TIDMRFX

RNS Number : 9014M

Ramsdens Holdings PLC

17 January 2023

17 January 2023

Ramsdens Holdings PLC

("Ramsdens", the "Group", the "Company")

Annual Results for the year ended 30 September 2022

Excellent recovery post pandemic

Ramsdens, the diversified financial services provider and

retailer, today announces its Annual Results for the year ended 30

September 2022 (the "Period").

The financial results for FY22 are significantly ahead of FY21

as the Group recovers from the impact of the Covid-19 pandemic.

FY22 FY21

Revenue GBP66.1m GBP40.7m

--------- --------

Gross Profit GBP38.2m GBP22.3m

--------- --------

Profit before tax GBP8.3m GBP0.6m

--------- --------

Net Assets GBP41.8m GBP36.1m

--------- --------

EPS 20.9p 1.2p

--------- --------

Final dividend 6.3p 1.2p

--------- --------

Full year dividend 9.0p 1.2p

--------- --------

Highlights:

-- FY22 profit for the Group has been driven primarily by the

strong recovery in foreign currency gross profit to GBP12.6m (FY21:

GBP3.3m) as international travel returned to a reasonable

level.

-- Revenue generated by the Group's jewellery retail segment

increased by almost 50% to GBP27.1m (FY21: GBP18.3m), supported by

strategic investments in stock, merchandising and the website.

-- Demand for the Group's pawnbroking loans grew during the year

as a result of customer spending habits returning to normal

following the easing of restrictions related to Covid-19 and fewer

alternative options for small sum short term credit being

available. As at 30 September 2022, the loan book had increased by

over 40% to GBP8.6m (FY21: GBP6.1m).

-- Precious metal buying volumes increased throughout the

summer, aided by the high gold price and increased footfall.

Revenue across this segment increased more than 50% to

approximately GBP16.0m (FY21: GBP10.3m).

-- The Board has recommended a final dividend of 6.3p per share

for approval at the forthcoming AGM taking the total dividend for

the Period to 9.0p per share (FY21: 1.2p), representing a return to

the Group's progressive dividend policy.

Current Trading:

The Board is pleased to provide an update on Q1 FY23 trading

(October to December 2022).

-- Jewellery retail gross profit increased by over 15% primarily

as a result of strong premium watch sales both instore and

online.

-- Q1 volumes of foreign currency exchange remained at

approximately 70% of pre pandemic levels.

-- The pawnbroking loan book has grown further from the year-end

balance of GBP8.6m to GBP9.1m.

-- The purchase of precious metal volumes and our other services

have continued to perform in line with expectations.

-- Following the year end, new stores have been opened in

Bootle, Basildon, Croydon and a second store in Bradford, taking

the store estate to 158 stores (including two franchised

stores).

Peter Kenyon, Chief Executive, commented:

"Ramsdens delivered a very strong performance in FY22, once

again reflecting the strength of our diversified income streams.

The strong rebound in our foreign currency exchange volumes,

coupled with increased demand for our excellent quality and value

for money jewellery, has enabled the Group to deliver significantly

increased profitability.

This momentum continued through Q1, with strong jewellery sales

during December driven by continued consumer demand for premium

watches.

Our team of committed staff have once again been central to our

success. They continue to deliver outstanding service to our

growing customer base, for which I am hugely grateful, and I would

like to take this opportunity to publicly thank them all for their

commitment. We continue to invest in attracting, retaining and

rewarding our staff as we develop what I believe to be the best

team in the industry.

While fully aware of the economic challenges that lie ahead,

with our trusted brand and proven, well invested and diversified

business model, I remain very optimistic about Ramsdens' future

prospects."

Availability of Report and Accounts

The Company confirms that the Annual Report and Financial

Statements for the year ended 30 September 2022, together with

notice of the Company's 2022 annual general meeting, will be

published and posted to shareholders shortly and will be available

to view on the Company's investor relations website:

https://www.ramsdensplc.com/investor-relations/reports-and-presentations

, in accordance with AIM Rule 20.

The information contained within this announcement is deemed by

the Group to constitute inside information as stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as amended by The Market

Abuse (Amendment) (EU Exit) Regulations 2019. The person

responsible for making this announcement on behalf of the Company

is Peter Kenyon.

S

Enquiries:

Ramsdens Holdings PLC Tel: +44 (0) 1642 579957

Peter Kenyon, CEO

Martin Clyburn, CFO

Liberum Capital Limited (Nominated Adviser) Tel: +44 (0) 20 3100 2000

Richard Crawley

Lauren Kettle

Hudson Sandler (Financial PR) Tel: +44 (0) 20 7796 4133

Alex Brennan

Emily Brooker

About Ramsdens

Ramsdens is a growing, diversified, financial services provider

and retailer, operating in the four core business segments of

foreign currency exchange, pawnbroking loans, precious metals

buying and selling and retailing of second-hand and new jewellery.

Ramsdens does not offer unsecured high-cost short term credit.

Headquartered in Middlesbrough, the Group operates from 158

stores within the UK (including 2 franchised stores) and has a

growing online presence.

Ramsdens is FCA authorised for its pawnbroking and credit

broking activities.

www.ramsdensplc.com

www.ramsdensforcash.co.uk

CHAIRMAN'S STATEMENT

I had every confidence that Ramsdens, underpinned by the

strength of its diversified business model and value-for-money

proposition, would emerge from the Covid-19 pandemic

well-positioned for continued growth. I am pleased to say this is

the position we are now in.

This Annual Report covers the 12-month period to 30 September

2022 (FY22).

The financial results for FY22 are significantly ahead of FY21

as the latter were severely impacted by retail closures and reduced

international travel resulting from the pandemic.

FY22 brought the challenges of the Covid-19 Omicron variant in

H1, which impacted retail, particularly in the weeks prior to

Christmas 2021, and also caused disruption to international travel.

While these challenges eased in H2, the trading conditions did not

return to those seen prior to the onset of the pandemic. Despite

these challenges, I am pleased to report that the Group has had an

excellent recovery.

FINANCIAL RESULTS & DIVID

The below table highlights the financial results:

GBP000's FY22 FY21

Revenue GBP66,101 GBP40,677

---------- ----------

Gross Profit GBP38,219 GBP22,262

---------- ----------

Profit Before GBP8,269 GBP564

Tax

---------- ----------

Net Assets GBP41,843 GBP36,143

---------- ----------

Net Cash* GBP8,835 GBP13,032

---------- ----------

EPS 20.9p 1.2p

---------- ----------

Final dividend 6.3p 1.2p

---------- ----------

Full year dividend 9.0p 1.2p

---------- ----------

*cash minus bank borrowings

The Group achieved revenue of GBP66.1m (FY21: GBP40.7m) and

Profit Before Tax of GBP8.3m (FY21: GBP0.6m). The Strategic Report

and Financial Review that follow provide a more in-depth analysis

of the Group's trading performance and financial results.

The Board has recommended a final dividend of 6.3p (FY21: 1.2p)

for approval at the forthcoming AGM. The full year dividend, of

9.0p (FY21: 1.2p) assuming approval at the AGM, would represent 43%

of the earnings per share. This payment recommences the Group's

progressive dividend policy of paying approximately 50% of post-tax

profits to shareholders, always subject to executing on the Group's

growth opportunities. Subject to approval at the AGM, the final

dividend is expected to be paid on 10 March 2023 for those

shareholders on the register on 3 February 2023. The ex-dividend

date will be 2 February 2023.

