TIDMPDL

RNS Number : 7641Z

Petra Diamonds Limited

16 January 2024

16 January 2024 LSE: PDL

Petra Diamonds Limited

H1 FY 2024 Operating Update

Petra reports its operating results for the first half of FY

2024

Richard Duffy, Chief Executive Officer of Petra, commented:

"Production increased 2% in this period as o perations continued

to stabilise at Finsch and Cullinan Mines and Williamson continued

its ramp-up to full production. We remain on track to meet our FY

2024 production guidance of 2.9 - 3.2 Mct although, as announced on

01 November 2023, we expect it will be towards the lower end of

guidance. We continue to make good progress on the CC1E development

project at Cullinan Mine and the 78-Level Phase II development

project at Finsch, and the resumption of the deferred capital

programmes remains on target for July 2024. The replanning and

value-engineering work associated with the deferred capital

projects continues and, once completed, the Company will inform the

market of the expected impact on forward looking guidance.

While we are seeing encouraging indications of price recovery

and some stabilisation in the rough diamond market, following

actions taken by both producers and the mid-stream, we continue to

adopt a cautious approach to the market in the near-term. Once

completed, the additional headroom afforded by our increased

Revolving Credit Facility will enable us to continue our flexible

sales approach and position ourselves to take advantage of any

market improvements. "

Highlights vs H1 FY 2023

-- LTIFR and LTIs decreased to 0.15 and 5 respectively

-- Ore processed increased 8% to 5.8Mt largely due to the

successful ramp-up of production at Williamson

-- Total diamond production increased 2% to 1.43 million carats

mainly due to resuming operations at Williamson and increased ROM

contribution at Finsch, partially offset by slightly lower grades

at the Cullinan Mine

-- Support from a weaker South African Rand continued throughout

the period, with the Rand averaging ZAR18.69 : US$1 (H1 FY 2023:

ZAR17.32 : US$1)

-- Revenue amounted to US$187.8 million (H1 FY 2023: US$208.5 million)

o As announced on 14 December 2023, like-for-like prices were

down 13.3% compared to H1 FY 2023 sales, with the balance of price

movements attributable to product mix

o No profit share uplifts were effected during the period; H1 FY

2023 revenue includes US$1.4 million from profit share

arrangements

-- Consolidated net debt increased to US$212.3 million as at 31

December 2023 (30 June 2023: US$176.8 million) due to the timing of

closing the Company's sales tenders, the continued lower diamond

pricing environment, working capital funding for the resumption of

mining at Williamson and the increasing capex spend profile, as

previously announced, to extend the life of our operations at

Cullinan Mine and Finsch

Operating Summary

Safety, sales H1 FY 2024 H1 FY 2023

and production

(restated to exclude

Koffiefontein)

Unit Q2 Q1 Total Q2 Q1 Total

--------- --------- --------- --------- --------- ---------

Safety

------ --------- --------- --------- --------- --------- ---------

LTIFR - 0.18 0.12 0.15 0.22 0.16 0.19

------ --------- --------- --------- --------- --------- ---------

LTIs Number 3 2 5 4 3 7

------ --------- --------- --------- --------- --------- ---------

Sales

------ --------- --------- --------- --------- --------- ---------

Diamonds sold Carats 727,189 932,431 1,659,620 788,661 516,308 1,304,969

------ --------- --------- --------- --------- --------- ---------

Revenue(1) US$m 90.2 97.6 187.8 105.7 101.4 207.1

------ --------- --------- --------- --------- --------- ---------

Contribution

from Exceptional

Stones(2) US$m 0.0 0.0 0.0 0.0 0.0 0.0

------ --------- --------- --------- --------- --------- ---------

Production

------ --------- --------- --------- --------- --------- ---------

ROM tonnes Tonnes 2,875,410 2,717,486 5,592,896 2,162,877 2,993,247 5,156,124

------ --------- --------- --------- --------- --------- ---------

Tailings and

other tonnes Tonnes 96,235 91,008 187,243 92,375 94,877 187,252

------ --------- --------- --------- --------- --------- ---------

Total tonnes

treated Tonnes 2,971,645 2,808,494 5,780,139 2,255,252 3,088,124 5,343,376

------ --------- --------- --------- --------- --------- ---------

ROM diamonds Carats 694,884 652,021 1,346,905 602,055 729,761 1,331,816

------ --------- --------- --------- --------- --------- ---------

Tailings and

other diamonds Carats 36,018 44,618 80,636 31,612 29,951 61,563

------ --------- --------- --------- --------- --------- ---------

Total diamonds Carats 730,902 696,639 1,427,541 633,667 759,712 1,393,379

------ --------- --------- --------- --------- --------- ---------

(1) Revenue reflects proceeds from the sale of rough diamonds

and excludes revenue from profit share arrangements (as noted in

the text above)

