (1,132,942) (710,377)

Operating (loss) (1,413,159) (517,420)

Finance expense (158,674) (7,887)

(Loss) before taxation (1,571,833) (525,307)

-

Taxation -

(Loss) after taxation (1,571,833) (525,307)

Other comprehensive income - -

COMPREHENSIVE INCOME/LOSS attributable to shareholders (1,571,833) (525,307)

Weighted average shares in issued over the period 38,440,561 32,428,333

(Loss) per share (GBp) (4.1) (1.6)

Diluted (loss) per share (GBp) (4.1) (1.6)

FINANCIAL STATEMENTS

Consolidated statement of financial position

As at 31 December 2022

As at

As at

GBP unless stated Notes 30 June

31 December 2022

2022

ASSETS

Non-current assets

Property, plant and equipment 328,599 374,475

Intangible asset 2,029 2,324

330,628 376,799

Current assets

Cash and cash equivalents 354,825 974,201

Inventory 8 17,863,378 15,127,758

Investment in associate - 50,000

Trade and other receivables 9 1,558,825 1,911,351

19,777,028 18,063,310

TOTAL ASSETS 20,107,656 18,440,109

LIABILITIES

Non-current liabilities

Borrowings 11 8,198,691 6,679,902

8,198,691 6,679,902

Current liabilities

Trade and other payables 10 1,770,928 1,944,632

Borrowings 11 9,888,334 9,241,139

11,659,262 11,185,771

TOTAL LIABILITIES 19,857,953 17,865,673

EQUITY

Share capital 12 386,783 324,283

Share premium 12 4,753,325 3,568,725

Retained earnings (4,890,405) (3,318,572)

TOTAL EQUITY 249,703 574,436

TOTAL LIABILITIES AND EQUITY 20,107,656 18,440,109

Shares in issue 38,678,333 32,428,333

Net asset value per share (GBp) 0.6 1.8

FINANCIAL STATEMENTS

Consolidated statement of cash flows

For the six months ended 31 December 2022

Six months to Six months to

GBP unless stated 31 December 31 December

2022 2021

Cash flows from operating activities

Loss for the period before tax (1,571,833) (525,307)

Adjustments for:

Share of profit in associate - (24,368)

Finance expense 158,674 7,887

Amortisation of intangible asset 295 63

Depreciation of property, plant and equipment 51,852 54,760

Movement in working capital:

Decrease/(Increase) in trade and other receivables 262,496 (63,737)

(Increase) in inventories (2,022,337) (3,430,259)

Increase/(Decrease) in trade and other payables 67,911 (1,611)

Cash from operations (3,052,942) (3,982,572)

Income taxation paid - -

Net cash used in operating activities (3,052,942) (3,982,572)

Cash flows from investing activities

Investment in intangible asset - (2,324)

Proceeds on sale of associate 50,000 -

Purchases of property, plant and equipment (5,976) (48,638)

Net cash used in investing activities 44,024 (50,962)

Financing cash flows

Issue of share capital 1,247,100 -

Interest paid (1,165,570) (416,026)

Advance proceeds from Corporate Bond - 400,000

Proceeds of borrowing 2,452,151 797,345

Proceeds of related party borrowing (2,160,880) -

Payments made in relation to lease liabilities 2,060,054 3,663,554

Net cash generated from financing activities (43,313) (2,089)

Net change in cash and cash equivalents (619,376) 409,250

Opening cash and cash equivalents 974,201 204,147

Closing cash and cash equivalents 354,825 613,397

FINANCIAL STATEMENTS

Consolidated statement of changes in equity

For the six months ended to 31 December 2022

Share Share Total

GBP Retained earnings

capital premium Equity

Balance at 01 July 2022 324,283 3,568,725 (3,318,572) 574,436

Loss for the period - - (1,571,833) (1,571,833)

Other comprehensive income for the period - - - -

Total comprehensive income for the period 324,283 3,568,725 (4,890,405) (997,397)