LOOKING AHEAD

The Board believes Ramsdens' diversified income streams provide

defensive qualities against the macroeconomic challenges that lie

ahead. The uncertainty caused by energy cost increases, general

inflationary pressures and higher interest rates will prove a

challenge to many businesses, and Ramsdens is no different.

However, we also see opportunities. We would hope that after

three years of disruption to summer holidays, 2023 may see the

level of holidays taken by consumers return to 2019 levels,

although it is always possible that economic conditions may delay

that.

Tougher economic conditions will no doubt lead to increased and

sometimes unexpected bills for our customers. As an asset-backed

loan, pawnbroking provides a solution to an immediate borrowing

need and allows customers six months to repay their loans or to

make longer term financial arrangements. We have seen the continued

demand for this simple solution as the Ramsdens pawnbroking loan

book finished the year end at a record high. Due to global economic

uncertainty, the gold price is also expected to remain higher than

long term averages, which will benefit both our pawnbroking and

precious metals buying business segments. While there is greater

uncertainty for the outlook on retail, as jewellery is often a

discretionary spend, Ramsdens has been investing heavily in

upskilling staff, building appropriate stock levels, stock

presentation and replenishment systems and it is expected that the

significant momentum we have seen during FY22 will support a

continued strong performance in FY23.

Of course, the Group is not immune from rising costs. While

energy prices for the vast majority of our stores are fixed until

February 2024, stores opened since February 2021 are not part of

that contract and have been subject to higher energy costs. The

biggest cost to the business is also our most important asset: our

people. We have a duty to look after our people and, in addition to

professional development initiatives, opportunities for career

progression and welfare programmes, we also want to reward our

staff well. In addition to a one off 'thank you' bonus, our January

2023 pay review will again ensure that our staff are paid at least

the Real Living Wage with the potential to earn more through

attractive bonus schemes.

I am extremely proud of the Ramsdens team's skills and their

continued commitment to our customers and the communities in which

we operate. I would personally like to thank each and every one of

my colleagues for their continued dedication.

During the year, Steve Smith took the decision to retire from

Ramsdens prior to the 2023 AGM. The Nominations Committee undertook

a recruitment process and I am pleased to report that Karen Ingham

joined the Board on 1 November 2022. I would like to thank Steve

for his contribution to Ramsdens and wish him all the best for the

future and welcome Karen to our board.

Andrew Meehan

Non-Executive Chairman

16 January 2023

CHIEF EXECUTIVE'S REVIEW

Despite the challenges faced during the year, I am pleased that

our diversified income streams have performed extremely well to

deliver strong annual profits, in line with those achieved prior to

the onset of the pandemic.

We started the year with optimism. We knew consumers had saved

significant sums and paid down debts through the pandemic and that

as restrictions were removed, normalised spending habits would

resume, and as a result there would be a greater need to borrow.

The Covid-19 Omicron variant slowed down the return to more

normalised trading conditions until after Christmas 2021. In early

2022, we saw the end of the red and green 'traffic light'

destination lists and constraints on international travel reduced,

most notably the uncertainty of a pre-departure Covid-19 test.

However, it soon became clear that many airlines and airports were

unable to manage the increased volume of consumers travelling

during peak holiday months which led to a reduced number of

international flights. As a result, our opportunity to sell foreign

currency was more limited than we initially expected.

The war in Ukraine and the resulting energy crisis combined with

other inflationary pressures has impacted on both our business and

customers. However, the Group has fixed energy pricing across the

majority of its estate until February 2024 which provides

mitigation in the short term.

Our staff have once again delivered outstanding service to our

growing customer base during the year for which I'm hugely

grateful. I would like to take this opportunity to publicly thank

them all for their commitment. We continue to invest in attracting,

retaining and rewarding our staff as we develop what I believe to

be the best team in the industry.

I remain very optimistic for the future of Ramsdens given our

diversified income streams, robust business model and strong

balance sheet.

BUSINESS REVIEW

Despite the external challenges faced during recent period, the

Group has remained committed to its growth strategy.

Our continuous improvement ethos has led to the core store

estate delivering growth across all income streams and gives us

momentum as we move forward. Within the core estate, we have

relocated four stores, namely Carlisle, Kilmarnock, Newcastle and

Manchester. We opened new stores in Bolton and Glasgow and

successfully expanded into the South East of England with a new

store opening in Chatham. We acquired a further store on the South

coast at Boscombe. All of the new stores and relocations have

performed well.

Two stores have been closed and merged locally in line with our

approach of regularly appraising individual store performance, new

opportunities and return on investment, and we ended the financial

year with 152 stores and two franchised locations.

Our online activities continue to grow. We commenced a project

to refresh the retail jewellery website to improve the search

facility for customers and for organic reach. The refreshed website

went live in Q1 FY23. In H1 2023, we will have individual websites

for our four key income streams, further improving the online

customer journey.

During the year we acquired the freehold of our head office

premises. This will allow us to expand this bespoke building to

support our long-term growth plans as well as introduce a greener

energy solution.

The performance of each of the Group's key income streams is

discussed in greater detail below.

OUR DIVERSIFIED BUSINESS MODEL: PRODUCT OFFERING

Ramsdens operates in the four core business segments of: foreign

currency exchange; pawnbroking ; jewellery retail; and purchase of

precious metals.

Foreign Currency Exchange

The foreign currency exchange (FX) segment primarily comprises

the sale and purchase of foreign currency notes to holidaymakers.

Ramsdens also offers international bank-to-bank payments through a

third-party arrangement.

FY22 FY21

Total Currency exchanged GBP364m GBP77m

--------- --------

Gross profit GBP12.7m GBP3.3m

--------- --------

Online click and collect GBP38.7m GBP6.9m

orders

--------- --------

Percentage of FX online 11% 9%

--------- --------

Percentage of Group gross

profit 33% 15%

--------- --------

October 2021 volumes were approximately 30% of pre-pandemic

levels, rising to over 80% in May 2022 before settling through the

summer at circa 70% of pre-pandemic levels.

During this period of supressed volumes, the industry has

widened margins, and Ramsdens has benefited from this while still

offering attractive and competitive exchange rates to our

customers. The overall margin achieved on all foreign currency

exchanged was 3.5%, down from 4.2% due to the changes in mix of

foreign currency sales and purchases.

The average foreign currency sale transaction value (ATV) was

GBP469, an increase on the pre pandemic level of GBP401. We

continue to have confidence that UK travellers will continue to

take cash abroad for both convenience and to assist with budgeting

whilst on holiday.

In line with our multi-channel strategy, the Group is refreshing

its currency travel card proposition with a new multi-currency card

due to be launched in 2023.

International payments income continues to be relatively small

in comparison to total foreign currency commission but we have a

loyal repeat customer base using the service.

We strongly believe that customers' desire to go on holiday

abroad remains high, especially after three summers of disruption.

We are optimistic that more holiday makers will travel during

summer 2023 than did during 2022, and that numbers may return to

2019 levels. However, it is also possible that economic conditions

may delay the return to pre-pandemic levels.

Pawnbroking

Pawnbroking is a small subset of the consumer credit market in

the UK and a simple form of asset backed lending dating back to the

foundations of banking. In a pawnbroking transaction an item of

value, known as a pledge, (in Ramsdens' case, jewellery and

watches), is held by the pawnbroker as security against a six-month

loan. Customers who repay the capital sum borrowed plus interest

receive their pledged item back. If a customer fails to repay the

loan, the pawnbroker sells the pledged item to repay the amount

owed and returns any surplus funds to the customer. Pawnbroking is

regulated by the FCA in the UK and Ramsdens is fully FCA

authorised.