(2) Petra classifies "Exceptional Stones" as rough diamonds

which sell for US$15 million or more each

INVESTOR WEBCASTS

Webcast presentation for institutional investors and

analysts

09:30am GMT today

Petra's CEO, Richard Duffy, and CFO, Jacques Breytenbach, will

host a webcast for institutional investors and analysts to discuss

this operating update.

Please register at: https://brrmedia.news/PDL_H1FY24OU

Dial in details:

UK-wide +44 (0) 33 0551 0200

UK toll free 0808 109 0700

South Africa toll free 0800 980 512

United States (Local) +1 786 697 3501

09:30am password (if prompted): Petra Diamonds

Link for recording (available later in the day):

https://www.petradiamonds.com/investors/results-reports/

Investor Meet Company webcast at 14.30pm GMT today

Petra's CEO, Richard Duffy, and CFO, Jacques Breytenbach, will

also present these results live on the Investor Meet Company

platform, predominantly aimed at retail investors. To join:

https://www.investormeetcompany.com/petra-diamonds-limited/register-investor

FURTHER INFORMATION

Please contact

Petra Diamonds, London Telephone: +44 207494 8203

Patrick Pittaway investorrelations@petradiamonds.com

Julia Stone

Kelsey Traynor

Financial PR (Camarco)

Gordon Poole Telephone: +44 20 3757 4980

Owen Roberts petradiamonds@camarco.co.uk

Elfie Kent

ABOUT PETRA DIAMONDS

Petra Diamonds is a leading independent diamond mining group and

a supplier of gem quality rough diamonds to the international

market. The Company's portfolio incorporates interests in three

underground mines in South Africa (Cullinan Mine, Finsch and

Koffiefontein) and one open pit mine in Tanzania (Williamson). The

Koffiefontein mine is currently on care and maintenance in

preparation for sale or closure.

Petra's strategy is to focus on value rather than volume

production by optimising recoveries from its high-quality asset

base in order to maximise their efficiency and profitability. The

Group has a significant resource base which supports the potential

for long-life operations.

Petra strives to conduct all operations according to the highest

ethical standards and only operates in countries which are members

of the Kimberley Process. The Company aims to generate tangible

value for each of its stakeholders, thereby contributing to the

socio-economic development of its host countries and supporting

long-term sustainable operations to the benefit of its employees,

partners and communities.

Petra is quoted with a premium listing on the Main Market of the

London Stock Exchange under the ticker 'PDL'. The Company's loan

notes due in 2026 are listed on the Irish Stock Exchange and

admitted to trading on the Global Exchange Market. For more

information, visit www.petradiamonds.com.

Corporate and financial summary 31 December 2023

Unit As at 31 December As at 31 December As at 30 June

2023 2022 2023

--------- ------------------ ------------------

Cash at bank

- (including

restricted amounts)(1) US$m 75.4 146.6 61.8

-------------------------- --------- ------------------ ------------------ --------------

Diamond debtors US$m 8.1 4.9 8.9

-------------------------- --------- ------------------ ------------------ --------------

Diamond inventories(2,3) US$m 53.5 59.9 65.9

Carats 483,142 540,153 715,222

------------------------------------ ------------------ ------------------ --------------

2026 US$336.7m

loan notes (4) US$m 249.2 241.7 247.5

-------------------------- --------- ------------------ ------------------ --------------

Bank loans and US$m 46.6 - -

borrowings(5)

-------------------------- --------- ------------------ ------------------ --------------

Consolidated

Net Debt(6) US$m 212.3 90.2 176.8

-------------------------- --------- ------------------ ------------------ --------------

Bank facilities

undrawn(5) US$m 49.2 58.8 53.1

-------------------------- --------- ------------------ ------------------ --------------

Note: The following exchange rates have been used for this

announcement: average for H1 FY 2024 US$1: ZAR18.69 (H1 FY 2023:

US$1: ZAR17.32; FY 2023: US$1: ZAR17.77); closing rate as at 31

December 2023 US$1: ZAR18.28 (31 December 2022: US$1: ZAR17.00, 30

June 2023: US$1: ZAR18.83).