Issue of share capital 62,500 1,187,500 - 1,250,000

Cost of share issue - (2,900) - (2,900)

Balance at 31 December 2022 386,783 4,753,325 (4,890,405) 249,703

For the six months ended 31 December 2021

Share Share Total

GBP Retained earnings

Capital premium Equity

Balance at 01 July 2021 324,283 3,568,725 (1,183,637) 2,709,371

Loss for the period - - (525,307) (525,307)

Other comprehensive income for the year - - - -

Total comprehensive income for the period 324,283 3,568,725 (1,708,944) 2,184,064

Issue of share capital - - - -

Balance at 31 December 2021 324,283 3,568,725 (1,708,944) 2,184,064

For the year ended 30 June 2022

Share Share Total

GBP Retained earnings

capital premium equity

Balance at 01 July 2021 324,283 3,568,725 (1,183,637) 2,709,371

Loss for the period - - (2,134,935) (2,134,935)

Other comprehensive income for the period - - - -

Total comprehensive income for the period 324,283 3,568,725 (3,318,572) 574,436

Issue of share capital - - - -

Balance at 30 June 2022 324,283 3,568,725 (3,318,572) 574,436

FINANCIAL STATEMENTS

Notes to the interim financial statements

For the six months ended to 31 December 2022 1. Reporting

entity

One Heritage Group PLC (the "Company") is a public limited

company, limited by shares, incorporated in England and Wales under

the Companies Act 2006. The address of its registered office and

its principal place of trading is 80 Mosley Street, Manchester, M2

3FX. The principal activity of the company is that of property

development.

These condensed consolidated interim financial statements

("interim financial statements") as at the end of the six month

period to 31 December 2022 comprise of the Company and its

subsidiaries. 2. Basis of preparation

These interim financial statements for the six months ended 31

December 2022 have been prepared in accordance with IAS 34 Interim

Financial Reporting as adopted for use in the UK, and should be

read in conjunction with the Group's last annual consolidated

financial statements as at and for the year ended 30 June 2022

('last annual financial statements'). They do not include all of

the information required for a complete set of financial statements

prepared in accordance with IFRS Standards. However, selected

explanatory notes are included to explain events and transactions

that are significant to an understanding of the changes in the

Group's financial position and performance since the last annual

financial statements.

The annual financial statements of the group are prepared in

accordance with UK-adopted international accounting standards. As

required by the Disclosure Guidance and Transparency Rules of the

Financial Conduct Authority, the condensed set of financial

statements has been prepared applying the accounting policies and

presentation that were applied in the preparation of the company's

published consolidated financial statements for the year ended 30

June 2022.

These interim financial statements were authorised for issue by

the Company's board of directors on 27 March 2023.

Going concern

Notwithstanding net current liabilities of GBP9,745,611

(excluding inventory balances totalling GBP17,863,378) as at 31

December 2022, a loss for the interim period then ended of

GBP1,571,833 and operating cash outflows for the period of

GBP3,052,942, the financial statements have been prepared on a

going concern basis which the directors consider to be appropriate

for the following reasons.

The directors have prepared cash flow forecasts for the period

to 30 June 2024 which indicate that, taking account of reasonably

possible downsides, the company will have sufficient funds, through

the proceeds from sale of developments supplemented by continued

financial support from its parent company, One Heritage Property

Development Limited ("OHPD"), and a related party, One Heritage SPC

Limited ("OHSPC"), to meet its liabilities as they fall due for at

least that period. OHPD and OHSPC have confirmed that their

respective loans due to mature in June 2023 and January 2023 will

not be demanded for repayment until such a time that the Group can

afford to repay them without impacting on its going concern. The

loan facility from the parent company was GBP9.5m at 31 December

2022, with GBP2.5m due to be repaid by 30 June 2023 and the balance

due by 31 December 2024. Of the total facility, GBP0.5m remained

undrawn at 31 December 2022. The total facility increased to GBP11m

in January 2023.