000's FY22 FY21

Gross profit GBP7,533 GBP6,678

--------- ---------

Total loan book* (capital value) GBP8,648 GBP6,137

--------- ---------

Past due (capital value) GBP721 GBP536

--------- ---------

In date loan book* (capital GBP7,927 GBP5,601

value)

--------- ---------

Percentage of Group gross profit 20% 30%

--------- ---------

*excludes loans in the course of realisation

As Covid-19 restrictions eased, as expected, consumers started

to spend more which resulted in an increase in some customers'

short-term requirements for financial assistance. This occurred

across both mainstream consumer credit, such as credit cards where

card balances increased in the last 12 months, as well as across

the consumer base using a pawnbroker. At the same time, the number

of small sum short term credit providers in the market reduced. As

a consequence, demand for pawnbroking loans has increased and the

loan book at the year-end was at a record high of GBP8.6m (FY21

GBP6.1m).

The average loan value as at 30 September 2022 was GBP303, up

from GBP264 as at 30 September 2021. Our lending remains

conservative in line with our long-term policy.

We predict that increased energy bills, high inflation and

higher interest rates will squeeze household incomes in FY23

leading to an increased demand for consumer borrowing. If consumers

have assets to pledge, pawnbroking can provide a short-term

solution and therefore our loan book is expected to increase during

FY23.

Jewellery Retail

The Group offers new and second-hand jewellery, including

premium watches, for sale. The Board continues to believe there is

significant growth potential in this segment by leveraging

Ramsdens' retail store estate and ecommerce operations. The Group

aims to cross-sell its retail proposition to existing customers of

the Group's other services as well as attracting new customers.

The retailing of new jewellery products complements the Group's

second-hand offering to give our customers greater choice in

breadth of products and price points. In addition, new jewellery

retailing enables the Group to attract customers who prefer not to

buy second-hand.

000's FY22 FY21

Revenue GBP27,107 GBP18,252

---------- ----------

Gross Profit GBP10,263 GBP6,965

---------- ----------

Margin % 38% 38%

---------- ----------

Jewellery retail stock GBP19,683 GBP13,979

---------- ----------

Online sales GBP3,904 GBP2,822

---------- ----------

Percentage of sales online 14% 15%

---------- ----------

Percentage of Group gross

profit 27% 31%

---------- ----------

The Group's retail performance is at a record high and continues

to perform well following investments in stock levels, stock

presentation, replenishment systems, staff training and our retail

website over recent years.

Retail revenue is now approximately equally spread across three

key categories of premium watches, new jewellery and preowned

jewellery. Margins by product category have remained consistent as

has the overall gross margin as all product categories have

performed well.

Online growth remains strong with revenue increasing to GBP3.9m,

up 38% for the year. Online sales represented 14% of all jewellery

items sold.

As well as a profitable sales channel, the jewellery website

also serves as a catalogue for our branches, assisting our staff

with serving customers where stock choice in a branch may be

limited. For example, our top watch sales branches have circa 60

watches in store but there are now over 1,800 watches available on

our website for customers to browse, choose from and buy.

We believe there is an ongoing opportunity, instore and online,

across our product categories, to develop and grow our jewellery

retail business.

Purchase of precious metals

Through our precious metals buying and selling service, Ramsdens

buys unwanted jewellery, gold and other precious metals from

customers. Typically, a customer brings unwanted jewellery into a

Ramsdens store and a price is agreed with the customer depending

upon the retail potential, weight or carat of the jewellery.

Ramsdens has various second-hand dealer licences and other

permissions and adheres to the Police approved "gold standard" for

buying precious metals.

Once jewellery has been bought from the customer, the Group's

dedicated jewellery department decides whether or not to retail the

item through the store network or online. Income derived from

jewellery, which is purchased and then retailed, is reflected in

jewellery retail income and profits. If the items are not retailed,

they are smelted and sold to a bullion dealer for their intrinsic

value and the proceeds are reflected in the Group's accounts as

precious metals buying income.

000's FY22 FY21

Revenue GBP15,847 GBP10,369

---------- ----------

Gross Profit GBP6,626 GBP4,240

---------- ----------

Percentage of Group gross

profit 17% 19%

---------- ----------

The Sterling price for 9ct gold has remained high in comparison

to long run averages, at an average of GBP17.15 per gram during the

year (FY21: GBP16.05).

While in the first half of the year the weight of gold purchased

was subdued in line with reduced footfall, during the second half

year, the weight purchased has returned to pre-pandemic levels.

Given the wider global political and economic situation, we

believe the gold price will remain high in the short to medium

term, supporting the Group's margins.

Other services

In addition to the four core business segments, the Group also

provides additional services in cheque cashing, Western Union money

transfer, credit broking and receives franchise fees.

000's FY22 FY21

Revenue GBP1,114 GBP1,122

--------- ---------

Gross Profit GBP1,114 GBP1,122

--------- ---------

Percentage of Group gross

profit 3% 5%

--------- ---------

This remains a steady source of income albeit we believe that

cheque cashing will continue to decline over the medium term.

STRATEGY

Following an extensive review, the Board believes that its

existing strategy, communicated over the last few years, remains

the right course for growing our business and delivering value for

all our stakeholders in a sustainable manner. Our staff and their

development are a core component of achieving our aims.

We continue to concentrate on:

1. Improving the performance of our existing store estate

2. Expanding the Ramsdens branch footprint in the UK

3. Developing our online proposition

4. Appraising market opportunities presented by operating in challenging markets.

5. Focusing on sustainability through our ESG policies

1. Improving the performance of the existing store estate

All income segments have shown significant growth over FY21

levels, as the Group has recovered from the pandemic

restrictions.

The strategic focus we have placed on attracting new customers

and driving a higher wallet share from our repeat customers has led

to a record pawnbroking loan book and record jewellery retail

revenue. Our focus remains the same across the existing store

estate.

Our costs are well controlled, with our largest cost being our

staff. We fully understand the important role our staff play in

achieving our strategic objectives and as a result we have budgeted

for a positive pay review which has been brought forward to January

2023 from April. We are committed to ensuring that our staff remain

not only productive but also feel rewarded in their careers at

Ramsdens.

Rents continue to be negotiated downwards where there is an

opportunity to do so, balanced with a desire for flexibility with

lease expiry and break dates, especially if the town has some

demographic challenges. In recognising this high street challenge,

where the return on capital justifies a relocation, we will

actively move a store to improve our footfall-reliant services of

foreign currency exchange and jewellery retail while potentially

reducing operating costs at the same time.

We believe our store estate performance is complemented by a

strong online proposition. By investing in our retail jewellery

website in recent years we have improved each store's access to a

wider range of jewellery which has improved customer service levels

and resulted in increased in-store sales.

In addition, we continually aim to improve the performance of

our key income streams:

Foreign currency:

-- The three key drivers for foreign currency remain trust,

convenience and price. Having available stock and transparent

pricing continues to build trust among consumers.

-- By having branches conveniently located on high streets and

in shopping centres, we will continue to attract consumers wanting

foreign exchange services.

-- By having competitive exchange rates, we will attract new and

retain existing customers whilst continuing to manage margins

closely, with due regard to local market conditions.