Notes:

1. The Group's cash balances comprise unrestricted balances of

US$56.5 million, and restricted balances of US$18.9 million.

2. Recorded at the lower of cost and net realisable value.

3. Diamond inventories for periods prior to 30 June 2023 include

the Williamson 71,654.45 carat parcel of diamonds blocked for

export during August 2017, with a carrying value of US$12.5

million. Under the Framework Agreement entered into with the

Government of Tanzania (GoT) in December 2021, it is stated that

the proceeds from the sale of this parcel are to be applied to the

Williamson mine to assist with the restart of operations and that

in the event such proceeds are not received by Williamson,

Williamson is not required to pay a US$20 million liability

relating to the settlement of past tax disputes. During

discussions, the GoT confirmed that the blocked parcel was

partially sold during the period and so this parcel has been

excluded from diamond inventories as at 30 June 2023. During these

discussions, the parties also confirmed their intent to resolve how

to treat the blocked parcel sale proceeds and the related US$20

million settlement liability.

4. The 2026 US$336.7 million loan notes, originally issued

following the capital restructuring (the "Restructuring") completed

during March 2021, have a carrying value of US$249.2 million which

represents the outstanding principal amount of US$209.7 million

(after the early participation phase of the debt tender offers as

announced in September and October 2022) plus US$48.2 million of

accrued interest and net of unamortised transaction costs

capitalised of US$8.7 million.

5. Bank loans and borrowings represent the Group's revolving

credit facility, which was increased from ZAR1 billion in December

2023 to ZAR1.75 billion, and is partially undrawn and available.

The upsized portion will be imminently available upon conclusion of

the required amendments.

6. Consolidated Net Debt is bank loans and borrowings plus loan

notes, less cash and diamond debtors.

Mine-by-mine tables:

Cullinan Mine - South Africa

H1 FY 2024 H1 FY 2023

Unit Q2 Q1 Total Q2 Q1 Total

--------- --------- --------- --------- --------- ---------

Sales

------- --------- --------- --------- --------- --------- ---------

Revenue US$m 45.5 51.0 96.5 45.8 56.9 102.7

------- --------- --------- --------- --------- --------- ---------

Diamonds sold Carats 345,867 519,362 865,229 400,999 267,728 668,727

------- --------- --------- --------- --------- --------- ---------

Average price per carat US$ 131 98 112 114 212 154

------- --------- --------- --------- --------- --------- ---------

ROM Production

------- --------- --------- --------- --------- --------- ---------

Tonnes treated Tonnes 1,078,409 1,137,435 2,215,844 1,120,282 1,110,912 2,231,194

------- --------- --------- --------- --------- --------- ---------

Diamonds produced Carats 331,349 318,261 649,610 328,137 368,796 696,933

------- --------- --------- --------- --------- --------- ---------

Grade(1) Cpht 30.7 28.0 29.3 29.3 33.2 31.2

------- --------- --------- --------- --------- --------- ---------

Tailings Production

------- --------- --------- --------- --------- --------- ---------

Tonnes treated Tonnes 96,235 91,008 187,243 62,178 77,572 139,750

------- --------- --------- --------- --------- --------- ---------

Diamonds produced Carats 36,018 44,618 80,636 28,211 26,790 55,001

------- --------- --------- --------- --------- --------- ---------

Grade(1) Cpht 37.4 49.0 43.1 45.4 34.5 39.4

------- --------- --------- --------- --------- --------- ---------

Total Production

------- --------- --------- --------- --------- --------- ---------

Tonnes treated Tonnes 1,174,644 1,228,443 2,403,087 1,182,460 1,188,484 2,370,944

------- --------- --------- --------- --------- --------- ---------

Diamonds produced Carats 367,367 362,879 730,246 356,348 395,586 751,934

------- --------- --------- --------- --------- --------- ---------

Note: 1. Petra is not able to precisely measure the ROM /

tailings grade split because ore from both sources is processed

through the same plant; the Company therefore back-calculates the

grade with reference to resource grades.