As with any company placing reliance on other related entities

for financial support, the directors acknowledge that there can be

no certainty that this support will continue although, at the date

of approval of these financial statements, they have no reason to

believe that it will not do so.

Consequently, the directors are confident that the company will

have sufficient funds to continue to meet its liabilities as they

fall due for at least 12 months from the date of approval of the

financial statements and therefore have prepared the financial

statements on a going concern basis. 3. Use of judgements and

estimation uncertainty

In preparing these Interim Financial Statements, management has

made judgements, estimates and assumptions that affect the

application of the Group's accounting policies and the reported

amounts in the financial statements. The management continually

evaluate these judgements and estimates in relation to assets,

liabilities, contingent liabilities, revenue and expenses based

upon historical experience and on other factors that they believe

to be reasonable under the circumstances. Actual results may differ

from the judgements, estimates and assumptions.

The key areas of judgement and estimation are: ? The carrying

value of inventory: Under IAS 2: Inventories the Group must hold

developments at the lowerof cost and net realisable value. The

Group applies judgement to determine the net realisable value of

developmentsat a point in time that the property is partly

developed and compares that to the carrying value. The Group

hasundertaken an impairment review of all of the Inventory and

determined that an impairment is appropriate on threeof the

developments. ? Going concern: The Directors have prepared forecast

financial information for the period to June 2024.This forecast

requires management to make judgements and assumptions with regard

to future performance, such as thetiming of completion of

development projects, and subsequent sales of inventory as well as

the availability ofresources to meet liabilities as they fall due.

4. Change in accounting policies

The accounting policies applied in these interim financial

statements are the same as those applied in the Group's

consolidated financial statements as at and for the year ended 30

June 2022.

The accounting policies will also be reflected in the Group's

consolidated financial statements as at and for the year ending 30

June 2023. 5. Operating segments

The Group operates four segments: Developments, Construction,

Property Sevices and Corporate.

All the revenues generated by the Group were generated within

the United Kingdom.

For the period ended 31 December 2022:

GBP unless stated Developments Developments - Sales Construction Property services Corporate Total

Revenue 228,117 3,292,524 1,887,022 276,729 64,333 5,748,725

Cost of sales - (3,086,903) (1,796,318) (42,980) - (4,926,201)

Impairment of inventory - (1,102,741) - - - (1,102,741)

Gross (loss)/profit 228,117 (897,120) 90,704 233,749 64,333 (280,217)

Administration expenses (132,877) - (111,874) (888,191) (1,132,942)

Operating loss 95,240 (897,120) 90,704 127,875) (823,858) (1,413,159)

Finance expense - - (158,674) (158,674)

Loss for the year 95,240 (897,120) 90,704 121,875 (823,858) (1,571,833)

Segment operating profit or loss is used as a measure of

performance as management believe this is the most relevant

information when evaluating the performance of a segment. 6.

Revenue

The Group generates its revenue primarily from development

management agreements, development sales and construction

services.

Six months to Six months to

GBP unless stated 31 December 31 December

2022 2021

Revenue

Development sales 3,292,524 -

Development revenue 228,117 117,628

Profit participation

- 26,163

Construction

Property services 1,887,022 -

Corporate 276,729 5,155

5,748,725 148,946

Cost of sales

Development sales (3,086,903) -

Impairment of inventory (see note 7) (1,102,741) -

Construction (1,796,318) -

Property services (42,980) (6,977)

Corporate - -

(6,028,942) (6,977)

Gross (loss)/profit (280,217) 141,969

Development sales is attributable to the sale of 27 units in the

completed Lincoln House development. This development reached

practical completion at the end of August 2022.

Development management consist of three development management

agreements with One Heritage Tower Limited, One Heritage Great

Ducie Street Limited and One Heritage North Church Limited.

The Group earns a management fee of 0.75% of costs incurred to

date per month and a 10% share of net profit generated by the

development through the agreement with One Heritage Tower Limited.