-- By improving the frequency of contact we have with our

foreign currency customers, we will stay in our customers' thoughts

when they next need foreign currency.

-- By developing a market-leading multi-currency travel card, we

will seek to capture more of the customer's holiday spend while

abroad.

Pawnbroking:

-- We have fully embraced the FCAs New Consumer Duty initiative.

We have always had the consumer at the heart of what we do and this

has been demonstrated by our loyal customer base. We will continue

doing what we believe are the right things for our customers - this

includes reducing interest rates for customers needing longer to

pay and, if a customer defaults, by continuing to obtain the best

price possible for them by selling by private treaty and not using

an auction process which we believe disadvantages customers.

-- We will continue to have prudent lending policies while

examining opportunities to lend more when the customer's borrowing

history suggests greater capacity to repay and where the pledged

assets are more desirable and readily saleable. Our improvement in

our retail jewellery operations gives the Group confidence that it

is able to lend more on higher value jewellery items.

-- We will continue to build upon the trust and high repeat

customer volumes earned by giving a great service and grow the

customer base through word-of-mouth recommendation.

Jewellery retail:

-- Stock levels have significantly increased over the last 18

months. This has been a deliberate strategy to give our customers

more choice in-store and online and enable improved replenishment

capabilities. This investment continues with the benefit of lessons

learned during recent years and with the belief there is room for

further improvement across both jewellery and premium watches.

-- We are continuing to work on the display of our products to

create more customer appeal as well as continuing to invest in our

retail website which also acts as a stock catalogue for our

branches to facilitate further in store sales.

-- Where appropriate, we will relocate to higher footfall

locations to improve the jewellery offer with larger window display

areas, often at similar rents to current locations.

Purchase of precious metals:

-- We are increasing the awareness amongst our existing customer

base, primarily foreign currency exchange customers who are unaware

of the service or the value held in damaged or simply unwanted or

unworn jewellery.

2. Expanding the branch footprint in the UK

The Group has a successful branch-based model. With diversified

income streams, stores generate a good return on capital while

leveraging the head office cost base. We have successful stores in

small towns and large cities which gives us confidence that we can

be successful on most high streets that have a nucleus of returning

shoppers.

As at 30 September 2022, we had 152 stores plus two franchised

stores.

During the year, we opened three greenfield sites and acquired a

pawnbroker in Boscombe. We closed stores in Middlesbrough

(secondary foreign currency kiosk) and Ripon; both of these stores

were merged with other local Ramsdens stores.

The year also saw the first new store opened in the South East

of England in Chatham, Kent. This store has had a good first year,

well ahead of expectations, and we plan to open up to another seven

stores in the South East in FY23.

Overall, we have targeted 12 locations to open in FY23. In Q1,

we have now opened stores in Bootle in the North West, a second

store in Bradford in Yorkshire, and Basildon in Essex. . In Q2 we

have stores scheduled to open in Croydon in Greater London,

Maidstone in Kent and additional stores in Yorkshire and the North

West of England.

3. Developing our online proposition

Jewellery retail website

www.ramsdensjewellery.co.uk

We continue to make good progress with the online sales of

jewellery items. Sales have increased to GBP3.9m, up 38% from

GBP2.8m in FY21. This performance excludes jewellery sales in

branches which used the in-store digital facility to access the

website as a catalogue of stock.

As part of our ongoing review of performance, the retail website

was refreshed in Q1 FY23. This review improved the website layout

and should significantly increase the success rates of our search

and filter functions. Together with improved search engine

visibility, investment in pay per click advertising, social media

and affiliate advertising, use of differing payment options,

improved photography and descriptions and learning from integrated

AI, this should drive ongoing retail jewellery sales growth.

We see the development of our online retail jewellery website as

complementary to our store estate and both will benefit as the

store estate expands and the website generates increased brand

recognition.

Website strategy - other key income streams

www.ramsdensforcash.co.uk

The ramsdensforcash website is currently being updated to create

a portal to individual websites for each of our four key income

streams.

Three new websites for foreign currency exchange, gold buying

and pawnbroking will launch early in 2023 and will be supported by

investment in search engine optimisation. By having this broadened

online offering we hope to enhance our online channel revenues and

profitability as well as support the performance of the branch

estate in these segments.

4. Appraising opportunities presented by operating in challenging markets

The high street retail landscape has been challenging for a

number of years. Following on from the impact of the pandemic,

retailers are more likely to have higher debt burdens and now face

increased energy costs and increased staff costs at a time when

consumer income is being squeezed by high levels of inflation and

increasing interest rates. This will impact some travel agents and

jewellers who may leave the high street or indeed the market

altogether, presenting opportunities for Ramsdens to attract new

customers, takeover prime retail locations or acquire

businesses.

Our estimate of the number of pawnbroking outlets in the UK

remains at approximately 870 - operated by circa 130 pawnbroking

businesses. The Ramsdens operating board are well networked within

the industry and should a pawnbroking business come up for sale in

the UK, we would expect to hear of it and then evaluate the

opportunity against our target rate of return. This was evidenced

by the purchase of Geo A Payne & Sons pawnbrokers in Boscombe

in February 2022. This business has performed well and in line with

expectations since acquisition.

While most pawnbrokers have seen increased lending levels in the

last 12 months and have optimism for future lending given the

macroeconomic conditions, the administration and cost burden of

increased regulation may mean some participants seek to exit the

industry, which may present further acquisition and expansion

opportunities.

The South East has the highest concentration of pawnbroking

outlets in the UK and presents a compelling expansion opportunity

for the Group. Our continued expansion into the South East is aimed

at creating a nucleus of Ramsdens stores that build brand

recognition and then, as opportunities arise, acquiring further

pawnbroking outlets or loan books to supplement our organic

growth.

We continue to hope for a full reform of the non-domestic rates

system which may encourage more retailers to open stores and

recreate vibrant high streets. Without reform, we fear some towns

and high streets may suffer further decline and more empty shops.

Our property portfolio has been purposefully managed to be as

flexible as possible to provide a defensive quality in case any of

our stores become isolated and performance deteriorates.

When looking at new town and relocation opportunities,

investments will only be made in new stores after significant

research of footfall and adjacent retailer quality. The demise of

certain retailers in a town can however provide an opportunity to

obtain reductions in rental levels in certain towns while not

compromising on location.

5. Focusing on sustainability through our ESG policies

Our ESG policies are detailed on page 24.

Our long-term strategic aims will only be delivered if we have

good foundations.

We remain:

-- conscious of the impact of our activities on the environment

and aim to reduce our energy use and recycle where we can;

-- focused on our place in the communities in which we operate;

how we look after our staff; how we play a wider societal role with

respect to our customers, suppliers and charitable organisations;

and

-- committed to having the highest standards of governance throughout the business.

LOOKING AHEAD

With the gradual removal of restrictions put in place during the

pandemic, FY22 saw the Group recommence the growth journey which it

had been on since its IPO in February 2017.

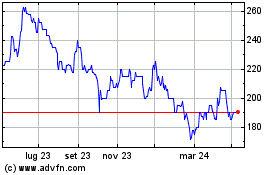

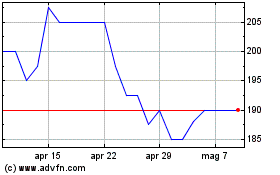

The graphs below set out the Group's performance in adjusted

profit before tax and in each of the four main income streams since

the IPO.