Finsch - South Africa

H1 FY 2024 H1 FY 2023

Unit Q2 Q1 Total Q2 Q1 Total

------- ------- --------- ------- ------- ---------

Sales

------- ------- ------- --------- ------- ------- ---------

Revenue US$m 28.1 38.9 67.0 32.0 23.4 55.4

------- ------- ------- --------- ------- ------- ---------

Diamonds sold Carats 298,889 375,214 674,103 283,833 177,285 461,118

------- ------- ------- --------- ------- ------- ---------

Average price per carat US$ 94 104 99 113 132 120

------- ------- ------- --------- ------- ------- ---------

ROM Production

------- ------- ------- --------- ------- ------- ---------

Tonnes treated Tonnes 635,872 544,140 1,180,012 522,578 572,976 1,095,554

------- ------- ------- --------- ------- ------- ---------

Diamonds produced Carats 276,842 259,864 536,706 234,150 260,217 494,367

------- ------- ------- --------- ------- ------- ---------

Grade(1) Cpht 43.5 47.8 45.5 44.8 45.4 45.1

------- ------- ------- --------- ------- ------- ---------

Tailings Production

------- ------- ------- --------- ------- ------- ---------

Tonnes treated Tonnes - - - 30,197 17,305 47,502

------- ------- ------- --------- ------- ------- ---------

Diamonds produced Carats - - - 3,402 3,160 6,562

------- ------- ------- --------- ------- ------- ---------

Grade(1) Cpht - - - 11.3 18.3 13.8

------- ------- ------- --------- ------- ------- ---------

Total Production

------- ------- ------- --------- ------- ------- ---------

Tonnes treated Tonnes 635,872 544,140 1,180,012 552,775 590,281 1,143,056

------- ------- ------- --------- ------- ------- ---------

Diamonds produced Carats 276,842 259,864 536,706 237,552 263,377 500,929

------- ------- ------- --------- ------- ------- ---------

Note: 1. Petra is not able to precisely measure the ROM /

tailings grade split because ore from both sources is processed

through the same plant; the Company therefore back-calculates the

grade with reference to resource grades.

Williamson - Tanzania

H1 FY 2024 H1 FY 2023

Unit Q2 Q1 Total Q2 Q1 Total

--------- --------- --------- ------- --------- ---------

Sales

------- --------- --------- --------- ------- --------- ---------

Revenue US$m 16.6 7.7 24.3 27.9 21.2 49.1

------- --------- --------- --------- ------- --------- ---------

Diamonds sold Carats 82,432 37,856 120,288 103,829 71,295 175,124

------- --------- --------- --------- ------- --------- ---------

Average price per carat US$ 201 203 202 269 297 280

------- --------- --------- --------- ------- --------- ---------

ROM Production

------- --------- --------- --------- ------- --------- ---------

Tonnes treated Tonnes 1,161,129 1,035,911 2,197,040 520,017 1,309,359 1,829,376

------- --------- --------- --------- ------- --------- ---------

Diamonds produced Carats 86,693 73,896 160,589 39,766 100,750 140,516

------- --------- --------- --------- ------- --------- ---------

Grade(1) Cpht 7.5 7.1 7.3 7.6 7.7 7.7

------- --------- --------- --------- ------- --------- ---------

Total Production

------- --------- --------- --------- ------- --------- ---------

Tonnes treated Tonnes 1,161,129 1,035,911 2,197,040 520,017 1,309,359 1,829,376

------- --------- --------- --------- ------- --------- ---------

Diamonds produced Carats 86,693 73,896 160,589 39,766 100,750 140,516

------- --------- --------- --------- ------- --------- ---------

Notes:

1. The following definitions have been used in this announcement:

a. cpht: carats per hundred tonnes

b. LTIs: lost time injuries

c. LTIFR: lost time injury frequency rate, calculated as the

number of LTIs multiplied by 200,000 and divided by the number of

hours worked

d. FY: financial year ending 30 June

e. CY: calendar year ending 31 December

f. H: half of the financial year

g. ROM: run-of-mine (i.e. production from the primary orebody)

h. m: million

i. Mt: million tonnes

j. Mct: million carats

k. Like-for-like: refers to the change in realised prices

between tenders and excludes revenue from all single stones and

Exceptional Stones, while normalising for the product mix

impact

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDKELFFZFLFBBK

(END) Dow Jones Newswires

January 16, 2024 02:00 ET (07:00 GMT)

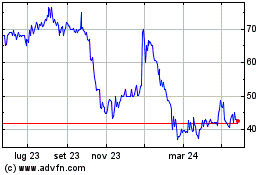

Grafico Azioni Petra Diamonds (LSE:PDL)

Storico

Da Ott 2024 a Nov 2024

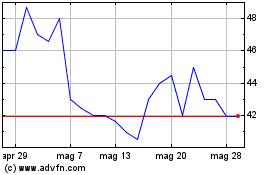

Grafico Azioni Petra Diamonds (LSE:PDL)

Storico

Da Nov 2023 a Nov 2024