The Group is also entitled to 1% of any external debt or equity

funding raised on behalf of the development. This agreement

generated GBP65,928 (31 December 2021: GBP59,836) in the period.

The Group signed a development management agreement with a related

party, ACT Property Holding Limited. As part of this agreement a

20% profit share of the net profit will be generated by the

development.

The One Heritage North Church Limited agreement splits the fees

into three: 1. 2% of total development cost, paid monthly over the

period of the development; 2. 15% of net profit, paid on

completion; 3. 1% on any debt finance raised. This agreement

generated GBP27,459 (31 December 2021: GBP57,792) in the period as

well as a debt raising fee of GBP31,650. The debt raising fee has

been shown as part of development management revenues.

The Group signed a development management agreement on 1 April

2022 with One Heritage Great Ducie Street Limited that splits the

fees as follows: 1. 2% of the total development cost, paid monthly

over the period of the development 2. 15% of net profit, paid on

completion; 3. 1% on any debt finance raised. This agreement

generated GBP103,080 in the period.

The Group has not recognised any revenue linked to the profit

share element of these agreements as the transaction price is

variable and the amount cannot be reliably determined at this time.

This is because the developments are in the early stages of

construction and there is too much uncertainty to reliably estimate

expected revenue.

Construction generates revenue from two entities; Robin Hood

Property Development Limited and One Heritage North Church Limited.

The Group receives a cost plus 5.0% margin on all works undertaken,

recognising GBP826,440 of revenue in the period. The Group has

undertaken work for One Heritage North Church Limited on a cost

plus 7.0% margin basis, this generated revenue of GBP1,023,018 in

the period.

The development management and construction revenues have been

generated through related parties.

The Corporate revenue is from contracts signed with Robin Hood

Property Development Limited, generating revenue of GBP58,333 and

One Heritage Portfolio Rental Limited, recognising revenue of

GBP6,000 and is in consideration for a range of administration

services and use of the Group's office. 7. Administration

expenses

Six months to Six months to

GBP unless stated 31 December 31 December

2022 2021

The aggregate remuneration comprised:

- Wages and salaries 402,518 199,251

- National insurance 40,979 19,708

- Pension costs 6,339 1,822

Staff costs 625,493 449,836

Other administration expenses 507,449 260,541

1,132,942 710,377

28 20

Average number of employees 8. Inventory - developments

GBP unless stated 31 December 2022 30 June 2022

Residential developments

- Land 5,179,071 4,394,799

- Construction and development costs 10,541,808 9,322,221

- Capitalised interest 2,142,499 1,410,738

17,863,378 15,127,758

On 12 July 2022 the Group completed the acquisition of

development land on Victoria Road, Eccleshill for GBP1,000,000, and

on 19 December 2022, the Group purchased Churchgate for the value

of GBP120,000.

As at 30 June 2022, the Group has taken the decision to impair

the value of its Bank Street and St Petersgate development, which

are owned by wholly owned subsidiaries, One Heritage Bank Street

Limited and One Heritage St Petersgate Limited. This was a

consequence of significant cost pressures and issues with the

previous contractors. The impairment totalled GBP1,297,560 as at 30

June 2022.

Due to further expenditures, the Group has taken the decision to

further impair the value of its Bank Street and St Petersgate

developments and additionally, the Oscar House development. The

impairment totalled GBP2,400,301 as at 31 December 2022 and the

charge for the period was GBP1,102,741. 9. Trade and other

receivables

30 June

GBP unless stated 31 December 2022

2022

Trade receivables 470,027 776,570

Other debtors 230,777 140,544

Prepaid sales fees and commissions 797,649 843,835

VAT receivable 60,372 109,811

Related party receivable - 40,591

1,558,825 1,911,351

Loan facility fees of GBPnil (30 June 2022: GBP146,276) were

paid in the period to cover the negotiation and arrangement of

facilities which will be offset against the respective loans when

drawn. Such fees are deferred if it is probable that a facility

will be drawn down.