To enhance comparability, the profit before tax below, has been

adjusted in 2017 by adding back the IPO fees and in 2020 by

removing the one-off profit from scrapping of aged stock. In

addition, the six-month period from April to September 2020, which

was the period severely impacted by the pandemic including the

closure of all stores and furloughing of 692 colleagues, has been

excluded from the graphs.

The graphs show the adjusted profit before tax, pawnbroking

gross profit, purchase of precious metals gross profit and foreign

currency exchange gross profit trajectories being interrupted by

the pandemic and the growth in jewellery retail revenue throughout

the time period as a result of the ongoing self-help

investments.

Adjusted profit before tax

The graph below demonstrates the growth in profit before tax

over the period and shows that profitability has now returned to

pre-Covid levels, despite performance in the first six months of

FY22 being impacted by Covid-related restrictions.

The adjustments are (1) adding back IPO fees in 2017 and (2)

removing the one-off profit from scrapping of aged stock in

2020.

Foreign Currency Exchange

The expected number of international travellers in FY23 is

subject to some debate given the squeeze on household incomes, but

with disrupted holiday travel over the past three years it is

anticipated that summer 2023 will bring normalised levels of

demand. Due to rising costs for bureau de change operators, we

believe that the margins will remain higher than pre-pandemic

levels.

Pawnbroking

It is reasonable to expect that the demand for pawnbroking loans

may continue to be high in FY23 due to the cost-of-living increases

and the squeeze on household incomes at a time when there are fewer

providers of short-term loans. There is potentially a greater risk

of default on the repayment of loans but the pawnbroker is secured

and would sell the jewellery to repay the loan, potentially at a

value which can return surplus funds to borrowers.

Jewellery Retail

Our jewellery retail segment may experience the greatest

headwinds in FY23 as a result of the inflationary environment and

rising cost of living, but we are pleased to be starting from a

strong position. This will be enhanced by several 'self-help'

initiatives - higher stock levels, staff training, improved window

displays and a website refresh, which means we have momentum to

navigate those headwinds and the confidence to continue to

grow.

Purchase of precious metals

We believe the gold price will remain high and with increasing

footfall over recent years our ability to cross sell should enable

gold purchases to remain strong in FY23.

SUMMARY

Our diversified income streams and our strong financial base

have allowed the Group to trade through the pandemic successfully.

We believe we have made good progress as a business since the

Group's IPO in 2017 and are well positioned for the future

particularly with regards to our well-invested staff development

and our pipeline of new stores.

The Board has continued optimism for the future and confidence

in our ability to deliver on our growth strategy for the long-term

benefit of all our stakeholders.

Peter Kenyon

Chief Executive Officer

16 January 2023

FINANCIAL DIRECTOR'S REVIEW

FINANCIAL RESULTS

For the year ended 30 September 2022, the Group's reported

Revenue increased by 63% to GBP66.1m (FY21: GBP40.7m) with growth

across each of the four key income streams. Gross profit increased

by GBP16.0m (72%) to GBP38.2m (FY21: GBP22.3m).

The Group's administrative expenses increased by GBP7.9m (37%)

to GBP29.4m (FY21: GBP21.5m), reflecting an increase in staff costs

as the business returned to more normalised trading operating

levels. Finance costs remained low reflecting the seasonal use of

the Group's revolving credit facility during peak holiday

periods.

Profit before tax increased to GBP8.3m (FY21: GBP0.6m) as the

Group benefited from improved trading conditions.

The Group's cash position remains strong with GBP8.8m net cash

at the year-end (FY21: GBP13.0m), with the reduction in the period

reflecting increased investment into jewellery stock and the

recovery of the pawnbroking loan book.

The table below shows the headline financial results:

GBP000's FY22 FY21

Revenue GBP66,101 GBP40,677

---------- ----------

Gross Profit GBP38,219 GBP22,262

---------- ----------

Profit Before Tax GBP8,269 GBP564

---------- ----------

Net Assets GBP41,843 GBP36,143

---------- ----------

Net Cash* GBP8,835 GBP13,032

---------- ----------

EPS 20.9p 1.2p

---------- ----------

*Cash less bank borrowings

EARNINGS PER SHARE AND DIVID

The statutory basic earnings per share for FY22 was 20.9p, up

from 1.2p in the previous year.

The Board is recommending a final dividend of 6.3p in respect of

FY22 (FY21: 1.2p). Subject to approval at the AGM, the final

dividend is expected to be paid on 10 March 2023 for those

shareholders on the register on 3 February 2023. The ex-dividend

date will be 2 February 2023. This brings the total dividend for

FY22 to 9.0p (FY21: 1.2p). This dividend is in line with the

Board's progressive dividend policy reflecting the cash flow

generation and earnings potential of the Group.

This dividend represents a 43% pay-out ratio of FY22 EPS. The

FY22 ratio is mindful of the forthcoming changes to the rate of

corporation tax and allows for future dividends to be increased

incrementally in line with profits generated and our stated policy

of approximately 50% of post-tax profits being distributed.

Moving forward, the Board intends to pay interim dividends in

October and final dividends in March in the approximate proportion

of one third and two thirds respectively, subject always to the

financial performance of the Group and growth opportunities.

FINANCIAL POSITION

At 30 September 2022, cash and cash equivalents amounted to

GBP15.3m (FY21: GBP13.0m) and the Group had net assets of GBP41.8m

(FY21: GBP36.1m).

CAPITAL EXPITURE

During the reporting period, the Group invested in the store

estate by opening three new stores and relocating four existing

stores. Capital expenditure for tangible and intangible assets was

GBP2.8m which also included the purchase of the head office

building for GBP0.5m. A business in Boscombe was acquired during

the year for GBP0.9m which included its pawnbroking loan book and

jewellery stock.

CASH FLOW

Working capital outflows in the year include the significant

investment in stock of GBP7.2m, and the growth of the pawnbroking

loan book which has resulted in trade and other receivables

increasing by GBP2.6m. Trade and other payables increased by

GBP1.1m mainly due to the increased currency creditor which was

lower in the prior year due to the impact of Covid-19. The net cash

flow from operating activities for the year was GBP2.9m (FY21:

GBP1.1m)

Net cash at the period end was GBP8.8m (FY21: GBP13.0m).

T he Group continues to have access to its GBP10m revolving

credit facility which expires in March 2024. The Group has one

covenant of 1.5x cash cover. At 30 September 2022, this facility

was GBP6.5m drawn to support the currency cash held. The cash

position and headroom on the bank facility provide the Group with

the funds required to continue to deliver its current stated

strategy.

TAXATION

The tax charge for the period was GBP1.7m (FY21: GBP0.2m)

representing an effective rate of 20% (FY21: 33%). The tax rate was

higher than the standard UK rate of corporation tax mainly due to

non-deductible expenses including the amortisation of certain

customer lists. A full reconciliation of the tax charge is shown in

note 10 of the financial statements.

SHARE BASED PAYMENTS

The share-based payment expense in the period was GBP314,000

(FY21: GBP254,000). This charge relates to the Long-Term Incentive

Plans (LTIP) and Company Share Option Plans (CSOP). Both schemes

are discretionary share incentive schemes under which the

Remuneration Committee can grant options to purchase ordinary

shares. The shares under option in the LTIP scheme can be purchased

at a nominal 1p cost to Executive Directors and other senior

management subject to certain performance and vesting conditions.

The shares under option in the CSOP scheme can be purchased at

their issue price of 200.5p.

