TIDMPPH

RNS Number : 8346G

PPHE Hotel Group Limited

18 November 2022

18 November 2022

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014, as it

forms part of domestic law by virtue of The European Union

(Withdrawal) Act 2018.

On publication of this information such information shall be

considered to be in the public domain

PPHE HOTEL GROUP LIMITED

("PPHE", the "Company" or the "Group")

Extension to Share Buyback Programme

The Board of Directors of PPHE, the international hospitality

real estate group which develops, owns and operates hotels and

resorts, is pleased to announce the extension of the Company's

Share Buyback Programme (the "Programme"). As announced on 29 June

2022, the Programme was originally due to expire no later than 29

June 2023. The extension will result in the continuation of the

Programme until no later than 29 June 2023 or up to a maximum of

500,000 Ordinary Shares (including the 123,335 Ordinary Shares

already acquired under the Programme) for an aggregate

consideration (excluding expenses) of up to a maximum of

GBP3,700,000 (previously GBP1,700,000) (the "Extension").

Since commencing the Programme, the Group has purchased 123,335

Ordinary Shares at an average price of GBP13.73 per Ordinary Share.

The total cost to date of the Ordinary Shares purchased is GBP1.69

million. All Ordinary Shares acquired under the Programme have been

or will be held in treasury.

As set out in the Group's interim results to 30 June 2022, the

Group's EPRA NRV per share stands at GBP21.88, a substantial

premium to the current share price. In light of the ongoing share

price discount relative to the EPRA NRV per share, and following

consultation with shareholders, the Board believes the Extension is

in the best interests of all shareholders.

The Extension reflects the Board's confidence in the Group's

performance to date, current trading and the strength of its future

development pipeline. As announced in the Group's trading update

published on 27 October 2022, the Group is on track to exceed

market expectations for revenue and EBITDA for the financial year

ending December 2022. This outperformance has been driven by a

strong Q3 revenue performance across the London and Croatian assets

which, when combined with the maintained focus on room rates, has

allowed the Group to better navigate short term inflationary

pressures.

The Extension, which is detailed below, is expected to commence

immediately.

Details of the Extension

PPHE announces that it has entered into a further instruction

with Jefferies International Limited ("Jefferies") in relation to

the purchase by Jefferies, acting as principal during the period

commencing on 18 November 2022 and ending no later than 29 June

2023 or, if earlier, such time that the Company's existing share

buyback authorities expire being the Company's next AGM, of up to a

maximum of 500,000 Ordinary Shares for an aggregate consideration

(excluding expenses) of up to a maximum of GBP3,700,000 and the

simultaneous on-sale of such Ordinary Shares by Jefferies to PPHE,

following which they will be held in treasury. The purpose of the

Programme is to reduce share capital. For the purposes of the Share

Buyback Programme, Jefferies will make its trading decisions

concerning the timing of the purchases of Ordinary Shares

independently of, and uninfluenced by, the Group.

The Share Buyback Programme will be conducted within certain

pre-set parameters, and in accordance with the general authority to

repurchase shares granted by shareholders at the 2022 Annual

General Meeting, Chapter 12 of the UK Listing Rules and the

provisions of the UK Market Abuse Regulation dealing with buyback

programmes.

PPHE will announce any market repurchase of Ordinary Shares no

later than 7.30 a.m. on the business day following the calendar day

on which the repurchase occurred.

In accordance with the Rule 9 Waiver authority approved by

shareholders at the recent AGM, the Concert Party do not intend to

participate in the share buyback programme in respect of their

shareholdings.

Enquiries:

PPHE Hotel Group Limited Tel: +31 (0)20 717 8600

Daniel Kos, Chief Financial Officer & Executive

Director

Robert Henke, Executive Vice President

of Commercial Affairs

Hudson Sandler Tel: +44 (0)20 7796

4133

Wendy Baker / Lucy Wollam / Charlotte Cobb pphe@hudsonsandler.com

Notes to Editors

About PPHE Hotel Group

PPHE Hotel Group is an international hospitality real estate

company, with a GBP1.8 billion portfolio, valued as at December

2021 by Savills and Zagreb nekretnine Ltd (ZANE), of primarily

prime freehold and long leasehold assets in Europe.

Through its subsidiaries, jointly controlled entities and

associates it owns, co-owns, develops, leases, operates and

franchises hospitality real estate. Its primary focus is

full-service upscale, upper upscale and lifestyle hotels in major

gateway cities and regional centres, as well as hotel, resort and

campsite properties in select resort destinations.

PPHE Hotel Group benefits from having an exclusive and perpetual

licence from the Radisson Hotel Group, one of the world's largest

hotel groups, to develop and operate Park Plaza(R) branded hotels

and resorts in Europe, the Middle East and Africa. In addition,

PPHE Hotel Group wholly owns, and operates under, the art'otel(R)

brand and its Croatian subsidiary owns, and operates under, the

Arena Hotels & Apartments(R) and Arena Campsites(R) brands.

PPHE Hotel Group is a Guernsey registered company with shares

listed on the London Stock Exchange. PPHE Hotel Group also holds a

controlling ownership interest in Arena Hospitality Group, whose

shares are listed on the Prime market of the Zagreb Stock

Exchange.

Company websites

www.pphe.com

www.arenahospitalitygroup.com

For reservations

www.parkplaza.com | www.artotel.com | www.arenahotels.com |

www.arenacampsites.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSFLFIALELDLIF

(END) Dow Jones Newswires

November 18, 2022 02:00 ET (07:00 GMT)

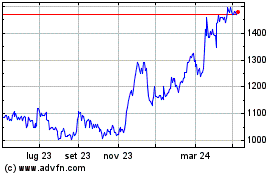

Grafico Azioni Pphe Hotel (LSE:PPH)

Storico

Da Mar 2024 a Apr 2024

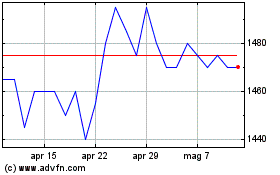

Grafico Azioni Pphe Hotel (LSE:PPH)

Storico

Da Apr 2023 a Apr 2024