Trade receivables includes GBP26,742 (30 June 2022: GBP50,980)

due from One Heritage Tower Limited, GBP7,534 (30 June 2022:

GBP154,089) due from One Heritage North Church Limited, GBP97,964

(30 June 2022: GBP3,221) due from One Heritage Great Ducie Street

Limited, GBP287,016 (30 June 2022: GBP565,880) due from Robin Hood

Property Development Limited and GBP2,400 (30 June 2022: GBP2,400)

due from One Heritage Property Rental Limited, whom are all related

parties.

The prepaid sales fees and commissions relate to the sales

agents fees and commissions paid on units from developments that

have been exchanged but not yet completed. These relate to units

exchanged on the Lincoln House, St Petersgate, Bank Street and

Oscar House developments.

Management consider that the credit quality of the various

receivables is good in respect of the amounts outstanding, there

have been no increases in credit risk and therefore credit risk is

considered to be low. Therefore, no expected credit loss provision

has been recognised. 10. Trade and other payables

30 June

GBP unless stated 31 December 2022

2022

Trade payables 444,462 794,181

Accruals and other creditors 204,500 115,392

Customer deposits 975,800 1,012,222

Related party payable 108,104 -

PAYE payable 38,062 22,837

1,770,928 1,944,632

Trade payables and accruals relate to amounts payable at the

reporting date for services received during the period.

The related party payable relates to amounts payable to various

related parties outside of the Group, with GBP104,373 of this

amount owed to ACT Property Developments Limited.

The Group has received deposits and reservation fees in relation

to its developments. These relate to units that have been reserved

for sale and exchanged contracts, but are yet to legally complete

sale. The deposits will only be repayable if significant property

damage occurs and reinstatement is not possible 11. Borrowing

As at As at

GBP unless stated 31 December 30 June

2022 2022

Current

Lease liability 219,340 267,125

Related party borrowings 6,540,855 5,000,000

Loan 1,438,496 1,412,777

8,198,691 6,679,902

Non-current

Lease liability 97,762 86,623

Related party borrowings 3,795,694 3,425,190

Loan 5,994,878 5,729,326

9,888,334 9,241,139

18,087,025 15,921,041

On 16 December 2021 a subsidiary, One Heritage Lincoln House

Limited, signed a loan agreement with Shawbrook Bank Limited. This

was for a gross amount of construction finance totalling GBP3.5

million. This had a term of 20 months and is to be drawn down to

fund costs incurred by the development in that subsidiary. As at 31

December 2022, the balance of the loan was GBP275,684 (30 June

2022: GBP2,436,564). In line with the agreement on the loan, when

the Lincoln House development reached practical completion in

August 2022, as units are sold, the proceeds of these will go

toward repayment of the loan. The Group paid an arrangement fee of

GBP35,000 and will pay an exit fee of GBP43,875 on final repayment.

The loan was repaid in full on 27 January 2022. The loan had two

covenants that are linked to the underlying development, the loan

to development cost of 44% and a loan to value of 45%, which have

both been complied with during the reporting period.

On 20 May 2021 a subsidiary, One Heritage Oscar House Limited,

signed a loan agreement with Lyell Trading Limited. This was for a

gross amount of construction finance totalling GBP4 million. This

had a term of 18 months and is to be drawn down to fund costs

incurred by the development in that subsidiary. On 18 November 2022

the Group enterd into an agreement to extend the loan to 19 May

2023. As at 31 December 2022, the balance of the loan was

GBP3,724,619 (30 June 2022: GBP2,166,706). The loan bears interest

at 9.6% per year. The loan has two covenants that are linked to the

underlying development, the loan to development cost of 69% and a

loan to value of 89%, which have both been complied with during the

reporting period.

On 01 June 2021 a subsidiary, One Heritage Bank Street Limited,

signed a loan agreement with Together Commercial Finance Limited.