During the year, the LTIP award from 2018 did not meet the

performance criteria and therefore none of the share options

vested. 250,000 share options, which vested in the 2017 LTIP

scheme, were exercised during the year.

GOING CONCERN

The Board has conducted an extensive review of forecast earnings

and cash over the next 12 months, considering various scenarios and

sensitivities given the ongoing economic challenges and has

concluded that it has adequate resources to continue in business

for the foreseeable future. For this reason, the Board has been

able to conclude the going concern basis is appropriate in

preparing the financial statements.

Martin Clyburn

Chief Financial Officer

Consolidated statement of comprehensive income

For the year ended 30 September 2022

2022 2021

Notes

GBP'000 GBP'000

Revenue 5 66,101 40,677

Cost of sales (27,882) (18,415)

--------- ---------

Gross profit 5 38,219 22,262

Other income 7 1 284

Administrative expenses (29,392) (21,510)

--------- ---------

Operating profit 8,828 1,036

Finance costs 6 (559) (472)

--------- ---------

Profit before tax 8,269 564

Income tax expense 10 (1,683) (198)

--------- ---------

Profit for the year 6,586 366

--------- ---------

Other comprehensive income - -

Total comprehensive income 6,586 366

--------- ---------

Earnings per share in pence 8 20.9 1.2

Diluted earnings per share in pence 8 20.7 1.2

Consolidated statement of financial position

As at 30 September 2022

2022 2021

Assets Notes GBP'000 GBP'000

Non-current assets

Property, plant and equipment 11 6,681 5,195

Right of use of assets 11 9,551 8,164

Intangible assets 12 779 714

Investments 13 - -

Deferred tax assets 10 - 80

-------- ----------

17,011 14,153

Current assets

Inventories 15 22,764 15,151

Trade and other receivables 16 13,264 10,379

Cash and short-term deposits 17 15,278 13,032

-------- ----------

51,306 38,562

-------- ----------

Total assets 68,317 52,715

-------- ----------

Current liabilities

Trade and other payables 18 8,905 7,673

Interest bearing loans and borrowings 18 6,443 -

Lease liabilities 18 2,086 2,159

Income tax payable 18 932 61

-------- ----------

18,366 9,893

-------- ----------

Net current assets 32,940 28,669

-------- ----------

Non-current liabilities

Lease liabilities 19 7,871 6,442

Contract liabilities 19 88 119

Deferred tax liabilities 19 149 118

-------- ----------

8,108 6,679

-------- ----------

Total liabilities 26,474 16,572

-------- ----------

Net assets 41,843 36,143

-------- ----------

Equity

Issued capital 21 316 314

Share premium 4,892 4,892

Retained earnings 36,635 30,937

-------- ----------

Total equity 41,843 36,143

-------- ----------

The financial statements of Ramsdens Holdings PLC, registered

number 08811656, were approved by the directors and authorised

for issue on 16 January 2023 and signed on their behalf by:

M A Clyburn

Chief Financial Officer

Consolidated statement of changes in equity

For the year ended 30 September

2022

Issued Share Retained

capital premium earnings Total

Notes

GBP'000 GBP'000 GBP'000 GBP'000

As at 1 October 2020 308 4,892 30,355 35,555

Profit for the year - - 366 366

--------- --------- ---------- --------

Total comprehensive income - - 366 366

--------- --------- ---------- --------

Transactions with owners:

Dividends paid 22 - - - -

Issue of share capital 6 - - 6

Share based payments 25 - - 254 254

Deferred tax on share-based

payments - - (38) (38)

--------- --------- ---------- --------

Total transactions with owners 6 - 216 222

As at 30 September 2021

--------- --------- ---------- --------

314 4,892 30,937 36,143

--------- --------- ---------- --------

As at 1 October 2021 314 4,892 30,937 36,143

Profit for the period - - 6,586 6,586

--------- --------- ---------- --------

Total comprehensive income - - 6,586 6,586

Transactions with owners:

Dividends paid 22 - - (1,231) (1,231)

Issue of share capital 21 2 - - 2

Share based payments 25 - - 314 314

Deferred tax on share-based

payments - - 29 29

--------- --------- ---------- --------

Total transactions with owners 2 - (888) (886)

As at 30 September 2022 316 4,892 36,635 41,843

--------- --------- ---------- --------

Consolidated statement of cash

flows

For the year ended 30 September

2022

2022 2021

Operating activities Notes GBP'000 GBP'000

Profit before tax 8,269 564

-------- --------

Adjustments to reconcile profit

before tax to net cash flows:

Depreciation and impairment of property,

plant

and equipment 11 1,265 1,074

Depreciation and impairment of right

of use assets 11 2,261 2,223

Profit on disposal of right of use

assets 7 (81) (45)

Amortisation and impairment of intangible

assets 12 163 218

Loss on disposal of property, plant

and equipment 7 78 140

Share based payments 25 314 254

Finance costs 6 559 472

Working capital adjustments:

Movement in trade and other receivables

and prepayments (2,583) 565

Movement in inventories (7,221) (3,992)

Movement in trade and other payables 1,144 1,217

-------- --------

4,168 2,690

Interest paid (559) (472)

Income tax paid (672) (1,135)

-------- --------

Net cash flows from operating activities 2,937 1,083

-------- --------

Investing activities

Proceeds from sale of property,

plant and equipment 3 10

Purchase of property, plant and

equipment 11 (2,817) (1,574)

Purchase of intangible assets 12 (28) (62)

Payment for acquisition 26 (909) -

-------- --------

Net cash flows used in investing

activities (3,751) (1,626)

Financing activities

Issue of share capital 21 2 6

Dividends paid 22 (1,231) -

Payment of principal portion of

lease liabilities (2,211) (2,304)

Bank loans drawn down 8,000 -

Repayment of bank borrowings (1,500) -

Net cash flows from financing activities 3,060 (2,298)

-------- --------

Net increase / decrease in cash

and cash equivalents 2,246 (2,841)

Cash and cash equivalents at 1 October 13,032 15,873

-------- --------

Cash and cash equivalents at 30

September 28 15,278 13,032

-------- --------

Notes to the consolidated financial statements

1. Corporate information

Ramsdens Holdings PLC (the "Company") is a public limited

company incorporated and domiciled in England and Wales. The

registered office of the Company is Unit 16, Parkway Shopping

Centre, Coulby Newham, Middlesbrough, TS8 0TJ. The registered

company number is 08811656. A list of the Company's subsidiaries is

presented in note 13.

The principal activities of the Company and its subsidiaries

(the "Group") are the supply of foreign exchange services,

pawnbroking and related financial services, jewellery sales, and

the purchase of gold jewellery from the general public.

2. Changes in accounting policies

There are no changes to accounting policies in the current year.

There are no future changes in accounting standards which would

materially impact the Group.

3. Significant accounting policies

3.1 Basis of preparation

The consolidated financial statements of the Group have been

prepared in accordance with UK adopted international accounting

standards.

The consolidated financial statements have been prepared on a

historical cost basis. The consolidated financial statements are

presented in pounds sterling which is the functional currency of

the parent and presentational currency of the Group. All values are

rounded to the nearest thousand (GBP000), except when otherwise

indicated.

3.2 Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and all of its subsidiary undertakings

(as detailed above). The financial information of all Group

companies is adjusted, where necessary, to ensure the use of

consistent accounting policies. In line with IFRS10, an investor

controls an investee when it is exposed, or has rights, to variable

returns from its involvement with the investee and has the ability

to affect those returns through its power over the investee.