This was for a gross amount of construction finance totalling GBP2

million. This had a term of 18 months and is to be drawn down to

fund costs incurred by the development in that subsidiary. During

November 2022 it was agreed with Together Financial Limited that

the loan be renewed for a further 12 months. As at 31 December

2022, the balance of the loan was GBP1,994,575 (30 June 2022:

GBP1,126,056). The loan bears interest at 0.85% monthly at a

variable rate, based on the Bank of England base rate. The loan has

two covenants that are linked to the underlying development, the

loan to development cost of 70% and a loan to value of 70%, which

have both been complied with during the reporting period.

On 18 March 2022 the Group had a GBP1.5 million corporate bond

admitted to the Standard List of the London Stock Exchange. This

had a 2 year term and an 8.0% coupon which is paid on 30 June and

31 December each year. The Group incurred listing costs of

GBP102,040 which were capitalised and released over the term of the

Bond.

On 11 August 2020 the Group received a loan worth GBP1,007,000

from One Heritage SPC. The loan has an interest rate of 12%. As at

31 December 2022 GBP288,692 (30 June 2022: GBP227,776) of interest

had been accrued against the remaining loan.

Related party borrowings

The Group signed a GBP5.0 million loan facility with One

Heritage Property Development Limited on 21 September 2020. This

can be drawn down as required and is to be repaid on 31 December

2024. The facility has an interest rate of 7.0%. On 18 February

2021 the facility was increased by GBP2.5 million to GBP7.5

million, this additional amount can only be drawn to fund property

development activities where obtaining project financing is delayed

or unavailable. On 14 October 2022 the facility was further

increased by GBP2 million to GBP9.5 million. On 17 January 2023 the

facility was increased with a further GBP1.5 million to GBP11

million. The balance on this loan at 31 December 2022 was

GBP9,040,881 (30 June 2022: GBP7,190,414).

The balance due consist of two tranches. A tranche of GBP2.5

million is repayable in June 2023. One Heritage Property

Development Limited confirmed however, that the loan will not be

demanded for repayment until such a time that the Group can afford

to repay them without impacting its going concern. The second

tranche of GBP6.5 million is repayable in December 2024.

Terms and repayment schedule

The terms and conditions of outstanding loans are as

follows:

31 December 2022 30 June 2022

Nominal interest Maturity Face Carrying Face Carrying

GBP unless stated Currency rate amount amount

Date value value

One Heritage SPC GBP 12.0% Jan-23* 1,295,694 1,295,694 1,234,776 1,234,776

Lyell Trading Limited GBP 9.6% May-23 3,724,619 3,724,619 2,166,706 2,166,706

Together Commercial Finance GBP 10.7% Nov-23 1,994,575 1,994,575 1,126,056 1,126,056

Shawbrook Bank GBP 6.3% Jan-23 275,684 275,684 2,436,564 2,436,564

One Heritage Property GBP 7.0% Jun-23** 2,500,000 2,500,000 5,000,000 5,000,000

Development

One Heritage Property GBP 7.0% Dec-24 6,540,855 6,540,855 2,190,414 2,190,414

Development

Corporate Bond GBP 8.0% Mar-24 1,438,496 1,438,496 1,412,777 1,412,777

17,769,923 17,769,923 15,567,293 15,567,293 *One Heritage SPC Limited confirmed that the loan due in January 2023 will not be demanded for repayment until such a time that the Group can afford to repay them without impacting its going concern.