3.3 Going Concern

The Group has prepared the financial statements on a going

concern basis, with due consideration to the present economic

situation.

The Board have conducted an extensive review of forecast

earnings and cash for the period to 31 January 2024 considering

various scenarios and sensitivities given the residual effects

Covid-19 and the ongoing cost of living crisis and uncertainty it

has produced around the future economic environment.

At 30 September 2022 the Group has significant cash balances of

GBP15.3m, readily realisable stock of gold jewellery and access to

the GBP3.5m unutilised element of a GBP10m revolving credit

facility with an expiry date of March 2024. In the year ended 30

September 2022 the Group has traded profitably and generated cash

from operations.

The Board have been able to conclude that they a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. Accordingly, the

Group continues to adopt the going concern basis in preparing the

financial statements. The going concern assessment covers the

period to 31 January 2024.

3.4 Business combinations and goodwill

Business combinations are accounted for using the acquisition

method. The cost of an acquisition is measured as the aggregate of

the consideration transferred which represents the fair value of

the assets transferred and liabilities incurred or assumed.

Acquisition related costs are expensed as incurred and included in

administrative expenses.

Goodwill is initially measured at cost, being the excess of the

aggregate of the consideration transferred over the fair value of

the identifiable assets acquired and liabilities assumed. If the

fair value of the net assets acquired is in excess of the aggregate

consideration transferred, the Group re-assesses whether it has

correctly identified all of the assets acquired and all of the

liabilities assumed and reviews the procedures used to measure the

amounts to be recognised at the acquisition date. If the

reassessment still results in an excess of the fair value of net

assets acquired over the aggregate consideration transferred, then

the gain is recognised in the statement of comprehensive income as

a gain on bargain purchase.

After initial recognition, goodwill is measured at cost less any

accumulated impairment losses. For the purpose of impairment

testing, goodwill acquired in a business combination is, from the

acquisition date, allocated to each of the Group's cash generating

units (CGU) that are expected to benefit from the combination,

irrespective of whether other assets or liabilities of the acquiree

are assigned to those units.

3.5 Intangible assets

Intangible assets acquired separately are measured on initial

recognition at cost. The cost of intangible assets acquired in a

business combination is their fair value as at the date of

acquisition. Following initial recognition, intangible assets are

carried at cost less accumulated amortisation and accumulated

impairment losses, if any. Internally generated intangible assets,

excluding capitalised development costs, are not capitalised and

expenditure is recognised in the statement of comprehensive income

when it is incurred.

The useful lives of intangible assets are assessed as either

finite or indefinite and at each date of the statement of financial

position only goodwill assets are accorded an indefinite life.

Intangible assets with finite lives are amortised over their

useful economic lives and assessed for impairment whenever there is

an indication that the intangible asset may be impaired. The

amortisation period and the amortisation method for an intangible

asset with a finite useful life are reviewed at least at the end of

each reporting period.

Amortisation is calculated over the estimated useful lives of

the assets as follows:

-- Customer relationships - 40% reducing balance

-- Software - 20% straight line

Changes in the expected useful life or the expected pattern of

consumption of future economic benefits embodied in the asset are

accounted for by changing the amortisation period or method, as

appropriate, and are treated as changes in accounting estimates.

The amortisation expense on intangible assets with finite lives is

recognised in the statement of comprehensive income in the expense

category consistent with the function of the intangible assets.

3.6 Property, plant and equipment

Property, plant and equipment are stated at cost, net of

accumulated depreciation and accumulated impairment losses (if

any). All other repair and maintenance costs are recognised in the

statement of comprehensive income as incurred.

Depreciation is calculated over the estimated useful lives of

the assets as follows:

* Freehold property - 2% straight line

* Leasehold improvements - straight line over the lease

term

* Fixtures & fittings - 20% & 33% reducing balance

* Computer equipment - 25% & 33% reducing balance

* Motor vehicles - 25% reducing balance

An item of property, plant and equipment is derecognised upon

disposal or when no future economic benefits are expected from its

use or disposal. Any gain or loss arising on derecognition of the

asset (calculated as the difference between the net disposal

proceeds and the carrying amount of the asset) is included in the

statement of comprehensive income when the asset is

derecognised.

The residual values, useful lives and methods of depreciation of

property, plant and equipment are reviewed at each financial year

end and adjusted prospectively, if appropriate.

3.7 Impairment of non-financial assets

The Group assesses at each reporting date whether there is an

indication that an asset may be impaired. If any indication exists,

or when annual impairment testing for an asset is required, the

Group estimates the asset's recoverable amount. An asset's

recoverable amount is the higher of an asset's or CGU's fair value

less costs of disposal and its value in use. It is determined for

an individual asset, unless the asset does not generate cash

inflows that are largely independent of those from other assets or

groups of assets. Where the carrying amount of an asset or CGU

exceeds its recoverable amount, the asset is considered impaired

and is written down to its recoverable amount.

In assessing value in use, the estimated future cash flows are

discounted to their present value using a pre-tax discount rate

that reflects current market assessments of the time value of money

and the risks specific to the asset. In determining fair value less

costs of disposal, recent market transactions are taken into

account. If no such transactions can be identified, an appropriate

valuation model is used.

The Group bases its impairment calculation on detailed budgets

and forecasts which are prepared separately for each of the Group's

CGUs to which the individual assets are allocated, which is usually

taken to be each individual branch store based on the independence

of cash inflows. Central costs and assets are allocated to CGUs

based on revenue. These budgets and forecast calculations are

estimated for three years and extrapolated to cover a total period

of ten years.

Impairment losses of continuing operations are recognised in the

statement of comprehensive income in those expense categories

consistent with the function of the impaired asset.

For assets excluding goodwill, an assessment is made at each

reporting date as to whether there is any indication that

previously recognised impairment losses may no longer exist or may

have decreased. If such indication exists, the Group estimates the

asset's or CGU's recoverable amount. A previously recognised

impairment loss is reversed only if there has been a change in the

assumptions used to determine the asset's recoverable amount since

the last impairment loss was recognised.

The reversal is limited so that the carrying amount of the asset

does not exceed its recoverable amount, nor exceed the carrying

amount that would have been determined, net of depreciation or

amortisation, had no impairment loss been recognised for the asset

in prior years. Such reversal is recognised in the Statement of

Comprehensive income unless the asset is carried at a revalued

amount, in which case the reversal is treated as a revaluation

increase.

Goodwill

Goodwill is tested for impairment at the end of each accounting

period and when circumstances indicate that the carrying value may

be impaired.

Impairment is determined for goodwill by assessing the

recoverable amount of each CGU (or group of CGUs) to which the

goodwill relates. Where the recoverable amount of the

cash-generating unit is less than their carrying amount, an

impairment loss is recognised. Impairment losses relating to

goodwill cannot be reversed in future periods. Goodwill is

allocated to CGUs based on the price paid of the relevant

acquisition.

3.8 Inventories

Inventories comprise of retail jewellery and precious metals

held to be scrapped and are valued at the lower of cost and net

realisable value.

Cost represents the purchase price plus overheads directly

related to bringing the inventory to its present location and

condition.

When the Group takes title to pledged goods on default of

pawnbroking loans up to the value of GBP75, cost represents the

principal amount of the loan plus term interest.

Net realisable value is the estimated selling price in the

ordinary course of business, less estimated costs of completion and

estimated costs to sell.

3.9 Financial instruments

A financial instrument is any contract that gives rise to a

financial asset of one entity and a financial liability or equity

instrument of another entity.

Financial assets

Financial assets are all recognised and derecognised on a trade

date basis. All recognised financial assets are measured and

subsequently measured at amortised cost or fair value depending on

the classification of the financial asset.

Classification of financial assets

Financial assets that meet the following criteria are measured

at amortised cost:

-- the financial asset is held within the business model whose

objective is to hold financial assets in order to collect

contractual cash flows; and

-- the contractual terms of the financial asset give rise on

specified dates to cash flows that are solely payments of principal

and interest on the principal amount outstanding.

In accordance with IFRS 9 Financial Instruments the Group has

classified its financial assets as amortised cost.

The amortised cost of a financial asset is the amount at which

the financial asset is measured at initial recognition less the

principal repayments, plus the cumulative amortisation using the

effective interest method of any difference between that initial

amount and the maturity amount, adjusted for any loss allowance.

The gross carrying amount of a financial asset is the amortised

cost of a financial asset before adjusting for any loss

allowance.

Cash and cash equivalents

Cash and short-term deposits in the statement of financial

position comprise cash at banks and on hand, foreign currency held

for resale and short-term deposits held with banks with a maturity

of three months or less from inception. Debit / credit card

receipts are recognised as cash at point of transaction.

For the purpose of the consolidated statement of cash flows,

cash and cash equivalents consist of cash, foreign currency held

for resale and short-term deposits as defined above, net of

outstanding bank overdrafts as they are considered an integral part

of the Group's cash management.

Impairment of financial assets

The Group recognises a loss allowance for expected credit losses

on financial assets that are measured at amortised cost. The amount

of credit losses is updated at each reporting date to reflect

changes in credit risk since initial recognition of the respective

financial instrument.

The Group recognises lifetime expected credit losses when there

has been a significant increase in credit risk since initial

recognition. However, if the credit risk on the financial

instrument has not increased significantly since initial

recognition, the Group recognises the 12 month expected credit

losses. As pawnbroking loans are typically over a six-month term

the lifetime credit losses are usually the same as the 12 month

expected credit losses.

In assessing whether the credit risk on a financial instrument

has increased significantly since initial recognition, the Company

compares the risk of a default occurring on the financial

instrument at the reporting date with the risk of a default

occurring on the financial instrument at the date of initial

recognition. In making this assessment, the Company considers both

quantitative and qualitative information that is reasonable and

supportable including historical experience.

The measurement of expected credit losses is a function of the

probability of default, and the loss (if any) on default. The

assessment of the probability of default is based on historical

data. The loss on default is based on the assets gross carrying

amount less any realisable security held. The expected credit loss

calculation considers both the interest income and the capital

element of the pawnbroking loans. Interest on loans in default is

accrued net of expected credit losses. Details of the key

assumptions for pawnbroking expected credit losses are given in

note 4.

Derecognition

The Group derecognises a financial asset only when the

contractual rights to the cash flows from the asset expire, or when

it transfers the financial asset to another entity. On

derecognition of a financial asset measured at amortised cost, the

difference between the assets carrying amount and the sum of the

consideration received and receivable is recognised in the

Statement of Comprehensive Income. Pawnbroking loans in the course

of realisation continue to be recognised as loan receivables until

the pledged items are realised.

Financial liabilities

Debt and equity instruments are classified as either financial

liabilities or equity in accordance with the substance of the

contractual arrangements and the definitions of a financial

liability and equity instrument.

All financial liabilities are recognised initially at amortised

cost or at fair value through profit and loss (FVTPL).

The Group's financial liabilities include trade and other

payables, loans and borrowings including bank overdrafts, and

derivative financial instruments.

After initial recognition, interest bearing loans and borrowings

are subsequently measured at amortised cost using the effective

interest rate method (EIR). Gains and losses are recognised in the

Statement of Comprehensive Income when the liabilities are

derecognised as well as through the (EIR) amortisation process.

Amortised cost is calculated by taking into account any discount

or premium on acquisition and fees or costs that are an integral

part of the EIR. The EIR amortisation is included in finance costs

in the Statement of Comprehensive Income.

Only the Group's derivative financial instruments are classified

as financial liabilities at fair value through profit or loss.

Financial liabilities at fair value through profit or loss are

stated at fair value, with any resultant gain or loss recognised in

the Statement of Comprehensive Income. The net gain or loss

recognised in the Statement of Comprehensive Income incorporates

any interest paid on the financial liability.

Derecognition

A financial liability is derecognised when the obligation under

the liability is discharged or cancelled or expires. When an

existing financial liability is replaced by another from the same

lender on substantially different terms, or the terms of an

existing liability are substantially modified, such an exchange or

modification is treated as a derecognition of the original

liability and the recognition of a new liability. The difference in

the respective carrying amounts is recognised in the Statement of

Comprehensive Income.

Offsetting of financial instruments

Financial assets and financial liabilities are offset with the

net amount reported in the Statement of Financial Position only if

there is a current enforceable legal right to offset the recognised

amounts and intent to settle on a net basis, or to realise the

assets and settle the liabilities simultaneously.

3.10 Fair value measurement

The Group measures financial instruments, such as derivatives,

at fair value at the date of each statement of financial

position.

Fair value is the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between

market participants at the measurement date.

The fair value of an asset or a liability is measured using the

assumptions that market participants would use when pricing the

asset or liability, assuming that market participants act in their

economic best interest.

The Group uses valuation techniques that are appropriate in the

circumstances and for which sufficient data are available to

measure fair value, maximising the use of relevant observable

inputs and minimising the use of unobservable inputs.

All assets and liabilities for which fair value is measured or

disclosed in the financial statements are categorised within the

fair value hierarchy. This is described, as follows, based on the

lowest level input that is significant to the fair value

measurement as a whole:

-- Level 1 - Quoted (unadjusted) market prices in active markets

for identical assets or liabilities

-- Level 2 - Valuation techniques for which the lowest level

input that is significant to the fair value measurement is directly

or indirectly observable

-- Level 3 - Valuation techniques for which the lowest level

input that is significant to the fair value measurement is

unobservable

3.11 Taxation

Current tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from net profit as reported in the

Consolidated Statement of Comprehensive Income because it excludes

items of income or expense that are taxable or deductible in other

years and it further excludes items that are never taxable or

deductible. The Group's liability for current tax is calculated

using tax rates and laws that have been enacted or substantively

enacted by the date of the statement of financial position.

Deferred tax

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profit, and is accounted for using the

balance sheet liability method. Deferred tax liabilities are

generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised. Such assets and

liabilities are not recognised if the temporary difference arises

from the initial recognition of goodwill or from the initial

recognition (other than in a business combination) of other assets

and liabilities in a transaction that affects neither the taxable

profit nor the accounting profit.

The carrying amount of deferred tax assets is reviewed at the

date of each statement of financial position and reduced to the

extent that it is no longer probable that sufficient taxable

profits will be available to allow all or part of the asset to be

recovered.

Deferred tax is calculated at the tax rates and laws that are

expected to apply in the period when the liability is settled or

the asset is realised. Deferred tax is charged or credited in the

Consolidated Statement of Comprehensive Income, except when it

relates to items charged or credited directly to equity, in which

case the deferred tax is also dealt with in equity. Deferred tax is

recognised on an undiscounted basis.