** One Heritage Property Development Limited confirmed that the

loan will not be demanded for repayment until such a time that the

Group can afford to repay them without impacting its going concern

12. Share capital

As at As at

GBP unless stated 31 December 30 June

2022 2022

Share capital 386,783 324,283

Share premium 4,753,325 3,568,725

5,140,108 3,893,008

On 7 July 2022 the Group issued 6,250,000 new ordinary share of

1.0 pence each at an issue price of 20.0 pence per share, raising

gross proceeds of GBP1,250,000. 13. Financial instruments and fair

value disclosures

The following table shows the carrying amounts of financial

assets and liabilities, including their levels in the fair value

hierarchy:

As at 31 December 2022

Carrying value Fair value

Other

GBP unless stated Financial assets at Total Level 1 Level Level 3 Total

amortised cost financial 2

liabilities

Financial assets not measured

at fair value

Trade and other receivables 1,558,825 - 1,558,825 - - 1,558,825 1,558,825

Cash and cash equivalents 354,825 - 354,825 354,825 - - 354,825

1,913,650 - 1,913,650 354,825 - 1,558,825 1,913,650

Financial liabilities not

measured at fair value

Secured bank loans - 7,433,374 7,433,374 - - 7,433,374 7,433,374

Related party borrowings - 10,336,549 10,336,549 - - 10,336,549 10,336,549

Lease liability - 317,102 317,102 - - 317,102 317,102

Trade and other payables - 1,770,928 1,770,928 - - 1,770,928 1,770,928

- 19,857,953 19,857,953 - - 19,857,953 19,857,953

As at 30 June 2022

Carrying value Fair value

Other

GBP unless stated Financial assets at Total Level 1 Level Level 3 Total

amortised cost financial 2

liabilities

Financial assets not measured

at fair value

Trade and other receivables 1,911,351 - 1,911,351 - - 1,911,351 1,911,351

Cash and cash equivalents 974,201 - 974,201 974,201 - - 974,201

2,885,552 - 2,885,552 974,201 - 1,911,351 2,885,552

Financial liabilities not

measured at fair value

Secured bank loans - 7,142,103 7,142,103 - - 7,142,103 7,142,103

Related party borrowings - 8,425,190 8,425,190 - - 8,425,190 8,425,190

Lease liability - 353,748 353,748 - - 353,748 353,748

Trade and other payables - 1,944,632 1,944,632 - - 1,944,632 1,944,632

- 17,865,673 17,865,673 - - 17,865,673 17,865,673

14. Related party

Parent and ultimate controlling party

At the reporting date 65.15% of the shares are held by One

Heritage Property Development Limited, which is incorporated in

Hong Kong. One Heritage Holding Group Limited, incorporated in the

British Virgin Islands, is considered the ultimate controlling

party through its 100% ownership of One Heritage Property

Development Limited.

Included in prepayments is GBP118,317 (30 June 2022: GBP132,046)

agency fees paid to One Heritage Property Development Limited.

During the period GBP105,900 of these fees have been released to

cost of sales and GBP144,463 remains in the inventory balance.

Compensation of the Group's key management personnel is short

term employee benefits.

Transactions with key management

Key management personnel compensation comprised the

following:

GBP unless stated 31 December 2022 30 June 2022

Short term employee benefits 149,996 311,061

149,996 311,061 15. Events after the reporting date

On 17 January 2023 the facility with One Heritage Property

Development Limited was increased with a further GBP1.5 million to

GBP11 million.

On 18 January 2023, the Group purchased Seaton House, for

GBP772,795. The site is in proximity to another One Heritage

development, St Petersgate. Seaton House is an existing office

building with permitted development rights which would allow

conversion into 12 apartments.

On 27 January 2023, the Group settled the Shawbrook loan in

full.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BLF79495

Category Code: IR

TIDM: OHG

LEI Code: 2138008ZZUCCE4UZHY23

OAM Categories: 1.2. Half yearly financial reports and audit reports/limited reviews

Sequence No.: 232903

EQS News ID: 1593571

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1593571&application_name=news

(END) Dow Jones Newswires

March 28, 2023 02:00 ET (06:00 GMT)

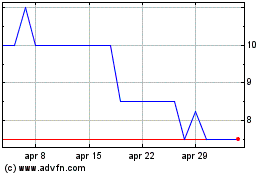

Grafico Azioni One Heritage (LSE:OHG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni One Heritage (LSE:OHG)

Storico

Da Apr 2023 a Apr 2024